Emerging Value Capital Management letter to investors for the year ended December 31, 2017.

Dear Partners and Shareholders,

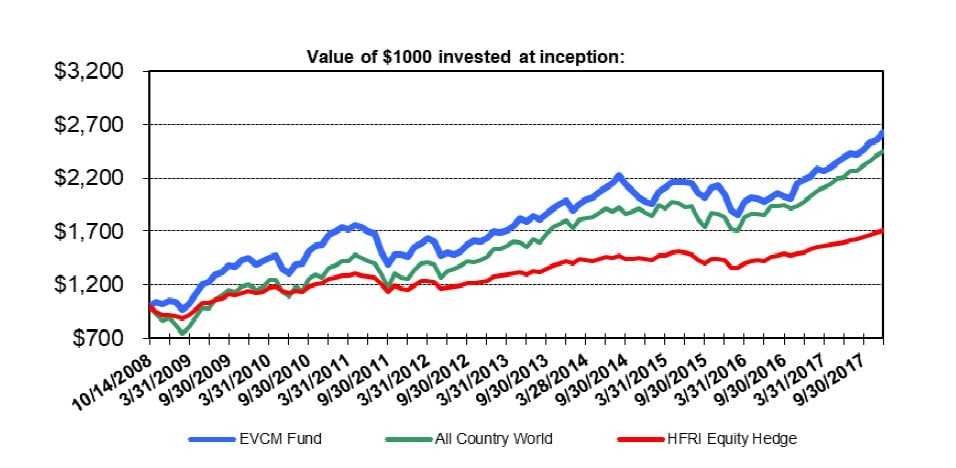

For 2017, EVCM fund returned an estimated +20.2% net to investors. Stock markets worldwide were up with the All Country World Index (ACWI) and the HFRI Equity Hedge Index up +24.0% and +13.2% respectively.

Since inception (10/15/2008), EVCM Fund returned an estimated +162.7% (net to investors). During this same time period the MSCI All Country World Index (ACWI) and the HFRI Equity Hedge Index returned approximately +144.7% and +70.6% respectively.

2017 Overview:

While stock market volatility was muted in 2017, geopolitical turmoil remained high. The multiple wars in the Middle East and North Africa persisted with no end in sight. Russia ramped up the fighting in Ukraine while partially withdrawing forces from Syria. China publicly berated North Korea while continuing, behind the scenes, to prop up the rogue regime which exchanged threats and insults with the US on a regular basis. Venezuela was unable to avert its economic implosion. Western Europe carried on with its slow economic recovery, now approaching year 10, while failing to make meaningful progress in negotiating a Brexit deal. Global investing, with so many active trouble spots around the world, requires careful analysis of the countries and economies where we choose to deploy our capital.

Under this backdrop, we continued investing in mostly good businesses trading well below their intrinsic business value and located, mostly, in our favorite economies: The US, South Korea and Israel. We made some changes to our portfolio in 2017, as a few positions approached fair value and were replaced by cheaper investments. We purchased large investment positions in General Motors and Fiat Chrysler and smaller investment positions in DowDuPont, Ares Management, Facebook, Alphabet, Luxoft Holding and Aimia Inc. We exited or trimmed our investments in Fortress Investment Group, Berkshire Hathaway, Goldman Sachs and Interactive Brokers – all positions sold or trimmed with significant profits.

In contrast to 2017, where most stocks went up, we think 2018 is likely to be a “stock pickers market” where our skill, process and zeal for selecting the most attractive value stocks for our portfolio are likely to prove particularly important and rewarding.

Approaching 10 Years Since Inception:

We launched Emerging Value Fund in 2008, in the midst of the great financial crisis. Stock markets world-wide had collapsed, financial pundits were worried about the end of the world or at least a second great depression. Everywhere we looked securities were trading at dirt cheap prices. At the time we told every investor we met that it was a great time to be buying stocks and that investors with the courage to be contrarian and deploy capital, sooner or later, would be richly rewarded. In our first letter to investors we wrote: “Panic sellers, distressed investors, and liquidating funds have been selling both good and bad businesses for almost any price they can get” and “Markets will recover and reach new highs in future years and decades”.

Now approaching our first 10 years of operation we can see that our conservative value investing approach has worked well. We outperformed both of our main benchmarks, the MSCI All Country World Index (ACWI) and the HFRI Equity Hedge Index. Importantly, we did so while bearing less market risk than our benchmarks. Our outperformance was achieve despite maintaining a net market exposure that has mostly been around 70% - 80%, investing in mostly high quality business, maintaining a reasonable level of portfolio diversification and occasionally hedging against potentially catastrophic risks such as a war between the US and North Korea. We outperformed despite all of these conservative investing practices which have somewhat depressed our returns.

In hindsight, the ensuing recovery from the 2008 financial crisis was even quicker, stronger, and longer than we expected. If we had a crystal ball in 2008, we could have thrown caution to the wind and invested aggressively for 10 years, knowing that markets would mostly be increasing. Conservative investing is like insurance, it seems like a waste of money when everything is great and markets are going up, but sooner or later, conservatism (like insurance) pays off when trouble ensues. We are proud to have delivered market beating returns for our investors despite the drag of conservative investing on our results. It is highly probable that the next 10 years will be more volatile making our conserve approach to investing even more important.

Looking Forward:

Following a year of strongly rising stock markets worldwide where the majority of stocks increased in price, it is natural to ask how much upside remains for each of our various investment positions? As we do on a regular basis, we have just completed a full review and reassessment of our entire investment portfolio. For each stock that we own, we asked ourselves: if we did not already own this stock, would we purchase it today at its current price? And if so, how big a position would we make it in our portfolio?

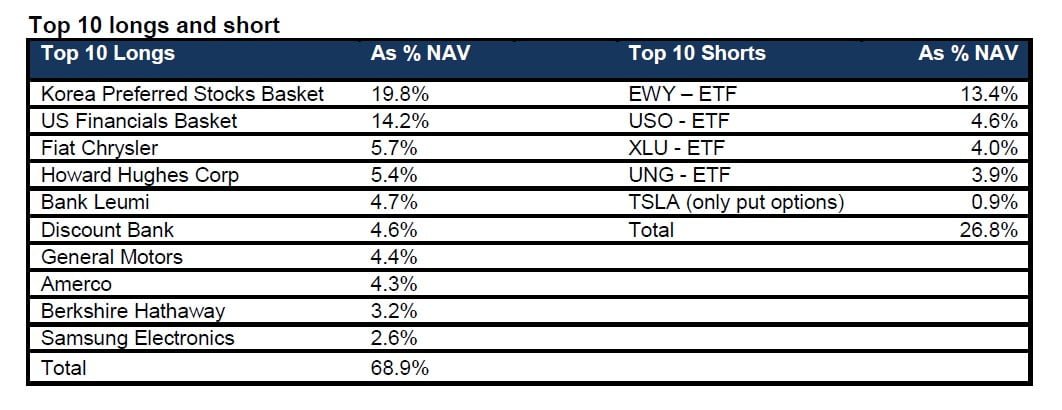

Our conclusion was that, with few minor exceptions, large upside remains for almost all of our investments. The following table shows our top 10 positions at year end. Except for Berkshire Hathaway, which we recently trimmed and still view as one of the best and safest businesses in the world, we expect all the other positions to compound at a 20% or higher annual IRR. We own a great portfolio of mostly cheap and safe businesses located in the best positioned global economies. We therefore remain very optimistic about our future expected returns.

Below, we will go into greater detail on some of these positions. For now, however, we think it is important to point out that our top 10 longs make up almost 69% of our long exposure. As of year-end, we were 97% long and 27% short. Our overall net exposure level of 70% reflects the compelling investments we are finding in global stock markets offset by our shorts and hedges.

Global Value Investing:

At Emerging Value Fund we have always adhered to the idea of “researching the country, not just the company”. Our analysis has shown that many countries that, in the past, were viewed as attractive investment destinations are now headed in the wrong direction. Despite offering cheap stocks, we are not currently investing in Russia, Turkey, Egypt, South Africa, Saudi Arabia, Venezuela, Brazil or China. We think that the macroeconomic and geopolitical risks for these

countries are too extreme.

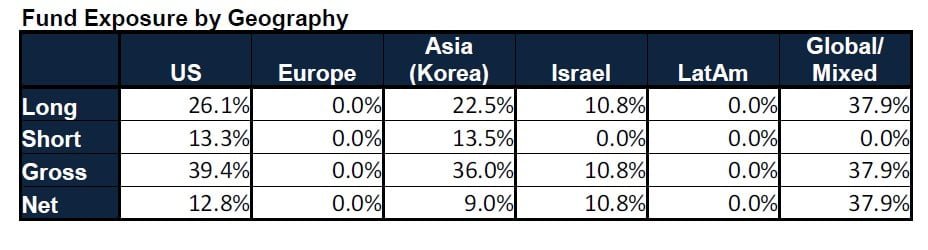

In contrast, we are certain that, despite occasional setbacks, the US, Israel, and South Korea are headed in the right direction and currently are among the best countries in which to invest our capital. These three countries are true capitalist democracies, enjoy favorable demographic trends, and are the world leaders in technological innovation – the driving force behind today’s economic growth. With technology comprising an ever growing portion of the global economy and with more and more “old economy” sectors getting technologically disrupted, economic success 0in the future will be based on the ability to innovate and stay ahead of the advancing technological curve. Israel, South Korea, and the US 0000are the best positioned countries to do so.

The following table shows how our capital is allocated among these countries.

Main contributors in 2017:

Main contributors to our returns in 2017 include: General Motors, Fiat Chrysler, Basket of Korean Preference Shares, Basket of Large Cap US Financials, Interactive Brokers, Israel Discount Bank, Berkshire Hathaway, Samsung Electronics, Howard Hughes Corp, Hilan and Bank Leumi, Below is short discussion of a few of these positions.

General Motors

General Motors continued its multi-year transformation. From a mismanaged, highly cyclical company mostly controlled by its labor unions, GM has become a well-managed highly profitable and innovative corporation run for the benefit of its shareholders. We were glad to see the divestiture of the loss making European operations as an additional important step in this transformation.

GM recently unveiled part of its extensive R&D efforts in self driving cars, electric cars and transportation as a service. Analysts following the company came to realize that these emerging technological areas were not just a risk factor for GM, but also a potential business opportunity. The stock increased significantly as a result, yet still remains cheap trading for under 7X annual free-cash-flow of $9B with a 3.6% dividend yield.

Fiat Chrysler

Good financial results combined with the emergence of several potential acquirers propelled Fiat Chrysler’s stock up significantly. Investors were initially skeptical that the company would meet its five year plan and earnings projections, announced in 2013, and reacted favorably when it became clearer that it probably will.

A merger between GM and Fiat Chrysler, if it can be approved by regulators, makes tremendous business sense. The companies have minimal overlap between their vehicle brands and could achieve several billion dollars in annual cost savings. Fiat Chrysler remains cheap, trading for under 8X annual free-cash-flow of $6B.

Basket of Korean Preference Shares

The current average price discount in our basket between our preference shares and their respective common shares is above 50%. We know of no other case in financial markets where essentially identical pairs of securities trade at such a huge price discount/premium to each other. In 2015, the management of Samsung Electronics, confirmed our investment thesis in their Q3 comments to investors. They said: “…many shareholders have expressed a view that buying back and cancelling preferred shares, which are traded at a discount to common shares is a more efficient use of capital as we can buy and cancel more number of shares with the same amount of money, thus increasing the effectiveness of any future capital return to the remaining shareholders. The company shares the same view. Therefore, we plan to increase the portion of preferred shares for repurchase and cancellation under this buyback program, as long as the price discount to common share is greater than 10%”.

Samsung management views any price discount above 10% to be a buying opportunity. For reference, our basket trades at an average price discount greater than 50%, confirming that huge upside remains. If, over the next 5 years, the average price discount narrows to a still large 25% and we assume 7% annual stock market returns and a 2.5% dividend yield, our basket should return about 17% per year.

Basket of large cap US financials including TARP warrants

The large cap US financial companies in our basket continued increasing in 2017 based on mostly good financial results. The new Republican administration is reducing corporate income taxes, rolling back financial regulations and may lead to higher interest rates. All three actions will increase the profitability of financial firms.

We have a large investment in financial stocks both in the US and abroad precisely because they are universally hated and cheap. Banking and insurance are critical building blocks of every modern economy and, in our opinion, will continue to generate fair returns for the foreseeable future. Competitive advantages in finance mostly come from size and market share, particularly given ever increasing regulatory costs that overburden smaller players. For these reasons we have mostly chosen to invest in the larger financial companies.

For example, if in a few years interest rates are 2% - 3% higher and corporate taxes are lower, then Citibank could earn a 12% - 14% ROE which could justify a 1.7 price to tangible book value multiple (currently 1.2). Combined with 8% annual book value growth over the next 5 years, this scenario could result in Citibank’s stock price more than doubling.

Interactive Brokers

Interactive Brokers offers the world’s lowest cost and most technologically advanced securities brokerage services. By relentlessly focusing on automation of back office tasks and expanding into ever more markets, the company has created a significant cost and coverage advantage over competing brokerages which it mostly passes on to its customers. We think that over the next decade, IBKR can disrupt the traditional brokerage industry. IBKR’s stock increased in 2017 as the company continued to wind down its non-core market making business and grow its brokerage business. At over 30X 2019 earnings, IBKR is the most expensive stock that we own, yet we think the price is justified given its huge future growth runway and disruptive potential.

Israel Discount Bank

IDB is the third largest and operationally least efficient bank in Israel. Its employees belong to a fairly militant union which makes cost cutting and operational improvements an always difficult undertaking. As a result IDB suffers from a bloated cost structure and earns sub-par returns on equity. When we invested, sustainable ROE was below 6%. The market is well aware of these issues and therefore values IDB with a low price to tangible book ratio of only 0.75 even after the stock increased over 20% in 2017. The bank continued making slow progress with its multi-year strategic cost reduction program. Adjusted ROE is now around 8% and is slowly increasing. We think IDB can achieve a 9% ROE in 2 years which would warrant a 0.9 tangible book value multiple. Adding 8% annual book value growth, this scenario could result in 40% upside in 2 years.

Samsung Electronics

Samsung Electronics, the world’s largest integrated consumer electronics manufacturer, was up 45% in 2017 as both the consumer electronics and memory circuits segments recovered from low points. Thanks to its size, Samsung enjoys low manufacturing costs (economies of scale) and high bargaining power with suppliers. To put its size in perspective, Samsung sells twice as many smartphones as Apple. Samsung gains additional competitive advantages from its vertical integration, with internal production of many of its own chipsets, memory circuits, and displays. The consumer electronics space continues to expand with new product categories emerging that did not even exist a few years ago such as house cleaning robots, smart watches, virtual reality headsets, personal fitness trackers, personal health monitors, Internet connected home appliances and more. Samsung is already leveraging its size and competitive advantages to become a leading supplier in all of these categories. Needless to say, all these devices will also require chipsets and memory components that Samsung will supply. Over the years Samsung has created tremendous shareholder value and will continue to do so in the future.

Even after its strong performance in 2017, Samsung remains cheap. It trades for 9x earnings and 3.5x EV to EBITDA based on our projected 2018 results.

Howard Hughes Corp

Combining unique and hugely valuable trophy development assets with an excellent and highly incentivized management team, HHC is arguably the worlds “best” real-estate company.

Noteworthy assets include:

- Ward Centers in Honolulu – 60 acres of under developed ocean front property where HHC is building several towers with high end residential and commercial spaces.

- Summerlin MPC in Las Vegas – Developing 22,500 Acres of in demand residential, retail, and office space.

- South Street Sea Port in Manhattan – Developing over a million square feet of high end retail space.

- Houston, Texas MPC’s (Bridgeland and Woodlands) – Developing over 30,000 acres of in demand residential, commercial, office, and hotel spaces.

- Additional valuable assets under development in Princeton-NJ, New Orleans, Alexandria-VA and Columbia-MD.

David Weinreb, HHC’s CEO, recently spent $50M of his personal money to purchase about two million six year HHC warrants with a $124.64 strike price. His warrants cannot be sold or hedged. To just break even on his investment, HHC would need to trade at $150 per share compared to $128 now. We believe the company will restructure itself as a REIT once its ongoing NOI becomes significant and this could serve as a catalyst for the markets to recognize its intrinsic value.

Hilan

Hilan is Israel's leading payroll processing and HR service provider. US investors might think of it as the “ADP of Israel”. The company provides an array of solutions for organizations: payroll, human resources, time & attendance and pension administration. Hilan possesses the most advanced and comprehensive system of its kind in Israel, rendering services to about half of the mid-size and large businesses in Israel.

Payroll processing and HR services is a predictable, slow growth business which generates a lot of recurring free cash flow, requires minimal capital investments, is recession resistant, and provides a high return on capital invested. Customers are very “sticky” since it would require a lot of time, effort, and expense to switch service providers.

Leveraging its existing customer relationships, Hilan continued its expansion into software services and IT infrastructure services. These segments are more competitive and lower margin than payroll & HR, but do provide more rapid growth. Hilan is a cheap, high quality business trading for about 11 times our estimate of 2019 operating earnings with a 3.2% dividend yield.

Main detractors in 2017:

Our only significant detractors in 2017 were our short Caterpillar and short TNA positions – both of which we closed during the year.

Reaching Out to New and Existing Investors:

Emerging Value Fund is close to fully invested, yet we continue finding highly attractive investment opportunities. Plainly put, we have more great investment ideas than capital. As you know, in 2017 I added over $100K to my personal EVCM Fund investment account. In 2018 I plan to add an additional $100K or more to my personal account. Actions speak louder than words so I hope these actions demonstrate my very positive expectations for our future returns. I wish to invite both existing and new investors to join me.

We spend little time and effort on marketing Emerging Value Fund so that we can, instead, focus our efforts on protecting and growing our capital. As a result, we expand our investor base mostly via word of mouth and recommendations. In other words, if you have a family member, friend, or acquaintance that could benefit from including Emerging Value Fund in his/her investment portfolio - we would appreciate and welcome the referral.

Concluding Remarks:

Some of our investors, including myself, have invested large parts of our life savings in Emerging Value Fund. We therefore consider it our solemn duty to protect and grow our capital while erring on the side of conservatism and capital preservation. Since inception, our investors have earned benchmark beating returns while bearing less than full market risk – exactly what a Hedge-Fund is supposed to do. Given our attractive portfolio and continued conservative value investing approach, we cautiously predict that our future results will be even better.

Thank you, our investors and shareholders, for your continued trust and support of EVCM fund. I continue to work tirelessly to protect and grow your capital and look forward to reporting continued strong positive returns in the future.

Happy, healthy, prosperous and profitable 2018!

Sincerely Yours,

Ori Eyal

Managing Partner

See the full PDF below.