In a January 10 research piece, Capital Economics points to key dots that are not often connected, which is nothing new for the independent research provider. In a global economy, historically geographic regions have exhibited a degree of noncorrelation. For hundreds of years, the economic ripples occurring in China were gently felt in the US. But with the advent of the global economy, and a digitally connected, an economic correlation trend can be seen. In a January 10 report titled “Will the global recovery de-synchronize in 2018,” Capital Economics Chief Economist Jonathan Loynes points to a key divergence, one that has been at the center of global growth.

Indeed, in a related topic – a CFR article today titled “China Is Heaping Debt on Its Least Productive Companies” notes:

By some estimates, China’s real growth rate, accounting for bad debt, is roughly half the official one of about 6.9 percent. To gauge whether China has been creating good debt—debt that will produce positive returns—or bad, we’ve examined who the beneficiaries of corporate lending are.

Global developed world central bank coordination has never occurred to this degree

The global economy is starting to turn hot and is likely to “grow strongly in 2018,” Loynes points out.

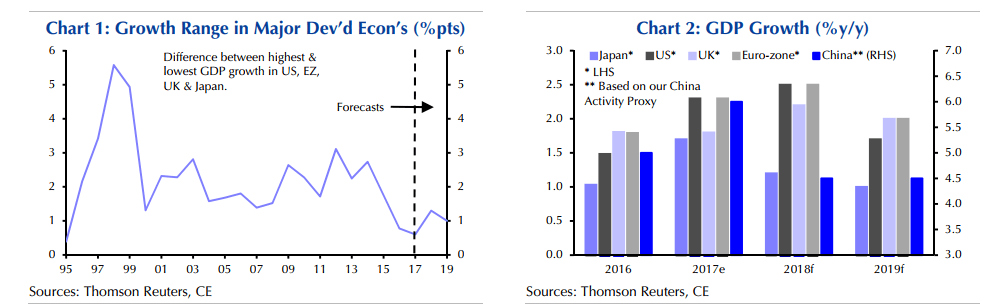

Looking at a global level, he observes “no weak areas dragging down the aggregate” with a “synchronization” being responsible for world GDP to end last year at 3.5%, a high level during the era of central bank monetary stimulation.

“It also provided a universally supportive back-drop for asset prices and led to some convergence amongst policymakers, with the Bank of England joining the Fed in raising interest rates (much sooner than previously expected) and the ECB scaling back its asset purchases,” he noted. With the US Federal Reserve leading, the Bank of Japan and the European Central Bank are all pondering withdrawing quantitative easing at the loud objection of market bulls.

Incoming Fed Chair Jerome (Jay) Powell takes a sober look at the global move to repress interest rates, noting that for stock market bulls “it will never be enough.”

The heft of the developed world, from Asia and Europe to the United States, acting in global financial synchronization, has not completely synchronized with China, however.

When China sneezes, the world can catch a cold if it is not careful

With trade barriers generally lowered globally and the advent of instant digital global communications, integrated financial ties and cash transference, the globe has never been closer together. When China sneezes, with rumors or threats to stop purchasing US debt amid a political rift, the reverberations were immediately felt in the overnight futures markets.

Markets stabilized, for now. But with a largely globally integrated economic system, China, recognized as a driver of global GDP growth to date, might become a tepid leader, as Capital Economics observes:

But there are reasons to expect the global recovery to become less synchronised in 2018. For a start, China activity indicators (including our own proxy) suggest that the growth of the economy is already slowing as the effects of previous policy stimulus fade. Official figures won’t reflect this, but we expect actual Chinese GDP growth to slow from 6% last year to 4.5% in 2018. We also expect Japanese growth to slow from 1.7% in 2017 to about 1.2% as the economy hits capacity constraints.

China slowing – and deleveraging a loan situation that some charge has taken the worst components of the US financial system in 2008 – is looking in stark contrast to the US, which could start to grow more quickly with “forthcoming fiscal stimulus,” he said. With the economy under the Trump administration having started to kick into high gear, Loynes makes an assumption that divergent political forces in Washington DC might actually work together and agree on meaningful government spending.

This providing accelerant on the fire comes just China looks like it is slowing — a point at which the US might take global economic leadership.