With the march of technological innovation, increasing competition and an expanded selection of opportunities, the investing landscape has become streamlined, accessible and cheap. And it’s likely to be even better in the decades to come.

Q4 2019 hedge fund letters, conferences and more

A brief picture of investing: pre-2000s

The 1950s saw a rather undemocratic investing landscape. Only 4.2% of Americans owned stocks. And investing was tedious: Executing a trade was a long process, and consumers paid stockbrokers enormous fees for the privilege. Brokers charged high fixed commissions with impunity, because competition was scarce. And when retail investors were able to get into the market, they had limited vehicles — or assets — in which to put their funds.

The outlook improved over the next few decades, with the growth of mutual funds helping to simplify investment decisions for consumers. In 1961, fixed-rate CDs were introduced as another way for investors to earn a set interest rate over a stated term. Wells Fargo’s first index fund in 1971 opened the door to broader, cheaper and more passive investment strategies. And the US government established IRAs a few years later, allowing Americans to save for retirement on a tax-deferred basis. Critically, the Securities and Exchange Commission outlawed fixed commissions, creating downward pressure on the cost of trading.

Trades still weren’t cheap, though, with commissions reportedly at an average of $45 in the late 1980s. These commissions could balloon as high as thousands of dollars, depending on order size.

But there was an unmistakable trend: The investing landscape was becoming accessible to more people. In the 1990s, trade commissions had widely dropped to $14.95. Technological innovations resulted in a system within reach of many retail investors. A turning point was the advent of online brokerage company E-Trade. By this point, more than 20% of Americans — a considerable 51 million — owned stocks.

The early 2000s: Investing becomes even faster and cheaper

In the new millenium, the investment industry accelerated due to the widespread adoption of two revolutionary advancements: the Internet and smartphones.

The benefits of these innovations are wide-ranging. Today, retail investors can choose from a variety of online brokers competing for their business and then open an account for free within minutes — all from a mobile device. Investors can search far and wide for esoteric securities or outsource most of the legwork to ETFs and index funds. As of late 2019, multiple brokers charge $0 commissions for stock, option and ETF trades. And for low-risk investments, investors have the option of opening a CD online.

By and large, financial planners still prefer working with clients with at least $100,000 in investable assets. Clients who make the cut typically pay 1% to 2% of assets under management (AUM). But robo-advisors have opened the doors to consumers with less to spare, allowing firms to serve retail investors at scale. Accordingly, the average robo-advisor fee is around 0.25% to 0.30% of AUM. Some platforms — such as SoFi Ally — charge 0%.

The barrier to entry is much lower too. Services like Betterment, Hedgeable and Motif Investing require no minimum deposit to open an account. Competitors like Wealthfront aren’t too far behind, allowing minimum deposits of $500.

As further evidence of a more level playing field, consumers now have access to investments that were once reserved for the well-connected and deep-pocketed. For example, improved technology and infrastructure has made fractional trading easier, allowing cash-strapped investors to invest in such otherwise inaccessible stocks as Alphabet and Amazon.

Crowdsourcing means that for as little as $2,000 to $3,000, consumers can invest in startups through platforms like SeedInvest and FundersClub. SeedInvest even welcomes unaccredited investors. And with the advent of Fundrise and Roofstock, real estate investing no longer requires tens of thousands of dollars. Retail investors can become peer-to-peer lenders, financing consumer debt through platforms like LendingClub and SoFi.

Put simply, investing has blossomed in the new millenium, bringing down many of countless barriers of the past. Evidence of that is the majority of Americans — some 55% — who now own stock.

How the investing landscape will change - and how it won’t

Despite the long strides we’ve seen in everyday investing, some things may not ever change.

Banal as it sounds, “Do your research” is critical. You don’t want to follow the herd to the point of getting in over your head. The cryptocurrency boom is but the latest cautionary example, whereby countless retail investors poured money into potentially lucrative — but speculative — assets they didn’t understand. And when the bubble burst, many consumers had a reckoning.

The principles of sound investing are timeless. A graph of Warren Buffet’s lifetime wealth is striking proof of the magic of compounding. Retail investors would be wise to heed professors Graham and Dodd’s principle of margin of safety, which is an effective guardrail against human error. And if active investing is what you aim for, devote enough research to understand potential return. Otherwise, it’s still possible to get an average return with passive investing, as Graham noted years ago.

As for what’s next in the investing landscape, a smart bet is what the industry’s excelled at for decades now: systems that make it faster, easier and cheaper to get in the market.

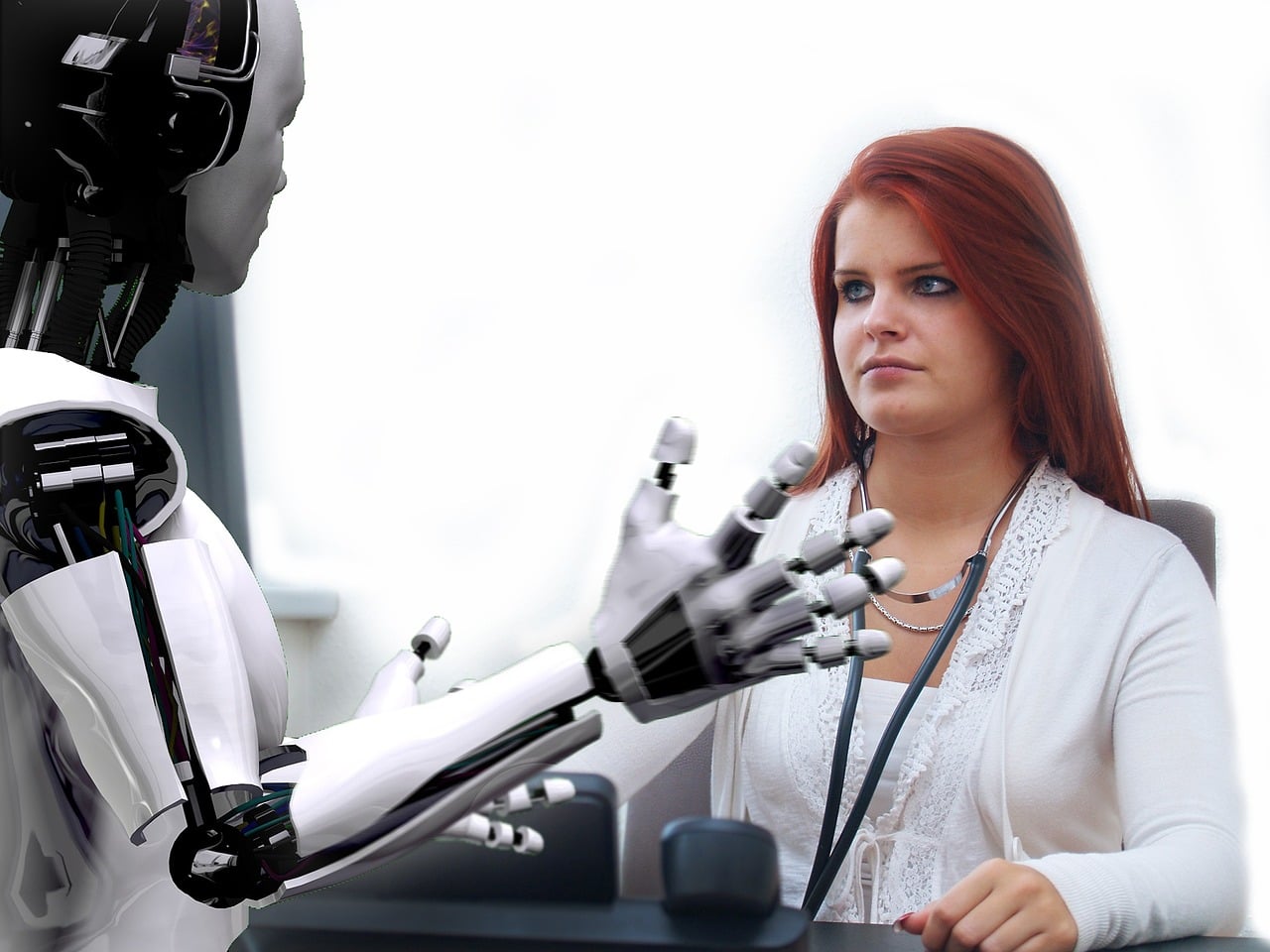

Artificial intelligence will become increasingly valuable. It can help advisers readily produce useful information and projections for their clients, and keep client portfolios within target allocations. It will continue to advance analytics and prediction, leaving financial advisers to handle the vital work of interpretation and guidance. Crucially, firms will look to AI for opportunities to streamline operations and cut costs, searching for profits as competition erodes fees.

Lastly, amid a dizzying array of choices, consumers will want more full-service suites for their finances. Ideally, firms will offer accessible checking, savings and investing accounts at a minimum in addition to targeted and personalized advice and cohesive, easy-to-use platforms. Companies such as Stash already bill themselves as all-in-one solutions. Competitors will follow suit, keen to produce profit from customer acquisition costs — and keep clients from wandering to the wave of fintech upstarts.