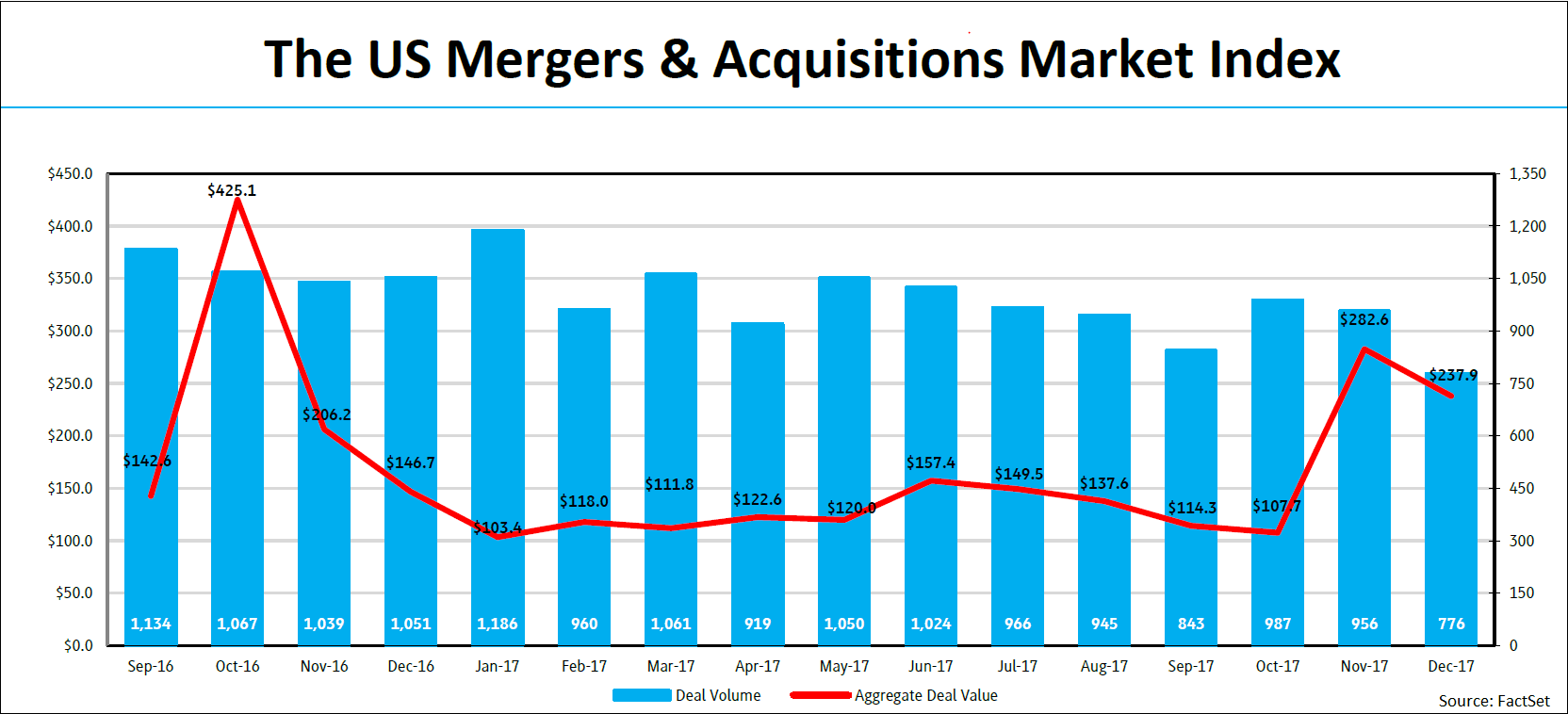

U.S. M&A deal activity decreased in December, down 18.8% with 776 announcements compared to 956 in November. Aggregate M&A spending decreased as well. In December 15.8% less was spent on deals compared to November.

Over the past three months, the sectors that have seen the smallest decreases in M&A deal activity, relative to the same three-month period one year ago, have been: Non-Energy Minerals (71 vs. 66), and Government (five vs. four). Only two of the 21 sectors tracked by FactSet Mergerstat posted relative gains in deal flow over the last three months compared to the same three months one year prior.

| Sector by activity | |||

| Target Sector | L3M 12/31/17 Deal Count | L3M 12/31/16 Deal Count | Difference |

| Non-Energy Minerals | 71 | 66 | 5 |

| Government | 5 | 4 | 1 |

| Misc. | 10 | 12 | (2) |

| Transportation | 54 | 64 | (10) |

| Distribution Services | 143 | 158 | (15) |

| Health Technology | 82 | 98 | (16) |

| Technology Services | 424 | 440 | (16) |

| Energy Minerals | 41 | 59 | (18) |

| Process Industries | 107 | 126 | (19) |

| Electronic Technology | 77 | 96 | (19) |

| Communications | 30 | 50 | (20) |

| Retail Trade | 108 | 128 | (20) |

| Consumer Durables | 51 | 71 | (20) |

| Consumer Services | 196 | 216 | (20) |

| Utilities | 68 | 94 | (26) |

| Consumer Non-Durables | 82 | 109 | (27) |

| Finance | 364 | 398 | (34) |

| Health Services | 111 | 146 | (35) |

| Commercial Services | 428 | 463 | (35) |

| Producer Manufacturing | 148 | 194 | (46) |

| Industrial Services | 119 | 165 | (46) |

| Total | 2,719 | 3,157 | (438) |

Over the past three months, the sectors that have seen the biggest declines in M&A deal volume, relative to the same three-month period one year ago have been: Industrial Services (119 vs. 165), Producer Manufacturing (148 vs. 194), Commercial Services (428 vs. 463), Health Services (111 vs. 146), and Finance (364 vs. 398). Nineteen of the 21 sectors tracked by FactSet Mergerstat posted negative relative losses in deal flow over the last three months compared to the same three months one year prior, for a combined loss of 444 deals.

Topping the list of the largest deals announced in December were:

- CVS Health Corp. agreeing to acquire Aetna, Inc. for $67.8 billion

- The Walt Disney Co.'s agreement to acquire Twenty First Century Fox, Inc. for $54.7 billion

- Kohlberg Kravis Roberts & Co LP offer to acquire the the Unilever NV's Spreads division for $8 billion

- Campbell Soup Co. entering into an agreement to acquire Snyder's Lance, Inc. for $4.9 billion

- Optum, Inc., a subsidiary of UnitedHealth Group, Inc., agreeing to acquire DaVita Medical Holdings LLC from DaVita, Inc. for $4.9 billion

FactSet Flashwire Monthly Report

Download the full report for more, including:

- Key trend information for the Overall and Middle M&A Markets, such as deal volume, deal value, mega-deals, leading buyers, leading industries, leading sectors, cross-border deals, US regional deals, average P/E, average premiums, payment methods, and much more

- Industry reports on the Internet, Telecommunications, Healthcare, Banking, and much more

- Special reports on technology, the public and private M&A markets, cancellation fees, industry activity, etc.

- Leading financial and legal advisor rankings

Article by FactSet