At the end of December, AQR published a paper claiming that most fixed interest funds “overstate the true “alpha” in active FI management.”

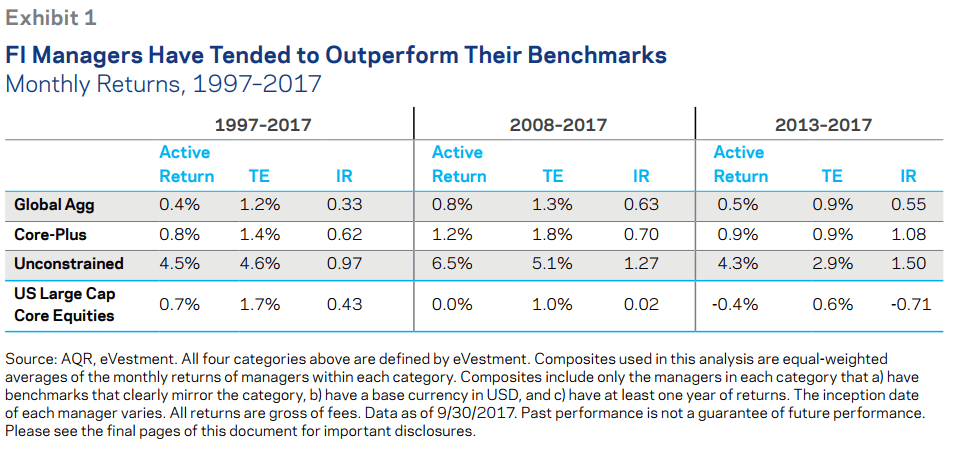

The paper notes that over the past few decades, many fixed-income funds have outperformed their benchmarks, a trend that has lead to the conclusion among investors that most of these managers are worth their fees.

Are Fixed-Income Funds Lying About Alpha?

AQR believes that a large amount of the outperformance these managers generate over their benchmarks can be explained by explained by overweight allocations to higher yielding credit instruments. These small 10% to 20% sub-investment grade buckets have been enough to create outperformance and justify fees. The paper concludes that these allocations mean "that average active returns overstate the true "alpha" in active FI management."

Although, it should also be noted that AQR had no direct access to bond fund holdings, only returns, from which this conclusion was drawn.

After publishing these findings, AQR concludes that, if you want to make the best bond investment, you should buy their funds, which chase factors. As explained below:

"We do find, again much like in equities, expensive traditional active fixed income management is a bust; however, the same factors we find effective elsewhere (value, momentum, carry, defensive/quality) show up in bonds. So, not surprisingly, we think there is hope, but it’s not because “active management works in bonds,” but because “the same basic things that work everywhere also work in bonds.” Basically, don’t go traditional “active” in fixed income, go factor."

This conclusion is all well and good, but as Jonathan Rochford of credit fund Narrow Road Capital points out, AQR's research ignored one key factor that usually leads to outperformance in fixed income: the illiquidity premium.

"This is an inconvenient truth for AQR, as their business model relies upon putting their very large funds under management to work in highly liquid securities."

Accounting for the illiquidity premium is an almost impossible task, and it's this premium that will enable active bond managers to continue to profit in all types of market. How would a factor based fund have traded momentum in 2008? Would it have sold everything? What happens to factor-based illiquid fixed-income funds in a bear market? There are no answers to these questions as of yet.