Studying sentiment surveys can help not only in short-term stockmarket timing decisions, but also in understanding the broader mood of the market. Taking the longer term view that we use in this article really illustrates this point in that clear changes in regimes and climaxes in sentiment can be identified and utilized to enhance the broader macro view.

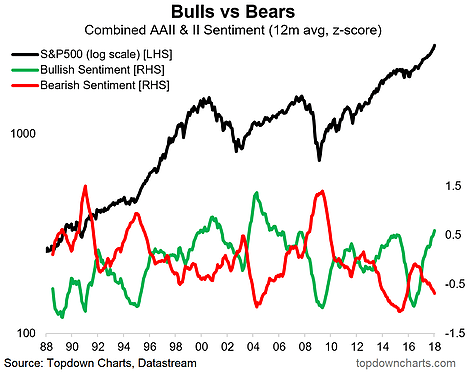

Over the past 2 years, and particularly in the last 12 months there has been a major shift underway. I highlighted earlier this week how the Euphoriameter had moved into extreme Euphoria territory. Indeed, the 12-month smoothed bullish sentiment indicator below is one of the components in the Euphoriameter. Narrowing in on all 3 major components of the sentiment surveys, you can see clearly how bears have given up, and neutrals have capitulated.

We are in a new phase of the market cycle, and this is usually the more dangerous stage. The part that offers both rapid and sizable returns, but the part that becomes increasingly vulnerable to shocks. As Warren Buffett says "we simply try to be fearful when others are greedy and greedy when others are fearful" (note with benefit that he says 'try'...).

The key takeaways from this unique view on sentiment are:

- Bullishness is the dominant mood of the market right now.

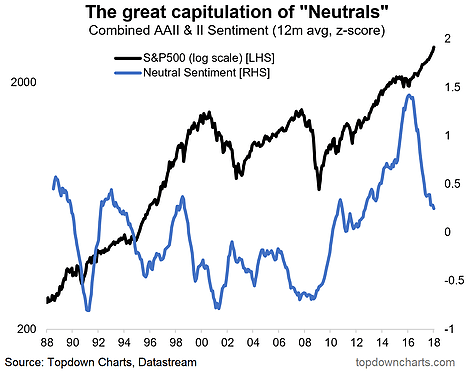

- There has been a major capitulation from neutral sentiment to bullish sentiment and this particular trend may have room to run further.

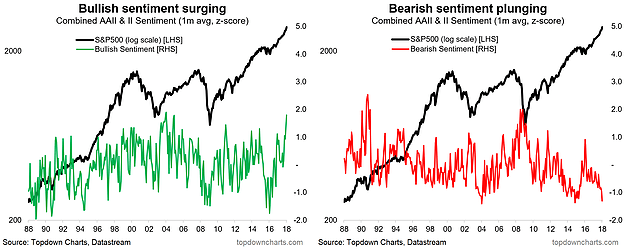

- On a shorter time frame, both bullish and bearish sentiment are near all time record extremes (high and low respectively).

- Such extremes in sentiment suggest the risk of a correction is rising.

- Smoothed View: First chart shows the rolling 12-month average of the combined AAII + Investors Intelligence surveys, normalized (i.e. historical z-score). Basically bullishness has resurged to levels last seen: a. during the height of the dot-com boom; b. at the start of the mid-2000's bull market; and c. just prior to the 2015 correction. I'll let you decide what kind of bullish climax this is, but I think example a. & c. are probably closest.

- Shorter Term View: Taking the monthly average view (specifically, the 4-week average of the 2 surveys) provides an even starker view (given the shorter term moving average places a greater weight on more recent datapoints). Bullish sentiment is close to the record high seen at the end of 2003, while bearish sentiment is at the third lowest point. This is extreme.

- Neutral Sentiment: The rise of neutral sentiment was a big theme for me back before the 2015/16 corrections. It was at the time a symptom of investors being basically bullish by force of momentum ("the trend is your friend"), yet skeptical enough to not label themselves as bulls. But since then there has been a wave of capitulation as these former neutrals have shifted over to the bullish side - interesting thing is it could probably still go further.

For more and deeper insights on global economics and asset allocation, and some more good charts you may want to subscribe to the Weekly Macro Themes. Click through for free look or a trial.

Follow us on:

LinkedIn https://www.linkedin.com/company/topdown-charts

Twitter http://www.twitter.com/topdowncharts

Article by Callum Thomas, Top Down Charts