Substantial investments in the market’s best business is the best way to describe the investment strategy of Cook & Bynum Capital Management.

Cook & Bynum is an unusual fund because, unlike many of its peers, it’s not afraid to sit still and do nothing. As Richard Cook described in an interview with ValueWalk last year, “we have been at this for nearly 15 years, and we have only made 31 distinct investments during that time. So, we are pretty patient and do wait on fat pitches before swinging the bat.”

Looking for more undervalued stocks? Check out Hidden Value Stocks

In the December issue of Value Investor Insight, Richard Cook provides some more insight into his strategy that has enabled the firm to earn 8.4% annualized since 2001 against a return of 7.1% for the S&P 500 over the same period. He also talks about a Coca-Cola value strategy.

Cook & Bynum Capital Management

Cook follows a value strategy based on cash flows. Cook says that the firm projects cash flows "in perpetuity and then use the current share price to solve for our expected annual rate of return." The expected annualized returns "has to be at least 10%."

In the current environment, only a few stocks meet this criterion, which is why, at the time of the VII interview, Cook had just eight stocks in the firm's portfolio. “Unloved” and “undiscovered” is how Cook describes the opportunities the firm is usually attracted to. However, this does not mean that it has to invest outside the S&P 500. Indeed, Microsoft, Wal-Mart, and Coca-Cola are some of the firm's top holdings today.

All of these positions were acquired when the rest of the market was avoiding the businesses. For example, Cook acquired Wal-Mart in "April of 2010 at a time when the market seemed to think it could do no right and Amazon could do no wrong." Paying only 11x earnings meant that "WalMart could continue to get a few things right to grow earnings modestly over the next ten years and deliver us a better-than-10% return on our money." Meanwhile, Microsoft was acquired in 2011 "when you could hardly pick up The Wall Street Journal without reading about how irrelevant it was becoming and how companies like Apple and Google were going to leave it in the dust." Stripping out cash, at the time the stock was trading at only 8x earnings, a multiple that seemed cheap compared to the earnings power of the Enterprise and Office businesses, which "were stickier than the market recognized." Any upside from "things like shipping better consumer products and building out the cloud business were tremendous free call options."

Coca-Cola Value Investing

These positions show Cook's quest to find value where others are afraid to look. Another great example is the firm's position in the Coca-Cola bottlers, a strategy I've name Coca-Cola value investing. Cook described his investment case for The Coca-Cola Co (NYSE:KO) in our interview last year:

"We first took a big stake in Coca-Cola in the aftermath of the financial crisis of 2008-2009 when it traded off to a P/E ratio of 12, as cheap as it had been on a multiple basis since the mid-1990’s. For most of the company’s history, realizing growth was simply a matter of selling more concentrate in more places while raising prices a little less than inflation – volumes and the price of concentrate were the only two variables that really mattered. While Coca-Cola still has one of the best economic moats around, its business has certainly become more difficult...

One of Coca-Cola’s big initiatives has been to work with bottlers to sell more value added products rather than just more volume. Consumers have shown a willingness to pay extra for the “right” amount of Coke at the right price. Packages of six 8 oz. cans might sell for the same as packages of six 12 oz. cans, for instance. Consumers who simply want Coke for the lowest price will buy the larger can package...Add to that fact that safe prepackaged drinks are an increasingly affordable convenience in much of the emerging world where demographics are positive and per capita incomes are rising, and we believe Coca-Cola continues to have a long runway of earnings visibility."

He added to this case in the VII interview noting:

"In countries with between $5,000 and $20,000 in annual per-capita GDP, people start switching to ready-to-drink beverages, meaning anything pre-packaged in a can or bottle. A lot of the world isn’t yet to $5,000 in per-capita GDP and most of the world earns less than $20,000, so as that changes Coke should be in a good position to benefit for quite some time."

Bottlers are also helping the company to innovate products for local markets:

"We hear terrific things from bottlers about new CEO James Quincy on this front, and we’ve seen some evidence that he is pushing management decisionmaking to local market experts and is willing to explore new product categories."

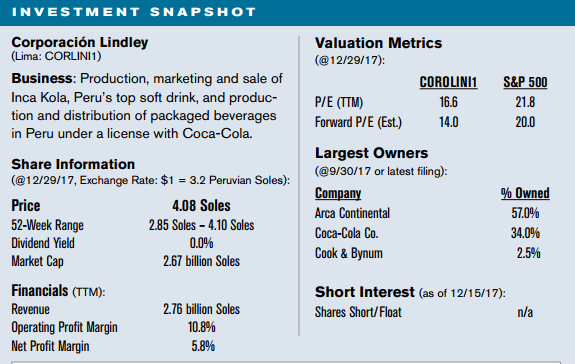

The VII interview goes on to take a look at two of Cook's favorite international Coke bottlers. First up there's Coca-Cola Embonor, which is based in Chile and produces bottled products in Bolivia and Chile. In Chile and Bolivia, the GDP per capita is $14,000 and $3,000 respectively, leaving plenty of room for consumer spending growth. Cook and team believe that the firm can increase earnings annually at a high-single-digit rate for at least ten years. Combined with a 4% yield on owner earnings gives a total prospective return in the low double digits over the long-term. The thesis is similar for Peruvian CocaCola bottler Corporación Lindley. Here Cook believes that "EBITDA can grow over the next three to five years by 50%, and that that can translate into a doubling of the share price."