Via Attain Capital

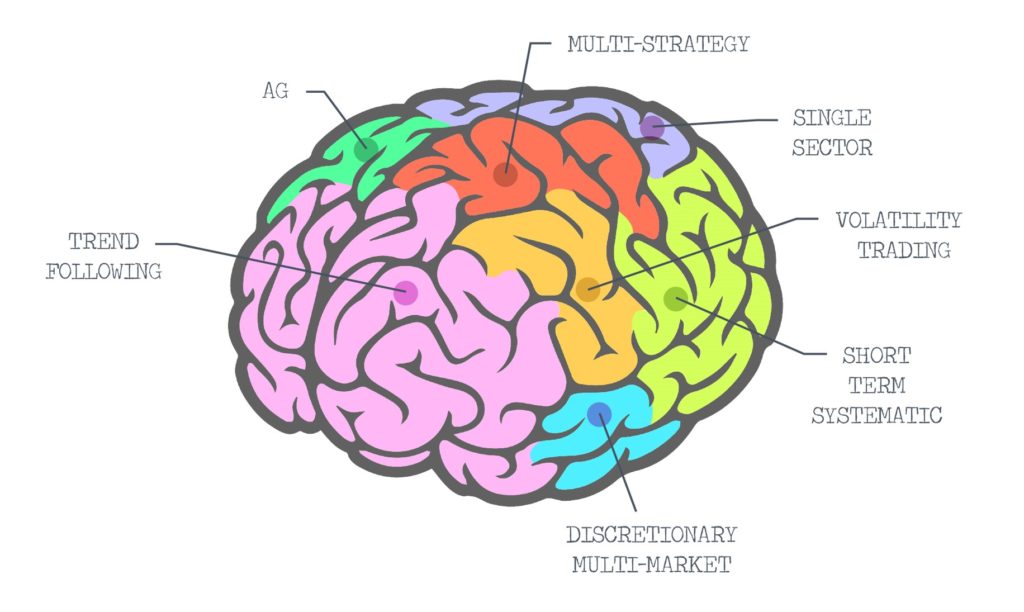

It’s that time of year, where we in the Managed Futures / Global Macro / Alternative Investment space take a look back at the year that was 2017 and sift through exactly what happened in each of the multiple categories which comprised the space, in our annual Strategy Review Whitepaper. We can all see what the overall asset class did for the year. But the problem with glancing at index returns for managed futures is there are so many programs that do things quite differently than the typical managed futures/global macro profile. Managed Futures, like our brains, may represent one structure, but each section of the brain does very different things. If we had to draw up what a Managed Futures brain would look like, divided by all the sectors, this is what it might look like:

What types of strategies found success, and where was there the most diversion amongst members of a strategy group? If you’ve been following along with our blogs and whitepapers all year, you’d know that Volatility Traders had the most “brain activity” in 2017. Here’s an excerpt from our review of this section:

Assets are coming into these volatility traders despite the category being a relatively new idea to the Managed Futures space, in part because they are nimble enough in their AUM, and partly because these types of strategies perform unlike most other CTAs, which is appealing considering the Managed Futures’ recently sideways performance.

To see how these managers, as well as the other types – everyone from energy traders to short term players, downloaded our Managed Futures / Global Macro 2017 Strategy Review!