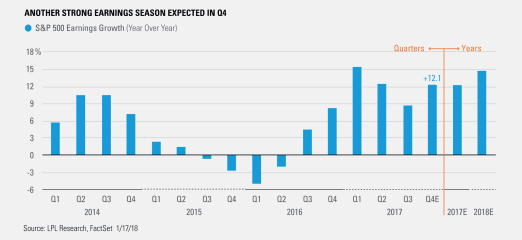

As fourth quarter earnings season kicks into high gear, we’ve put together a list of six reasons why we expect it to be a good one:

[REITs]- Economic surprises: The U.S. Citi Economic Surprise Index, a measure of economic data relative to expectations, is near record highs, and economic momentum points to good upcoming results.

- Strong manufacturing activity: Manufacturing surveys (ISM and PMI indexes) have been among the strongest in a dozen years and are historically well correlated with earnings growth.

- Weak U.S. dollar: Dollar weakness (-6.0% in the fourth quarter) props up overseas earnings for U.S.-based multinationals and may present a tailwind for fourth quarter earnings.

- Pre-announcements: The trend for fewer negative profit warnings tend to lead to better-than-expected earnings results.

- Stable estimate revisions: Analysts’ estimates for the fourth quarter have remained largely unchanged—resilient estimates are typically a positive sign for final results.

- Higher energy prices: Higher oil prices mean more profits for energy companies (6% of the S&P 500 Index weighting) and also more investment in energy infrastructure via the industrial sector.

Considering these trends, John Lynch, Chief Investment Strategist, notes that the combination of solid global demand, tighter corporate income statements, and the recent tax law indicate that profitability remains a strong tailwind entering 2018.

We will provide a more detailed earnings season update in our next Weekly Market Commentary.

*E=Estimate

Article by LPL Research