In mid-December, as the price of bitcoin climbed toward $20,000, I couldn’t help but think of one of my favorite quotes by baseball legend Yogi Berra: “No one goes there anymore, it’s too crowded.”

Just a few months earlier, every crypto bull knew higher prices were ahead. However, even the most ardent bulls only had year-end price targets of $10,000. Nobody imagined that Coinbase would add 250,000 new users a day and surpass brokerage firm Charles Schwab in number of customers.

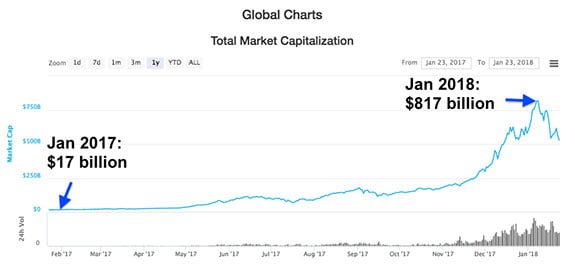

This stampede of new bitcoin buyers was enough to push prices of the digital asset to $19,500. As “a rising tide lifts all boats,” crypto’s total market cap surged to $817 billion earlier this month, up nearly 5,000% from the same time last year.

(Source: CoinMarketCap.com)

Almost overnight, the “can’t miss” trade of 2017 became too crowded. And we all know how crowded trades end.

The Crypto Craze

The amount of people who started contacting me about crypto gave me pause. Acquaintances I hadn’t spoken to in years were texting me asking if it was a good time to get in.

My advice is always: “Only put as much in as you’d be willing to lose in the stock market tomorrow.”

I began noticing people in my everyday environment talking about it on the subway and in line for coffee. Casual investors were trading on Coinbase as if they were chasing Pokémon, like in the augmented reality mobile game craze of last summer.

It was evident that this new batch of crypto buyers was less intrigued by the promise of decentralizing existing businesses, and more interested in chasing the hottest new thing to unexpected valuations. Things looked almost too good to be true.

This new wave of crypto buyers that only thought prices went in one direction suddenly learned the same lesson as the previous wave of top-pickers — prices go down faster than they go up. What was once looked at as a “store of value” quickly became a “destroyer of value.”

The More Things Change, the More They Stay the Same

This isn’t the first time bitcoin pulled out the rug from a new crop of crypto chasers. In the past year, the bellwether crypto asset has plunged over 20% on eight different occasions. As I noted last week, what didn’t kill it made it stronger, and prices eventually rebounded to new highs.

One of the reasons bitcoin is so hard to time is that its volatility ensures that the weak hands are firmly weeded out before the asset moves to a new high.

The Narrative Is Still There

We have hit escape velocity. Governments are taking note and are beginning to fear the power shift to decentralized systems. The empires are striking back, as regulators from China to India are increasingly making it harder for citizens to exchange fiat money for digital currency.

It is my opinion that regulation is needed to limit the crypto scams and assuage the concerns of new entrants.

Corporations are still rapidly integrating blockchain technology into their business lines. Just last week, global shipping giant Maersk and IBM announced plans to joint venture on a trade platform intended to decentralize the global supply chain.

Even top bitcoin critic Jamie Dimon, the CEO of JPMorgan Chase, now says he “regrets” calling the cryptocurrency a “fraud.”

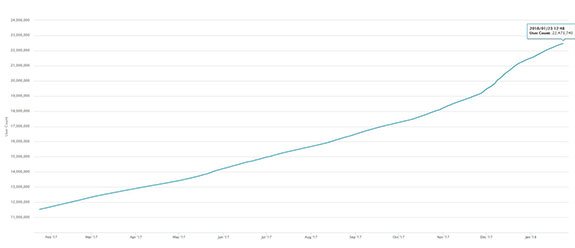

Prices may have dropped. However, growth in new bitcoin wallets continues unabated. In just the past three months, bitcoin users have grown from 18 million to 22.5 million. That’s a 25% growth in the last quarter.

(Source: https://blockchain.info/charts/my-wallet-n-users)

This total is only a fraction of the potential pool of bitcoin owners by 2020, when 5 billion people will own a mobile phone.

Investors are still flooding the sector with fresh capital, and not one crypto project has shelved plans for an initial coin offering.

The Bottom Line

Bitcoin is a bootstrapped currency with an ingenious self-reinforcing circle that leads to a stronger, more secure network as the platform grows.

More users lead to more applications, which lead to higher prices, which lead to more secure networks, which lead back to more users.

As long as user growth continues higher, the scarcity value of bitcoin’s 21 million coins will lead to higher prices ahead.

Or as Yogi Berra also quipped: “It ain’t over ‘til it’s over.”

Regards,

Ian King

Editor, Banyan Hill Publishing