Quantitative investing is a niche inside a larger industry, but it is rapidly changing the core nature traditional investment processes. From an artificial intelligence and machine learning to algorithmic portfolio management, what it means to build and execute an investment plan has changed as a result. At Deutsche Bank’s DBAccess Global Quant Conference 2017 Hong Kong, everyone from bottom-up stock pickers and top-down cross-asset allocators and portfolio allocators were talking about investment process refinement. It even included talk about socially responsible investing, a topic that seemingly put a Blackrock quant at odds with recent comments made by BlackRock CEO Larry Fink.

Big data and automated portfolio construction at DBAccess Global Quant Conference

As one might expect at a quant conference circa 2017, big data was a big topic.

Axioma, InfoTrie and QuantCube were said to have “dazzled the audience” with their ability to transform “massive data” into “smarter data,” a January 18 Deutsche Bank report noted.

QuantCube Founder and Chief Executive Officer Thanh-Long Huynh gave a noted presentation on “Massive Data Analytics for Strategic Intelligence” while Axioma’s Olivier d’Assier, head of applied research in the Asia Pacific, noted a difference between correlation and causation.

In a presentation, “History Doesn’t Repeat Itself, but It Often Rhymes: Insights from Stress Testing,” d’Assier outlined design methods to “design better hedges against unacceptable levels of risk.” He touched on the key problem with purely algorithmic investment process when asking “What if there is no historical precedent?” This would include war with North Korea, he said, and “a Trump impeachment.” In the presentation slides reviewed by ValueWalk he did not appear to mention that most major stock market sell-offs have occurred under surprise or unprecedented situations.

When establishing a risk management protocol, d’Assier advocates “never” relying on one stress test, but rather blending results in a “probability-weighted mixture model.”

Multi-strat algo firm seeks machine takeover of asset allocation

At a quant investing conference, the talk is typically framed in probabilistic language. Seldom are their absolutes, but rather various paths with numerically modeled possibilities.

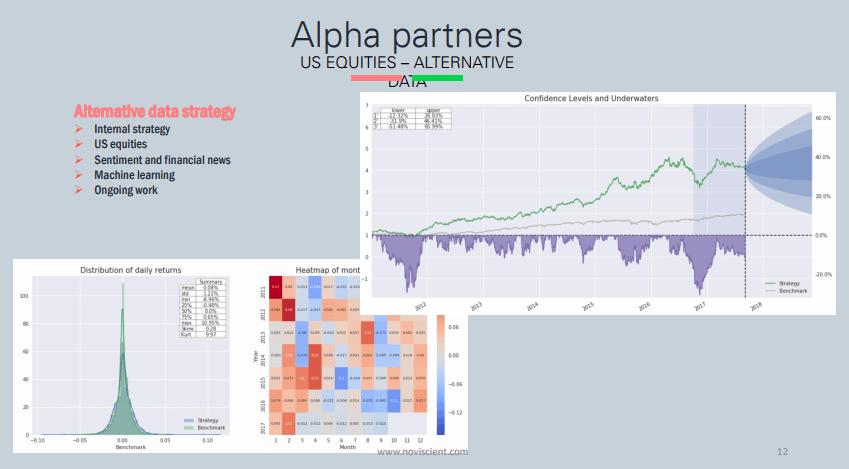

Noviscient Founder Scott Treloar, for instance, gave a presentation, “Using Probabilistic Programming to Construct Optimal Portfolios in a Multi-Strategy Fund,” that works by “filtering skill from luck.”

In his broad vision of the world, the traditional, human-based method of asset allocation should entirely change. Where “man” is currently entirely involved in the capital allocation and strategy development process, with man and machine handling trade execution, he sees a new model. Machines should entirely operate the capital allocation and trade execution processes while a man and machine combination should develop strategies.

Rather than allocating to stocks and bonds, Treloar looks at different trading strategy returns streams with the goal to fully automate the process.

“These return streams have less data that most securities, which can be challenging,” he said. “They do tend to exhibit autocorrelation and cross-correlation, which we want to exploit in our portfolio construction.”

It is on the topic of returns, or lack thereof, that a quantitative outlook might find socially responsible investing challenging given the primary mission to improve returns.

Blackrock quant points out ESG might be problematic, while Blackrock CEO implores corporations to think with a socially-driven conscious

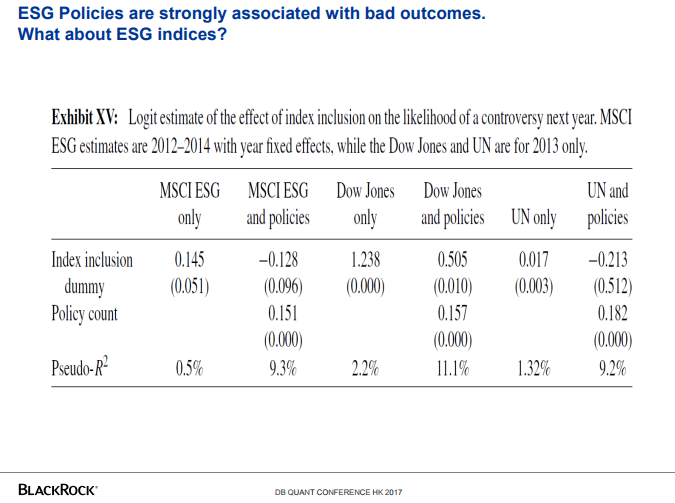

One concept that might not make it through quantitative filters might be “ESG investing” based on environmental, social and governance concerns.

BlackRock’s Larry Fink sent a letter to the world’s largest corporate executives asking them to consider their social purpose, not just short-term profits. “Society is demanding that companies, both public and private, serve a social purpose,” he wrote. “To prosper over time, every company must not only deliver financial performance but also show how it makes a positive contribution to society. Companies must benefit all of their stakeholders, including shareholders, employees, customers, and the communities in which they operate.”

Can the world’s largest asset manager make social good an investment decision process factor?

Blackrock’s Gerald Garvey, speaking at the Deutsche Bank conference in November, outlined the problems. He pointed out pitfalls with ESG investing, including a study published in the Journal of Investment Management that noted increased regulatory problems for companies that “disclose a richer set of ESG-friendly policies.”

One slide specifically stated that “ESG Policies are strongly associated with bad outcomes.”

One wonders if Fink saw Garvey’s presentation?