“Anyone who started investing after 1981 has never experienced a bear market in Treasuries.

But with short-end Treasury yields now at their highest levels since 2008, and the 10-year yield threatening

to break out of its long-term trend channel, could this be the end for the bond bull market?”

– John Mauldin

For more than 35 years, fixed income has been, and for many investors remains, a portfolio must. When I started working in the business in 1984, my mentor was a man named John Ray. John was an institutional money manager at Delaware Fund. I’d have lunch with him in his office once a month and he’d do his best to point me in the right direction. He shared many books about stocks. The best and most important book was Reminiscences of a Stock Operator. It’s a 1923 book written by Edwin Lefèvre and is the thinly disguised biography of Jesse Lauriston Livermore. Livermore was a great investor and trader.

I was John’s Merrill Lynch broker and I’d watch him trade stocks and options. And he was good. Of course, I was green. At one of my lunches with John, I was surprised when he told me I should put all of my clients into long-term 30-year zero coupon Treasury bonds. He told me he pounded the table at a recent Delaware Funds Investment Committee meeting, with little success, to get management to let him do the same. He wanted to go 100% all-in AAA-rated U.S. guaranteed bonds, compounding at 15% per year return for the coming 30 years. Every $10,000 would go on to be worth $662,117 and every $1,000,000 would grow to be worth $66,211,772. One trade, nothing to do for the next 30 years. (Note: Corrected Math vs. OMR email text). That same $1,000,000 compounded at 2.85%, today’s 30-year bond yield, would grow to only $2,323,426. Your starting condition matters.

Of course, he was an equity fund manager, but it was the right call. To give you a sense for what that trade looked like, following is the path yields have taken since my friend, John, gave me his great advice:

And here is a look at 10-year Treasury Notes:

The point I’m trying to make is that your starting conditions matter. And it is a point well summed up in a letter I share with you below from my good friend, John Mauldin. John said, “Anyone who started investing after 1981 has never experienced a bear market in Treasuries. But with short-end Treasury yields now at their highest levels since 2008, and the 10-year yield threatening to break out of its long-term trend channel, could this be the end for the bond bull market?”

Jeff Gundlach and Bill Gross are in the press signaling the great bond bull market is over. What might a secular bear market look like? You have to go back to the 1970s to find a long-term secular bear market in bonds. We can earn the small yield, of course, and face risks like losing our buying power to rising inflation. Earning a 2.55% yield is lost to a 2.55% inflation rate. Also, what many investors might not realize is that, when interest rates move higher, your bonds lose value. Who wants to buy from you your 2.55% bonds when yields are at 5.55%? Your statement will show your 10-year bond or bond fund down about 30%. Safe? Only if you hold it to maturity and then there is the loss to inflation. Gundlach thinks the 10-year yield might rise to 6%. It’s possible. It’s a big risk. And investors continue to pour money into bond funds and bond ETFs.

I shared the next chart at an advisor presentation in August 2016 and with you in On My Radar several times since. When interest rates fall, bonds gain in value, when they rise they lose.

Here is how to read the following chart:

- The 10-year Treasury Yield is shown on the top row.

- The 30-year Treasury Yield is shown on the bottom row.

- On July 11, 2016, the 10-year yielded 1.40%. For every 1% rise in rates, you can see the corresponding loss (red circles).

- Since the 30-year has a much longer time until maturity, the decline is worse (red circle lower section).

- If rates were to move lower, bonds gain in value. Note the 24.95% gain in the 30-Year if rates were to have dropped another 1% from that 2.25% July 11, 2016 starting condition.

Could the 10-year Treasury rise to 6% as Jeffrey Gundlach is predicting? Yes. The point is that with yields so low, bonds just can’t do what they did for you in the past.

Unfortunately, investors are racing into bonds. Note the flows into bond funds since 2016.

Baby boomers beware! Look at those flows into investment grade bond funds (blue line). Could it be the baby boomers rushing into so called “safe assets” pre-retirement or in retirement? I’m on record saying the greatest bubble of all bubbles is in the bond market. Bonds are not so safe.

In 2007, prior to the great financial crisis, the 10-year Treasury yielded 5%. They offered better return and lower risk to your portfolio. We sit today at a different starting place. Mauldin says, “Where yields go from here will affect all asset prices and change how we invest. I believe this is the single most important trend investors need to pay attention to.” He’s right.

This week I share my friend’s outstanding piece called, “The Moment of Truth for the Secular Bull Market in Bonds has Arrived.” Mauldin writes Gundlach’s call, “By far his biggest call, possibly in his entire career, is that the secular bond bull market is over, and that the U.S. 10-year Treasury yield will hit 6% by 2020.” And he concludes, “If Jeffrey is correct, and the secular bond bull market is over, the entire financial infrastructure will change.”

Grab that coffee and find your favorite chair and read on. Mauldin’s a great story teller. You’ll enjoy his piece. You’ll also find a link to Dr. Lacy Hunt’s most recent letter. He sees lower rates. For the record, I see higher rates first, then recession, then one more test of the lows. That’s my fundament view but I’m sticking to the trend evidence. I share a few ideas on what you can do.

Included in this week’s On My Radar:

- The Moment of Truth For the Secular Bull Market in Bonds Has Arrived

- Inflation and Higher Rates

- Trade Signals — Record Extreme High in Optimism Suggests Caution

- Personal Note — Vail, Florida, Utah and San Diego

The Moment of Truth for the Secular Bull Market in Bonds has Arrived, by John Mauldin

“The moment of truth has arrived for [the] secular bond bull market!

[Bonds] need to start rallying effective immediately or obituaries need to be written.”

—Jeffrey Gundlach

“Jeffrey started his career as a nearly broke rock and roll drummer, now he goes under the nickname the Bond King.

What he says and does literally moves markets.”

—Bethany McLean

Welcome to the first installment of this five-part series on the individuals and ideas informing my worldview as of late. My goal with this series is to highlight the ideas which have been deeply influential on me, and share with you what I’ve learned.

I mentioned in my email to you yesterday that this series will start with a bang, and the following fact certainly hit me like a ton of bricks: Anyone who started investing after 1981 has never experienced a bear market in Treasuries. The vast majority of today’s investors have only ever invested when Treasury yields are falling.

The secular decline in bond yields is one of the most definable trends in financial markets, and also one of the most important. As you know, US Treasury yields are the bellwether for global interest rates. Almost every market and asset class in the world is affected by them.

At every opportunity, I like to point out that interest rates are the cost of money. Unfortunately, at 68, I’m old enough to remember when the cost of money was high.

In the early 1980s, I took out a business loan with an 18% interest rate. The repayments were no fun, but I was one of the lucky ones who could actually afford to borrow money at that time. Those rates created an insurmountable hurdle for most entrepreneurs, and banks were not willing to lend like they are today.

In the 36 years since then, the cost of money has fallen sharply—and demand for it has skyrocketed. Today’s US financial infrastructure is addicted to “easy money.”

- Government: Low interest rates have enabled the Federal government to increase their total debt by 113% since 2008, yet interest payments have risen by only 5%.

- Corporations: Corporations have borrowed huge amounts of debt to fund stock buybacks and increases in their dividends. Today, nonfinancial corporate debt is 79% higher than it was in 2008.

- Households: The New York Fed’s latest quarterly report on household debt showed that US households have a total of $12.96 trillion in debt outstanding. That’s $280 billion higher than the previous all-time peak in Q3 2008.

The US economy has become heavily reliant on easy money, which leads to the question, “what would happen if interest rates increased substantially?”

One famed investor who has explored this question is “Bond King” Jeffrey Gundlach. The man needs no introduction, but I’ll give him one anyway. Jeffrey is the CEO of DoubleLine Capital, where he manages $116 billion—and has a stellar track record. Jeffrey has outperformed 92% of his peers over the last five years. His flagship DoubleLine Total Return Bond Fund (DBLTX) has also outperformed its benchmark by a wide margin over the same period.

Although Jeffrey manages one of the world’s largest bond funds, he is an independent thinker who has courage and conviction in his beliefs—maybe because he comes out of left field. Jeffrey holds degrees in mathematics and philosophy from Dartmouth College and was once the lead for a new-wave rock band, back when Paul Volcker had me paying 18% interest on that loan.

Jeffrey has had an ultra-successful investment career and has been spot-on with market timing, especially in 2017. He has called the direction of Treasuries and the US dollar, to almost the exact tick.

However, by far his biggest call, possibly in his entire career, is that the secular bond bull market is over, and that the US 10-year Treasury yield will hit 6% by 2020.

I want to dissect Jeffrey’s thought process behind this call. Let’s look at the three reasons why he believes the secular bond bull market is over and that we are headed into a period of rising interest rates.

Growth is good, but not for bonds

In a December interview with CNBC, Jeffrey commented on the recent economic growth numbers:

We’ve had 2% real [GDP growth] for three quarters in a row. GDP NOW at the Atlanta Fed is around 3% for the [Fourth] quarter. It seems to me that interest rates should continue to rise as we move into 2018, because bonds don’t like economic growth.

For the first time since 2007, not one of the 45 economies included in the OECD Expansion Contraction Growth Indicator is contracting. The below chart from a recent presentation Jeffrey gave shows this.

By this measure, the global economy is in a synchronized upswing for the first time in a decade—and the short-term outlook is positive. Leading economic indicators in all major regions are flashing green. In the US and Europe, the purchasing managers indices (PMIs) are at multi-year highs. This is good news for everything, except bond prices.

Higher economic growth means more demand for credit, which drives up its cost. In this case, the cost is interest rates. This relationship between economic growth and interest rates is why, over time, bond yields track nominal GDP growth.

The below chart from the recent presentation by Jeffrey shows that when the 7-year moving average of nominal GDP growth is higher than the US 10-year Treasury yield, yields should rise. The current setup suggests that bond yields should now be rising.

I have my doubts about the sustainability of growth in the US because of the rising debt burden and anemic growth in productivity and the working age population. With these headwinds, I believe it will be almost impossible to achieve sustained growth, like what we experienced in the 1990s. However, I concede that growth could continue to rise over the next 2–3 years.

Along with rising economic growth, Jeffrey sees the return of inflation as the second “building-block” to higher bond yields.

An arch enemy returns to the fray

In his December webcast, Jeffrey gave his thoughts on the current inflation numbers:

If [inflation] continues to rise, the Fed would have ample reason to follow through on its indicated three rate hikes in 2018.

Despite the best efforts of central banks, inflation has remained largely absent from the US and other advanced economies over the past decade. In 2015, the US CPI annualized at just 0.11%. Finally, it appears that bonds’ arch enemy may be making a comeback.

Inflation, as measured by the CPI, is on track for its highest annual growth rate since 2011. It is also at multi-year highs in Europe, the UK, and Japan. Longtime readers know I have been a critic of the CPI, for a host of reasons I won’t go into now.

The indicator I use to get a broader, real-time measure of inflation is the New York Fed’s Underlying Inflation Gauge (UIG). This gauge captures sustained movements in inflation from information contained in a broad set of price, real activity, and financial data. In December, the UIG hit its highest level since August 2006, as the below chart shows.

We know that inflation erodes purchasing power. Therefore, if it continues to rise, bond yields will have to move higher to meet investor expectations. Remember, when the 10-year Treasury yielded 15% in 1981, inflation was running at 11%.

Since 1960, the average spread between the 10-year Treasury and the CPI is 2.4%. Today, it is just 0.15%. It’s likely to widen as investors’ inflation expectations increase.

Furthermore, at their December meeting, the Fed hinted that they are willing to let inflation run a little over their 2% target. Although they upgraded GDP growth, their forecast for three hikes in 2017 remained unchanged. Given that Janet Yellen once said, “To me, a wise policy is occasionally to let inflation rise even when inflation is running above target,” this is no surprise.

The last building block to higher bond yields, which Jeffrey has identified, is the coming tidal wave of supply in the bond market.

Price is a function of supply and demand

Jeffrey provided insight into how the supply and demand dynamics of the bond market are going to change in his December webcast:

One thing that has helped rates stay low is the lack of [bond] supply. For the last three years, there was negative net supply of bonds from the G3 central banks, and that’s about to change with quantitative tightening. There is a lot of bond supply coming.

The third reason Jeffrey believes the secular bond bull market is over is the coming tsunami of supply about to hit the bond market.

By purchasing a huge amount of sovereign bonds through quantitative easing (QE), central banks have suppressed bond yields over the past decade. For example, demand for sovereign bonds exceeded issuance by around $250 trillion in 2017, thanks to QE by the G3 central banks.

With the Fed now reducing the size of their balance sheet by $30 billion per month, and the European Central Bank scaling back bond purchases by $20 billion per month, this dynamic is going to change, radically. There will be a shift from a $250 billion net demand in 2017, to a $550 billion net supply in 2018. As the below chart shows, that is quite a large swing.

There will be an additional $800 billion in sovereign bond supply in 2018, compared to 2017. Econ 101 tells us that this will push bond yields up. But central banks stepping off the gas is not the only trend that is going to contribute to a glut of supply in the bond market. We also have higher budget deficits to factor in.

According to the Congressional Research Service, mandatory Federal spending is set to increase $1.56 trillion by 2026. To pay for this additional spending, more bonds will be issued.

For me, the increasing supply of bonds is the most compelling reason for the end of the secular bond bull market. I have no doubt that quantitative tightening will cause interest rates to rise. Plus, increases in mandatory Federal spending are baked in the cake.

Along with providing reasons why he thinks the secular bond bull market is over, Jeffrey has given insight into how he thinks it will happen. One of his favorite anecdotes about how he sees it playing out is a famous dialogue from Ernest Hemingway’s 1926 novel, The Sun Also Rises.

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

In other words, interest rates will rise gradually over several years, and then everyone will notice, suddenly.

If Jeffrey is correct, and the secular bond bull market is over, the entire financial infrastructure will change.

For starters, how will the governments, corporations, and households who have become dependent on cheap money, react? In 2008, we saw forced deleveraging in action—and it wasn’t pretty.

What will happen to global stock markets if interest rates continue to rise? As Warren Buffett said in a recent interview, “Measured against interest rates, stocks actually are on the cheap side compared to historic valuations. But the risk always is that interest rates go up, and that brings stocks down.”

Now, a world with a 6% yield on the 10-year Treasury is hard to imagine. Saying that, if you had told me when I took out that business loan in the early 1980s that in 30 years, the 10-year yield would be less than 2%, I would have called you crazy.

Jeffrey thinks that we are headed into a much tougher environment because “the Central Bank balance sheets will stop growing at the beginning of 2018, [and] the liquidity that’s helped drive the market is going to reverse. That is not favorable for risk markets.” As such, Jeffrey and his team at DoubleLine have been de-risking their portfolios and have cautioned investors to do the same.

However, the Bond King is not bearish on everything. Jeffrey made a big multi-year call on emerging markets earlier this year and just came out with his top trade idea for 2018: add commodities to your portfolio.

Getting back to Jeffrey’s call on the end of the secular bond bull market, given its wide-ranging implications, it might be the biggest call of his investment career.

Where interest rates go from here will change how we invest and how society functions. I don’t think that’s an exaggeration given the amount of debt in the system and the expectations that the era of easy money will continue, indefinitely.

Because of this, I want to get Jeffrey’s most up-to-date thoughts on how it may play out, and what he believes the implications will be for investors and the economy. That’s why I’ve asked him to give a keynote speech at my Strategic Investment Conference in San Diego, next March.

Jeffrey is a truly independent thinker who is never afraid to make bold, out-of-consensus calls. That’s why I know when he takes the stage at the SIC, he will provide insight into much more than the secular bond bull market. I’m really excited to welcome Jeffrey back to the SIC, and I hope you can be there with me to experience it, first-hand. If you would like to learn more about attending the SIC 2018, and about the other speakers who will be there, you can do so here.

That concludes John’s piece. I included the information on his conference in case you would like to attend. I’ve been attending for years and consistently find it the best conference I attend. Let me know if you are thinking about attending and I’ll see if I can convince John and his Mauldin Economics team to give you a discount. The conference will be on March 6-9. They are expecting more than 750 attendees and it’s likely to reach capacity soon.

Inflation and Higher Rates

Well, fixed income was the story yesterday as the bond market sold off. Part of the selloff was due to news from Bloomberg that Chinese officials have recommended that they slow or even halt the purchase of U.S. Treasurys. China later denied the news. China is the largest holder of U.S. debt.

Rates appear to be headed higher. Along with Gundlach, Bill Gross (the other anointed “Bond King”) was in the news touting higher rates. Let’s take a look at the trend.

1. The 10-year Treasury yield climbed above 2.5% for the first time since March.

2. A good portion of the recent increase in yields has been driven by higher inflation expectations.

3. The short end of the curve is also in play. The 2-year yield spread between the U.S. and Germany is at the highest level in almost two decades. That makes U.S. bonds more attractive than German bonds.

Higher Inflation?

The CRB may be nearing a breakout. That would signal higher inflation. This from John Murphy at StockCharts.com:

COMMODITY UPTURN MAY POSE THREAT … So what could go wrong this year? How about a new uptrend in commodity markets. Stocks have been rallying in a low inflation environment which has helped keep interest rates down. Any serious uptick in inflation this year could upset that scenario, and could tempt global central bankers to become more aggressive raising short term rates later in the year.

The weekly bars in Chart 3 show the Reuters/Jefferies CRB Index in an apparent bottoming formation that started at the beginning of 2016. A secondary bottom last summer was higher than the earlier bottom (up arrow) which is usually a bottoming sign. The CRB Index of 19 commodities is now challenging previous highs formed in the summer of 2016 and the start of 2017.

I don’t have to tell chart watchers that an upside breakout through those peaks would be a bullish sign for commodity markets. That might even get the attention of economists at the Fed who don’t usually watch such things. The CRB Index might actually be understating the inflation threat. Most commodity gains over the last year have been in industrials metals (+28%), precious metals (+14%), and energy (+13%). They’re the markets most sensitive to economic trends.

Agricultural markets (which make up 41% of the CRB) lost ground over the last year (-2%). They’re more closely tied to weather. Imagine what would happen if they ever started rising. Rising commodity prices could also put upward pressure on bond yields at the same time that global central bankers are either reducing their bond holdings (like the Fed) or buying less (like the ECB). Source: John Murphy StockCharts.com.

GOLD MAY BE BOTTOMING … No commodity bottom is credible without a corresponding upturn in gold. And that may be happening. The weekly bars in Chart 4 show the price of gold forming a potential bottoming formation that started in the middle 2013 (four and half years ago). I’ve drawn a “neckline” over the last three rally peaks extending back to the start of 2014. The last two failed rally attempts took place in mid-2016 and late summer of last year (see arrows). Gold’s latest upturn (helped by a weak dollar) may lead to another test of that major resistance line. A decisive close over that line would signal that the gold market has bottomed. That would certainly strengthen the inflation argument. And it might also be a sign that investors are starting to hedge their bets against an overbought stock market. They may be buying gold miners for the same reason.

Each week in Trade Signals, I post a “dashboard” of sorts that contains a section called “Economic Indicators” along with my other favorite indicators. Currently, my favorite “Inflation Watch” indicator is signaling “Low Inflation Pressures.” So we carefully watch. The Trade Signals link is shared below.

I’d be remiss in not sharing an opinion opposite what Gundlach and Gross foresee and that is from my friend, Dr. Lacy Hunt from Hoisington Investment Management. Like my mentor John Ray advised way back in 1984, Lacy is the only person I know, other than John Ray, who stuck to that trade.

Lacy and his partner Van Hoisington are out with their latest quarterly letter and conclude with the following:

In English, the brunt of the Fed’s Quantitative Tightening (raising interest rates and exiting its large asset purchase program) will be felt in 2018. Rising interest rates with so much outstanding debt will stop the economy in its tracks. Taking the opposite side of the Gundlach and Gross bet, Lacy sees Treasury bond yields ultimately going lower. You can find his full piece here. It is very geeky stuff, but I always want to know what they have to say. I wish Lacy was Fed Chairman.

Confused? I bet. Here’s an idea for you to consider:

I favor looking at what is happening to price. All buyers meet at the point of price and through price, we can identify primary trends. More buyers than sellers and price rises — the trend is bullish. More sellers than buyers, the trend is bearish. In Trade Signals, you’ll find what we are seeing in regards to the short-term fixed income asset classes, HY bonds as well as a long-term trend indicator for high quality bond exposure (Zweig Bond Model). Current long-term trend conditions, despite the relatively small uptick in yields, remains bullish.

My best advice is to stay nimble with fixed income. Since yields are so low and risk high, stick to the weight of trend evidence and also consider underweighting your fixed income exposure and overweighting the balance of that fixed income to liquid ETF global all asset trading strategies.

If you combine several strategists together, I believe you may achieve a much better potential return stream than bonds can provide with about the same amount of volatility (or risk). Please consult your advisor.

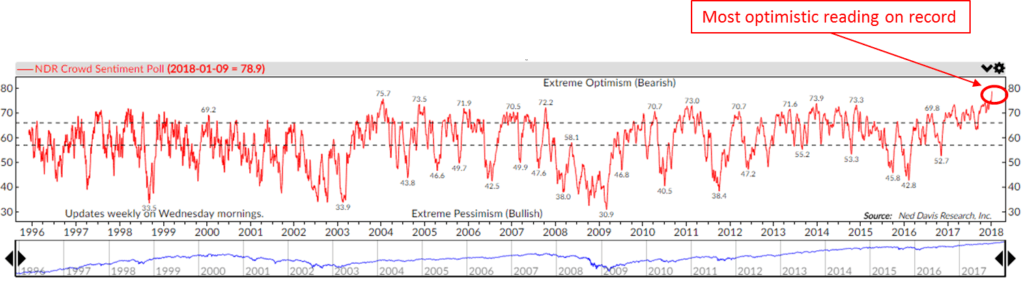

Trade Signals — Record Extreme High in Optimism Suggests Caution

S&P 500 Index — 2,743 (01-10-2018)

Notable this week:

Optimism is off the charts. One of my favorite sentiment charts is the NDR Crowd Sentiment Poll. Generally, when sentiment is extremely optimistic, the markets underperform. When sentiment is pessimistic, the markets tend to outperform. The theory is that when optimism is extreme, investors are largely invested in stocks. Less buying power to push prices higher. The reverse is true with extreme pessimism.

Here is a look at weekly readings going back to 1995:

And here is a look at returns based on the state of investor sentiment:

Here is how to read the chart:

- Current weekly sentiment reading is 78.9.

- Yellow shows the historical returns when above 66.0.

- It shows a -2.89% gain per annum. Readings above 66 occurred 24.47% of the time since 1995.

- Best buying opportunities occur at “Extreme Pessimism” readings from below 57.

Yet, trend trumps optimism and the trend indicators continue to signal a modestly bullish trend for stocks.

Following is a quick look at the latest Trade Signals “Dashboard”:

Click here for the latest Trade Signals.

Important note: Not a recommendation for you to buy or sell any security. For information purposes only. Please talk with your advisor about needs, goals, time horizon and risk tolerances.

Personal Note — Vail, Florida, Utah and San Diego

Vail was fun. CMG’s Andrew Elkin and I landed at 11:30 am last Sunday and were greeted with 9 inches of new snow. We joined 18 other friends in the industry, mostly traders and market makers. It was three and a half days of intellectual and physical fun. Our last day was Wednesday and it turned out to be another light snow powder day. A skier’s dream.

But it wasn’t all great fun. In a weakened state, I joined 19 of my fellow conference attendees for an après ski happy hour featuring tequila shots. I’m more of an IPA and red wine guy. Let’s just say I had to take a good nap prior to dinner. I know, “poooor Steve.” It was a fun and productive few days in Vail.

Meetings in Boston are likely next week and from January 21-24 I’ll be in Florida for the annual Inside ETFs Conference. However, the most important date immediately ahead is my Susan’s 50th birthday. I’m crazy about her though I’m not so sure she’s crazy about the new number. Another wonderful life marker. A dinner celebration with family is planned.

Susan is even more soccer crazed than me, so on her birthday, next Saturday, we’ll be attending, along with more than 11,000 coaches, the United Soccer Coaches National Convention in Philadelphia. She was a strong college player and then played professionally in Europe for a few years. Today she’s a youth soccer coach, and I love hearing about her players. Can you imagine waking up on a Saturday morning, coffee in hand, and your spouse asks you if you want to turn on the TV and watch an English Premier League soccer game? That happens to me all the time. I know, “pooor Steve…” again. What can I say?

Post the Inside ETFs Conference, I’ll be sharing my notes with you. Here is a quick look at sessions I’m most excited about:

- Are We in a Bubble? Dr. Mohamed A. El-Erian

- Leadership Is a Choice: Lessons From a Military Legend, General Stan McChrystal

- Beyond the Hype: Strategically Implementing Factor-Based ETFs

- Pitfalls in Smart Beta: Data Mining, Selection Bias & Performance-Chasing, Rob Arnott, Founder and Chairman, Research Affiliates

- As Good as It Gets: PIMCO’s Macroeconomic Outlook & the Importance of Active Management in Core Bond Portfolios

- The ETF Lab: 10 ‘Hidden Gem’ ETFs You’ve Never Heard Of

- Fixing Income: Bond ETFs, Active Strategies & Portfolios for Rising Rates

- Everything You Need to Know: Active & Factor-Driven Fixed-Income ETFs

- Bitcoin, Cryptocurrency, ETFs & the Future of Finance

- Everything You Need to Know: Hedging Your Downside & Protecting Against Tail Risk

- The Best New ETF of 2017: We Present, You Decide

- Alternative Income Strategies

- How to Deploy Tactical & Strategic ETF Portfolios That Work (SB here: Seeing what the competition is up to)

I wrote a few weeks ago about my friends, Mark Finn and Rory Riggs. Rory will be presenting on the Future of Business Classification & Indexing panel. I’ll be sure not to miss Rory’s session.

If you too are attending, please shoot me a note. I’d love to say hello. Here is a link to the Inside ETFs Conference agenda. I’ll be taking notes to share with you in a future OMR.

Park City follows the first few days of February. Another advisor conference (I’ll again be packing my skis) and the Mauldin Strategic Investment Conference is March 6-9.

I hope to see you in Florida or at the Mauldin Strategic Investment Conference. Registration and agenda information for the Mauldin SIC can be found here. Dr. Lacy Hunt, David Rosenberg, George Friedman, Mark Yusko and Jeffrey Gundlach are but a few key names who will present. More note taking to share with you.

Have a wonderful weekend!