Smaller Hedge Funds Bow Out

2017 was a strong year for the hedge fund (HF) industry – a year in which hedge funds delivered average returns above 7% for the first time since 2013.1 However, market dynamics both within and outside the sector have been driving consolidation. Smaller funds have been closing as bigger funds grow and intensify the competition. The active investment business environment has tightened with the success of passive instruments in 2017 attracting investors in higher volumes into ETFs. On top of this, in Europe, MiFID II was launched into action on January 3rd, 2018, which in itself will compound consolidation, with smaller funds unable to meet the cost burden of implementing and maintaining the new regulatory rules.

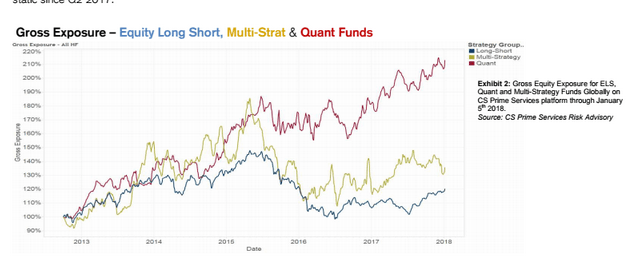

Shifts in Exposures

This consolidation has meant that scrutiny of successful portfolio allocations is higher than ever before as hedge funds compete for investor capital. In response, fund managers are sharpening their focus in seeking risk-reward optimised spaces within the current market climate. Specifically, we are seeing more allocations into fundamental L/S strategies as well as increased interest in passive vehicles, with ETFs in peak demand. In addition, discretionary strategies have been nudged into incorporating more systematic processes into their investment decision-making processes. As a prominent theme in this space, we are seeing macro discretionary strategies adopt data-driven techniques, such as sentiment indicators, into their investment decision making. Investments incorporating style-factor analyses are also becoming more popular as fund managers seek to support fundamental allocations by robust, statistical indications.

2018 – Is an Oil reversal on the cards?

In energy, managers have been waiting a while now to make a call on a significant reversal in oil. While the technical and fundamentals are nudging into an overbought signal territory, we also saw a net long peak in crude holdings to a 98% level against a 3-year look back on December 17, according to recent research from Credit Suisse' Prime Brokerage. 1 As is often the case when trying to call any market reversal, it is a mixed bag of sentiment. The same research shows that fund managers have been trimming equity net long positions in energy related securities as we start 2018. However, according to the U.S. Commodity Futures Trading Commission and ICE Futures Europe, hedge funds on aggregate are adding to bullish crude positions to new highs in the first week of January. Specifically, data from the CFTC indicates that the WTI net-long position increased by 10 percent to an all-time peak of 437,770 futures and options during the week ending 9th January 2018. 2 Meanwhile, during the same week, ICE Futures data indicates that Brent net-long positions increased 1.5 percent to a record level of 574,152 contracts. 3

Equities - Staples On, Technology and Financials Off

2017 was a year of heavy tech investment for hedge funds. Equity L/S managers have started to reduce their multi-year overweight long holdings in US technology stocks. Into year end, we have seen managers increase equity net long positions to all time high levels (35%) in the Industrials and Staples sectors.1 Meanwhile, financials have seen managers exit longs congruent with expectations. This defensive repositioning will support exposures against the average net short holdings in US rates as expectations of a rate rise in 2018 still remain low. Thus, the outlook is not looking good for bank earnings in the continuing low rate environment and the flat yield curve market conditions.

Sources:

1Credit Suisse, Mark Connors, PRIME SERVICES RISK & PORTFOLIO ADVISORY MARKET COLOR, 10th January 2018

2CFTC, WTI Market Reports, January 2018

3ICE, Brent Market Data, January 2018