Alluvial Capital Management commentary for the fourth quarter ended December 31, 2017.

Also see

- David Waters — Alluvial Capital Management …

- In depth discussion of some of David Waters’ process on finding under the radar value gems here

Dear Partners,

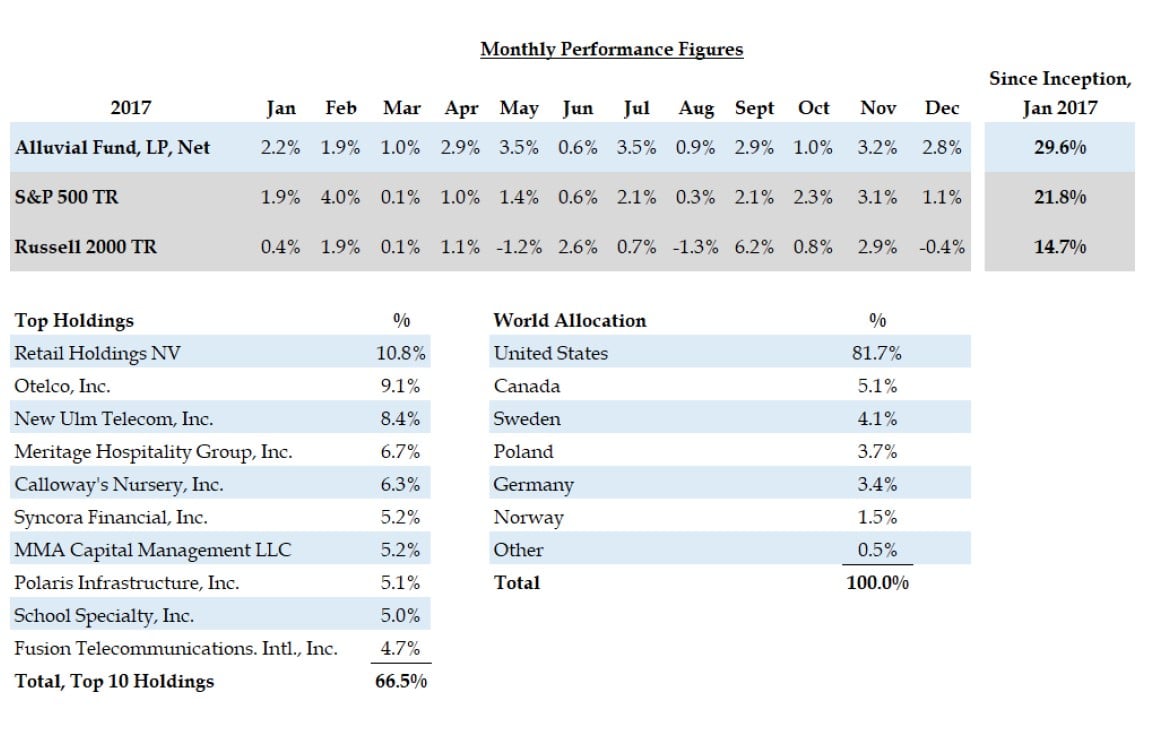

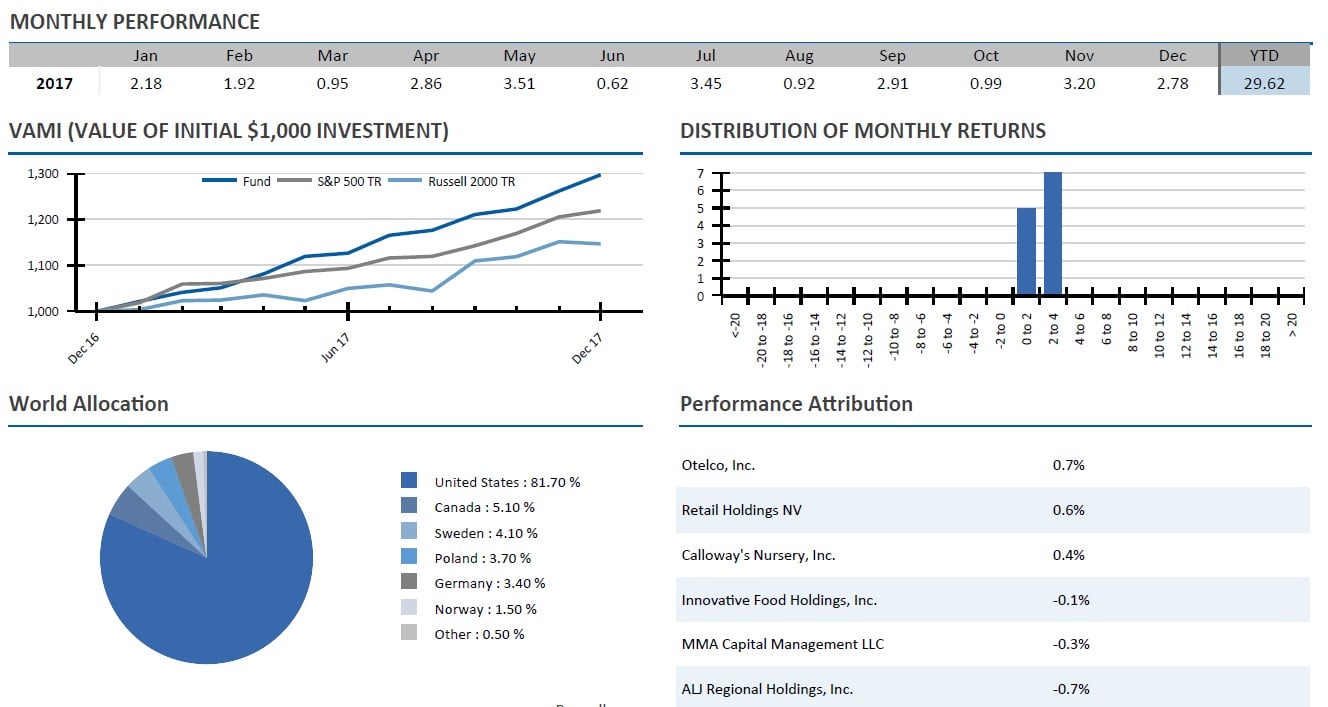

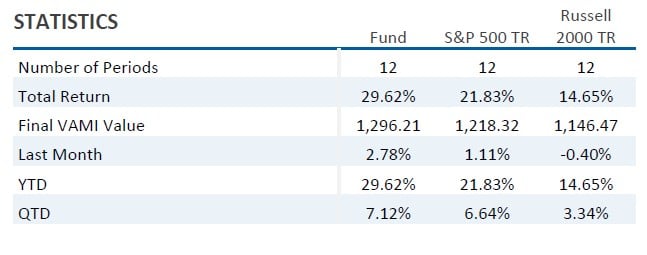

In its initial year of operations, Alluvial Fund returned 29.6% net of fees and operating expenses. As an investor in the partnership, I am as pleased as anyone with our results since we launched. As the manager of the partnership, my satisfaction is tempered by the knowledge that the prudent investor is rarely rewarded for his labors so quickly or so steadily. I once again urge partners to judge the success of Alluvial Fund and my abilities as its manager only after the conclusion of three to five years, especially if those years include periods of market losses.

We are now in the quietest part of the year for Alluvial’s portfolio. Many small companies with December 31 fiscal years take the full allotted ninety days to file their annual reports. This doesn’t mean I’ll be sitting on a beach somewhere with a choice beverage. The lack of news flow is a perfect opportunity to go searching for new opportunities and return to half-finished research projects. There’s always another industry to understand or another company to evaluated. I never get bored!

I don’t pay much mind to the movement of the broad market, but it does appear that at current levels, shares of many companies are pricing in a scenario where a Goldilocks economy allows for uninterrupted growth in corporate profits. Perhaps this is exactly how the coming years will unfold, and buyers of these shares will enjoy enviable returns. But perhaps…not. I have a strong preference for securities priced at levels that allow for positive outcomes even if the business environment proves more challenging than anticipated. I believe the securities we hold in Alluvial Fund are very attractively priced even if company revenues fall short of expectations, or margins compress, or funding costs rise. That is not to say the prices of securities we own would not decline in adverse scenarios, whether economy-wide or company-specific. They don’t call it a stock market for nothing and the collective euphoria or despair of market participants can drive the price of any security to extremes. But by avoiding securities priced to perfection, I believe we reduce risk and create a portfolio that is robust to a variety of market and economic outcomes.

Tax Reform

While last year’s tax reform bill remains controversial, its impact on Alluvial Fund’s holdings is overwhelmingly positive. Few of the small American companies in our portfolio have significant overseas operations or high research and development expenses, so under the former tax regime, most paid close to the statutory federal corporate tax rate of 35%. The new federal corporate tax rate of 21% will cause an immediate and substantial uplift in net income and free cash flow for these companies. While companies like Calloway’s Nursery and New Ulm Telecom produced great returns in 2017, I expect follow-on performances this year as the market catches up to their new economic reality.

If there is any downside from the new tax regime, it is in the reduced value of accumulated net operating losses. Portfolio companies with large tax assets like ALJ Regional Holdings and MMA Capital Management will now see much smaller tax benefits from these accumulated historical losses. However, these companies will benefit like the others once their tax assets have been utilized fully.

Otelco, Inc.

Partners will notice a large new holding in Otelco, a rural telecom company. Rural telecoms on the whole are largely ignored or dismissed despite surprisingly robust economics and serious free cash flow yields. Those who have invested with Alluvial for some time may be familiar with Otelco, which I have owned before. I originally sold shares after the company failed to refinance its debt on reasonable terms and settled for borrowing from Cerberus at absurd rates, plus even more costly mezzanine financing. The resulting capital structure greatly diminished the company’s ability to make progress in reducing its leverage. Management seemed unconcerned by this onerous new debt and so I found it prudent to sell. Nevertheless, I continued to monitor the company. Otelco achieved a new lease on life in November, when it announced a refinancing of all its debt at very attractive terms from a very attractive lender, CoBank. In the transaction, Otelco reduced its cost of debt by more than 400 basis points. The company also gained the ability to distribute increasing amounts of its cash flow to investors, a first since the company emerged from bankruptcy years ago. The refinancing was made possible through a combination of continuing debt reduction and improved earnings visibility thanks to the new federal ACAM funding mechanism.

The market was slow to react to this immensely positive transaction, and I was able to accumulate a large block of shares at $10 to $11. With shares now between $14 and $15, I believe Otelco remains extremely cheap. Between interest and tax savings, I expect the company to earn at least $3.25 per share in 2018. I also expect the company to pay down at least $10 million in debt and to initiate a dividend. The company’s number of access line equivalents will likely continue to decline, but I expect the decline will be largely offset by increasing non-regulated revenue and ACAM income. Looking ahead, I expect one of two outcomes to occur. Either Otelco will begin to trade on its earnings and cash flows, or it will be acquired. To this point, Otelco has been painted as an overleveraged, melting ice cube. The company’s cash flows were robust, but “trapped” with all available cash flow earmarked for debt reduction. Going forward, this will not be the case. Beginning in 2020, Otelco is permitted to distribute 50% of available cash flows as dividends, assuming leverage targets are met. Assuming my earnings targets are met, a 60% earnings payout ratio would mean a dividend of more than $2 per share. As time goes on, Otelco will become a more and more attractive acquisition target. If the company can hold its annual EBITDA decline to 3%, its valuation on an EV/EBITDA basis will fall below 4.0 at some point in 2019. Already the statistically cheapest rural telecom provider, the company will look more and more attractive to a competitor or a financial buyer as leverage continues to decline.

School Specialty

School Specialty is as about close to an ideal Alluvial holding as a stock can be. The company is small, with a market capitalization of just under $120 million. Trading liquidity is minimal, with a handful of funds controlling the large majority of shares outstanding. And the company is boring, operating in the low-growth school supply industry. Scissors and glue, dodgeballs and desks. School Specialty went through bankruptcy and emerged in 2013. Since its emergence, the company has focused on maintaining sales, improving efficiency, and controlling costs as school district budgets remain constrained. The company has also focused on improving its working capital management, freeing up millions from inventory and net receivables.

School Specialty shares trade at less than six times free cash flow. The company is working hard on uplisting to a national exchange pending achieving the required number of round lot holders. The additional visibility certainly wouldn’t hurt, but I don’t expect School Specialty will achieve its full value until the shares become much more liquid or the company is sold outright. In the meantime, I expect the company will increase its equity value by reducing debt and making smart acquisitions to round out its product set and reduce seasonality. Many of the company’s largest shareholders are former debtholders that received equity through the bankruptcy process, and these holders will insist on a good return sooner rather than later.

Polaris Infrastructure

Polaris Infrastructure is a newer holding from another favorite category of mine: fallen angels. Companies that once burned their investors are often forever tarnished in the eyes of the market, even if full atonement for past sins has been offered. Polaris Infrastructure was once called “Ram Power,” and Ram Power was a disaster. Ram experienced cost over-runs and delays when constructing a geothermal plant in Nicaragua, and was forced to restructure its debt and raise significant equity. Ram Power shares and debentures were all but wiped out. The company turned to institutional investors for capital. These investors in turn replaced company management and the board of directors. Now named Polaris Infrastructure, the company is in fine condition. The geothermal plant in Nicaragua is fully operational and has a long-term power purchase agreement with a Nicaraguan electrical utility. Polaris Infrastructure’s debt load is manageable and the company is free to make distributions to shareholders. Polaris has several projects in its pipeline that will increase the San Jacinto geothermal facility’s output and cash flow, and holds the right to develop a nearby geothermal field if feasibility studies indicate good potential.

Despite these tremendously improved results, the market has been slow to “warm up” (please forgive my little geothermal joke) to Polaris. Comparable renewable energy companies trade at double digit multiples of EBITDA, yet Polaris trades at under 7x. More importantly, Polaris has a free cash flow yield of 11% after scheduled debt amortization. The company expects its earnings and cash flows to ramp up over the next one to two years as efficiency-improving investments are completed. Part of Polaris Infrastructure’s modest valuation is reasonable due to its lack of geographic and project diversification, but I believe the majority of the discount is due to a “once bitten, twice shy” mindset on the part of investors. However, the Polaris of today has nothing in common with the Ram Power of yesterday. I expect the market to reevaluate Polaris shares as the company continues to increase its dividend and show rising profits.

Portfolio Updates

The new year is off to a good start with multiple portfolio companies announcing corporate actions or providing optimistic guidance. MMA Capital Management announced the sale of its investment management assets to the Hunt Companies with a concurrent stock placement at $33.50. Going forward, the company will be externally managed and will seek to grow its various lending and investment platforms. The market welcomed the announcement but shares continue to trade well below the company’s post-transaction book value. Syncora Financial announced the merger of its two insurance subsidiaries and a huge settlement with Greenpoint, resulting in the receipt of up to $350 million. In the coming months, I expect the company to announce the sale of its toll road assets and to redeem a substantial percentage of its outstanding surplus notes. Ultimately, the company will very likely lay off its insurance exposure entirely through a reinsurance transaction or the sale of its entire book of business. ALJ Regional Holdings did not announce any transactions, but did provide earnings and free cash flow guidance for 2018. If the company meets its projections, it will produce over $19 million in free cash flow, or over 50 cents per share. This free cash flow will be used to pay down debt, resulting in a much less leveraged company. Finally, Retail Holdings NV paid its $9 per share distribution. The company’s discount to net asset value has narrowed slightly following the distribution, but still exceeds 25%. I expect the company to make additional distributions in 2018 and to complete its liquidation by the end of 2019.

Looking Ahead

As I write, Alluvial Fund’s holdings are a little more US-centric than they are likely to be in the long run. Adjusted for Retail Holdings (which is really an emerging markets holding) about 75% of the portfolio is invested in US securities. On average, partners should expect about one third of the portfolio to be invested in international stocks. The current prevalence of US holdings is mostly the result of recent outperformance by our domestic securities, and the fact that multiple attractive special situations have popped in American markets of late. If Alluvial Fund adds new positions this year, they are more likely than not to be foreign companies. As before, I view foreign markets as both broadly cheaper and much less efficient than American markets.

I continue to be biased toward companies that enjoy stable cash flows, reasonable leverage, and healthy margins. There are, of course, exceptions, but I am not finding much in the way of great value among the ranks of highly leveraged or deeply cyclical companies. I continue to find opportunities in companies that are excluded from market indexes and passive investment vehicles due to their small size or illiquidity, as well as companies that are undergoing significant changes. When it comes to small and less liquid stocks and securities, the market can be slow to catch on to positive trends and transactions in the underlying companies.

Merger and acquisition activity among small banks was torrid in 2017, and I expect no different this year. Alluvial Fund continues to hold small positions in several extremely cheap, profitable community banks. The economic rationale behind bank mergers is compelling, and I am confident an acquirer will eventually come calling for most of these holdings.

Partnership Updates

Alluvial Fund’s capital now exceeds $17 million. As the partnership grows, we gain the ability to access new markets and securities, increasing our opportunity set. Some have asked if I am concerned that Alluvial Fund will outgrow the ability to invest in very small companies in a way that is meaningful for the fund’s results. That day may come, but not until the partnership reaches multiples of its current size. I continue to see numerous value opportunities in domestic and international markets, and I look forward to welcoming additional partners and capital in 2018. Thank you for participating with me in Alluvial Fund this year. I will strive to produce the results you deserve in 2018 and beyond.

Best Regards,

Dave Waters, CFA

Alluvial Capital Management, LLC