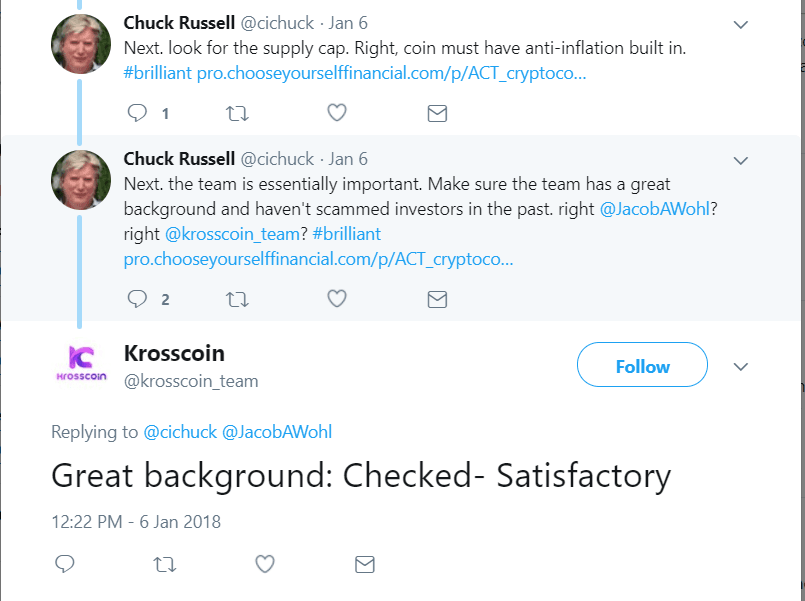

Jacob Wohl appears to have found a new career. The self-described “financial expert,” whose expertise includes having been banned for life from membership in the National Futures Association, was briefly named Chief Operating Officer of KrossCoin, a cryptocurrency trading business. After announcing on the website that Wohl was COO and proclaiming on Twitter he had cleared a background check, KrossCoin took down the job announcement posting and now says he is no longer involved in management.

In addition to being banned by the NFA, Wohl recently settled securities fraud charges with Arizona regulators but has yet to pay that fine, according to regulatory proceedings and published reports.

But the teenage trading sensation featured on Fox Business Network now appears to have found a new religion: cryptocurrencies.

KrossCoin not sure of the spelling of Annapolis, Maryland, the location where its global headquarters are located

For Wohl, finding his calling in KrossCoin might not have been a big of a leap for the teen sensation. But physically finding KrossCoin’s location might be more of a challenge because the firm misspelled Annapolis (Annepolis) on its website.

Wohl’s next career adventure, specifically, is anchored at 1125 West St #200, Annapolis, Maryland, the global headquarters for KrossCoin, according to their website. The firm is located in a strip mall with a big screen TV retailer and is down the street from Carlson’s Donuts and Thai Kitchen – with donuts and Thai food itself an odd combination – and a short walk to the Annapolis National Cemetery on West Road in the city best known for training the world’s sharpest naval minds.

Wohl is personal life coach for KrossCoin CEO and Wohl, the COO, was only in an “honorary role”

When KrossCoin CEO Efaso Ighodaro was asked if he was aware of enforcement actions against Wohl, he initially claimed to be unaware even after being sent links to official regulatory documentation. He eventually acknowledged, however, that Wohl “may have made some indiscretions” after being pressed with evidence.

“Jacob Wohl is one of my personal life coaches and the role of COO was an honorary position,” Ighodaro said in an email to ValueWalk, marking a rare moment in history when a chief operating officer was considered an “honorary position.”

“I decided to remove his name from the role and from the website (and soon whitepaper, version 2.0 coming) for discretionary reasons,” he said. “He still is a respected mentor to me.”

KrossCoin appears to be soliciting for derivatives and equities business, in violation of regulatory guidelines

KrossCoin claims to be a “consumption-based token framework” that enables payment to be made via a “Pipdroid app family” that “provides mobile execution and management of cloud-based (crypto) trading bots.”

KrossCoin’s website claims to offer automated trading of “forex, commodities and stocks,” but this could present a problem:

The only user-launched mobile algorithm trading platform, Pipdroid lets traders access Metatrader by launching MQL5 Expert Advisors (EAs or bots). Traders can automate trading of forex, commodities and stocks. Some transactions consume KSS.

Up to now, automated trading requires maintaining complex technical infrastructure, monthly recurring costs, plus large initial up front bot program cost. Pipdroid reduces costs significantly and offers easy, state-of-the art mobile trading at your fingertips.

The problem with such claims is the firm is not registered with any US regulator, according to CFTC SmartCheck. Anyone offering trade execution services to retail investors and collecting a commission must be registered with either the NFA for derivatives and FINRA for stocks. It is unclear the extent to which Krosscoin solicited listed derivatives and securities transactions to individual retail investors and traders.

Jacob Wohl, on the edge of regulatory guidelines once again.