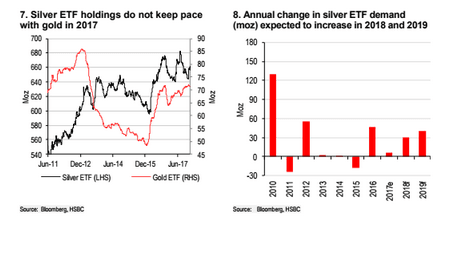

With a vast, and rapidly expanding, array of little-known applications to boast of, silver may have lost some of its lustre in 2017. However, with both solid demand and supply support factors we can expect to see silver prices rise in 2018, as well as continued momentum through 2019.

Where we left off.. 2017

Although over the year silver closed slightly higher, the 2017 end of year price still fell short of 2016’s peak. Meagre support from gold gains (high correlation) and dollar weakness (negative correlation) provided some upside, closing the year almost 7% higher at USD16.94/oz. 1 However, against other factors, the year was quite frankly an uphill struggle, what with gains in equity markets, calming of geopolitical risks (compared against 2017), and weak jewellery demand.

2018/19 – A Silver Lining?

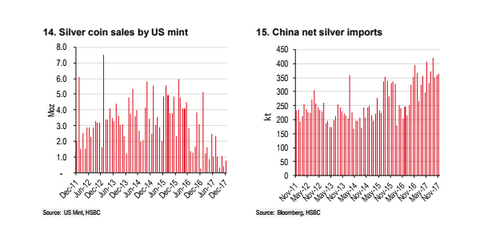

So, what will 2018 bring? For starters, markets are showing an expectation of a neutral dollar performance in 2018. This will provide some base support for silver. Any major risk trigger will also provide buoyancy and investors fly-to-quality. Most importantly, industrial demand has been growing, fuelled specifically by photovoltaic and electronic applications, to the point where industrial demand represented 60% of the total 2017 offtake. 2 Commodity strategists, after balancing the supply and demand factors, are expecting prices to drift upwards in 2018. For example, January research from HSBC estimates a price range of USD16.10-19.25/oz for 2018. 1

Industrial Demand – Fuelling Returns

Economists are expecting positive industrial growth across the globe for 2018 – which will drive demand higher for silver. Silver's unparalleled electrical conductivity secures its position in global industrial growth as more and more analogue applications move towards electronic based systems – the automotive industry is one valuable example as the artificial intelligence based arms race in self-driving vehicles gains pace.

Accounting for approximately one-fifth of total silver demand, jewellery demand is also forecast to grow by approximately 4% in 2018, following a less impressive 1% gain in 2017.2

Supply – Constrained for 2018 and beyond..

So optimistic is the outlook of industrial growth in 2018 that growth in supply may fail to keep up. Mining supply is forecast to grow, but only slowly in this year and the next. Research from HSBC estimates the market ran a production/consumption surplus of 31moz in 2017 but will run a deficit of 25moz in 2018, which will further widen to a 64moz deficit in 2019. 1 There are even rumours of supply contracting in the next decade. Recycled supply offers little relief but is also forecast to grow moderately as a bi-product of expanded industrial activity overall.

Combined, these factors would indicate increased net long positioning will gain favour through the course of 2018. However, keep in mind that other asset classes are expecting to deliver decent returns this year. Even given the silver alpha on offer, the commodity is facing stiff competition from an investor perspective and capital will be allocated to the best risk-reward optimised asset class.

Higher demand, tighter supply – we certainly see a silver lining for silver pricing into 2018 and 2019. But with silver’s broadening scope of applications and contracting supply, longer term, it will be interesting to see how this plays out - with consumer goods prices likely to jump higher if this trend continues.

Sources:

1 HSBC, Global Research, Silver Outlook, 12th January 2018

2 The Silver Institute