Welcome to the first update of the new fourth quarter financial statements of U.S. Companies.

Q3 2020 hedge fund letters, conferences and more

The recent SEC filing update has just started and the volume will be sparse until December annual filers report in the coming weeks. These year-long financial statement have a later filing deadline than quarterly filings do and it will be early March before the update is complete.

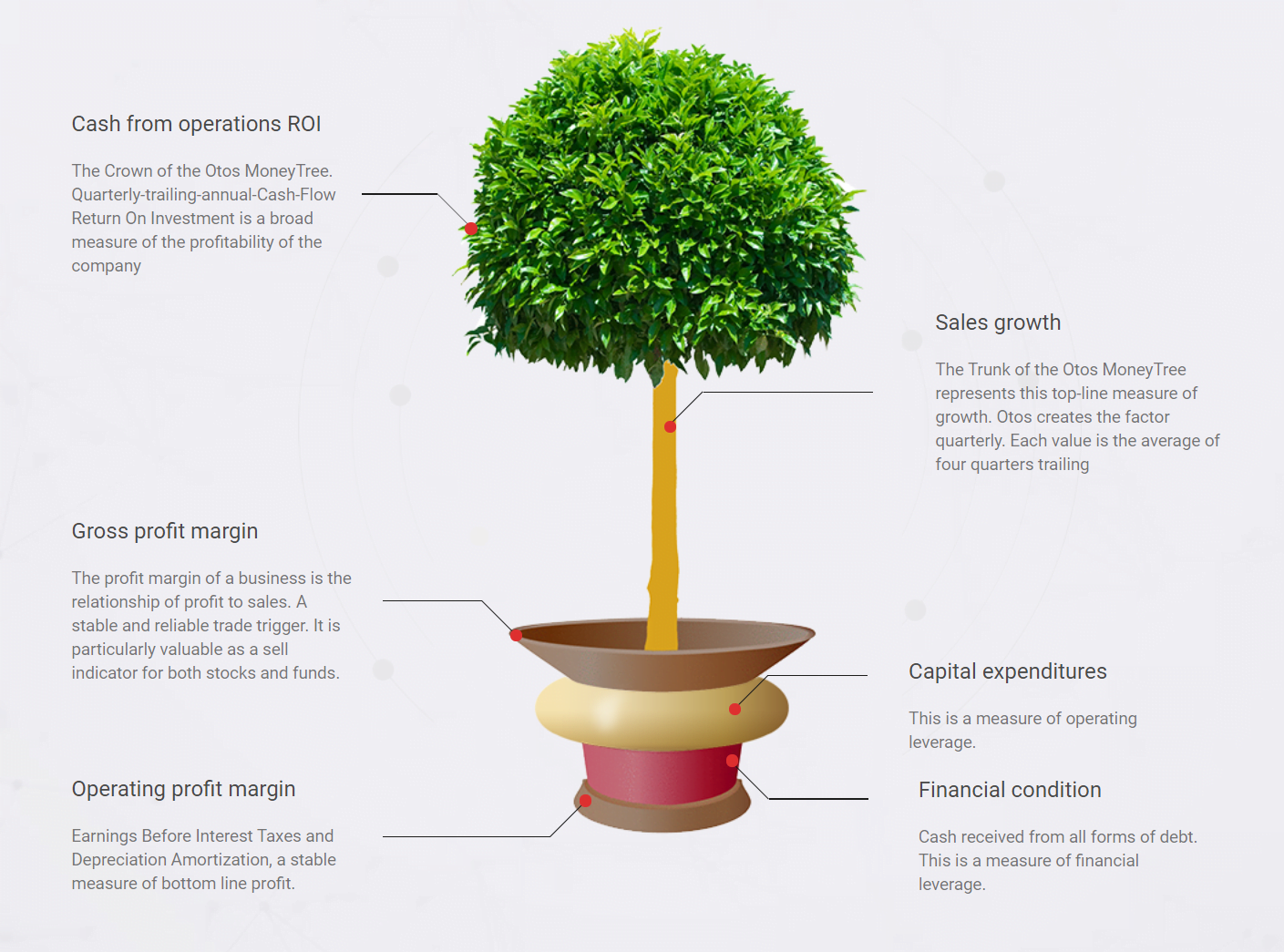

The first companies to appear are the small population with fiscal quarters ended November. The most interesting feature of the third quarter just completed is the large number of companies in crisis mode with sales growth negative and lower. Aggressive cost reduction at the production level has improved gross profit margins (lower variable costs) and lower white-collar headcount has reduced SG&A expenses (lower fixed costs) and enhanced the operating profit margin.

Negative Sales Growth & Aggressive Cost Cutting

Both result in layoffs and the growing unemployment claims in recent weeks suggest that the fourth quarter will not show a trend change. Investors have become accustomed to the central bank creating money at whatever rate is necessary to shore up asset prices.

This has created a false assessment of the (low) level of risk in financial assets. With corporate growth falling broadly and steeply and share-prices tracing all-time highs and now financial assets are very risky. Until we can gauge the timing and magnitude of a post coronavirus economy, valuation measures will be very deceptive, so be sure to stay with companies with exceptional fundamental attributes.

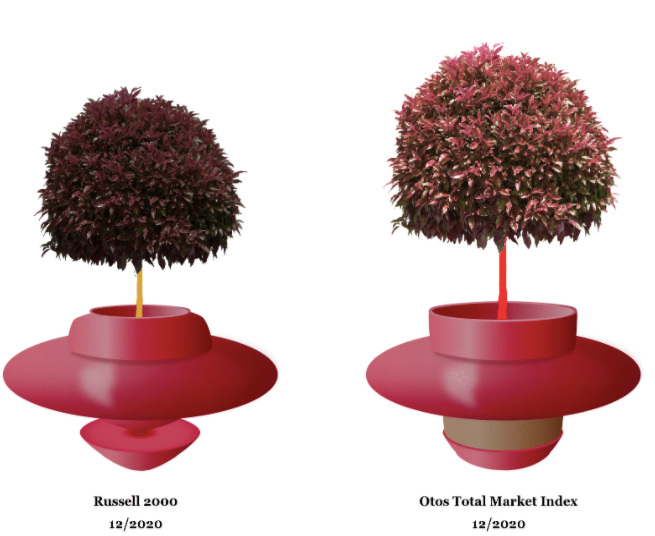

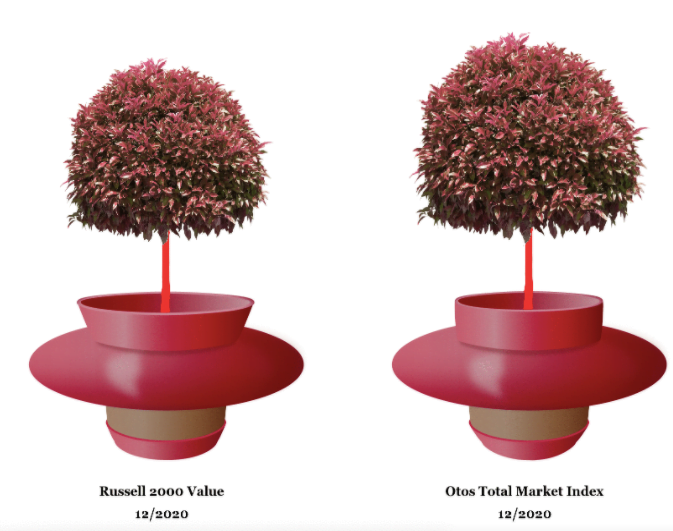

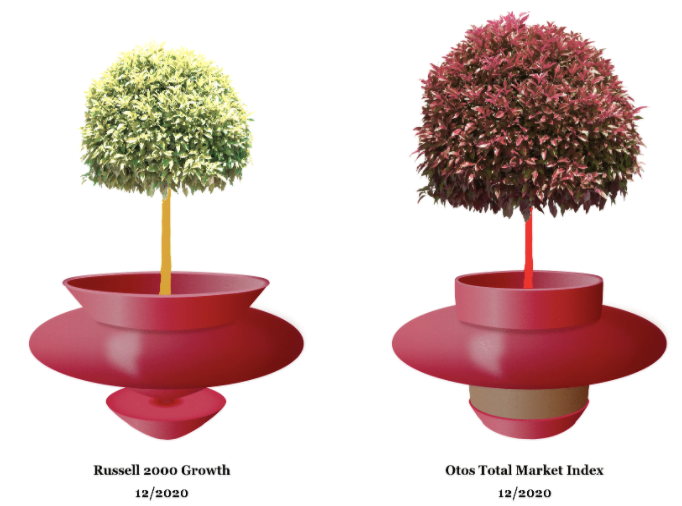

Otos Total Market Index: Highest Market Valuation in Record

Our benchmark, the Otos Total Market Index has declined by 16% relative to the index of long treasury bonds since the September, 2018 high. Current price-to-sales (valuation) is the highest level in the record of the Index.

We have collected all the recent quarter 2020 sales data for 1,519 comparable record companies in the Otos Total Market Index representing 100% of the capital value.

The Otos Total Market Index capital weighted average sales growth rate last quarter was low 4.6% and falling. The proportion of Index market capital accounted for by rising sales growth companies is up to 45.5%, compared to 40.0% last quarter.

The Index is recording a falling gross margin and the proportion of total market capital accounted for by rising gross profit margin companies is up to 40.4% compared to 38.0% last quarter. Inventories are down, improving the chance of a future increase in the gross margin.

SG&A expenses are high in the record of the Index and falling. That implies that the Index has further capability to support their profit margins relative to sales with lower costs; but for how long?

The gross margin is already falling at a more rapid rate than SG&A expenses, producing a deceleration in EBITDA relative to sales. The shares have been highly correlated with the direction of the profit margins.

Opportunities to buy depressed shares are fewer now after the recent market advance. Look for companies with strong gross profit margins and choose rising sales growth with a good financial condition and whenever possible buy stocks with depressed share prices.

Shift to Active Management now and maintain a portfolio of companies with high & rising profitability.

Otos Inc. makes it possible to make an active decision on every stock, industry, sector or style in your portfolio.

We at www.Otos.io have the technology to monitor the evolving condition of the US financial markets more effectively than ever before. The New Year will bring challenges and opportunities. We at Otos are committed to making it all fun and profitable.

Here is a how-to video around our weekly email (YouTube):

Thank you for all your support and wishing you and yours a happy & prosperous New Year!

Please make sure to share my blogs and provide me comments & suggestions for 2021.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.