When I write about the F.A.N.G. names I oftentimes get mixed reactions. Many of my readers are of the conservative, income oriented variety. They’re nearing retirement and have little to no desire to associate themselves with names/acronyms so closely associated with speculative growth.

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

Being that none of the F.A.N.G. names currently play a shareholder dividend, I can’t blame investors who require a certain yield threshold from their investments for showing disinterest in these companies that don’t meet their investment goals.

If this is the investing mindset that you typically adhere to, I’ll forewarn you now, this article is going to be of little interest to you…

However, there are two groups of readers who I think will benefit from reading this piece: the younger investors who follow my work with very long time horizons ahead of them in the markets and those individuals who hear F.A.N.G. and simply turn up their noses, as if these companies and all of the hype that surrounds them is nothing more than a scam driven by market hysteria and Jim Cramer’s histrionics.

Although I consider myself to be a dividend growth investor, I have exposure to a handful of non-dividend paying names. This was the discussion of my last piece here at Sure Dividend and the editors have asked me to follow up with this piece, focusing on the famous (or notorious, depending on which side of the fence you find yourself on) F.A.N.G. names.

Back in 2013, Jim Cramer began hyping the F.A.N.G. names after his colleague at RealMoney.com, Bob Lang, came up with the nickname for the four biggest growth stocks of the time: Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google (GOOG) (which has since changed its name to Alphabet). Here’s what I believe to be the original article breaking down the F.A.N.G. names. Say what you will about Cramer, but he certainly nailed this call.

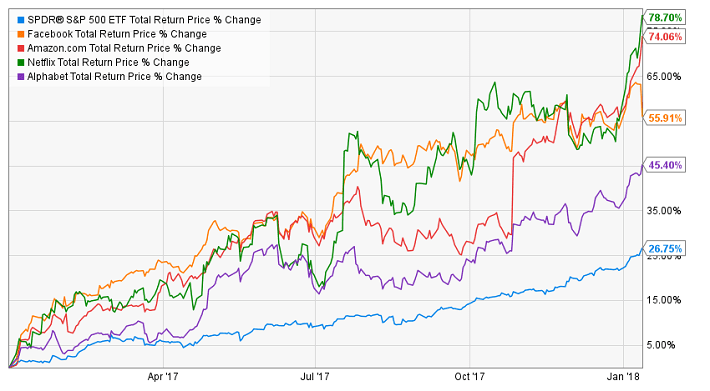

Let’s take a look at F.A.N.G.’s massive out performance over the last 12 months. If you thought the broader indexes went on a run during 2017 then you’ll be taken aback by F.A.N.G.’s performance.

Although I’ve been an owner of several of these names for awhile now (admittedly, I didn’t get behind the theme as early as Mr. Booyah himself). With that said, I was still surprised by the extent of their relative out performance during the past year or so. First of all, I never expect 40-50% total return in any 12-month period. Those expectations are just outlandish, regardless of the growth potential of a holding. What’s more, 2017 was supposed to be the year of the Trump Rally, meaning financials and industrials were set to soar, not the big names from Silicon Valley whose social and political stances tend to lean left. With a couple of exceptions, Silicon Valley wasn’t a friendly place for President Trump during the election and I think the F.A.N.G.’s out performance during the first year under a changing (and theoretically less-friendly regime) speaks volumes about the strong secular trends driving the growth of these names.

But even more impressive than their 2017 returns are the 5-year returns produced by the F.A.N.G. names. As you can see below, anyone holding these stocks has done quite well for themselves since Mr. Lang and Mr. Cramer created the F.A.N.G. bandwagon.

As I said in my prior piece here at Sure Dividend, after deciding to pursue a DGI strategy, it took years for me to diversify away from the traditional domestic dividend growers. I view my willingness to expand my horizons into international markets, as well as into non-dividend paying growth stocks when looking for growth, as a sign of maturity as a portfolio manager.

I got pretty good at identifying DGI names that were trading at fair value or better. My returns early on were great using a basic DGI, buy and hold approach. Looking at my results alongside many of the other DGI success stories that I’ve been told, I have no doubt that this is a fine strategy for investors seeking financial freedom. However, as solid as my returns were in the market, they were not F.A.N.G.-like.

I saw the massive runs that these big tech names were going on and the competitor in me wanted a piece of that action. For so long, I avoided the temptation to buy into these high growth names. I did my best to stick to the conservative roots that had been treating me so well.

I bought into the mindset that these “fabulous F.A.N.G.” stocks were massively overpriced and highly speculative assets. I used their valuation as an excuse to protect myself from the thin resentment that I tried to ignore when I spoke to others who who had bought a ticket to the F.A.N.G. ride and were having an amazing time.

“I’ll wait for a pullback,” I said to myself.

Well, this waiting game went on for years and I eventually realized that the market wasn’t the irrational one, it was me. I was letting the conservative, DGI dogma that I had cut my teeth on as a young investor get in the way of probably the best opportunity for long-term wealth creation that the market had in store for me.

I didn’t closely follow any of the F.A.N.G. names back in 2013 when the acronym was coined, but I wouldn’t be surprised if they all weren’t highly speculative on a fundamental basis at the time. The digital revolution as we know it today was just getting started and I don’t think anyone had an accurate idea of just how powerful and disruptive these digital/mobile business models would be. However, flash forward to early 2016 when I began buying some of these names and their businesses had matured. Not only had they developed extraordinarily wide moats in growth industries with long runways ahead of them, but they had developed envious cash flows as well.

So, let’s start breaking down these companies individually. I’ll also be discussing the speculative likelihood of shareholder returns (and especially dividends) when looking at the fundamentals, because while income is far from the forefront of my mind when looking at my F.A.N.G. exposure, I also wouldn’t be totally surprised if 50 years from now, several, if not all of these four companies have evolved into dividend aristocrats.

Facebook

When I did my year end portfolio overview, Facebook comprised 1.91% of my portfolio, which was almost enough to allow it to crack my top 10 holdings (Facebook was my 11th largest position, behind Johnson and Johnson’s 1.97% weighting). Facebook is my second largest F.A.N.G. position, behind Alphabet. I’ve built such a large Facebook position because of the intriguing valuation that I find here.

I know that certain investors hear the F.A.N.G. acronym and assume that all four stocks are irrationally overpriced. Oftentimes we hear about Amazon’s or Netflix’s incredible, triple digit earnings multiples and this drives the F.A.N.G. narrative. However, this simply isn’t the case for two of the four F.A.N.G. names. You’ll never hear me attempt to make an argument for Amazon or Netflix being rationally valued by traditional valuation methods in the present.

I don’t own Netflix because I can’t make sense of its valuation relative to its competitive position and its future growth prospects. And while I do have a relatively large position is Amazon, I didn’t buy those shares because I was attracted to their valuation, but instead because I wanted exposure to the potentially world-beating, revolutionary behemoth that Jeff Bezos was building.

But, when I bought shares of Facebook and Alphabet, it was because of their attractive valuations. Throughout 2016 and 2017, I actually believed that these two companies provided value oriented investors a couple of the most intriguing opportunities in the market.

I always use forward earnings projects when evaluating equities, but this is especially important when I’m looking at high growth names because if I was to use ttm EPS figures, I would likely find multiples that weren’t acceptable. When a company offers the market above average growth the market places a premium on it. Facebook has earned $4.47/share during the trailing 12 months, meaning that its ttm EPS is nearly 41x based upon its ~$180 share price. 40x is a lot to pay for any company, regardless of growth prospects. However, due to Facebook’s unique bottom line growth outlook, we see that analyst expect to see EPS of $6.69 for the full year in 2018, meaning that Facebook’s forward EPS multiple is less than 27x.

In today’s yield starved market, we’ve seen companies in the typically conservative & defensive consumer staples and utility sectors trading with similar multiples. This is what originally drove me into the F.A.N.G.-type names. I couldn’t justify paying 25-30x multiples for historically high quality companies (with slight, flat, and even negative top line growth projections) just because I was drawn to their reliably increasing yields. As a dividend growth investor I’ve had a real conundrum over the last few years as I’ve had to balance the value investor in me with my pursuit of financial freedom via my passive income stream.

Even though I consider myself to be a dividend growth investor, I’m rarely willing to abandon my value based principles. Sure, I’ve allocated a small percentage of my portfolio to entirely speculative investments, but other than these trades, I think it’s paramount that I target companies that are trading at fair or better values if I’m to meet my long-term management goals. I spoke about this in my prior piece here at Sure Dividend, but as a younger investor, my income stream isn’t my sole priority in the markets; I pay a lot of attention to total return as well in an attempt to reach retirement as soon as responsibly possible.

Because of this focus on value, I had to search elsewhere for potential investments with so many of the traditional DGI companies trading at what I believe to be irrational valuations because of the T.I.N.A. market that we’ve been living with; there is no alternative (to equities if you’re looking for yield).

Facebook posted top-line growth of 37.1%, 54.7%, 58.4%, 43.8%, and 54.2% during the years spanning 2012-2016, respectively. This is tremendous growth over a 5-year period and to me, represents a trend rather than a fad. Making matters even better for a somewhat conservative investor doing due diligence on Facebook shares, Facebook posted bottom-line growth that was even more impressive during this same period of time with annual EPS of $0.01, $0.60, $1.10, $1.29, and $3.49, respectively. It’s clear to me that this company and its talented management team understand how to turn a profit while still growing the company’s market share and widening its moat with ancillary products.

One of the reasons that Facebook is so profitable is that it doesn’t have a huge content spend like many of the other media platforms. The vast majority of Facebook’s content is user generated (or even better, paid content created by advertisers). It’s hard not to be attracted to this business model, which is much less capital intensive than its competitors in the media/video space.

I recently published an article over at Seeking Alpha regarding my belief that Mark Zuckerberg should consider initiating a shareholder dividend. That argument was based upon the fact that Facebook is relying on variables that are out of its control: population growth and infrastructure development that will allow further internet penetration world wide, for its future growth. For more in-depth analysis of this argument, please refer to the link above.

I believe that Facebook still has a long growth runway ahead of its because it still has platforms to better monetize; however, I don’t think investors should expect to see ~40-50% top-line growth over the long-term and my fear is that pricing premiums will contract, putting pressure on the company’s share price. I offered a dividend as a way to counteract any multiple contraction due to slowing growth; my view is that a strongly growing dividend can serve as a buoy for companies to latch on to as they transition from the high growth phase to a more mature operation.

Here’s an excerpt from the Seeking Alpha piece linked above with a specific focus on a potential dividend from Facebook:

“I think if Facebook initiated an annual dividend in the $2.70 range, representing a 1.5% yield at today’s share price, and began increasing it ~10% annually, it would go a long way towards cushioning any blows from the multiple contraction associated with slowing top-line growth. A $2.70 dividend would represent a forward payout ratio of ~41. This is rather conservative and assuming that FB gave investors annual increases in the low-mid double digits (which would be more than acceptable to the vast majority of investors) this payout ratio would likely drop in the short-medium term while FB’s bottom line growth outpaces dividend growth.”

I stand by this initial ~$2.70 dividend suggestion; If Zuckerberg were to head down the dividend path, he would open up ownership of his stock to a much wider variety of shareholders (both retail and institutional) who’re looking for yield. Because of Facebook’s massive profits, I think this company is very well suited to be a dividend growth company and could potentially develop into an aristocrat over time.

It does worry me that ~98% of Facebook’s revenues come from digital advertising, but then again, traditional media companies have done quiet well over the years relying on advertising dollars, proving that this is a sustainable long-term business model (so long as you have the necessary eyeballs). But then again, without a doubt, Facebook has the necessary eyeballs. ~65% of the world’s population (outside of China, where Facebook does not currently operate) uses a Facebook platform on a monthly basis.

Amazon

I won’t spend nearly as much time delving into Amazon here at Sure Dividend because I highly doubt that this company will ever pay its shareholders a dividend. I don’t even expect to see meaningful shareholder buybacks. Or, I should say, that I don’t expect to see either of these two things as long as Jeff Bezos is in charge. They’re simply not in his DNA. Mr. Bezos is all about growth. He’s all about disruption. He’s all about taking market share and dedicating money towards shareholder returns doesn’t help him to achieve these goals. And you know what? I’m just fine with that.

I don’t think that there’s a better CEO, or salesman, than Jeff Bezos on the planet. I oftentimes talk about buying management teams when I purchase stock and that is surely the case when it comes to Amazon. When you look at this company’s fundamentals, it doesn’t take long to realize that they’re all over the place. Amazon has done an absolutely amazing job growing its top-line, but it has razor thin margins, which is typically something that I would avoid. Cash flows continue to rise but this growth isn’t trickling down to the bottom line.

Amazon isn’t shy about entering into new markets and one could even make the argument that management doesn’t always appear to be focused. But, with all of that being said, this company’s growth is undeniable and I’m a shareholder because I believe in Bezos and I look forward to seeing just how big this thing can get before he’s satisfied.

I say that Bezos is the best salesman of all-time because somehow, he’s managed to convince the market to give him the benefit of the doubt when it comes to profitability… for decades. Sure, he turned a small company selling books on the internet into a global retail powerhouse with best in class cloud and AI assets, strong content divisions, oh… and in his spare time, he’s building reusable space rockets; but, none of these accomplishment are more impressive than the leeway that he’s convinced the markets to give him.

I’m sure that just about every other CEO is completely jealous that Bezos and Amazon don’t have to pursue profits. Instead, they can dedicate all of their energy (and cash) towards taking market share. This requires long-term thought and faith that isn’t often granted in a market that is mostly concerned with quarter over quarter growth.

As I said before, I don’t see Bezos slowing down anytime soon. Amazon has made a habit of using innovative technology to disrupt any market/industry that appears to be bloated. In attempt to take market share, Amazon is willing to accept lower margins. Many view these undercutting tactics as anti-competitive, but I can hardly blame Bezos; instead, I blame the markets for continuing to place such a high premium on Amazon without bottom-line production.

This is why my biggest fear regarding my Amazon position isn’t valuation, but instead, government oversight and/or regulation. The vast majority of retail sales are still made at physical locations and I believe the cloud game is still in its early innings. This points towards room for ample growing moving forward in its primary markets (without factoring in continued disruption in ancillary spaces).

However, Amazon’s dominance in eCommerce has changed the perception of the game and I worry that many Americans (and politicians) already believe that Amazon (along with several of the other most powerful tech companies, including the other F.A.N.G. names) is becoming too powerful and should be either broken up or regulated. As a shareholder, I like the high tech conglomerate structure, giving Bezos the cash flows he requires to go after new markets. Amazon has several segments that would be attractive stand alone businesses, but I think the entire pie is a much more powerful force than the individual parts.

Netflix

Netflix is the only F.A.N.G. name that I don’t personally own. Unlike the other companies included in this acronym, I’ve never been able to buy into this secular growth story. Actually, let me rephrase myself: I’m a big believer in the new age, mobile based, a la carte type of on demand content, but I don’t believe that Netflix has created a moat strong enough to defend itself against its competition and therefore, I have a very hard time believing that this company deserves the multiple that the market has benevolently bestowed upon it.

Disney (DIS) is my second largest holding behind Apple (AAPL), so that should go to show who I’m a believer in in the media/entertainment industry. What’s more, AT&T (T) is a top five holding of mine (needless to say, I’m bullish on the Time Warner acquisition) and I have a significant position in Comcast (CMCSA) as well. Honestly, I think what Netflix has done from an operational standpoint is very impressive. I’m even more impressed with the stock’s performance. How could you not be? It’s the best performing F.A.N.G. on both the 1-year and 5-year graphs. But, while I know there are very large future profit estimates floating about on the Street, I have a very hard time seeing those take place due to the costs that Netflix will incur as it continues to compete in a crowded industry for eyeballs.

Unlike Facebook, which faces little notable competition in its most profitable market (North America), Netflix is battling for screen time with some of the richest and most powerful companies out there. Apple, Amazon, Alphabet, the aforementioned Disney, Comcast, AT&T, and other behemoths, such as Verizon (VZ) in the traditional media/distribution space. There has been so much consolidation in the media space as distribution companies look to diversify their revenue streams and differentiate their pipes from their competitors’ by adding original content and your traditional production companies look to add distribution and/or alternative experiential products/services (theme parks, cruise ships, etc).

We’re witnessing a land grab for content right now with the AT&T/Time Warner and Disney/Fox deals. I believe that Netflix’s growing power has inspired these deals. Without a doubt, Netflix was the first mover in the over the top content arena, but only time will tell if its brand and services will stand up to this intense showdown.

Netflix is expected to produce an EPS of $1.25 for FY 2017 and $2.29 in FY 2018. If the company hits these analyst estimates, it will represent fantastic bottom-line growth, but the company is still a long way from having the necessary earnings to justify its current share price relative to other large media peers and FCF/share to pay a dividend.

Netflixis trading for ~100x 2018 EPS projections. Disney and Comcast are trading for much less than 20x their forward looking figures. What’s more, Netflix’s ttm FCF/share is -$4.65. Netflix’s FCF/share metric has actually been getting worse in recent years even though the company has grown sales and subscription metrics significantly. Even Amazon, who investors love to hate for its valuation, has produced fabulous FCF/share growth over the last 5 years or so (Amazon’s FCF/share was just $0.87 in 2012 and its ttm FCF/share comes in at $14.71).

I’d never bet against any of the F.A.N.G. names with a short position, but I also haven’t been willing to give myself speculative exposure to this company’s equity because of its unattractive fundamentals. Granted, this decision hasn’t been a great one in recent years as Netflix continues to create wonderful wealth for its shareholders (on paper, at least), so feel free to take my bearishness here with a grain of salt.

I think that Facebook has the potential to be a dividend aristocrat and I would say the same thing about Amazon if it wasn’t for Mr. Bezos, but at the end of the day, I think Netflix simply faces too many risks. I have a very hard time imaging a scenario where this company pays a dividend or puts in place a significant buyback program, which is why I’ve decided to place my bets in the media/entertainment industry elsewhere.

Google (which is now called, Alphabet)

Alphabet is my third largest position, behind Apple and Disney, with a 4.96% weighting. It’s by and large my biggest F.A.N.G. position, more than twice the size of second place, Facebook. Why? Because Alphabet is a wildly profitable company with an incredibly wide moat (albeit, with a somewhat narrow focus with regard to ~90% of sales/profits coming from digital ads) and a balance sheet to die for.

I would say that Alphabet is probably the most mature company of the F.A.N.G. names. Alphabet is still in the habit of posting strong double digit top-line growth, but unlike several of the other high growth names, Alphabet is highly profitable, allowing conservative investors like me to evaluate it on a traditional P/E basis. Even after its massive run-up, from from ~$800 to $1,100 over the last year or so, Alphabet is only trading for ~27x 2018 EPS expectations. 27x isn’t cheap, but it’s not bad at all a company that is growing its bottom line in the 20% range.

It’s been awhile since I’ve added to my Alphabet position, which is already overweight. I liked the valuations I received in the $600’s, $700’s, and $800’s better than the ones available to investors today; however, I’m still very bullish on this company’s prospects long-term and I have no plans to sell my shares.

When I look at the F.A.N.G. names, I think Alphabet is the second most likely, behind Facebook, to institute a shareholder dividend and become an eventual Dividend Aristocrat. Alphabet has a stronger financial position than Facebook at the moment, and a slightly more diversified revenue stream in the present, but I think Alphabet has some of the same DNA that I talked about regarding Amazon and Bezos, with a mind to solve problems outside of its current core competency, which could be capital intensive and potentially take away from shareholder returns.

Alphabet is best known for its Google properties, where it dominates search and generates a ton of cash with digital ads; however, Alphabet is basically a venture capitalist firm with its “other bets” category and operations in the cloud, AI, healthcare, automation (both of the home with hardware and driverless cars, with Waymo’s software), just to mention a few. Alphabet’s willingness to broaden its horizons and compete in various high growth areas of the tech sector seems to imply that the company is more interested in investing its cash flows in growth initiatives rather than shareholder returns.

As a shareholder, I’m fine with this focus on growth, but I admit that this doesn’t like bode well for more income oriented investors (at least, in the short-term). I’m really excited about Alphabet’s autonomous vehicle potential, as well as some of the data driven work that the company is doing in the healthcare space. Search/digital ads will remain the cash cow for the foreseeable future, but I think Alphabet’s growth runway is so impressive because of the investments that the company has made in other areas.

Because of its dominant market position in the search space, I worry about government oversight/regulation. We’ve already seen Alphabet face issues in Europe about anti-competitive practices/tax issues and I expect that this trend will continue as foreign governments attempt to extract more cash from rich American companies.

Alphabet has nearly $100b in cash on the balance sheet (much of which is held overseas) so I think we’ll soon find out just how generous Alphabet’s plans to be towards shareholders during the repatriation process. A large buyback/shareholder dividend would come as a surprise to me, but I don’t think either is totally out of the question due to the large amounts of cash that Alphabet now has cheaper access to. What’s more, this company has very little debt (just a tad bit less than $4b of long-term debt, according to Morningstar) meaning that paying down debt, which is something that I expect to see elsewhere in the corporate world, is not something that Alphabet management has to concern itself with moving forward.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Article by Nicholas Ward, Sure Dividend

The world's best investors have trounced the market decade-after-decade. The course Invest Like The Best uses actionable cases studies from investors like Warren Buffett, Peter Lynch, Seth Klarman (and more) to teach you the tools and techniques of super investors. Click here to enroll today and save $100.