A few weeks ago the Japanese health ministry reported a shocking stat: 2017 was the lowest number of births in all of the recorded history of the country. However, Japan is not alone with fertility rates in many Asian and European countries nearing Japan style levels. This all begs that question what to do with the aging population and from an investing point of view how to profit off of it.

Dealing with aging population trends is one of the most significant issues facing governments around the world today. The problem is most acute in developed markets but there are also trends brewing within emerging markets as healthcare and retirement benefits improve.

According to the United Nations, the world's population will grow by just 0.5% per year for the next 80 years. A lack of population growth will hold back the number of workers who can support retirees. The UN estimates that there will be 25 million fewer developed market workers over the next decade and 500 million fewer emerging market workers. Over the next decade, the number of over-65s in the world will rise by 38%, or 250m, led by China and Europe.

According to research from HSBC, global growth potential could be impacted by as much as 0.6 percentage points over the next decade thanks to these headwinds. And this isn't the only problem.

Companies (as well as countries) are struggling to cope with higher liabilities stemming from this trend. The long-term care insurance industry has been driven into near-insolvency over the past decade as care costs have far exceeded premiums paid. Meanwhile, most developed market pension schemes are struggling to fund ballooning deficits. There has been some talk of cutting benefits as a result.

Easy solutions to these problems are often unpalatable or difficult to instigate. For example, to help offset the decline in the working population, greater immigration could be a solution, although this is often unpalatable. Also, raising retirement ages is politically difficult, and increasing fertility rates is practically difficult.

For investors, HSBC notes that there are several ways to play these trends.

How to play aging population trends

First off, healthcare is the most obvious example. As the world's population ages, and needs better care, healthcare providers will profit. There is "also evidence aging populations spend more on leisure – hotels, resorts and cruise liners" so these could be other sectors to consider. The regions that are likely to see the fastest growth in demand for these sorts of services are those with the fastest aging population trends including "Korea, China, Thailand, Hong Kong, Malaysia, Singapore, Colombia, and Brazil."

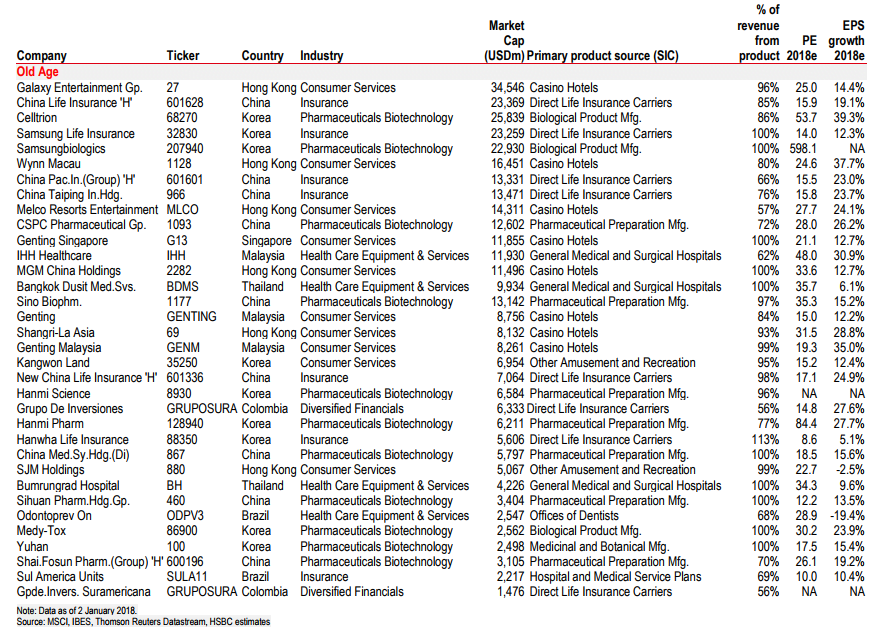

HSBC's Global Equity Strategy team has put together a screen designed to look for those companies set to benefit the most from these trends.

"To do this we look only at the top 10 countries which are expected to have largest increase in "Old Age" populations from 2015-2025. We then select all companies which have more than 50% of their revenue from products which are expected to benefit from these demographic trends. This includes Healthcare, Pharmaceuticals Life & Health Insurance and Hotels, resorts and cruise liners."

The results of the screen are below: