o I grew up in this industry as an intern in 1999. I vividly remember companies adding .com to their name to entice investors into thinking they were associated with the ‘New Economy’. Per the attached white paper, this ‘dotcom’ effect produced cumulative abnormal returns on the order of 74 percent for the 10 days surrounding the announcement day http://home.business.utah.edu/finmc/FinalJFversion2371-2388.pdf. Credit to Wes Gray @ alphaarchitect.com for pointing this paper out. It gave me flashbacks when I read it!

o I now see a few companies doing the same thing (either changing their name, acquiring a SPAC in the blockchain field, or announcing they are accepting crypto currencies as a form of payment) and their stock price soars as a result. Be careful here!

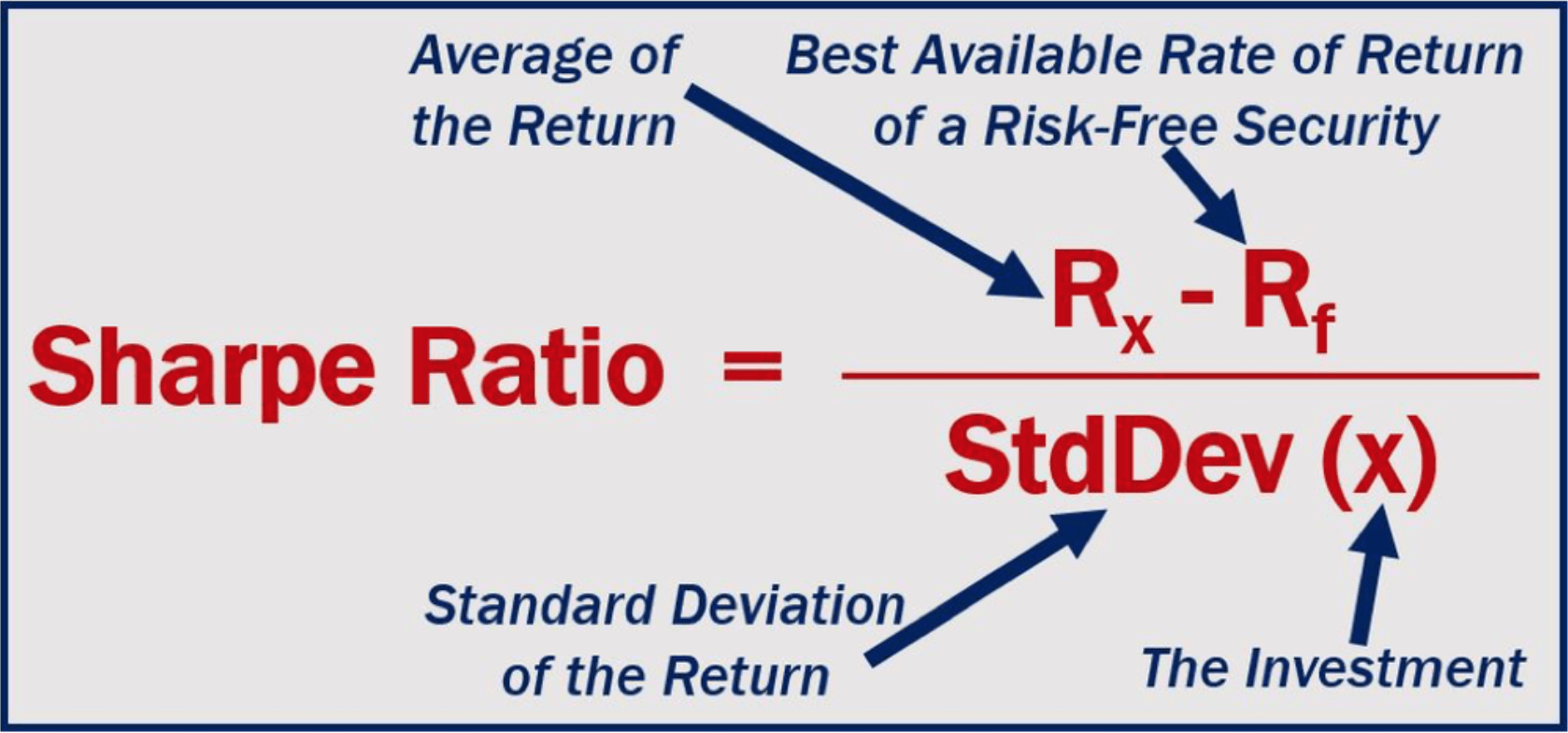

2017 – The Year of the High Sharpe Ratio

o 2017 will go down as the ‘Year of the high Sharpe Ratio’ for anyone that was investing in global stocks and bonds. A 70% MSCI ACWI and 30% Bloomberg Barclays US Aggregate Bond Index produced a Sharpe Ratio of 7 in 2017. Keep in mind that historical Sharpe Ratios are not indicative of future Sharpe Ratios!

o And for all the geeks out there, let’s move past the argument of whether you should use geometric vs. average returns or what the liner interpretation is being used for the underlying cash benchmark. 2017 might be the only year we are questioning Sharpe Ratio calculations!

o A 7 Sharpe Ratio is statistically unusual to say the very least (I won’t tell you how many z-scores because you might chuckle). Investors should NOT expect a similar magnitude in 2018. Why? Well, for one thing the ’17 rally has been driven by (1) a synchronized earnings recovery globally (2) tremendous central bank liquidity and (3) muted inflation.

o However, each of these 3 variants are going to change on the margin in 2018. We wrote about this in our 2018 ETF outlook published on Dec 6, 2017. https://www.astoriaadvisors.com/single-post/2017/12/06/8-ETFs-for-2018 or you can watch my Bloomberg TV Interview here https://www.bloomberg.com/news/videos/2017-12-27/the-year-of-the-hedge-for-etfs-video

o To summarize our 2018 ETF playbook,

-

The rate of change for liquidity will decline (Fed rate hikes, QT, and ECB tempering their QE program)

-

YoY comps for earnings will be tougher in 2018

-

Inflation is ticking up. Does anyone know that commodities posted back to back positive returns for the first time since ‘10 (we are using the BCOM index).

o We still own the risk assets that generated a 6 Sharpe Ratio in '17 for our Multi Asset Risk Strategy fund, but we have some hedges to ensure we have a well-diversified portfolio in 2018. The key is to find hedges that carry well in an ETF portfolio.

o As Astoria, we utilize our quantitative background and focus our efforts looking at the distribution of outcomes and assigning probabilities to it.

o Regardless of how you define risk (standard deviation, drawdowns, probability of permanent loss of capital, etc.), the probability that it will rise in ‘18 is high. In ‘17, the standard deviation of the 70% ACWI and 30% Aggregate Bond Index was 2%. How much lower can it go in 2018? 1%? Anything is possible, but the probability it declines from 2017’s level is pretty low in our view.

o Standard deviations were low in 2017 for the reasons mentioned above. It also has a big part to do with the generational shift away from stock picking to systematic investing. $500 billion of inflows into the US ETF market will also help!

o I hope those companies that change their name to blockchain or people buying cryptocurrencies at these levels find a way to hedge themselves. All they need to do is look at the 2000 bubble to see how that experiment lasted. New technology stocks were supposed to change the world (I don’t push back some eventually did) but investors paid an incredible multiple and argued that the old economy stocks were going to go out of business. Are most of those old economy stocks still around? You bet!

o And if you bought NASDAQ-100 index at the peak in 2000, it took you 14 years to breakeven (if you wound up holding for those 14 years which I doubt many did). Whatever investing discipline you believe in (stock picking, quant, long/short, multi asset) don’t ever forget that your initial entry price for an asset is crucial when determining the success of your investment.

o Besides being engraved into my DNA about this concept of investing with a margin of safety (i.e. buying Value stocks), I just think it makes sense given where we are in the cycle. The S&P 500 is up 400% since Mar 2009 and Europe and Emerging Markets are up only half that! This is largely why we are big fans of International Value stocks. Would we be surprised if the US has a blow off the top, euphoric rally in 2018? Anything is possible. But there’s no way to model that.

How did Astoria’s Multi Asset Risk Strategy (MARS) fund get a 6 Sharpe Ratio in 2017?

o For one, MARS takes active share. We aren’t closet indexers or a Robo-Advisor. If you want closet indexing, there is a Robo-Advisor that is now free. However, in our view, those Robo-Advisors deploy too much data mining and over extrapolate. I can’t think of a more dangerous way to invest.

o Astoria deploys a systematic, quantitative investment process, blends various factor based investing principles, and then use risk models to neutralize our exposures and desensitize the portfolio. We are data driven but forward looking with our investment approach.

o We should note that our investment process by design will incur tracking error but will always focus on risk-adjusted returns. We feel strongly that most Fixed Income segments are a poor risk / reward and commodities are particularly attractive. Commodities are not in our benchmark and neither are the alternatives that we utilize to help manage the downside.

o MARS currently exploits the value, momentum, & size risk factors across stocks, bonds, and commodity ETFs. In short, we buy asset classes that are cheap, offer a margin of safety, and have upward price momentum. We avoid expensive assets like the plague.

o Value and momentum are two factors which have decades upon decades of research showing their attractive risk reward (there are too many footnotes to reference here but please email me if you are interested and I will suggest some books & papers).

o Adding value and momentum (both negatively correlated) together in a portfolio has had distinct risk/return characteristics compared to a traditional stock portfolio. Further research shows that International value is stronger and more persistent than in the US.

o In 2017, we also benefited from the size risk premia through our exposure to International Small Caps. Liquidity was incredibly abundant in ’17 and given the direct linkage between small caps and liquidity, it shouldn’t surprise anyone that VSS was up 28% in 2018.

o Once we settle on the risk premia we want to exploit, we layer several risk models to ensure we understand and control for our factor tilts, sensitives across asset classes and to risk events (large drawdown in equities, widening credit spreads, large rate moves, etc).

o We have as many as 15 ETFs in our MARS which literally consists of thousands upon thousands of underlying stocks, bonds, commodities, alternatives, etc. We need to make sure we are not taking on any unintended consequences with our ETF selections. We incorporate uncorrelated assets that carry well within an ETF portfolio construct to ensure we dampen the portfolio’s volatility to provide investors with attractive risk adjusted returns.

o As mentioned, we apply the traditional risk premia investing approach within Fixed Income. For instance, US and European High Yield along with sovereign debt in Europe and Japan rank extremely poorly based on our quantitative framework. Why on earth anyone would purchase that part of the Fixed Income segment is beyond me.

o By incorporating our quantitative factor based investing framework within stock, bonds and commodities, we find this lowers our portfolio volatility and increases our Sharpe Ratio. We aren’t using leverage although our mandate allows us. We can’t have all the fun right out the gates, can we? ?

o By the way, I purposely used the word Blockchain in my subject line because these days if you write the word Bitcoin or Blockchain in the subject line, there is a high probability that you will get high readership. But I thought it was important as we feel quite strongly that risk is mispriced. Plus, we have received a lot of inquiries about our investment process, so we wanted to take the opportunity to address our framework to the investment community.

* We are happy to have a more detailed discussion on Astoria’s Multi Asset Risk Strategy’s Sharpe Ratio. The latter would involve, in part, our asset allocation, investment and our risk management process. We would encourage that discussion.

From the team at Astoria, we wish you and your families all the best in 2018!

Best, John Davi

Founder & CIO of Astoria

For more information, please refer to our website: https://www.astoriaadvisors.com/disclaimer