The following is a summary of our recent podcast interview with Dave Morgan on Metals, which can be accessed on our site here or on iTunes here.

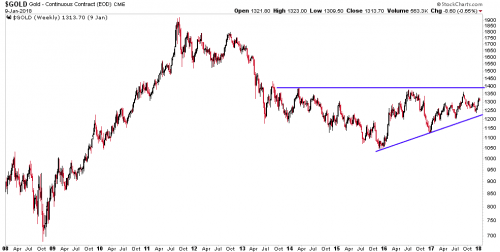

[REITs]We’ve seen gold pass the $1,300 level, and now some are wondering if the yellow metal might be poised to move higher.

This time on Financial Sense, we spoke with Dave Morgan of The Morgan Report for his take on precious metals and commodities, and what we might expect to see in the near future.

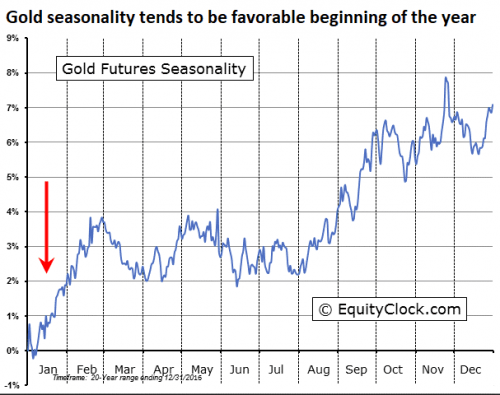

Seasonal Effects in Play Early 2018

Gold is going to hold the $1,300 level and go up from there, Morgan stated. The annual favorable seasonal period for gold is about to hit, and it will carry the white metals, platinum and palladium especially.

“I’m confident that, one, the rebirth of the major bull market (that started in December 2015) is intact. … and two, this year I think is going to be equal to or better than 2016.”

Revaluation Coming

“I think 2018 is going to be a year where there is a revaluation across the board of all asset classes, and as always … my concern over the U.S. debt markets and the U.S. Treasuries in particular are something that I always keep a big eye on,” said Morgan.

A large debt overhang will dampen borrowing, Morgan said, and the yield curve is extremely flat, which normally portends a recession, he noted.

What’s more, he sees us already in the midst of peak gold, though silver production still likely has room to grow.

“I think that this is the year where there is a shift in consciousness in the financial markets,” Morgan said. “After that, 2019 to 2020, we’ll return to a rather robust precious metals market, but we’ll have to just wait and see.”

Listeners tell us Financial Sense is the best financial podcast on the web. Subscribe and listen to all our daily interviews with leading guest experts by clicking here.

Article by Financial Sense