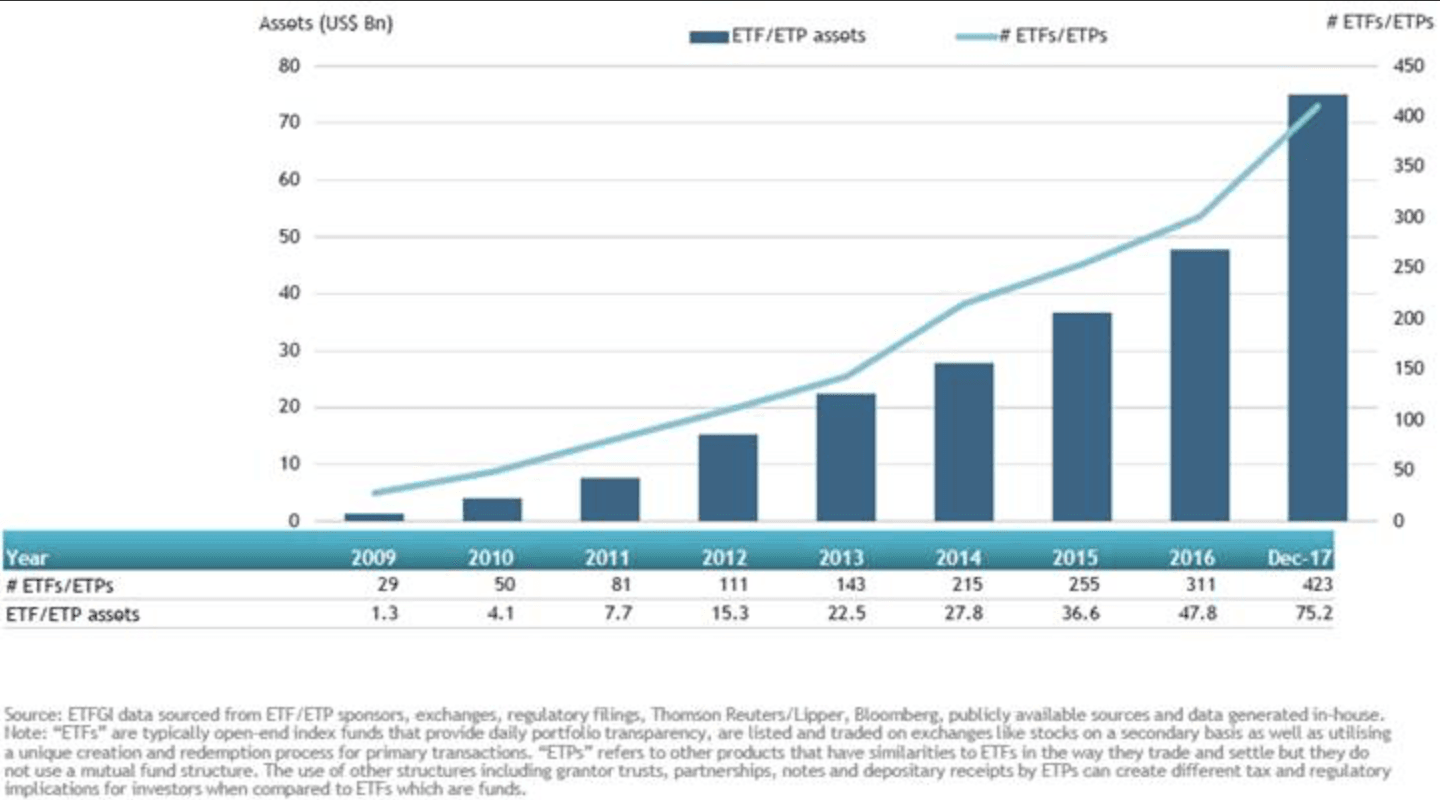

ETFGI reports that assets invested in Active ETFs and ETPs listed globally increased by 57.3% during 2017 to reach a new high of US$75.20 Bn

LONDON — January 29, 2018 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that assets invested in Active ETFs and ETPs listed globally increased by 57.3% during 2017 to reach a new high of US$75.20 Bn at the end of December. (All dollar values in USD unless otherwise noted.)

According to ETFGI’s December 2017 Global Active ETF and ETP industry insights report, an annual paid-for research subscription service, assets invested in Active ETFs/ETPs listed globally grew by a record $27.40 Bn during 2017, over double the previous record of $11.20 Bn set in 2016. The increase of 57.3%, from $47.84 Bn at the end of 2016, also represents the greatest growth in assets since 2009 when markets recovered following the 2008 financial crisis.

Highlights

- Assets invested in Active ETFs/ETPs listed globally increased by a record $27.40 billion during the year, to reach a new high of $75.20 Bn.

- Year-to-date, through end of December 2017, Active ETFs and ETPs listed globally saw net inflows of $24.92 Bn.

This record was achieved on the eve of another milestone for the ETF industry: the 25th anniversary of the listing of the first ETF in the US, the venerable SPDR S&P 500 ETF (SPY US), on 22nd January 1993. At the end of 2017, SPY on its own accounted for assets of $271.39 Bn.

December 2017 marked the 36th consecutive month of net inflows into Active ETFs/ETPs listed globally, with $1.21 Bn gathered during the month. During 2017 Active ETFs/ETPs listed globally saw net inflows of $24.92 Bn; 154.33% more than net inflows for 2016.

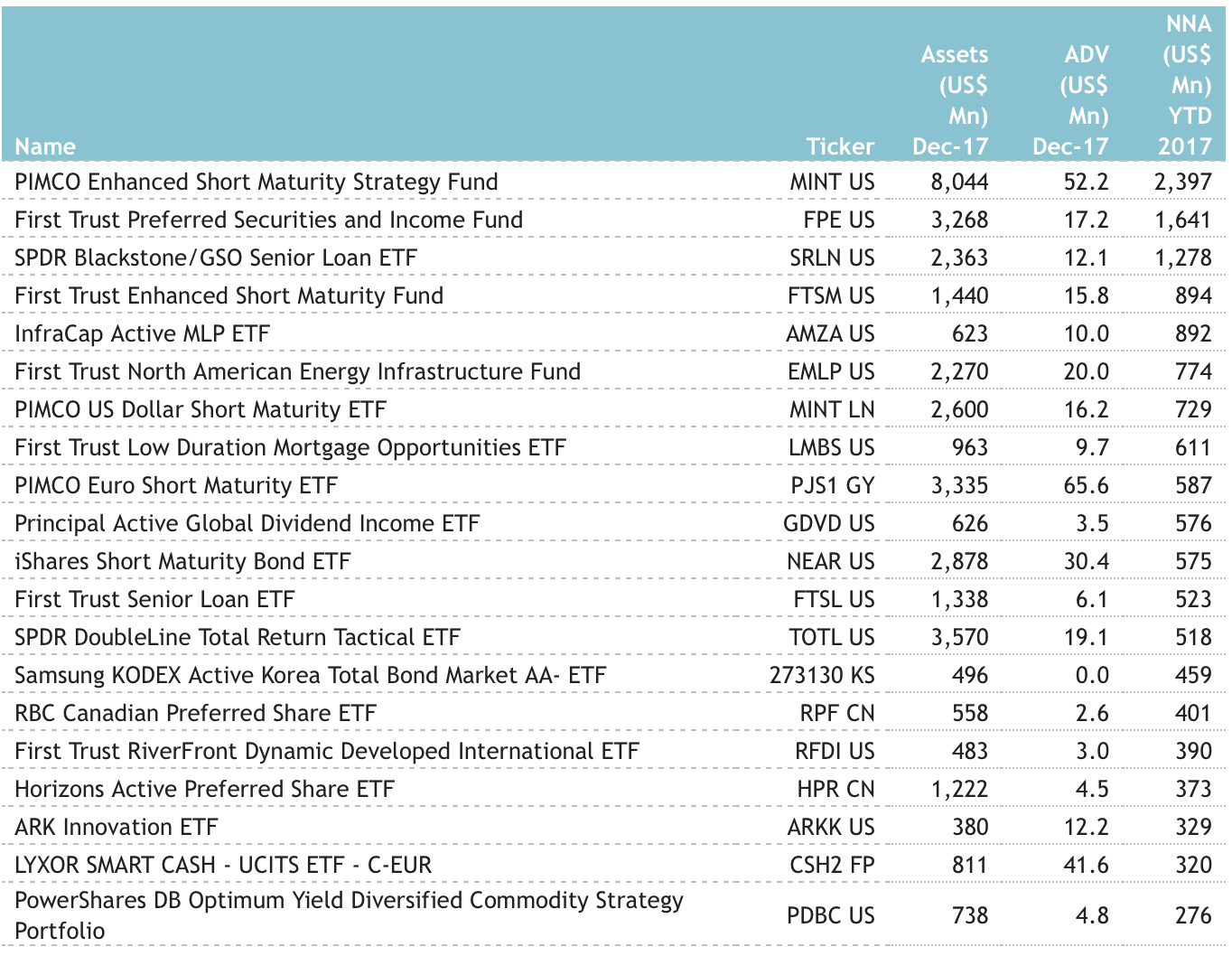

The majority of these flows can be attributed to the top 20 Active ETFs by net new assets, which collectively gathered $14.54 Bn during 2017. The PIMCO Enhanced Short Maturity Strategy Fund (MINT US) on its own accounted for net inflows of $2.40 Bn.

Top 20 Active ETFs by net new assets: Global

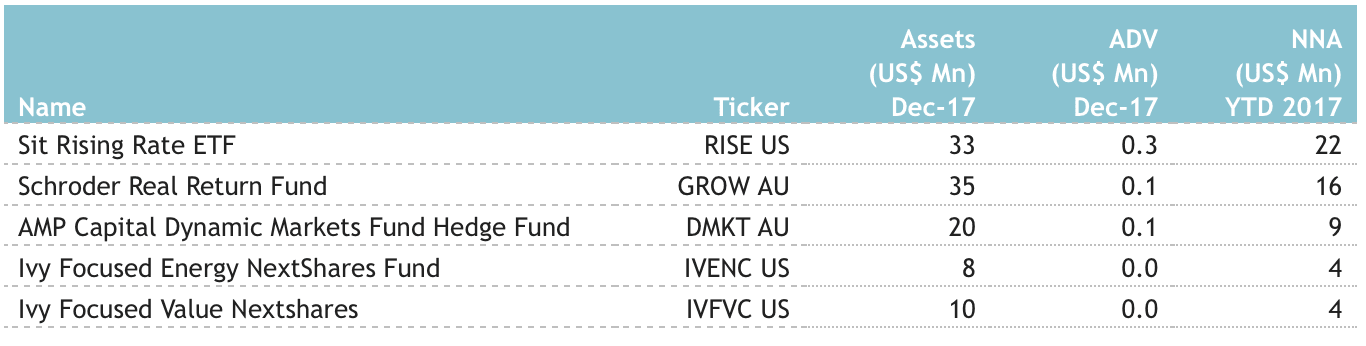

Similarly, the top 5 Active ETPs by net new assets collectively gathered $54.07 Mn year-to-date during 2017.

Top 5 Active ETPs by net new assets: Global

Equity ETFs/ETPs listed globally saw net inflows of $876.00 Mn in December, growing net inflows for 2017 to $7.20 Bn. Fixed Income ETFs and ETPs gathered net inflows of $126.00 Mn in December, bringing net inflows for 2017 to $16.43 Bn.

To conclude, investors have tended to invest in Fixed Income Active ETFs in 2017 with the PIMCO Enhanced Short Maturity Strategy Fund (MINT US) accumulating net inflows of $2.40 Bn.

Please contact [email protected] if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.