2018 will be a transition year with clouds on the horizon for the global economy

PHILADELPHIA, PA, January 12, 2018 – FIS Group, a manager of U.S. and global developed, emerging and frontier markets equity portfolio strategies, today issued its latest Q1 2018 Market Outlook, ‘Goldilocks need not fear the bear in 2018… but her respite will be more fitful,’ which provides a review of a nearly perfect market for risk assets in 2017, and predictions for what is to come in the year ahead.

“As we turn the page to 2018, there are a few obvious clouds on the horizon for the world economy,” says Tina Byles Williams, CEO and CIO of FIS Group. “Nonetheless, we expect 2018 to be a transition year. Stretched valuations and extremely low volatility imply that risk assets are vulnerable to the consensus macro view that central banks will not be able to reach their inflation targets, even in the long term.”

According to the Q1 2018 Market Outlook, in the U.S., tax cuts will give business outlays and overall GDP growth a modest lift in 2018, boosting real GDP growth by 0.2 to 0.3 percentage points. While US equities are due for a correction, Byles Williams doubts that they will plummet into bear market territory in 2018, instead anticipating that the S&P 500 will only slide into bear territory in 2019.

Meanwhile, global emerging markets have been turbocharged by both external and internal forces, according to the Q1 2018 Market Outlook. The initial spark was Chinese reflationary policies, followed by a growth uptick in the U.S. and Europe and a weak US dollar in 2017. EM equities have been supported by improving earnings momentum, rebounding export growth, and strengthening balance sheets.

Byles Williams states: “We believe that Emerging Markets will continue to outperform in 2018, but will be challenged over time by China’s changing growth strategy, which will gradually remove a powerful tailwind for EM economies that most directly benefit from its historical capital-intensive growth emphasis.”

“On the positive side,” she adds, “the earnings rebound for many EMs are lagging the cyclical upswing more broadly and is still supported by mostly accommodative bank policies.”

FIS Group also believes that Japanese and Eurozone equities will once again outperform U.S. equities, and that late-cycle and Capex-exposed sectors will benefit from synchronized global growth ensuing for the first time since the Great Financial Crisis.

2017 saw a mountain of geopolitical concerns which turned out to be either red herrings or were overcome by positive market fundamentals, including tensions in North Korea, according to the Q1 2018 Market Outlook.

In terms of geopolitical risks for the year ahead, “Of greater concern is the risk of increased foreign policy adventurism, as well as the ratcheting up of protectionist trade policy by the Trump Administration both to distract from domestic political troubles and feed red meat to the President’s base. It is in this context that we are keenly monitoring the recent ratcheting up of tensions in Iran,” says Byles Williams.

2017 IN REVIEW

2017 was nearly perfect for risk assets. Buoyant global growth, political stability in Europe, strong earnings momentum, a weak US dollar and steady policymakers’ hands in China fueled risk assets to extraordinary levels. Most asset classes performed well, with many delivering double-digit returns (see CHART 1). Because the US dollar depreciated by over 10% during the year, non-US investments were especially attractive for US investors.

The events many worried about in early 2017 – including the election of a far-right government in France and aggressive US trade policy – didn’t materialize. The MSCI ACWI closed at record highs 61 times, and the 30-day realized volatility of the S&P 500 Index hit its lowest level since the early 1960s. Global equities were also boosted by falling inflation and basically flat long-term bond yields, even as the economy improved, while cryptocurrencies posted huge returns. Finally, 2017 was also a year of extraordinary divergences. In the U.S., the top performing sector, technology (up 38%), outperformed the worstperforming sectors, energy and telecom (down around 5%), by more than 43 percentage points. For emerging markets equities, the divergence was even more stark. Four Chinese technology stocks – Alibaba, Baidu, JD.com and Tencent–outperformed the MSCI Emerging Markets index by 59%, 5%, 25%, and 75% respectively and collectively accounted for 19% of index’s performance. For a report card on the performance of our 2017 calls, please see TABLE 1 on PAGES 8-11.

For the seasoned investor, 2017’s extraordinary equity returns should give rise to concerns that positive economic news and earnings have already been discounted and therefore are ripe for mean reversion. In the U.S., for example, the economic surprise index rose to a six year high during the last week of 2017 and global indices rose by 40%. According to CFRA, in years with above average new highs and below average volatility, the S&P rose the following year only 55% of the time, with an average gain of 3.1%. Conversely, in years where the dispersion between the best and worst performing sectors was high (such as 2017), the S&P 500 was up only 57% of the time in following year, with an average gain of 1.9%. Therefore, it would be reasonable to ask what additional positive economic or earnings surprises await us in 2018 that have not already been discounted? Relatedly, what risks are being underappreciated as the market plumbs new heights? On PAGE 4 of this report, we discuss four such risks that, in our opinion, bear close monitoring.

2018: A TRANSITION YEAR

As we turn the page to 2018, there are few obvious clouds on the horizon for the world economy. Business surveys suggest positive sentiment and Purchasing Managers’ Indices as well as earnings momentum continue to improve. Global equities will continue to be buoyed by three critical economic locomotives – the U.S., the European Area and China – none of which face an imminent meltdown in 2018. Underpinned by this synchronized global upturn, top-line earnings growth should be able to withstand less accommodative policies by the Fed and ECB. Despite tighter labor markets and above trend growth, our base case is a modest rise in inflation, particularly outside of the U.S., anchored by the deflationary effects of technological innovation and globalized competition which limits the pass through to wages. Therefore, a key risk in the U.S. could be an upside surprise in inflation.

Nonetheless, we expect 2018 to be a transition year. Stretched valuations and extremely low volatility imply that risk assets are vulnerable to the consensus macro view that central banks will not be able to reach their inflation targets, even in the long term. We expect equity markets to begin discounting the next US recession sometime in early 2019, but markets will be vulnerable in 2018 to a bond bear phase and escalating uncertainty regarding the economic outlook. Therefore, as suggested in the title of this research note, the Goldilocks markets will once again gain respite from the bear, but her rest will be somewhat more fitful in 2018.

In the U.S., tax cuts will give business outlays and overall GDP growth a modest lift in 2018. The new legislation will cut

individual taxes by about $680 billion over ten years, trim small business taxes by just under $400 billion, and reduce corporate taxes by roughly the same amount (including the offsetting tax on currently untaxed foreign profits). The direct effect of the tax cuts will likely boost US real GDP growth in 2018 by 0.2 to 0.3 percentage points and boost after corporate tax profits by 3-5%. However, much depends on the ability of the tax changes and immediate capital expensing to further lift animal spirits in the business sector and bring forward investment spending. Any infrastructure program would also augment the fiscal stimulus.

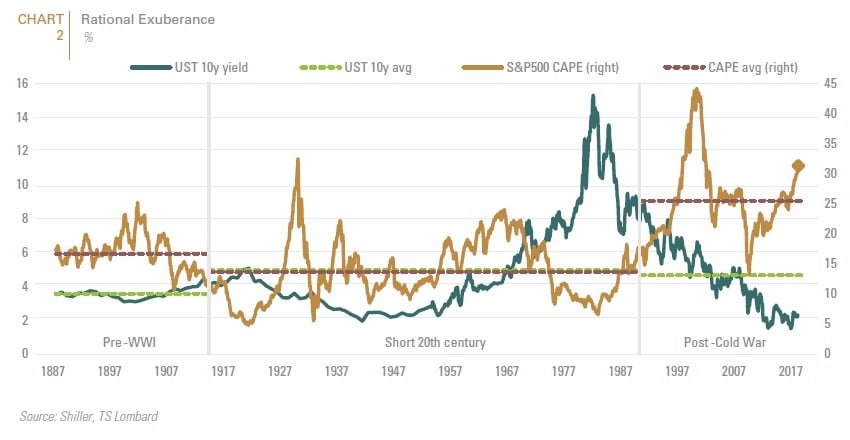

While we recognize that US equities are due for a correction, we doubt that they will plummet into bear market territory in 2018, even if the FOMC implements its interest rate hike projections, because the economic backdrop in the U.S. and elsewhere should remain healthy. Although equity valuations are not cheap by historical standards, they are still attractively valued compared to bonds. Shiller’s cyclically adjusted p/e ratio, for example, is currently more than 31, well above the post-cold-war average of 25.5. However, 10-year US Treasury yields are also well below their 4.7% average (see CHART 2 below). Moreover, growth in the US economy has tended to slow only gradually in response to higher rates. The party in the stock market has often only ended when it has become clear than the economy is about to stop growing altogether. This is the key reason why we project that the S&P 500 will only slide into bear territory in 2019.

Regionally, the Euro Area and Japanese economies registered the biggest upside surprises relative to IMF and consensus forecast. Moreover, in the Eurozone, growth has become increasingly broad-based both in terms of geography (even Italy is on the rebound) and in sector composition. Heretofore, the recovery was primarily led by export-oriented sectors but leadership is increasingly moving towards domestically oriented sectors such as financials, construction and consumer services. This is one of the reasons why continued strength in the Euro should not disrupt growth. Japan’s strong Q3 GDP performance marked the longest expansion it has experienced this century. Moderate increases in wages and inflation suggest that Japan continues to climb out of its deflationary slumber. However, inflation will remain sufficiently subdued to prevent the BOJ from significantly altering its dovish monetary stance. Equities in the euro-zone and Japan will again outperform US equities next year. Profits in both regions are less likely to be squeezed by rising wages than in the U.S.

Global emerging markets have been turbocharged by both external and internal forces. The initial spark was Chinese reflationary policies which began in late 2015 and continued into 2016, followed by a growth uptick in the U.S. and European Area as well as a weak US dollar in 2017. However, EM equities have also been supported by improving earnings momentum, rebounding export growth, and strengthening balance sheets. With their higher risk premiums, EM companies have disproportionately benefited from yield-seeking in a low-rate world. Accordingly, through September 30, 2017, EM attracted $65 billion in total inflows after approximately $155 billion in outflows from early 2013 to mid-2016.

Encouragingly, the rally in EM equities appears to be broadening from one largely confined to Chinese, Taiwanese, and Korean technology companies in the second quarter to greater market interest in energy and materials companies as a result of improving economic data out of both Russia and Brazil as well as stabilizing oil prices. During Q4, earnings growth improved for most EM sectors, which should support rising Emerging Markets equity valuations (see CHART 3).

In China, a newly emboldened President Xi will further centralize economic policies by emphasizing deleveraging in the financial sector; enforcing a more intense anti-corruption campaign focused on the shadow-banking sector; reducing the regional government control over economic policy; and improving the quality and environmental sustainability of Chinese growth at the expense of its capital intensity and pace. As Xi and the topdecision- making Politburo officially stated on December 9, the coming year will be a “crucial year” for advancing the most difficult aspects of the agenda. Therefore, we expect Chinese government policy to become a headwind, after having been a tailwind in 2016-17.

We believe that Emerging Markets will continue to outperform in 2018, but will be challenged over time by China’s changing growth strategy, which will gradually remove a powerful tailwind for EM economies that most directly benefit from its historical capital-intensive growth emphasis. On the positive side, the earnings rebound for many EMs are lagging the cyclical upswing more broadly and is still supported by mostly accommodative central bank policies. At 15.7 times trailing earnings and 12.6 times forward earnings, EM equities offer increasing earnings growth, better (and rising) returns on equity, and slightly higher dividend yields compared to developed markets. Across emerging markets, companies have made inroads in reducing capex over the past two years and free cash flow margins have risen substantially. Despite these fundamental improvements, emerging markets equities continue to trade at a 25% discount to developed markets on a forward basis, suggesting that the runway for the asset class remains decent.

Among the various EM regions, despite short term growth challenges emanating from China’s economic rebalancing, we still expect Chinese equities, particularly H-shares, to outperform the EM benchmark, assuming the economy does not spiral out of control and cause a global rout. President Xi’s goal of “leaping forward” to become a global “new economy” leader in 10 years will result in heavy state sponsored subsidies and protections in renewable energy, biotech, robotics, artificial intelligence and big data. On a sectoral basis, China’s health care, tech, and consumer staples sectors (and arguably energy) all outperformed China’s other sectors in the wake of the party congress, as one would expect of a reinvigorated reform agenda. These sectors should continue to outperform. In our inaugural “Foresights” for 2018, we explore the sustainability of the Chinese tech stock rally.

LATE CYCLE AND CAPEX EXPOSED SECTORS WILL OUTPERFORM

As is typical for late in the global market cycle, performance will be driven primarily by earnings as opposed to multiple expansion. With synchronized global growth ensuing for the first time since the GFC, we expect performance leadership from cyclical sectors as well those who primarily benefit from increased businesscapex. For the Q1 2017 Outlook, we posited that industrials and defense stocks in particular would be buoyed by both their exposure to capex and rising global geopolitical risks. Defense stocks rose by 39% in 2017 and therefore are somewhat expensive. However, this sector remains a high conviction sector for us and we believe that it would be worth buying after a generalized pullback. Another high conviction sector is financials, which should benefit from improving economic activity and credit conditions globally and rising interest rates and regulatory rollbacks in the U.S. In Europe and particularly in Germany and Spain, we expect domestically oriented sectors such as construction to outperform. More broadly, technology (whose industries that are exposed to the business capex cycle) is another high conviction sector. However, this sector warrants some discrimination after its stratospheric performance in 2017.

As we begin the year, semiconductor stocks appear to provide the best value. Finally, energy is our fourth high conviction sector. Like industrials and technology, our positive view on this sector is a continuation of our 2017 view, which was based on an expected rebalancing of energy supply/dynamics. While the energy markets did rebalance in 2017 (oil prices rose from 53.75 per bbl. at the beginning of 2017 to 60.35 per bbl. at its close), energy ETFs decoupled and lagged oil prices. Going forward, we expect this discrepancy to close. Moreover, the Trump Administration’s increasingly bellicose stance towards Iran and unfettered support for Saudi adventurism in our view adds a geopolitical risk premium to oil prices which is not fully appreciated. The last two years have been remarkably benign regarding unplanned oil production outages. Iran, Libya, and Nigeria all returned production to near-full potential, adding over 1.5 million b/d of supply back to the world markets. This supply increase is unlikely to repeat itself in 2018, particularly as geopolitical risks remain elevated in Iraq, Libya, Nigeria, and Venezuela. On PAGES 12-14, please find a summary of our regional and sector positions (TABLE 2).

Potential risks to an otherwise rosy scenario for global equities

in 2018 include:

1. Aggressive fed rate hikes

2. A “melt-up” in the US dollar

3. Mean reversion of the market’s extraordinarily low volatility

4. Market relevant geopolitical red herrings

Below, we discuss our perspective on all four.

1. AGGRESSIVE FED RATE HIKES

Ever since the 2013 taper tantrum, the markets and the Fed have been locked in a game of chicken in which the market has consistently (and thus far correctly) ignored the Fed’s projections. This game has continued into 2018. The FOMC is projecting three rate hikes in 2018; but financial markets have only priced in one rate hike.

It remains to be seen whether incoming chair Jerome Powell will continue Chair Yellen’s dovish and cautious approach. For the Trump Administration, continued dovishness by the FOMC along the lines of the market’s expectations would be the most politically expedient. This would prolong the current Goldilocks environment and prompt a melt-up in risk assets along the lines of 1999 in 2018.

Ultimately, the path taken by the Fed to increase interest rates will follow the trend in inflation expectations. To date, the Fed, like its counterparts in Europe and Japan, has made little progress in returning inflation to target since the FOMC started its tightening cycle. In November, the annual core CPI inflation rate fell to 1.7% from 2.3% in January 2017, with most of the drop coming from shelter, medical care and wireless services. As discussed previously, inflation has been plagued by structural headwinds emanating from both globalization as well as technological disruption. However, it is possible that the market may be underappreciating the risk of inflation surprising to the upside. For one, economic slack is disappearing at the global level. The OECD as a group will be operating above potential in 2018 for the first time since the Great Recession. Secondly, oil prices have further upside potential. Higher energy prices will add to headline inflation and boost inflation expectations in the U.S. and the other major economies. Thirdly, focusing on the U.S., the lagged effects of dollar weakness as well as the Trump Administration’s fiscal expansionism in an economy which is close to or at full employment (see CHART 4) would also be expected to boost prices. As a result, we believe that conditions may be in place for at least 3 rate hikes in 2018.

See the full PDF below.

About FIS Group

FIS Group is an investment management firm that provides customized manager of managers investment solutions for institutional investors. For 20 years, we have delivered risk-adjusted returns by conquering the complexity of identifying high skill, high active share entrepreneurial managers that have gone largely undiscovered by the institutional investor community. Unique among our peers, FIS Group enhances risk-adjusted returns by using macro strategy insights to allocate capital among the managers and/or through a global macro tactical completion strategy. Our culture is a fusion of relentless curiosity and a scientific, disciplined process.

For more information please visit us at www.fisgroup.com.