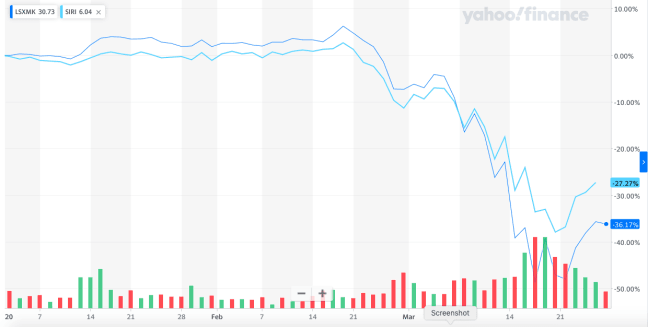

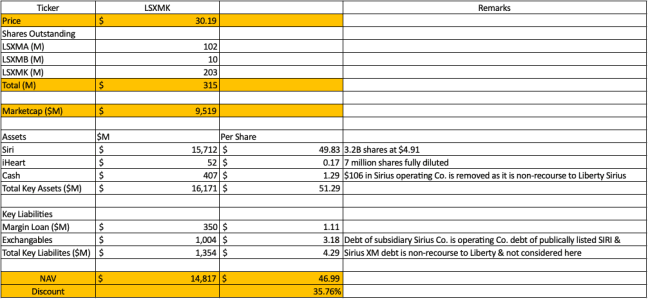

Liberty Sirius closed at $30.19 / share on March 27th. Its main asset is 3.2B shares of publicly traded Sirius XM (SIRI). Since the start of the year, the discount between SIRI and LSXMK has increased by close to 9 pts. (Courtesy: Yahoo Finance) Given the fact that LSXMK was trading at a discount at the beginning of the year, it is worthwhile to see the NAV discount that LSXMK is trading at.

Q4 2019 hedge fund letters, conferences and more

The key to note before we dive into the NAV calculation is that LSXMK financials consolidates SIRI as it holds over 71% of the shares outstanding. This is from an accounting perspective. In reality though, SIRI operates as a separate public listed company and the debt / cash are non-recourse at this point to Liberty Sirius Group or the Liberty Media group. The other way to think about it, the debt and the cash held at SIRI is at an operating company level.

Taking that into consideration, the NAV calculation shows a significant discount to the underlying asset which can be valued using market listed securities.

Liberty Sirius bull case

There are four possibilities that could cause the discounts to be significant.

- The market is treating the SIRI debt as recourse to LSXMK and the given the higher level of debt at SIRI and deteriorating market conditions is discounting LSXMK further. This makes no sense because if that were the case, SIRI should be falling as well. Furthermore, SIRI’s FCF is good and the debt is at operating company level. This was shown clearly at the annual meeting. Furthermore, the churn during the last recession was actually much lower than people expect. It was in low single digit %.

- The market is assuming that given the drop in stock price, John Malone might pay a premium to buy Sirius completely. Given the disciplined nature of M&A that the Liberty complex has exhibited so far, that seems improbable.

- Ability to roll over debt in the near term (nothing alarming there)

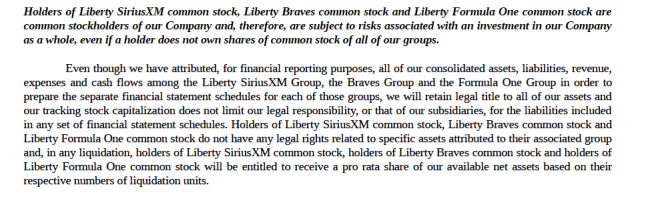

- Since LSXMK is a tracking stock, the market has increased the discount considering the possibility of liquidation of entire Liberty Media complex with a deterioration for FWONK and BATRK. Currently, there is nothing that indicates that FWONK or BATRK is impacted to the point of liquidation that will demand a 35% haircut on NAV of LSXMK.

It seems to be a case of the market discounting tracking stocks in general a lot higher in this environment. Time will tell.

Any comments on what I could be missing is welcome. [email protected]

Disclosure: Long SIRI and action expected in Liberty Sirius