Intro

Previously, in Part 1, I discussed a way of sourcing for ideas, which is to scrutinize funds’ holdings to find a handful of ideas that meet one’s criteria for investing.

This part will focus on applying the framework laid out in Part 1 to FPA’s International Value Fund [referred in the rest of the post mostly as ‘FPA’] portfolio, and showing how the process moves down to finding a handful of investment ideas to add to one’s watch list.

Component 1: Choosing Funds

Below follows my application of the analytical framework that I’ve described in Part 1 of this series of posts, to FPA’s International Value Fund 3Q17 commentary and other filings (there’s also the Paramount Fund, which also invests globally, but for the sake of brevity, focusing on the former is enough to bring the point across).

Investment Philosophy and Process: FPA International Value is a group of absolute return oriented value investors that seek bargained equity securities – with a discount greater than 30% of the business’ intrinsic value – that they hold on average for five years in an attempt to generate above average returns. The Fund employs a bottom up approach to developing and researching investment ideas, and focuses on investing in high quality businesses with healthy balance sheets and capable management teams. In order to achieve their goal of providing equity-like returns with lower risk, the Fund invests across market caps, industries and geographies, and tends to run a concentrated portfolio of around 25-35 stocks.

- Further clarification of both these elements can be found in the specific Fund’s Prospectuses, which go over everything, from their analysis methods to their return profile and incentives structure.

Overall, this all seems similar to other firms. The reason I tend to see otherwise is due to the firm’s unique research methodology.

- To find out more about this, I’ve read extensively about the fund and looked out for how its managers think about the investment research process. These interviews are with Columbia Business School’s Graham & Doddsville Newsletter, with Barron’s, and Advisor Perspectives. A summary of my findings show that the firm vigorously focuses on FCF yield, believing that FCF is “important because it allows a company to pursue opportunities that enhance shareholder value” and that its healthy generation protects against many downside scenarios. It’s also clear that the fund gives large weight to asset value calculations, which as traditional value investors, they purport to preserve capital first and foremost. And going beyond technical factors, one can see through the interviews that the firm has a foundation built on thinking about history and cycles. So they’re conclusions and investments go beyond financial analysis, which I believe to be central when pursuing an edge.

Manager(s): FPA managers are known to be some of the best investors of all time. There’s Robert Rodriguez and Steve Romick, the godfathers of FPA, who won awards for Managers of the Year by Morningstar and have proved their investing prowess over many business cycles. But since the focus here is the International Value Fund, the manager in question is Pierre O. Py. Py began at FPA in 2011, and serves as Portfolio Manager for the International Value Fund and the Paramount Fund, which is another global-focused fund. He has had training in management, investment banking and law, and has worked at legendary global value firm Harris Associates as a Sr. International Investment Analyst. Safe to say, Py has a diversity of knowledge and experience, and proved investing competence.

Incentives Alignment: In addition to assessing capacity and results, it’s important to evaluate intention to maintain those over the long-term. Reading many interviews, I came across the following quote by FPA’s Managing Partner: “I’m very careful in stating value investors’ and not value investment firm because our money is invested alongside our clients”. We can trust that the decisions they make are in line with investors’ capital, and thus the commentaries they write to their clients.

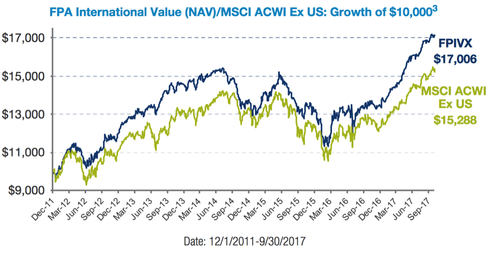

Returns/Track Record: But sometimes, capacity alone isn’t enough. That’s why evaluating returns is perhaps the most important factor here. I also use Morningstar’s rating and commentary on this section, as they have proven to offer great insights. The table below illustrates how FPA’s International Value Fund has performed over time (a more detailed overview can be found here):

Source: FPA Funds

Component 2: Evaluating Funds

Lets now move on to evaluating the fund. What we need to find out is what we can disregard when doing our own work, and where we need to focus on. The best way to identify this is to see how the fund talks about their investments; what they disclose and what they don’t.

So what is FPA good at when reporting their positions and describing their analysis?

The simplicity and completeness of their logic is evident from the structure. They correctly think top-down, moving from the point in which we find ourselves in the economic and business cycle, to thematic drivers, to then idiosyncratic investments. This is invaluable, as it provides context to their decisions. And to compliment this logical merit, they are highly self-aware and keen on historical comparison, which in investing is indispensable.

Portfolio Strategy

In terms of investment strategy, FPA International Value is largely positioned in industrials and tech. Together they correspond to more than 40% of their exposure. We can also see that they have a pretty large consumer exposure, corresponding to around 11% of their portfolio. What does this all mean, and what does it tell us as investors? Well, when crosschecked with macro analysis and other admired funds’ views that we agree with, it helps clarify where we stand in the economic and business cycle. This helps direct our investment research efforts. For example, amid the downturn in the industrials sector, the search for bargains might be easier in that pond rather than in others. And given the momentum of the technology sector, many compelling investments based on risk/reward ratios can arguably be found. Of course none of this is foolproof, but in an environment of low expected returns and record-high valuations, this sort of filtering may increase our probability of finding winners.

Stock Picking

When it comes to discussing their stock investments, FPA’s International Value team is fantastic at pointing out and discussing the cause and effect of the current mispricing around a situation or company, and why the company will revert from it’s current price level.

The three main case studies in their 3Q17 commentary are Fenner (UK), KSB (Germany), and Totvs (Brazil).

For Fenner, a provider of industrial engineered solutions, FPA argues that the market has overly punished the stock due to the business’ susceptibility to cyclicality of the mining industry. In addition, FPA argues that the market seems to misunderstand and underestimate the quality of the company’s business model, while ignoring the company’s mid-teens returns on capital, high single digit free cash flow yield, its solid balance sheet (for an industrial company), and its competent management team.

Secondly, for KSB, a provider of pumps, valves and related systems, FPA not only presents the issues that the company will have to face amidst a restructuring it’s going through – which include high competition, environmental concerns, and overall weak energy and power markets – but shows how KSB can and will bounce back, due to its strong balance sheet, cash generative business model, and avenues for growth in terms of entering new markets like water and waste. On top of that, FPA shows how the probability of the investment is skewed to the upside, given that KSB was trading at 1x book value around the time they invested. This demonstrates rigor of analysis and strategic thinking.

And thirdly, for Totvs, an IT business focusing on developing integrated management software solutions, the mispricing is caused by short-term vision, country risk related to the political and economic confusion in Brazil, as well as the business integration difficulties relating to Totvs’ recent M&A activity that is part of its transformation. But again, FPA explains how Totvs’ solutions sold via a subscription model, generates network effects, which will help the company strengthen and expand its competitive advantages in an industry that has high barriers to entry and is constantly changing. So in a few lines, FPA moves from macro, to competitive, to financial analysis, highlighting the key data points required to understand this specific investment opportunity.

Blind spots

What FPA fails to go into detail are the track record and remuneration of management, ownership structure around the stock, and more depth into valuation, especially in regards to why they’ve used a specific metric to value a company instead of alternatives. Noted, it’s pretty hard to condense all that information into a short paragraph. We can expect a detailed write-up in a quarterly commentary (although every quarter FPA Funds choose one case study to analyze in-depth over their quarterly webcasts). In their commentaries, FPA chooses to prioritize a discussion on mispricing, which in my opinion is the first element to understand the possible attractiveness of an investment opportunity. See, they’re helping us! All of this saves us time, and we’d be fools not to take advantage of their ideas.

Quick Summary

Strengths:

- Discussion of mispricing, and explaining quantitatively and qualitatively if it truly exists, why it exists, and why it will probably revert;

- Always integrating financial and business model analysis to explain the story around the stock;

- And adding quantitative evidence to their thesis in terms of why the mispricing will most likely be corrected.

Weaknesses:

- Insight into the quality of management in terms of performance, alignment with shareholders, and capital allocation;

- And further explanation into their valuation methodology for each specific case, given that no single metric can be used to value every kind of business model.

What’s more impressing is that, in a short paragraph, FPA manages nail the few points that truly matter when analyzing a complex system that is a company, and see past cyclicality and other macro factors when they don’t necessarily matter, but which might create irrational hesitation for other investors that aren’t able to see the forest from the trees. Reading their stuff can’t hurt.

Component 3: Screening for Ideas

So we’ve decided to follow or not a specific fund. We’ve gone through their data, writings and holdings in order to analyze the merits and demerits of their analytical process. Now we must take into consideration our view about the fund, and apply our basic investment criteria to the ideas that they mention that seem worthy candidates.

But moving onto the third component of this system, it’s vital to keep in mind that the fund had three months to make the ‘new’ purchase, which they are discussing in this specific quarterly commentary, and a lot, can change in three months.

Looking at the price changes over these three months is maybe the first thing we should do. I don’t necessarily like to look at where the specific stock is trading today, but how the price moved during these past three months. If the price has gone down that’s even more attractive for further research; more chances of hitting the treasure (since many fund managers have admitted to being early, etc.).

We then should try to uncover why, asking question like: Was there a problem with the business model, or just uneconomic and irrational selling? Are the fundamentals retracting or are the issues the company is going through temporary? Is their plausible and probable disruption on the horizon or is the market simply underestimating the sustainability of the company’s competitive advantages?

And if the opposite is the case, and the price has gone up, we then should find out whether the present or expected catalysts have played out, or whether it’s simply momentum and/or macro factors that are driving the stock.

What we want to find out is what’s are the causes to the effect of the changes in price over the last three months. That helps us to save time by knowing whether to say no to an idea quicker, and then tailor our research to the ones we’ve decided to say yes to.

Idea Selection

The next step is filtering the ideas presented by FPA through the two categories discussed previously in Part 1: (1) a special situation, either corporate or otherwise, that creates a mispricing; and (2) a combination between business quality and whether the stock is attractively priced.

Out of the 18 mentioned, the stocks that passed these loose filters were the following:

- Essilor/Luxottica: A special situation – combining two high quality companies with relatively inelastic products protected by strong economic moats – linked to the scrutiny around anti-trust issues that might be created from the merger between both.

- Ryanair Holdings: A high quality company with a great management team and high growth potential that seem to be under-discounted by the market.

- Britvic: Another high quality compounder in a defensive sector with strong brands protecting its position in such a competitive industry. This seems like an interesting idea to investigate further given the uncertain times in the market today, even though the company’s stock has appreciated significantly, a situation similar to Ryanair.

- Page Group: An interesting turnaround story in a trending industry that delivered an average ROCE greater than 20% through the last business cycle, which successfully transitioned post crisis from UK-centric and finance focused into multi-discipline global company, by entering new markets, expanding into new disciplines, and further developing its IT and operations capacity.

- KSB: A restructuring story that seems to provide returns skewed to the upside, with a strong company with solid fundamental and growth avenues behind the special situation, which can be bought at low relative valuations.

- Totvs: An interesting company going through many changes in a problematic country, in an industry difficult to compete in and going through changes every day, which might provide good opportunity to buy it at a discount. The business has been developing solid competitive advantages by strengthening the network effects of its solutions through smart acquisitions, improvements to its sale model, and increasing customer-focus.

In Part 3, three of these six companies will be discussed in more detail.

Article by Joao Alves, Ahead Of The Crowd