Take‐Aways

- While the emerging economic/market crisis in the United States is driven primarily by COVID‐related health and economic shocks, our data suggests the crisis will continue to be exacerbated by domestic political

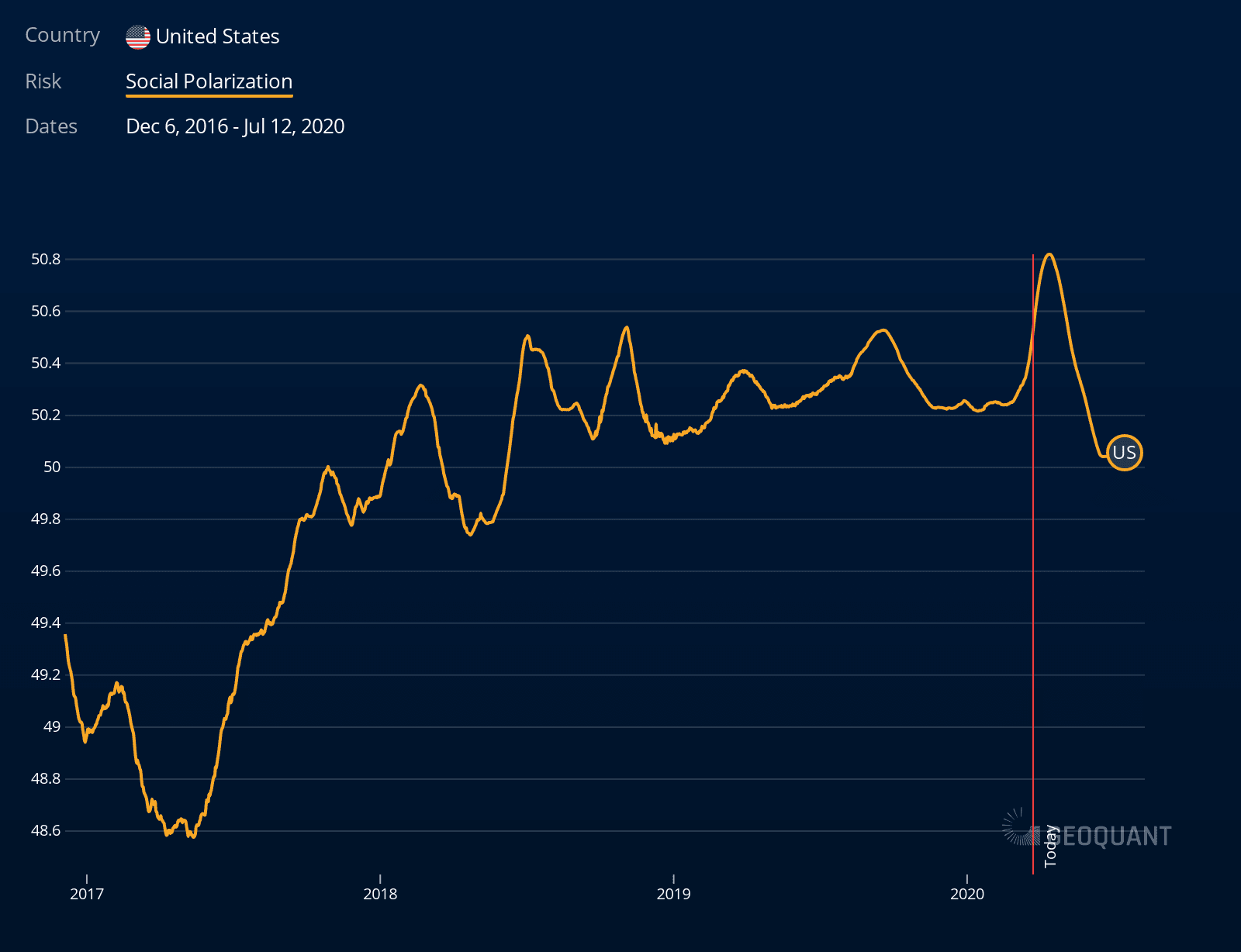

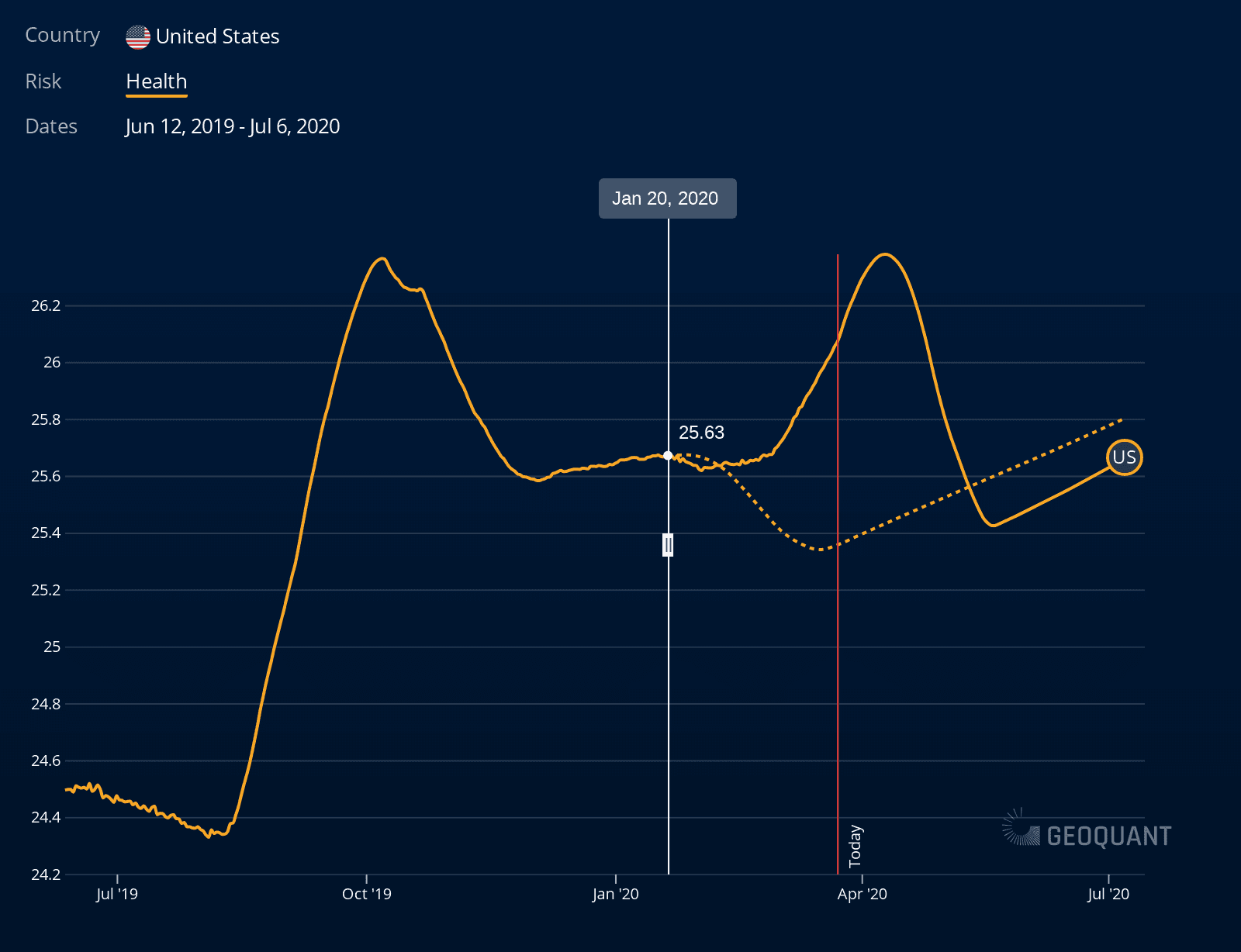

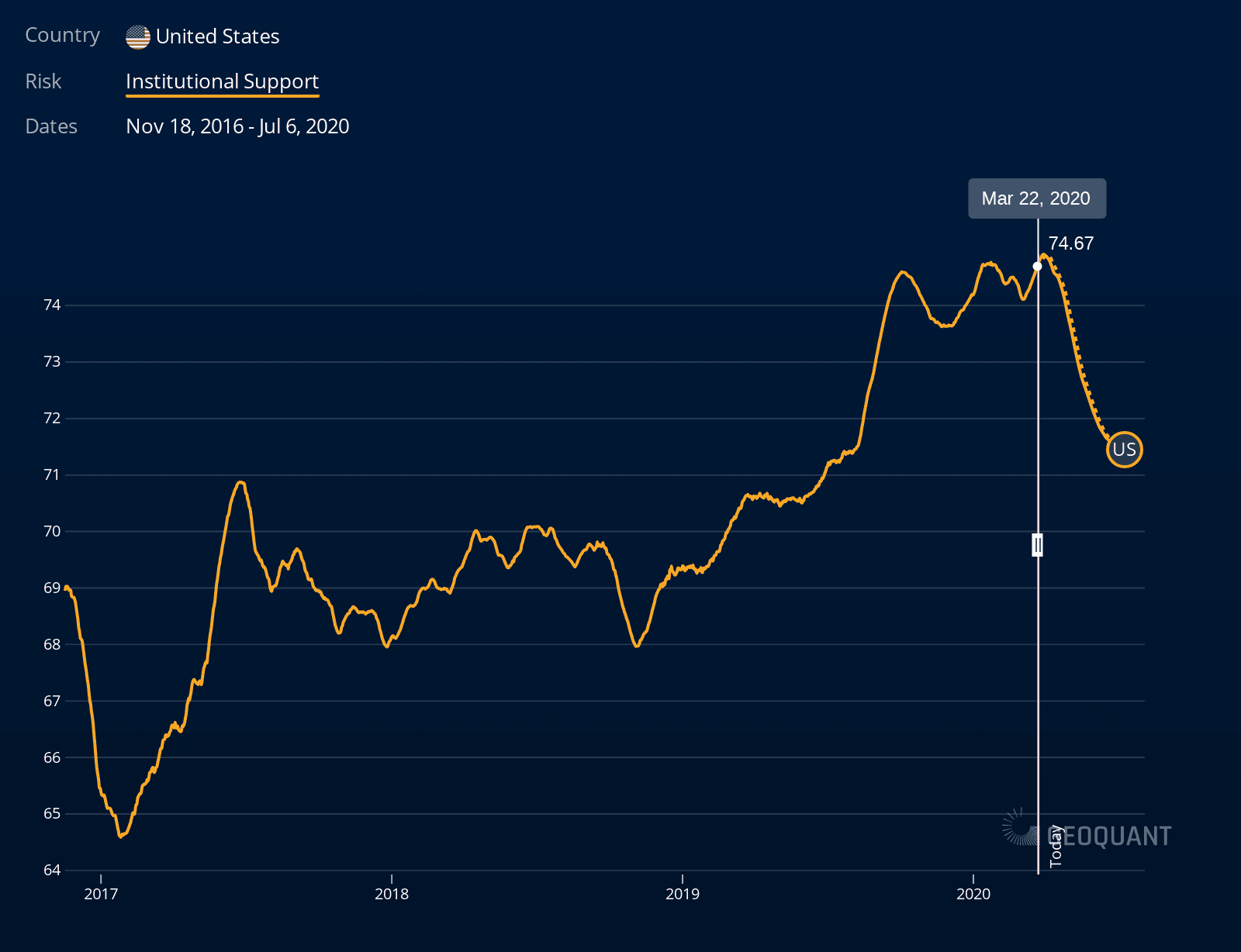

- U.S. Social Polarization Risk and State Capacity Risk are markedly elevated relative to early 2017, while Institutional Support Risk under the Trump administration is approaching a historic peak, underscoring government weakness. Health Risk is still increasing and set to peak in early April.

- As such, political risks will continue to undermine the federal government’s ability to effectively mitigate the social and economic impacts of the COVID‐19 pandemic, with direct implications for S. equity markets.

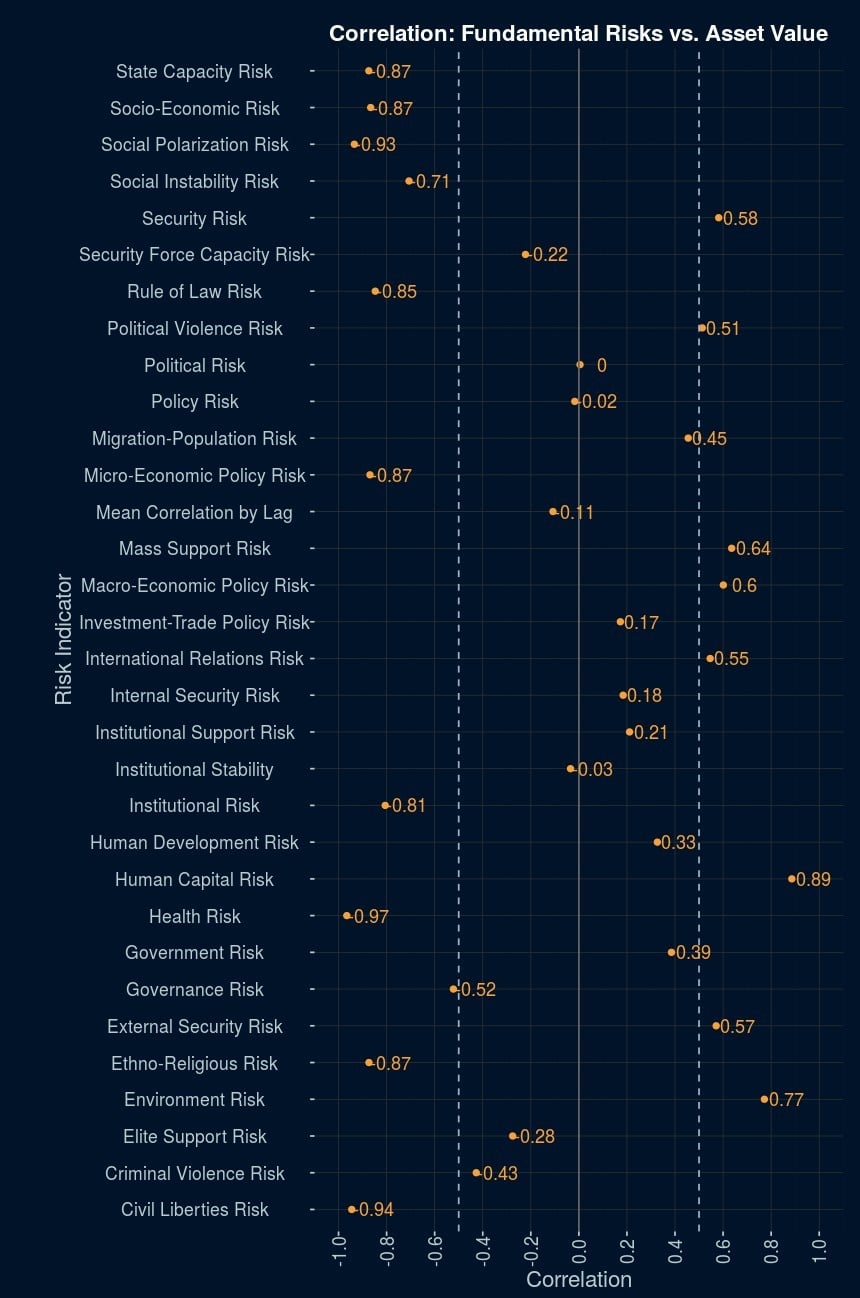

- Health Risk (r = ‐0.97), Social Polarization Risk (r = ‐0.93) and State Capacity Risk (r = ‐0.87) are all strongly and negatively correlated with the S&P 500 YTD/2020.

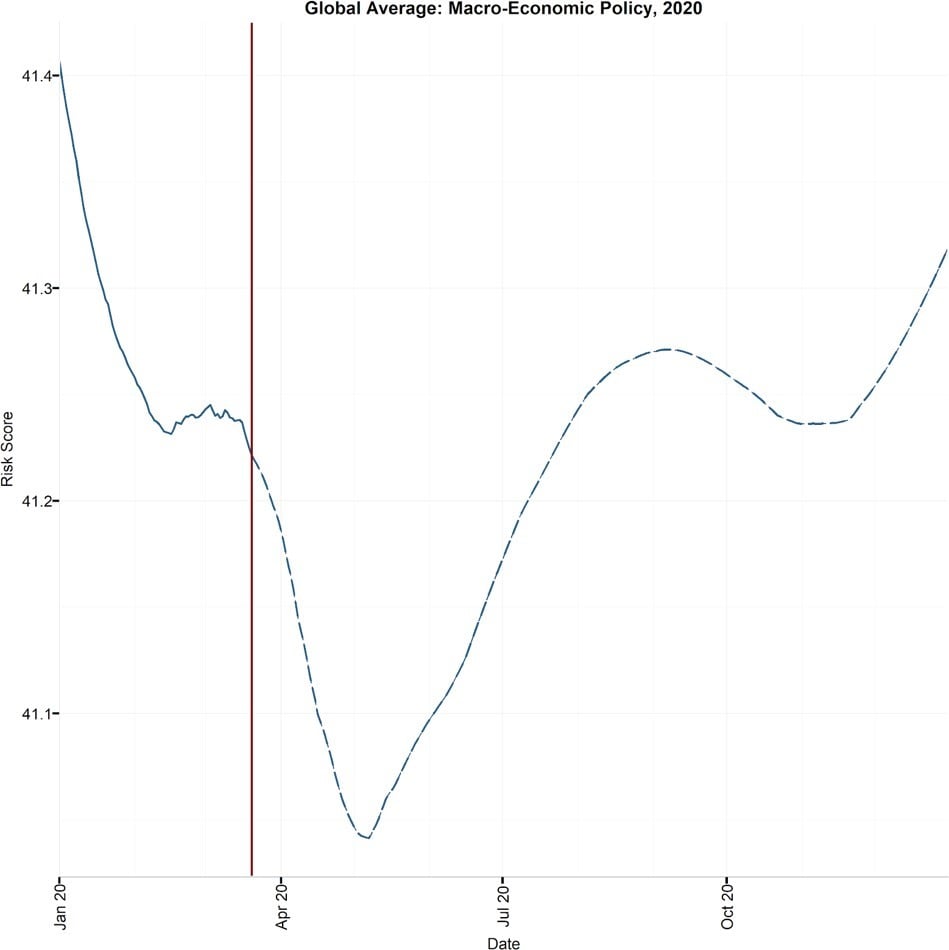

- Moreover, while U.S. Macro‐Economic Policy Risk is currently downward‐trending, we forecast a reversal – of both U.S. and global Macro risk – from May

Q4 2019 hedge fund letters, conferences and more

We interpret these trends as suggesting that while central bank activity may help calm markets in the very short‐ term, more coordinated policy actions will continue to be both more important and more politically difficult to achieve.

Analysis:

While financial and economic turmoil in the U.S. is being driven by the COVID‐19 global pandemic, political factors are clearly at play as well, especially as U.S. political and economic institutions attempt to respond to the COVID health shock.

Our previous analyses have indicated that the U.S. has a relatively high level of Political Risk – and thus a low level of political resilience – when it comes to responding to a health shock like COVID‐19. While the baseline daily U.S. Political Risk score is still low (it currently ranks 11th out of 51 countries in our system), the political trends most relevant to COVID‐19 resilience are negative. Specifically, both State Capacity Risk and Social Polarization Risk have increased markedly since 2017. Note that while the former is projected to decline somewhat going forward, the latter is set to increase in the coming months.

Meanwhile, the spread of COVID‐19 in the U.S. has driven a jump in U.S. Health Risk from levels projected before the first confirmed case in the U.S, on 21 January. Note that U.S. Health Risk is projected to increase through early next month.

Our data also continues to show that the Trump administration is weak, with especially low levels of institutional support (i.e. support from/control of the legislature and broader state institutions), particularly following the earlier impeachment proceedings. This trend further undermines the federal government’s ability to coordinate among agencies and states and effectively mitigate the social and economic impacts of the COVID‐19 pandemic. Ongoing U.S. government difficulties in ramping up testing and provision of medical supplies; enforcing social distancing measures; and legislating large scale fiscal stimulus are all consistent with this analysis.

In short, while the emerging economic/market crisis in the United States is driven primarily by a health crisis, it is just as clearly exacerbated by a potential political crisis.

To help make this point more explicitly, the figure below reports day‐on‐day correlations between the full gamut of our daily U.S. political risk indicators and the S&P 500 for 2020/YTD.

Note that a wide range of risks relevant to U.S. political resilience to the COVID‐19 shock – from Health Risk to State Capacity Risk to Social Polarization Risk – all have strong negative bivariate correlations with the S&P 500 in this period.

Importantly, with the exception of Micro‐Economic Policy Risk, nearly all of these indicators actually have positive or weak negative correlations with the S&P 500 since 2013, highlighting both the general agnosticism of U.S. equity markets to U.S. political risks over this period, as well as the apparent sensitivity of these markets to politics this year.

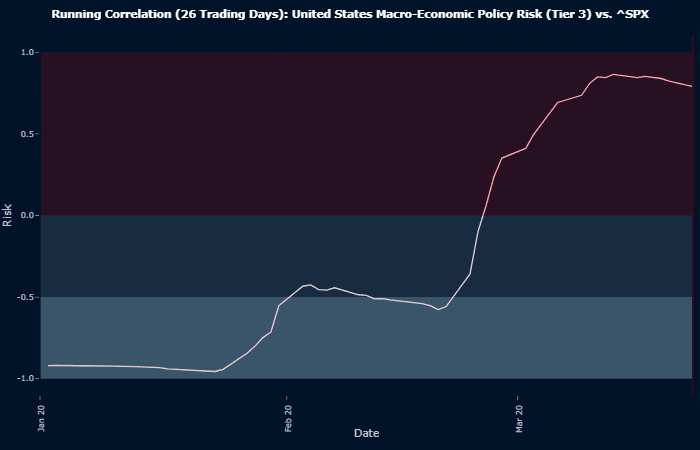

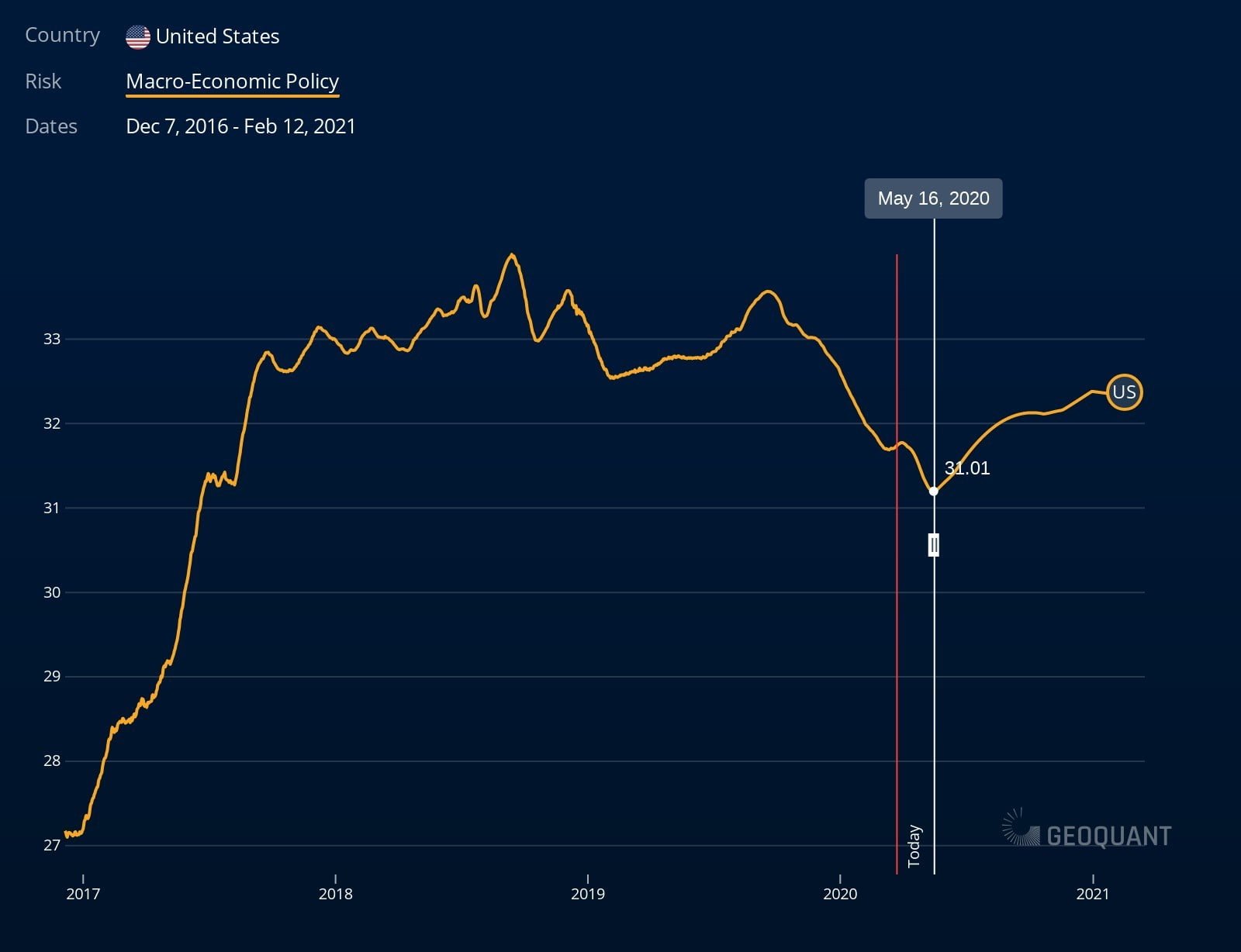

NB: In contrast to Micro‐Economic Policy Risk, Macro‐Economic Policy Risk has maintained a positive relationship with the S&P 500 close in 2020 (see figures below), with macro risks declining into the period of market turmoil and set to decline further through mid May; this trend mirrors the Fed’s ongoing and aggressive respond to the crisis.

That said, from roughly May onwards, we forecast an upswing in Macro‐Economic Policy Risk both in the U.S. and globally (see below), extending well beyond the dates at which our country‐level Health Risk indicators are forecast to return to pre‐COVID baselines in several countries recently experiencing outbreaks. We interpret these trends as suggesting that while central bank activity may calm markets in the very short‐term, more concerted and potentially coordinated action – including on the fiscal policy front – will be needed well beyond that timeframe to address what is likely to be longer‐term fallout from the pandemic, including massive fiscal deficits.

GeoQuant Insight By Mark Y. Rosenberg, PhD - CEO and Co‐Founder

GeoQuant Insights provide timely analysis of major political risks and their anticipated (geo)political impact and mar‐ ket implications. Insights help our clients stay ahead of the political impact curve, in conjunction with our AI‐driven political risk intelligence platform. Learn More: www.geoquant.com | Contact Us: [email protected].