A look at American Whiskey distillers and whiskey sales

Following the announcement on 18th March 2020 of their new asset backed fund, Wave Financial, in collaboration with High Spirits Marketing, has compiled data from various research reports, industry resources, and interviews to provide a detailed snapshot of the Kentucky Bourbon and encompassing whiskey industry. Our team believes that whiskey is an attractive investment opportunity, not yet available to a majority of individuals outside the industry. At the core of this thesis is the understanding that whiskey increases in value significantly during the aging process, but to better evaluate this opportunity we wanted to take a dive into the related macroeconomic factors and trends.

Q4 2019 hedge fund letters, conferences and more

Executive Summary:

- Whiskey sales growth in the U.S. and across the globe has been constant and our research indicates it will remain strong past 2023

- Consumers are trading up to higher quality whiskey brands, and into the High End Premium and Super Premium priced whiskeys

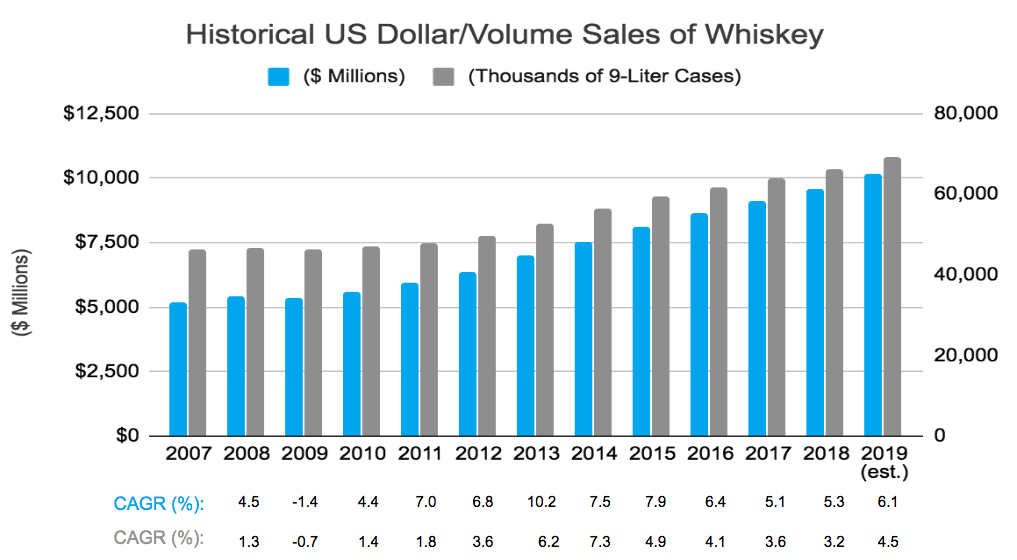

- US Whiskey sales remain robust during times of economic downturn. During the 2007–2009 recession, whiskey by volume and dollar sales only fell YoY once, by 0.7% and 1.4% respectively

- Easing regulations have helped to boost whiskey sales in the United States and across the globe

- Kentucky distillers filled more than 2.1 million barrels of Bourbon in 2018

- While total Bourbon inventory in Kentucky was 8.5 million barrels as of January 2019, the highest since 1970, expansion into new markets and forecasted increasing demand indicate the Bourbon industry will continue this growth sustainably in the near future

- Whiskey was the most exported of all U.S. distilled spirits in 2018, with 43,686 thousand proof gallons by volume¹, magnitudes greater than that of Rum in second place

- Due to the high demand for whiskey, especially Kentucky Bourbon, it is especially difficult to find wholesale Bourbon Whiskey that has aged four years or greater on the open market

- Bourbon Whiskey and Tennessee Whiskey are projected as the highest growing segment out of all US distilled spirits

Many factors have contributed to the rapid and continuous growth of the U.S. whiskey industry. Favorable economic conditions, including low unemployment, growing disposable incomes, and increasingly favorable hospitality taxes are among the more obvious of these, but there are also far more nuanced consumer behavior shifts driving this growth as well.

Source: Sundale Research — State of the Industry: Whiskey in the U.S.

U.S. consumers have demonstrated a continued interest in at-home entertaining, resulting in an increase in beverage purchases outside of traditional bars and restaurants. This has not negatively impacted on-premise consumption though, as the frequency and quality of on-premise whiskey consumption in 2019 saw growth in parallel.

The craft movement is another trend extending its effects on the whiskey industry, driving a strong rise in the number of new craft/artisan, small-batch, and locally-produced whiskey coming to market. Consumers are demonstrating they are eager to know the story behind the production process and are willing to pay a premium for an original, higher quality product. Craft spirits allow consumers to distinguish themselves while drinking something unique, and the sales growth in this segment reflect this behavior.

Finally, possibly the strongest trend driving whiskey’s demand to outpace that of other spirits is consumer’s growing preference for higher quality spirits — namely high end premium and super premium whiskey. We will dive deeper into this demand in a succeeding section.

As demonstrated in the chart above, even during times of tough economic conditions like throughout 2007–2009, whiskey sales remain robust. During this time, there was only one period where whiskey sales decreased over the previous year, and only by 1.4%. If sales during this year are analyzed on a volume rather than dollar basis, these sales only decreased by 0.7%, or 330,000 9-liter cases during that year, indicating a consumer shift towards cheaper brands.³

Obstacles To Whiskey Sales

While the outlook of the whiskey industry is almost unanimously positive, it is important to identify risk factors before delving into industry forecasts.

Recent tariffs on imports and exports of U.S. products have the potential to dampen U.S. whiskey sales abroad. Since June of 2018, the European Union has placed a 25% retaliatory tariff on American Whiskey in response to U.S. tariffs on aluminum and steel under the Trump administration. It is no coincidence that these tariffs would have an especially adverse affect on businesses in Kentucky, which produces 95% of the world’s supply of Bourbon Whiskey.² Kentucky also happens to be home to Senator and Republican majority leader Mitch McConnell, making these tariffs more strategic than they may appear on the surface.

Strict regulations on the alcohol beverage industry also may disproportionately affect craft distillers. Taxes like those on appreciating inventory value can especially hurt craft distillers, who often start by producing and then sitting on aging whiskey for years without seeing revenue.

There is also the threat of large companies exerting influence and pressure on distribution channels. The three-tier alcohol licensing system prevents distillers from selling product directly to consumers or retail, and distillers must rely on distributors to place and sell their product. Large companies may have the leverage necessary to pressure large distributors away from distributing certain products, potentially limiting the reach of new players.

Domestic Demand

Based on projections by a variety of independent researchers, whiskey growth in the U.S. and across the globe has been and will remain strong past 2023. In 2018, the dollar sales of whiskey increased by 5.3% over the previous year.³ Looking forward, total whiskey sales are projected to increase at a compound annual growth rate of 5.1% through 2023.⁴

Source: Statista — DISCUS; ID 233527

In comparison to the overall distilled spirits industry, whiskey sales by both price and volume are expected to grow at a faster rate than that of total distilled spirits. When comparing $ value of sales, whiskey’s market share of all distilled spirits is projected to increase from 34.8% in 2018 to 36.1% in 2023.⁵ Whiskey’s volume share of distilled spirits is also expected to increase, from 28.6% in 2018 to 30.3% in 2023.⁶

Much of this sustained growth has been driven by the high end and super premium segments within the whiskey industry. While growth of low and mid tier whiskey sales has more or less stagnated, growth in the more premium segment is expected to stay solid, driving growth across this alcoholic beverage category as a whole.

Source: Sundale Research — State of the Industry: Whiskey in the U.S.

When broken out by type of whiskey rather than price point, Bourbon Whiskey and Tennessee Whiskey combined have the highest forecasted growth — 6.7% sales CAGR until 2023.⁷ In 2018, $ sales of this segment grew by 6.5% to $3.59 billion.⁸

Global Demand

Growth of global whiskey revenues is expected to be slower than that of U.S. domestic sales, but still strong — with projections ranging from 3.6% to 4.5% in the years between 2019 and 2023.⁹ Demand from the Asia Pacific region especially is expected to increase whiskey revenues. Drivers of this include an increasing demand in emerging economies including India and China, paired with a growing demand for premium quality spirits.

Source: Statista.com — Worldwide, Whiskey and Spirits Projections-Statistics

When considering the global demand for U.S. spirits, whiskey constantly leads as America’s most exported distilled spirit. In 2018, 43.7 million proof gallons — equivalent to one gallon of 50% ABV spirits at 60 degrees F — was exported from the U.S., dwarfing rum, vodka, and gin combined.

Source: Beverage Information Group; DISCUS; ID 466445

Kentucky Distiller Landscape

Whiskey and Kentucky have a famously interconnected relationship, with the state being home to more than a third of the country’s total distilling jobs. Surprisingly, there are almost 2 aging whiskey barrels for every person alive in Kentucky.¹⁰ Kentucky’s most famous spirit is Bourbon Whiskey, deemed as Bourbon only if the product meets a variety of requirements. One of these requirements dictates that Bourbon must be made in the US from grains constituting at least 51% corn. As previously mentioned, the state of Kentucky produces 95% of the global Bourbon supply.

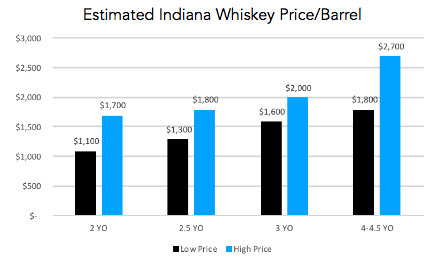

Due to the high demand for whiskey, it is especially difficult to find full barrels four years or older on the open market. Through conversations with distillers, brokers, and others involved in the industry, we have captured a range of prices for some of the few attempted sales of aged whiskey inventory. These numbers reflect the wholesale offer prices of full aged 53 gallon barrels, and do not reflect the final sales price which is private to those involved in the transaction. Of the three whiskey types, Kentucky Bourbon commands the highest asking price in each age bracket.*

Based on these conversations with distillers, we also estimate a barrel of Bourbon Whiskey can be produced by a mid-sized distiller for under $700. This number includes the $100–200 paid for the physical barrel. Using this estimate, these sales offer prices demonstrate how lucrative holding and aging whiskey inventory can be for distillers. Assuming a production cost of $700, a 3 year old barrel of Kentucky Bourbon can be worth 3–4x that after 3 years of aging.*

whiskey sales: Conclusion

Even though American Whiskey distillers last year produced the most Bourbon since the 1970s, industry experts and analysts are still bullish that this growth is not yet near its peak. Driven by increasing global and domestic demand, strong economic conditions, and consumer trends, projections over the next four years at minimum show growth in whiskey sales by both volume and revenue¹¹. Distillers are hyperaware of the value of their aging whiskey, and for that reason will primarily elect to age the whiskey themselves over selling it prematurely.

The production and aging of whiskey can be a lucrative business, but outside of the distilling industry this opportunity to capture its upside has traditionally only been available to large institutions, financiers, and governments (who enjoy large tax revenues).

Unlocking the return associated with this unique asset and making it available to individuals seems like a novel idea, but may be more realistic in the near future.

Authors:

Benjamin Tsai, President, Wave Financial

Andrew Ballinger, Analyst, Wave Financial

Steffani Scheurich, Owner and Founder, High Spirits Marketing

About Wave Financial

Wave Financial (Wave) is a Los Angeles and London based investment management company that provides institutional digital asset fund products. Led by a team of highly experienced financial services professionals, Wave applies traditional investment strategies to digital assets and in a tokenized form of high growth, real assets such as whiskey. Wave also provides treasury management services and consultation to the digital asset ecosystem.

Wave is regulated as a California Registered Investment Advisor (CRD#: 305726).