FPA Crescent Fund commentary for the fourth quarter ended December 31, 2017.

H/T Dataroma

Dear Shareholders:

December capped a banner year for the S&P 500. For the first time ever, it delivered a positive return in every month, setting more than four dozen new records along the way.

Our conservatively postured FPA Crescent Fund (“the Fund”) returned 2.90% in the fourth quarter of 2017. This compares to the S&P 500’s 6.64% return and the MSCI ACWI’s 5.73% return in the same period. For the full year, the Fund returned 10.39% compared to 21.83% for the S&P 500 and 23.97% for the MSCI ACWI.

Portfolio Commentary

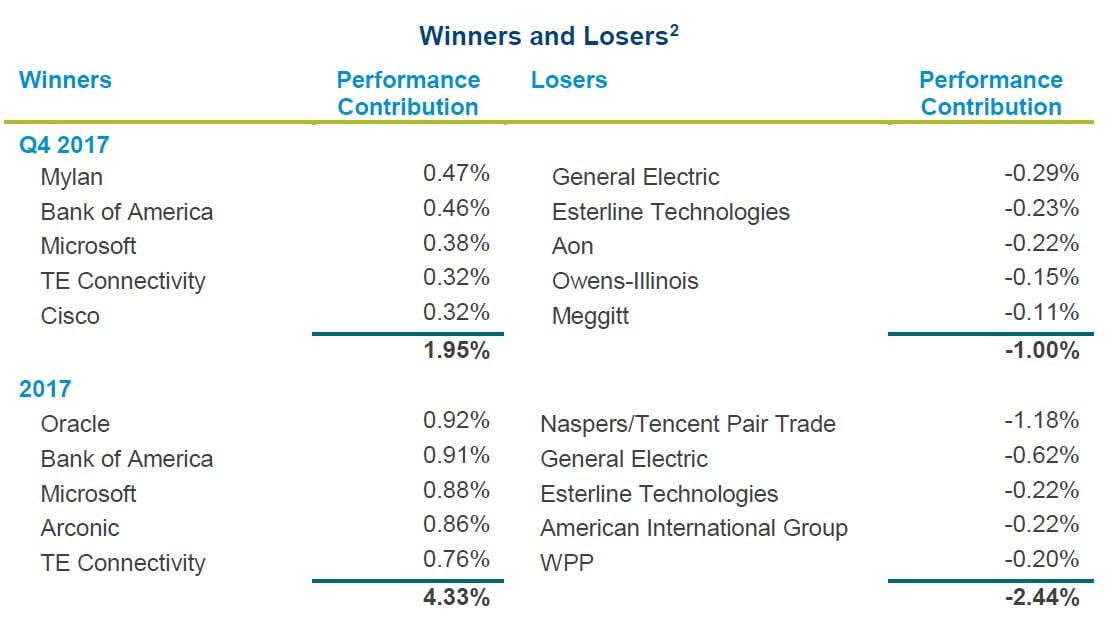

The Fund’s top five performing positions added 4.33% to our full year return while the bottom five detracted 2.44%, with almost half of that due to the Naspers/Tencent pair trade mentioned in previous commentaries.1 Naspers trades at an irrational $52 billion discount to its investment in Tencent with its remaining businesses thrown in for free. We hold out hope for the day when it’s priced more reasonably. General Electric (GE) cost the Fund 0.62% last year and warrants a longer discussion that we include in the Investing section below.

Not much in the way of news influenced the returns of the other investments amongst the winners and losers.

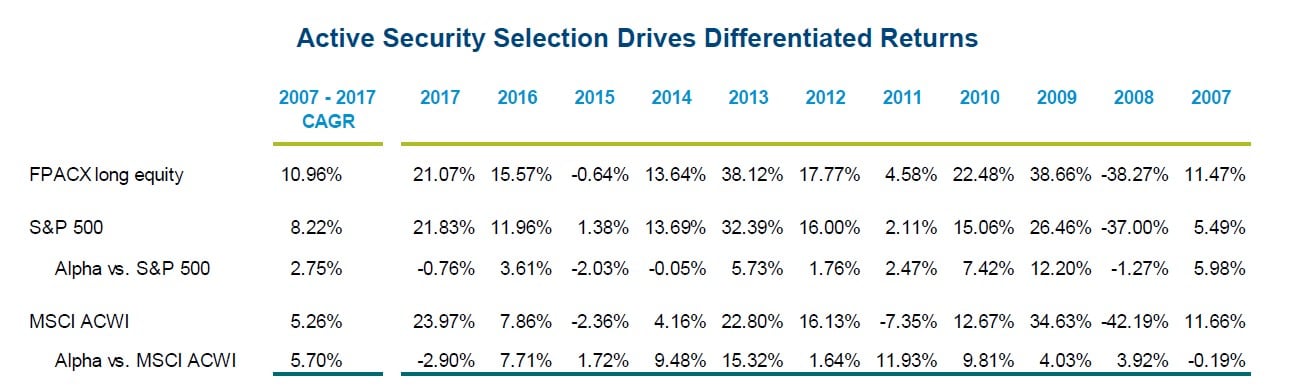

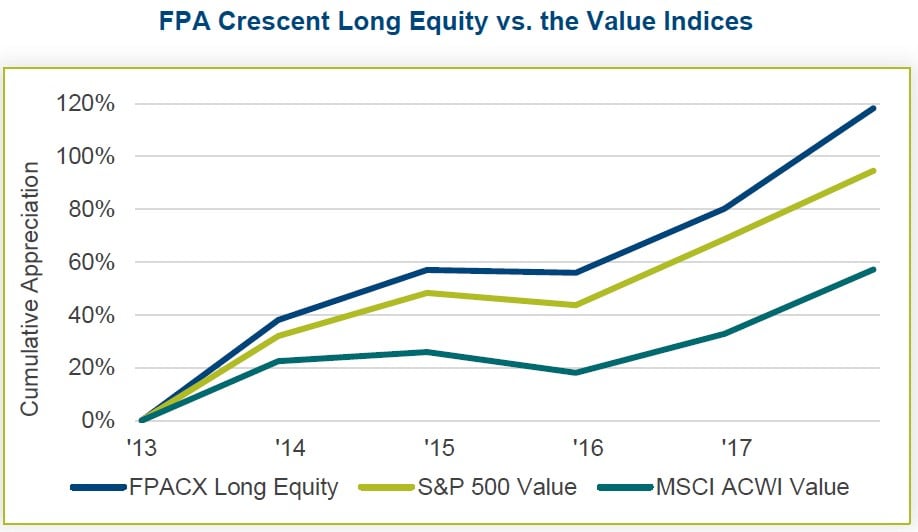

The Fund’s long equity book that generally represents the largest portion of its risk exposure returned 21.07% (gross) in 2017, lagging the S&P 500 by 0.76% and the MSCI ACWI by 2.90%. Over time however, your portfolio managers have added alpha of 2.75% and 5.69% over the S&P 500 and MSCI ACWI, respectively.

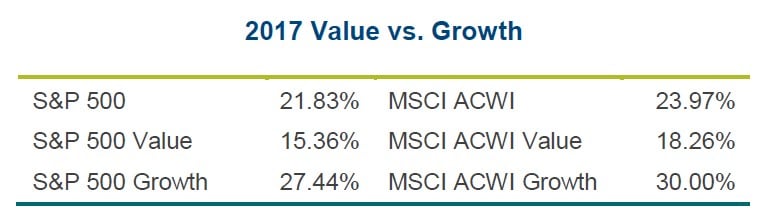

Our bread and butter — value stocks — continue to lag the overall market. Value stocks trailed the S&P 500 by 6.47% and the S&P 500 Growth index by 12.08%, their worst calendar year performance since 1999.

Value has been out of favor since 2013. The Fund’s long equity book did, however, substantially outperform both the S&P 500 Value and MSCI ACWI Value indices as seen in the following table.

What has proven more important than our security selection over this market cycle is that the exposure to long equities and other risk assets has been too low in retrospect. There is no hiding from the fact that this underweighting has reduced the benefits of the excellent performance of our long book. In our efforts to deliver equity rates of return while avoiding a permanent impairment of capital, we generally err on the side of caution. That said, when opportunities once again reveal themselves, please know we are ready to take advantage of them.

Markets and Economy

We are bottom-up investors who work to build a strong understanding of businesses and industries. We decide what companies we would like to own and the market decides if it would like to offer them to us at a price that provides an attractive risk/reward. Once we identify a business we would like to see in our portfolio, we await a time it might reasonably be delivered to us.

The macro picture is only an afterthought. The larger environment might help explain why we buy more or less of something but it certainly does not drive the Fund’s overall exposure. Understanding where the world is and the prices markets are offering us for the assets we’d like to own helps to explain the Fund’s positioning.

We lack any ability to prognosticate, but here’s what we know…

Global stock markets have not been inexpensive enough for a number of years to offer the potential for high single-digit rates of return and are now trading at new highs. We continue to believe there isn’t enough of a margin of safety3 to warrant a fully-invested portfolio. Stocks that were not inexpensive before are even less so now with U.S. large cap valuations valued in the 97th percentile and global stocks in the somewhat more attractive 77th percentile. Government bond prices are close to all-time highs despite yields being off the bottom. Corporate bond yields are also near their all-time lows. High-yield corporate bonds hardly offer much more return and carry more risk. If history is any guide and defaults and recoveries reach past levels, then the expected return of U.S. junk bonds would be less than one percent better than U.S. Treasuries while European junk yields would be negative. There are more levered companies now than there have ever been. The levered companies are, on average, carrying more debt than in the past and with reduced investor protection (e.g., weaker covenants). High valuations and a low margin of safety explain our low risk exposure of 63.3%4

Unlike us, most investors shake off their concerns because global economic growth has been okay albeit lower than in the past. Corporate operating margins continue to reach new highs for this cycle and any cycle that has preceded this one. The 40% decline in U.S. corporate tax rates will help increase the earnings of many domestic companies but much of that already looks like it is baked into current market valuations. Giving an additional lift to public markets is the fact that the supply of shares has been declining. Mergers and leveraged buyouts have reduced the number of public companies and public companies have been active repurchasers of their own shares.5

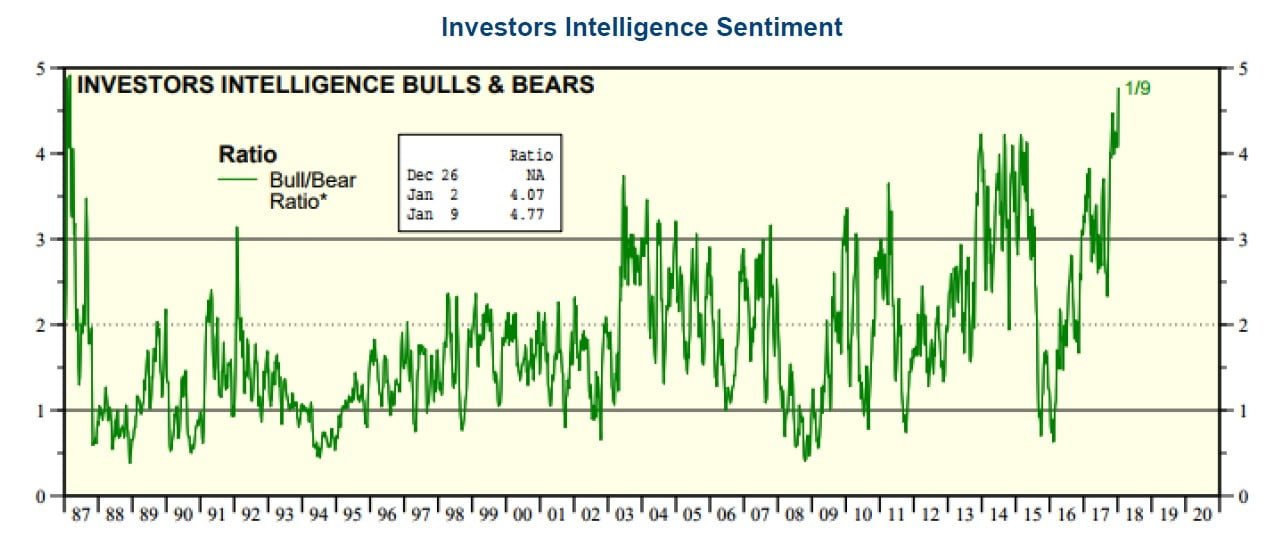

Given the low, low level of interest rates, there seems to be little in the way of investment alternatives. Either because of that or as a result of it, volatility hit its lowest level ever last November at 8.56 intraday6… all of which leads to happy and bullish investors because what goes up must only continue to rise, right? Yardeni Research publishes a survey of market sentiment and, as seen in the following chart, bulls currently outweigh bears almost 5:1 – the most bullish ratio in more than thirty years.

As Prince sang, “Sign o’ the times mess with your mind...”8 Here’s the mind-bending reality we’re wrapping our brains around in this bullish environment:

- Cryptocurrency trading and valuations have reached mania proportions. Chris Larsen, the co-founder and largest shareholder of the cryptocurrency company Ripple, temporarily became the world’s fifth wealthiest person on the planet in early January when he was worth $59.8 billion.9 For a moment, he was wealthier than the founders of Google and Oracle, the Koch brothers, and Michael Bloomberg. Oh, and he was “only” worth less than $5 billion a month earlier.

It makes the gold rush seem slow. Prince’s next line in that song is, “Hurry before it’s too late!” A lot of people seem to invest, sadly, based on that philosophy. More realities:

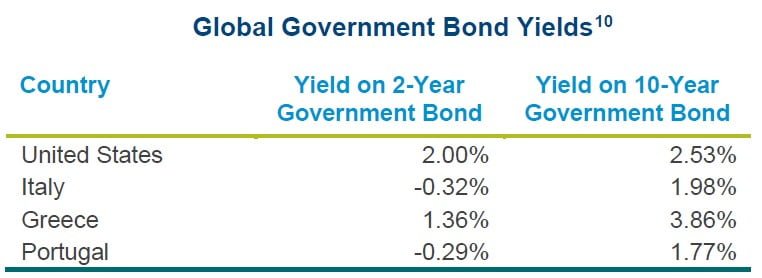

- The governments of Italy, Greece and Portugal can borrow at a lower rate than the U.S. for a 2-year term. The same is true for 10-year bonds issued by Italy and Portugal. The U.S. may not have its financial house in order but we would take its bonds over these alternatives.

- High-yield European corporate paper now has the same yield as US Treasuries.11

- Index funds & passive ETFs now own approximately 20%-25% of the stock of the typical small-cap company.

- North Korea launched a ballistic missile over Japan on August 29, 2017 and the Nikkei was higher by the following day.

- Stockpile,12 a startup website and app, brings trading to kids, allowing them to buy fractional shares of their favorite stocks or ETFs. It lets them “start investing with just $5” with “no hidden fees” so “kids and teens can track their stocks, create a wish list and even place trades you (the parent) can approve” all for “only 99¢ per trade with no monthly fees or account minimum.” I’m not sure of a typical child’s wherewithal but if my two youngest daughters busted open their piggy banks, they probably would not have more than $50 between them. Maybe that’s not typical but assuming the minimum advertised account balance ($5) is used to buy one security, then the 99¢ commission equals 19.8% of the total value. Seems as though it might be a good lesson on how to lose money! (Not to worry though, Mom or Dad can purchase a gift card to offset the transaction costs in increments as low as $10.)

John Kenneth Galbraith reminds us in his book A Short History of Financial Euphoria of “the extreme brevity of the financial memory. We quickly forget financial disasters and the circumstances that brought them about, and as a consequence, when the same or closely similar circumstances arise again, sometimes in just a few years, they are hailed by a new, often youthful, and always extremely self-confident generation as a brilliantly innovative discovery in the financial and larger economic world.” For Galbraith, it becomes a consistent cycle of “illusion to disillusion and back to illusion…. There can be few fields of human endeavor in which history counts for so little as in the world of finance.”13

Even though stocks can rerate faster and give back the gains more quickly than they were made, we have no idea when a downturn might come. It could be tomorrow, next month or sometime in the coming years. When we think about what could change, we appreciate that more things might happen than will happen. We also appreciate that we cannot identify all that could go wrong.

Here's what we don’t know…

- What if several big economies fall into recession? The U.S. is already in its third longest economic expansion. The EU is still guided by an unproven mix of central monetary authority and decentralized fiscal responsibility. Political instability persists there and elsewhere.

- China – thanks to a rapid accumulation of debt in the shadow banking sector - could suffer a cascade of defaults, stymieing lending.

And could there be:

- political and/or social upheaval in a part of the world that affects Western economies?

- higher inflation which leads to higher interest rates?

- a loss of control by Republicans of the House and/or Senate and a negative reaction by investors to the specter of greater regulation, higher taxes and general uncertainty?

- terrorist (including cyber) strikes at home or at some place that hits too close to home?

- a war or some serious jingoistic saber-rattling?

- a loss of faith in central banks?

- a decline in the value of cryptocurrencies that destroys hundreds of billions of dollars of value? Cryptocurrencies currently have a value of at least $784.8 billion.14

After Bull Market Year 8 ended in 2016, we talked about how complacency leads investors to believe they have a greater risk tolerance. Now, after Bull Market Year 9, we’re beginning to see a level of excitement that reflects something more akin to risk ignorance, which has led us to a lower-than-average exposure to risk assets.

See the full PDF below.