The Broad Market Index was down 8.79% last week and 27% of stocks out-performed the index. Another dramatic week and again the real insight came from the bond market. The stock market dropped so steeply on Monday and Thursday that emergency trade-halt switches were initiated. Most stocks are so steeply down recently that no-short rules apply. These attempts to manipulate stock trading can only slow the decline.

Q4 2019 hedge fund letters, conferences and more

In the early weeks of this recent market index decline, the US Federal reserve intervened aggressively pushing interest rates to new lows and generating the biggest daily increase in treasury bond prices in history. Last week that changed. Bond prices fell steeply. The biggest daily drop on record was Tuesday.

That is a policy reversal that represents a first since the financial crisis in 2008 and suggests that monetary policy has reached its limit. Further evidence came on Thursday when the Fed announced a $1.5Trillion infusion. That is pure propaganda since the global central banks have already pledged to provide liquidity into infinity if required.

Asset values have been upwardly biased for 30 years by a persistent decline in interest rates (long term treasury bond yield fell from 17% in 1982 to 0.7% on Monday). The wealth effect proposes that people will go into debt and over-spend their income if they feel richer. This has become a central theme of policy.

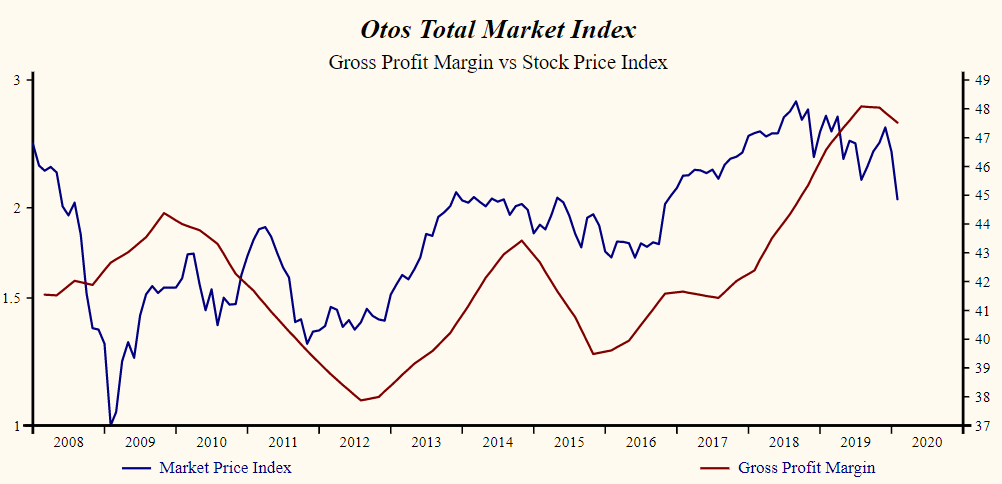

Otos Total Market Index Shows Slowdown In Sales Growth

Corporate growth has been falling at an increasing rate in each of the past four quarters. Currently, sales growth is low in the record of the Otos Total Market Index and lower than last quarter. The gross profit margin is falling from the highest level in US corporate history. Lower corporate growth has been very reliable as a predictor of lower stock prices.

It will be several more quarters before this downward trend is reversed but last quarter there was a sharp jump in the frequency of improvement in sales growth.

With shares now broadly depressed it’s time to buy. Look for improving sales-growth, rising profit-margin companies with good financial condition and lower costs (this is a green tree with a dark trunk in a stable solid golden pot).