Lembirik Group Investments letter to partners for the year ended December 31, 2017.

To my partners,

Since June 1st (the day our partnership was launched officially) the S&P 500 advanced from 2,430.06 to 2,673.61, a rise of 243.55 points or 10%. On a yearly basis, the S&P 500 returned 20% including dividends.

Although this is the type of market environment where we should have the most difficulty in exceeding this high standard, we achieved a return of 31.37% since inception (7 months) or 59.63% on an annual basis.

After fees, which is the figure that’s most of interest to you, we achieved 25% during these seven months or 46.80% on an annual basis.

Please keep in mind that seven-months' or even one-year's results are not to be taken too seriously, as you know, value investing –our philosophy- tends to underperform during bull markets due to the lack of undervalued securities. We managed to outperform the index solely thanks to some of Wall Street darlings: Amazon and Tesla. Not that we bought their common stocks, as they are anything but bargains but, the hype around these securities allowed us to find opportunities in their respective sectors: retail and automobile.

The word on the Street is that Amazon is disrupting the retail environment, its common stock is trading at $1,170. With a market cap of $567 billion, investors are assuming the company is operating in a monopolistic manner. A CNN report recently said “America’s malls are rotting away” and “the worst is yet to come”. We do not agree with that reasoning and believe that the retail industry is not going away. According to Statistica, the e-commerce shares of total global retail sales in 2017 is 10.1%. In 2021, they expect that share to grow to 15.5%. While this growth is respectable, the majority of the dollars spent are in retail. This is not a zero-sum game, e-commerce should complement the retail experience not replace it totally. As a consumer, you can buy an iPhone online and have it delivered to your home, however, the majority of us will still go to the Apple store to purchase one because of the experience we get there. This explains why Amazon is opening new physical stores even though they master the online business.

Though we tend to agree that Amazon is gaining some market share, we find that those revenues gained don’t trickle down to its bottom line either: According to their latest annual report, their sales were $135.9 billion while net income was only $2.3 billion (1.7% net margin). This margin is synonym with a commodity business, not a monopolistic one!

The following are the businesses we hold in our portfolio:

MICHAEL KORS HOLDINGS LTD.:

Michael Kors designs, distributes, and sells high-fashion apparel, footwear, and accessories for men and women. North America represents 68% of revenue, and to help it diversify its product portfolio and expand globally, the company acquired the luxury fashion house Jimmy Choo for about $1.2 billion in cash.

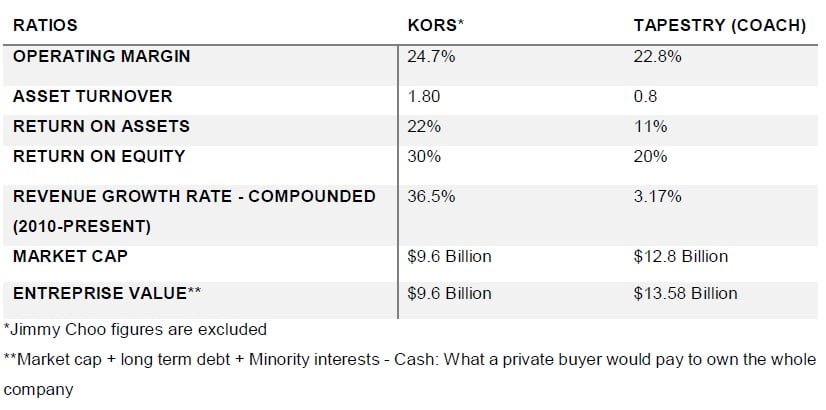

I have been following Michael Kors since summer 2013 when the shares were trading for around $70, having a market capitalization of $14 billion. Since then, the company more than doubled its sales (from $2 billion to $4.5 billion), increased net income 39% and bought back 48 million shares without incurring any debt! Meanwhile, its market capitalization fell more than 62% to $5.2 billion offering us an opportunity to buy the stock on the cheap. Our average price was $32.73 per share, now trading for $63 giving us a 92% return. While this return seems enticing, we are planning to hold our stake a lot longer as we believe the company still has room to grow. Negative sentiment is what provides us opportunities, while we were buying KORS, analysts were calling the company doomed, that it lost its popularity among customers and calling Coach (now called Tapestry after Kate Spade acquisition) the winner in this category. The following is a comparison between the two companies:

For every $1 invested, Michael Kors generates $1.80 in sales that produce $0.44 in operating income to the shareholders. While Tapestry generates only $0.80 for every $1 invested and produces only $0.18 for shareholders. Michael Kors is by far creating more value to investors than Tapestry while selling for less in the market place.

FORD MOTOR CO:

While Wall Street was mesmerized by Elon Musk’s Tesla (You may read about my analysis of Tesla here), the old automobile industry is regarded with scorn and neglect. We purchased Ford’s stock in June right after Jim Hackett was announced as the new CEO. The company’s valuation looks very attractive, $11.15 was our average price, $9.76 is backed by cash. The company also pays a dividend of $0.60 per share, giving us a yield of 5.4% (the company is in strong financial position to sustain it).

On hindsight, if we bought General Motors Co.’s stock instead, our return year to date (YTD) would have been 17% instead of the 12% we’re getting from Ford (dividends excluded) especially that both companies were trading at similar valuations when we made the purchase, however we believed that the appointment of a new CEO would act as a catalyst to unlock shareholders value. We are very happy with this investment nonetheless, and we believe the company is still trading at a discount to its intrinsic value.

We are not interested in the same data that many analysts pay attention to: market share, monthly car sales figures, … Although this information is important we believe that the balance sheet says more about a company than those figures. An example follows:

According to Statista, Tesla motors dominates the electric vehicle market with a share of 29%, while GM has 16% and Ford 2% (opportunity for Ford to grow in this category). Yet, Tesla lost $267, $258, $241 and $535 in the last 4 quarters respectively (figures in millions!) while long term liabilities increased to $16.9 billion during this same period. GM’s operating income last fiscal year was $9.5 billion while Ford’s was $4.1 billion.

Even though Tesla has the largest market share in this category, it does not translate to profits to the company. I would rather invest your hard-earned money (my family’s too) in a company with a strong balance sheet (and large margin of safety) than one with an enormous market share but weak fundamentals.

FOOT LOCKER INC.:

Another victim of the Amazon effect was Foot Locker. When Nike announced it will start selling some sneakers directly on Amazon.com, shares of the retailer dropped 28% after the press release. We purchased a stake at an average price of $41.95. Our return excluding dividends YTD is: 12% (or 13.5% with dividends included).

We believe that the 28% drop in stock price was an overreaction. Nike’s new product line that will be sold on Amazon is for undifferentiated items; a category of sneakers not sold at Foot Locker and it should not affect the company in any significant matter. Foot Locker’s business model is launch driven, relying on new product releases to drive traffic to the stores, a phenomenon that does not play out the same way online. Another advantage Foot Locker has is that the majority of its sales are in cash, this isolates it from the threat of e-commerce.

The company is run efficiently; since 2010, revenue grew 54%, while net income grew 293%. Earnings per share increased 359% meanwhile, shares outstanding decreased by 21 million or 13%.

While these figures are impressive, they were achieved organically, with no debt.

The market cap now is $5.5 billion, with $1 billion in cash. A private buyer is basically paying $4.5 billion for this business that generates $664 million in net income for a yield of 14.7%. A bargain!

OTHER BUSINESSES:

We hold three other undervalued businesses, since we might be purchasing more of their stocks we are unable to divulge them at this moment. We will provide you with our analysis when the timing is right.

I would like to welcome a few new partners to our group, and I would like to remind them of our tenets. I apologize to my existing partners if this is becoming repetitive, however I would rather have 9 partners out of 10 that are slightly bored than 1 out of 10 with the wrong expectation.

OUR TENETS:

We are not, and we will never promise you returns. What we promise, is that we are investing our money with yours. (Unlike a financial advisor who will sell you a fund to collect a commission.)

Our approach is long-term, we believe that markets are a voting machine in the short-term and a weighing machine in the long-term. Since we invest in undervalued securities, we need time to correct the mispricing of these securities.

From time to time, markets will crash. Do no panic, that’s the moment we must cherish as companies are being sold with a discount.

Since our approach is long-term, you will be hearing from us -via letters to partners like this one- twice a year, or when there are major developments in the market place. Please do not expect a letter every quarter as we strongly believe that quarter to quarter communication entails a short-term investment behavior. This short-term vision is the anchor on performance.

We do not engage in speculative trading. We do not use margin and we rather achieve a 5% return unleveraged than a 20% return leveraged. As a partner, you should judge the fund's performance relative to the S&P500 (over a 3-year horizon) and equally how those returns are achieved.

We compare our performance to the S&P500 not because it’s an easy benchmark to beat. On the contrary, according to Financial Times, since 2006, 99% of actively managed funds under-perform this benchmark (mutual funds and hedge funds combined!). We selected it because it’s the most widely known index and as a partner you can just buy a low fee fund that mimics its performance if we don’t deliver results. Why many funds underperform the S&P500? Because, again they are pressured by their investors for short-term results!

In order for me to do my job well, it’s extremely important to have my partners share the same philosophy as mine. That being said, let’s talk about the highlight of 2017.

CRYPTOCURRENCIES:

Bitcoin’s 1,350% rise in 2017 ranks it as the most performing “asset” in human history (surpassing the tulip mania). The attention the cryptocurrencies are getting raises many questions, mostly about the hysteria behind bitcoin rise to a bubble territory. However, to answer that question we must first know what is really a cryptoccurency? Is it a commodity, an asset, or a currency?

Commodity: According to Oxford Dictionaries, a commodity is a raw material or primary agricultural product that can be bought and sold, such as copper or coffee. Bitcoin therefore does not qualify under this category.

Asset: According to Investopedia, an asset is a resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit.

In other words, an asset produces cash flow or reduces expenses. Since bitcoin does not provide any of these benefits, then it should not be labeled as such.

Since bitcoin is not a commodity nor an asset, it’s plausible to think of it as a currency. Let’s go through the role of a currency: Medium of exchange and store of value:

A currency, or money must be easily exchangeable between two parties. If you can’t pay someone with it, it’s definitely not a currency.

A currency should be a useful place to store value, it’s more convenient to keep savings in it than in property or gold.

Medium of exchange: Bitcoin is a very poor medium of exchange, its network can only handle a limited number of transactions per second, and is being overwhelmed by traffic. This is causing delays in settlement times and transactions (or blackchaines) take a long time to process. High fees must be paid to get a transaction prioritized by the “miners” (average transaction fee is $28). According to Coin Central a transaction takes on average between 30 minutes to over 16 hours. This is a medium of stagnation!

Store of value: Bitcoin is a very poor store of value too (someone would disagree if he bought some in the beginning of the year). If you save let’s say $10,000, you want to be confident of having $10,000 when you need them (inflation may erode some purchasing power, but that’s another topic). However, this year, bitcoin has had ten-day periods where it was up 44% or down 25% against the dollar.

It’s clear that the main reason people are buying bitcoin is simply because it’s going up, in my opinion that’s a dumb reason and it’s dangerous. Many companies, in order to cash in on this wave, change their names to blockchain, a trend witnessed during the dot-com bubble. Beverage maker Long Island ice Tea, saw its shares jump to around $9 from $2 after the company changed its name to Long Blackchain Corp., Bioptix inc, a biotech company saw its market cap skyrocket close to 300% when they changed their name to Riot Blockchain Inc. Bubbles are created because people want to be part of the “next big thing”. The irony of the matter is that bitcoin was created in 2009 to make small online transactions easy and remove the need to use financial intermediaries, however it’s so complicated to use that it has created a whole new set of financial intermediaries. The “next big thing” is as efficient as the barter system!

TAXES:

Our capital gains are unrealized for two reasons: first reason is that we believe our holdings are still undervalued, and the second reason is if we realize the gain in less than 1 year we will be taxed as if it was income (according to our marginal tax rate). After one year the capital gain is taxed at 15%. However, we have received dividends, and you should be expecting your statements and tax information in a timely manner. If you have any questions or if you need a clarification, please do not hesitate to contact me.

Yours truly,

Sid-El Mehdi Lembirik

Managing Partner,

Lembirik Group Investments

See the full PDF below.