One company… One investment made — or not made… It can make all the difference to your personal wealth. Just consider for a moment what the removal (for 40 years!) of just one company, IBM, did for the Dow Jones Industrial Average.

What might that index look like today if IBM had been kept as a Dow component during one of the greatest periods of growth in its history?

The No. 1 Stock to Own for 2017

Wall Street legend Paul Mampilly just revealed his No. 1 investment for 2017 … a tech stock he says is about to hand those who act fast the opportunity to make a lifetime’s worth of gains in just months.

The year 1932 wasn’t a kind one to companies or their workers. The Great Depression was ravaging the U.S. economy, which was well on its way to shrinking by one-third; a similar percentage of working-age Americans were out of a job.

Yet International Business Machines (no one called it IBM yet) was virtually alone among U.S. companies in being able to report that its yearly profits were still climbing (albeit marginally — $7.42 million versus $7.35 million).

Brooklyn’s Daily Eagle — one of the larger daily newspapers of the era — lauded that growth: “It is the 10th consecutive year that this company has shown an annual increase in dollar income, [which] is probably the most remarkable performance of any company of its scope and size on record.”

Dow jones selection committee – IBM vs. the Dow: Round One

And over at Dow Jones, the Dow Jones selection committee decided the time was right to add IBM for the first time as one of the select components of the index.

Over the next seven years, through 1939, the U.S. economy struggled to recover. But the Dow, helped along by IBM’s strong profit growth, doubled in value.

And that’s where IBM’s first brief association with the index came to an end. For reasons which still aren’t very clear, the Dow Jones selection committee took IBM off the average and added AT&T in its place.

As we know, with the benefit of 20/20 hindsight, the Dow Jones committee’s timing couldn’t have been worse. AT&T grew plenty, but its best days of growth were already behind it. In contrast, IBM was just getting started, hitting its stride as corporations and governments around the world, from the smallest to the very largest organizations, decided they needed IBM’s computing products.

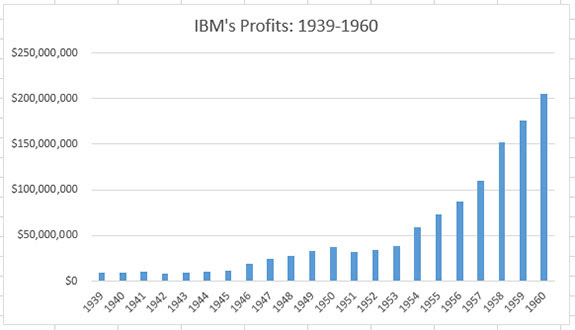

Just take a look at IBM’s net earnings over the next two decades. In 1939, IBM was earning a record $9 million a year, but it barely registers on the chart below thanks to the company’s phenomenal growth.

IBM – Did The dow jones selection committee |

| (Source: IBM archives) |

IBM’s stock rose more than a hundredfold over those two decades. But the company was still just warming up…

Between 1960 and 1970, IBM’s net earnings nearly quintupled to $934 million. By 1978, IBM was earning more than $3 billion annually.

The “22,000 Point Mistake”

As for the Dow Jones selection committee, after 40 years of ignoring IBM’s massive growth, they finally got around to adding the stock back into their industrial average.

On June 29, 1979, IBM became (for the second time) a component of the Dow.

It begs the question: What would the Dow average have been if IBM had never been booted out in the first place?

A few years ago, the folks at Global Financial Data wrote a fascinating article about what might have been had IBM been kept on as a Dow component between 1939 and 1979. The title, “Dow Jones’ 22,000 Point Mistake,” says it all.

By that measure, Profits Unlimited Editor Paul Mampilly’s prediction of “Dow 50,000” in the near future is almost anticlimactic. Dow 100,000, anyone?

But in making that statement, Paul’s bigger point is to avoid the mistake made by Dow Jones’ selection committee. Indexes such as the S&P 500 and the Dow may serve as a reference point for the health and growth of the U.S. economy as a whole.

But the real “22,000 point mistake” is not looking for companies, like IBM during its phenomenal 40-year run, that are consistently growing much faster than the U.S. economy as a whole.