Wise to the failings of the global banking system that led to its collapse in 2007-08, Chinese banking regulators have been working at double speed to enact regulations designed to protect against similar downside risks. Specifically, the Chinese banking sector will implement the Basel Committee framework for controlling risk exposures more conservatively than before. As we entered the new year the China Banking Regulatory Commission published a draft regulation of commercial banks’ large exposure management – opening up the new regulation for public comment and debate. 1

The proposals have been designed in accordance with the Basel Committee on Banking Supervision’s framework. Financial regulators in China are hoping to control a number of growing risk factors in the domestic banking sector with the new regulation. Key examples include: steps to curb shadow banking, expanded disclosure requirements, more accurate estimation of counterparty risk, tighter derivative risk management controls and more conservative capital buffers. Let’s look at some of the most significant themes we can expect from the regulation.

The Chinese banking sector and the shadow banking sector

This element of the draft regulation will actually lead to expanded business for the legitimate banking sector as the shadow banking sector is brought out into the light. The new regulation takes direct steps to prevent a major function of the shadow banking industry – investment in complex, structured investment products with little regard or understanding of the risks involved. As a first for the Chinese banking sector, the regulation will enforce the use of quantifiable metrics to highlight the credit exposures of various investments with more transparency than ever before.

Counterparty Risk through Capital Controls

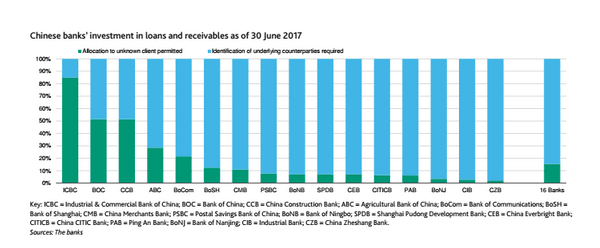

While understanding the risk of the structured products is one vital element of improving Chinese banking there is also a lot of ground to be gained by managing counterparty risk more effectively. Banks will be required to aggregate unidentified counterparty risk when the credit exposures relate to a single counterparty. A limit will be placed on this aggregate exposure such that it must be demonstrably under 15% of the bank’s Tier 1 capital by year end 2018. Above this threshold the counterparty risks must be identified, and steps taken for enhanced risk mitigation. 2

Derivatives

The regulation would of course be remiss in failing to address how risks will be ring-fenced for derivatives trading. As part of the recently issued regulation, banks will be required to set up controls specifically for managing counterparty risks related to this area of doing business.3 Chinese commercial banks have been expanding offshore derivatives trading over the past few years and the regulation is just now catching up to controlling the risk exposures involved. New rules have been established which will require tools to be in place by the 1st January 2019 to measure derivative risk sensitives and ensure higher standards set in place.

These rules are only the beginning of what is expected to be a sizeable overhaul of regulations across the board for the Chinese banking sector. As the world’s second largest economy the goal is to put in place safety measures to guard against the potential risks that are lurking from a growing debt burden domestically whilst also attempting to maintain economic growth. This will be tricky. However, implementing internationally agreed standards from the Basel Committee are certainly a good place to start.

Sources:

1Reuters, January 14th 2018, “China to step up banking oversight in 'arduous' fight on financial risks”,

2Moody’s Investor Services, 11th January 2018, China implements Basel Committee framework for controlling large exposures, curtailing bank risk.

3Reuters, January 16th 2018