Summary

- Health care is a rapidly changing industry – one driven by significant changes demographics and emerging technological solutions

- People are living longer around the world and the senior population is becoming an increasing large cohort

- A proactive approach to one’s health and wellness is becoming increasingly common, resulting in more focus on healthy food, exercise, and holistic health

- Technology, such as tele-health, surgical robots, and Artificial Intelligence, is fundamentally changing how individuals monitor their health and receive medical care.

- Investors looking to potentially capture the growth opportunities emanating from these major health care-related themes may consider using thematic ETFs like LNGR, BFIT, and BOTZ.

Health Care is Changing Rapidly

It’s no surprise that health care is rapidly evolving around the world. Some of these changes are unfolding in front of us, like politicians publicly debating the government’s role in health care. But others are less conspicuous, like the significant demographic and technological changes that are transforming the world’s health care needs and treatments. In this piece, we will shed light on four powerful themes that we believe will reshape the health care industry over the coming decades.

People are Living Longer

By 2025, the world’s average life expectancy is expected to reach 73 years. This is up from just 65 years in 1995, meaning that over a mere 30 years, advancements in medical care and greater access to nutrition will have added an additional eight years to the average person’s lifespan.1 In addition to this increased longevity, birth rates are expected to steadily decline, with births per woman falling from 2.5 from 2010 – 2013 to just 2.0 by the end of the century.2 As a result of these demographic trends, the world’s population will skew significantly older than ever before. Compared to 2010, there is expected to be 180% more people over the age of 65 on earth in 2050. The portion of the population ages 15 and under is expected to only grow 10% over this time frame.3

As a result of an aging population and a growing cohort of seniors, we believe there will be significant demand for certain products and services that cater to this segment of the population. Some areas that could benefit include pharmaceuticals treating advanced age-related diseases, biomedical devices, senior living facilities, and health care service providers that cater to seniors.

Wellness Goes Mainstream

Another powerful theme is the emergence of people prioritizing health in their everyday lives. Rather than simply treating symptoms as they occur, individuals are increasingly taking a proactive approach to improving their overall health as part of a holistic approach to medicine. They are doing so by eating healthier foods, engaging in regular exercise, and managing stress through meditation or yoga. Some health care providers are accelerating the health & wellness trend by incentivizing these practices through discounted gym memberships or health monitors, given their long term potential health benefits.

This turn towards improving one’s wellness has spurred the growth of a variety of industries, including organic food brands, workplace wellness services, preventative health care centers, and athletic apparel and equipment. Another area expected to benefit from this trend is health monitoring technology. By 2019, the global demand for sport, fitness, and wearable devices is anticipated to reach $2.8 billion – double the $1.9 billion spent on these devices in 2013.4

Care will be Remote

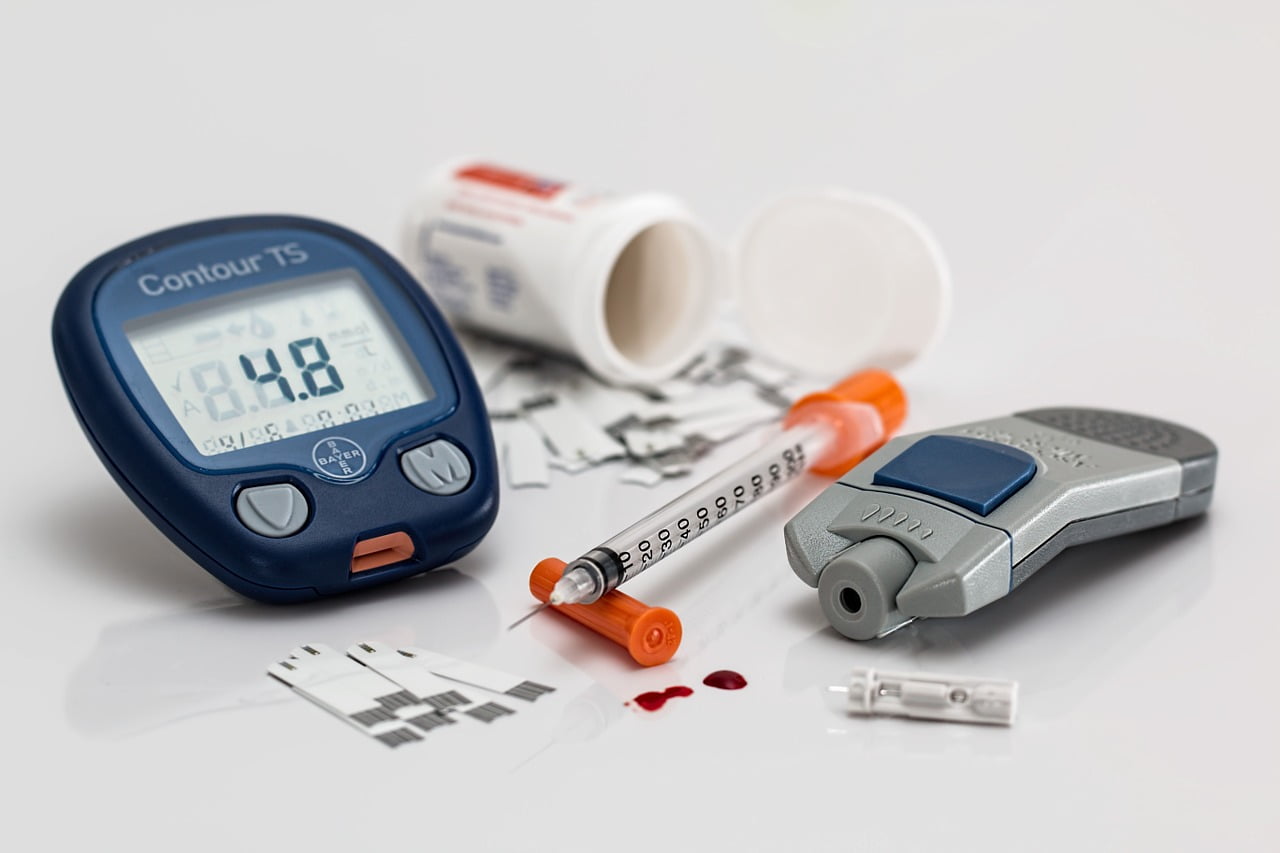

When we get sick, most of us head to the doctor’s office, but this model is quickly being disrupted by technological advancements. With some providers, a routine visit to the doctor’s office is already being replaced by a videoconference or email, allowing patients to save time or remain comfortable at home, while the provider saves on costs. This trend of ‘tele-health’ is possible because of the emergence of a variety of technologies: the ubiquity of social media companies providing video and chat functions has been essential, but the emergence of the Internet of Things (IoT) – which allows “things” to send and receive data to a network – is pushing this trend another leap forward. When applied to medical devices, the IoT can allow doctors and nurses to remotely collect biometric information from patients, meaning in-home care could be provided remotely.

Dr. Robot will See You

The course of action recommended by a health care professional will increasingly rely on analysis conducted by artificial intelligence (AI).5 This technology is capable of examining a patient’s symptoms or biometric data and comparing that information to terabytes of data from other patients with similar symptoms, academic papers, or doctors’ notes. By leveraging AI for diagnoses, doctors can potentially improve their accuracy for identifying common ailments while saving their time for more complex or rare health issues.

While AI will be used primarily for diagnoses, robotics will be increasingly depended on to provide surgeons with greater vision, precision, and automation during complex surgeries. Instead of relying on human hands to make incisions and place sutures, a robot – monitored or controlled by a surgeon – will conduct most of the procedure. This approach is nothing new: the first robot-assisted heart surgery was completed in 1998. But as robots become smaller and more capable, they will be used in an ever increasing capacity.

Conclusion

Health care is a rapidly changing industry – one driven by significant changes demographics and emerging technological solutions. Investors could be well suited to identify these future trends in health care and the companies that stand to benefit from the materialization of those trends.

Related Funds

- Global X Longevity Thematic ETF (LNGR) seeks to invest in companies positioned to serve the world’s growing senior population through exposure to health care, pharmaceuticals, senior living facilities and other sectors that contribute to increasing lifespans and extending quality of life in advanced age.

- Global X Health & Wellness Thematic ETF (BFIT) seeks to harness the effects of changing consumer lifestyles by investing in companies geared toward promoting physical activity and well-being.

- Global X Internet of Things ETF (SNSR) seeks to invest in companies that stand to potentially benefit from the broader adoption of the Internet of Things (IoT). This includes the development and manufacturing of semiconductors and sensors, integrated products and solutions, and applications serving smart grids, smart homes, connected cars, and the industrial internet.

- Global X Robotics & Artificial Intelligence ETF (BOTZ) seeks to invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence (AI), including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles.

FOOTNOTES

1. World Health Organization, “50 Facts: Global Health Situation and Trends 1955-2025.”

2. United Nations, “Fertility Levels and Trends as Assessed in the 2012 Revision of World Population Prospects,” December 2013.

3. Pew Research Center, “10 Projections for the Global Population in 2050.”

4. Statista, 2016

5. Artificial Intelligence Will Redesign Healthcare, http://medicalfuturist.com/artificial-intelligence-will-redesign-healthcare/. December 2008

6. Robotic-Assisted Surgery http://www.ebme.co.uk/articles/clinical-engineering/83-robotic-assisted-surgery as of 8/14/17.

Investing involves risk, including the possible loss of principal. The investable universe of companies in which the Funds may invest may be limited. BOTX and LNGR invest in securities of companies engaged in Information Technology which can be affected by rapid product obsolescence, and intense industry competition. LNGR invests in securities of companies engaged in Healthcare, Pharmaceutical, Biotechnology and Medical Device sectors, which can be affected by government regulations, expiring patents, rapid product obsolescence, and intense industry competition. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. The funds are non-diversified.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Carefully consider the Funds’ investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Funds’ full or summary prospectuses, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxfunds.com. Read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC. Global X Funds are not sponsored, endorsed, issued, sold or promoted by Indxx, nor do these companies make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO nor Global X is affiliated with Indxx.