High School Graduates vs College Graduates – Is College Worth It? Study Reveals Grads Make $13k More Per Year

As unemployment rates across the country continue to hit record lows, millions of jobs remain unfilled due to a high number of unqualified workers. Many times, while people are available to work, they don’t have the skills needed to perform certain positions. A primary cause of this gap can be attributed to the lack of access to higher education in the United States, most recently perpetrated by the rising cost of college and the pervasive piles of debt incurred by students.

Q4 2019 hedge fund letters, conferences and more

While the importance of higher education should not be questioned, Americans across the country find it difficult to ignore these barriers and debate whether the dive into loans is worth it. However, there’s a stark difference in the perceived value of college between those who have a college degree and those who do not.

High School Graduates vs College Graduates And The Job Search

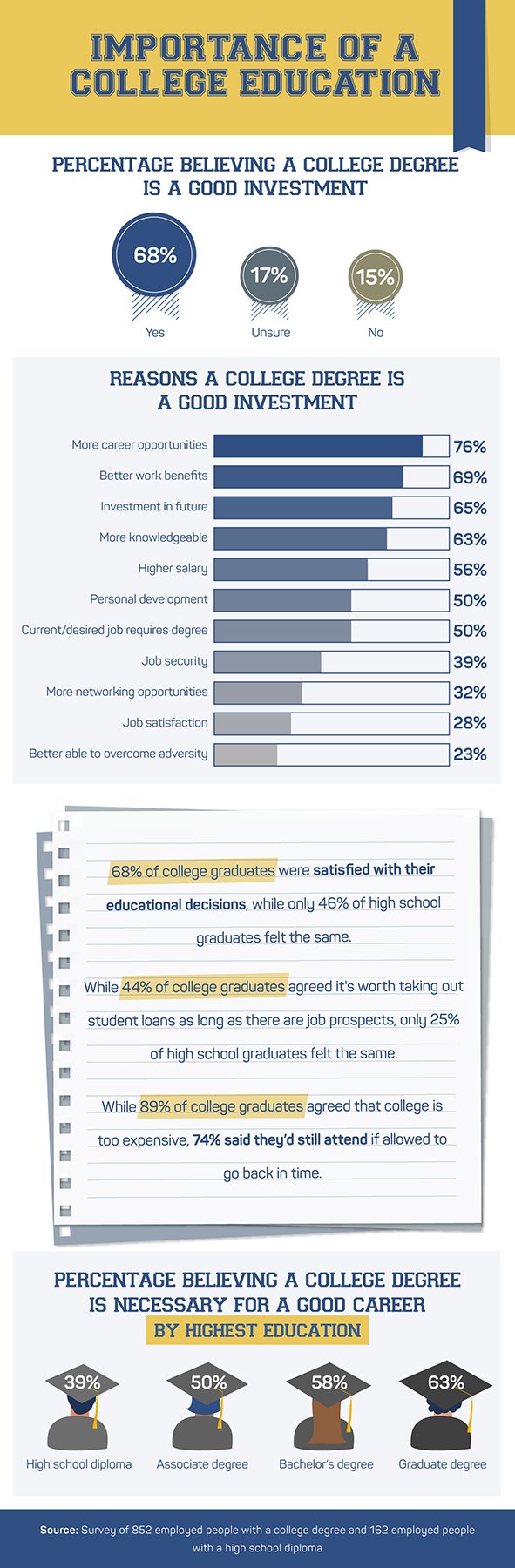

According to a recent survey by CollegeFinance.com, the more time people spend at higher education institutions, the more they value their education and a college degree. While more than 2 in 3 high school and college graduates agree college is a good investment, only 39 percent of high school graduates believe a college degree is necessary for a successful career. However, 63 percent of those with at least a graduate degree think degrees are a must for success.

The perception that higher education leads to a higher income also remains higher with college graduates. In fact, almost two-thirds of survey respondents thought that their education helped them obtain a higher-paying job compared to previous roles.

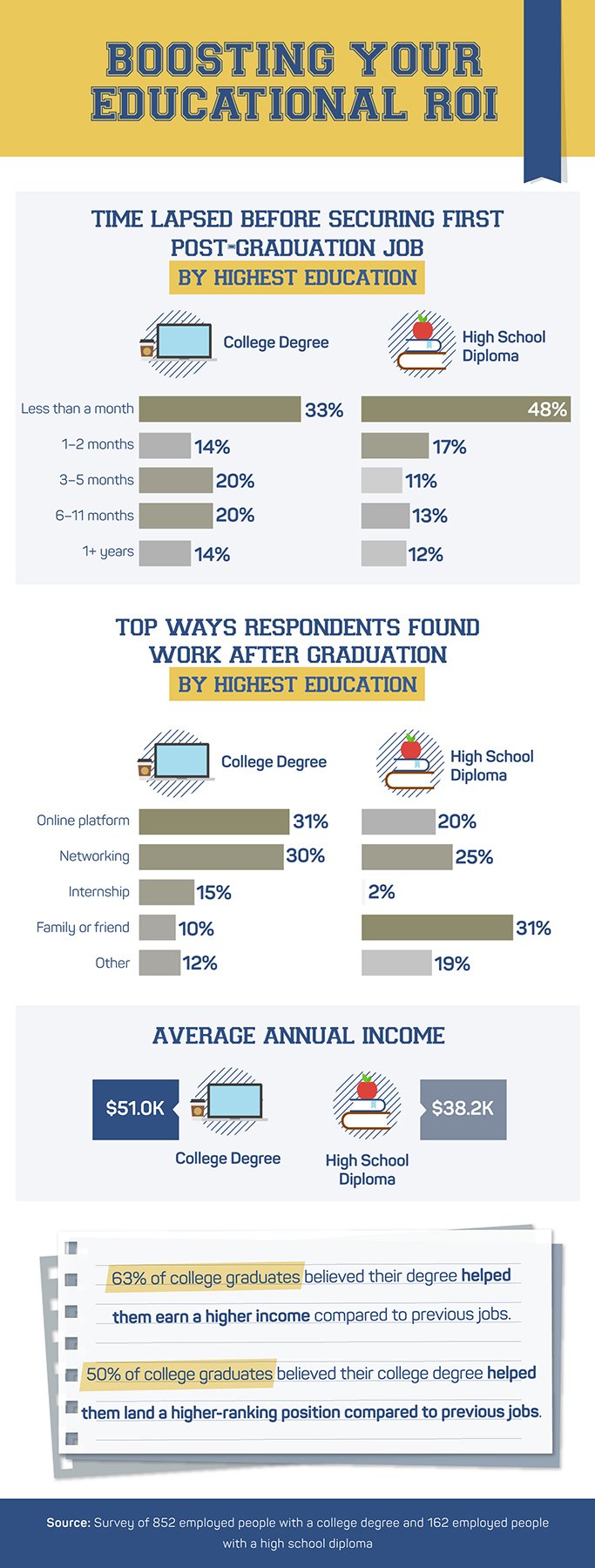

Post-graduation employment is one of the most viable metrics for assessing whether college was worth it for people. Among the scariest scenarios for college students or those deciding to go to college are paying thousands for a post-secondary education and ending up unemployed. However, although perception about how much more you earn after college differs, the numbers (and the money) say it all. While high school graduates tend to find work faster right after graduation, those with a college degree, on average, earn nearly $13,000 more than high school graduates per year.

Do Loan Borrowers Understand Loans?

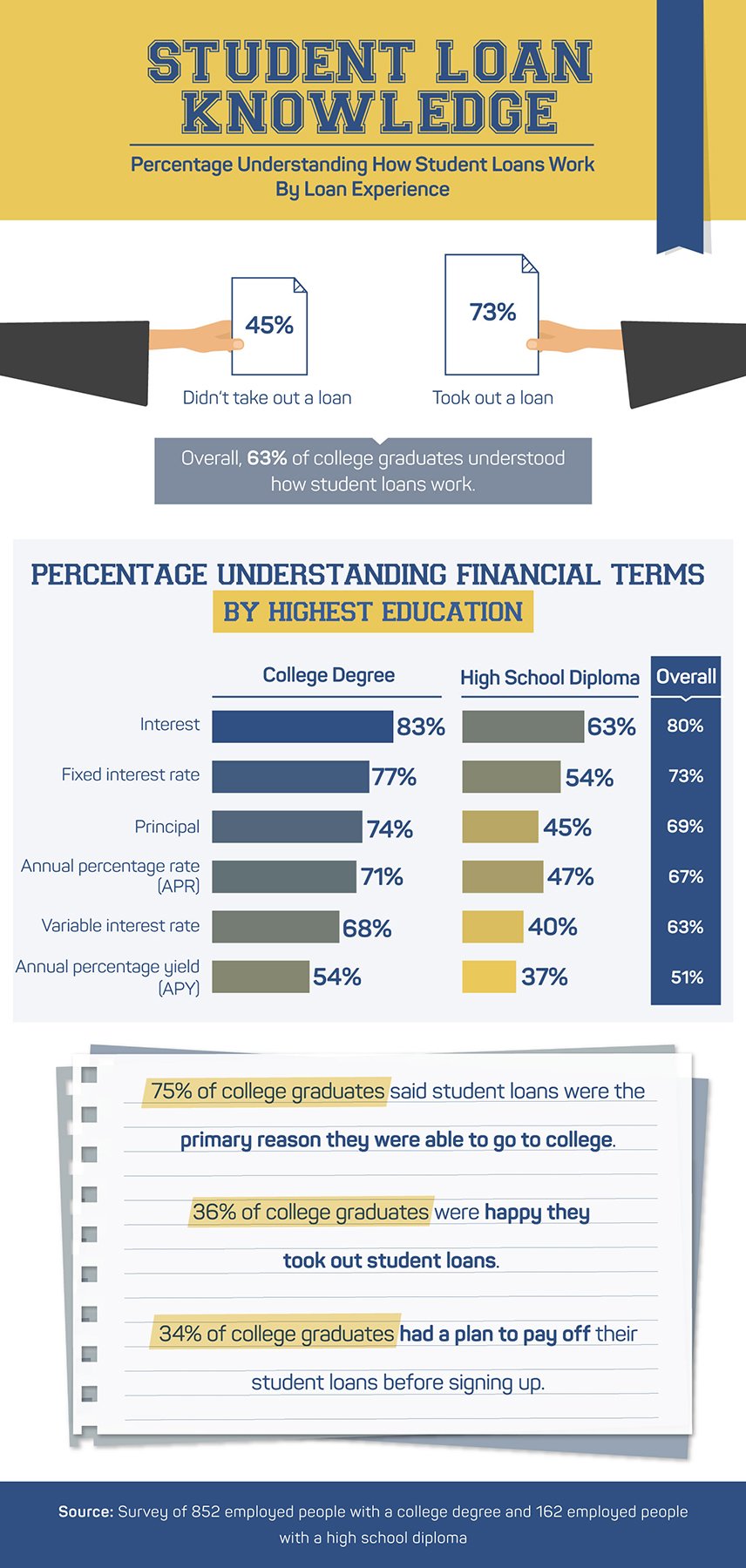

Over the last several years, college tuition increases at an average of 8 percent annually, and although scholarships and financial aid are available to students, most have to find another way to pay for college – student loans. A vast majority of college students today rely on loans to help pay for college, but with all the millions of dollars being borrowed, how many students actually understand how loans work?

College Finance found over 1 in 3 students do not understand loans and how they function, often leading to poor financial planning and an accumulation of debt through interest rates. While an overwhelming 83 percent of college graduates understood the meaning of “interest” only half knew what “annual percentage yield (APY)” meant. Furthermore, only a mere 34 percent had a plan on how to pay off those loans before borrowing.

Paying Off Debt

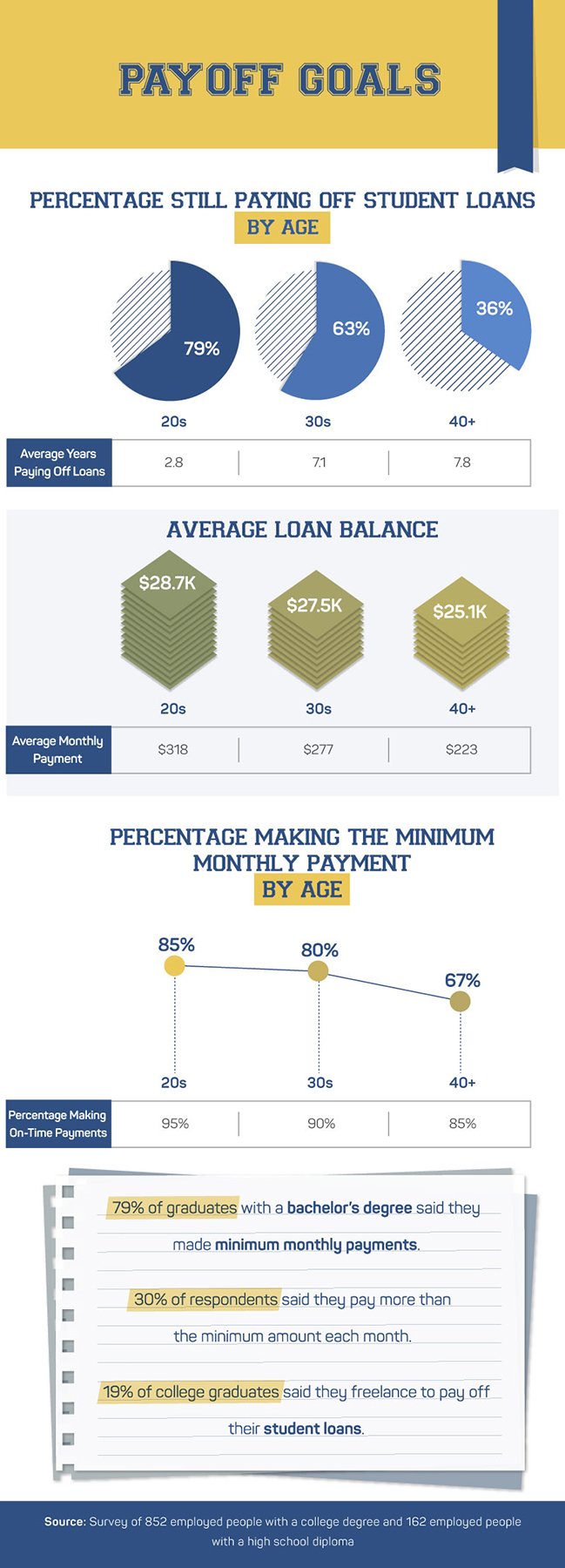

Regardless of whether college students understand how their loans worked, they have to find a way to pay off the debt. The study surveyed respondents 20 years and older with a minimum of $25,000 in student debt, finding that college grads in their 20’s paid an average of $300 monthly, 30 and 40 year-olds paid only $277 and $223, respectively.

Though the popular public perception believes debt affects those in their 20’s and 30’s, college grads in their 40’s will be quick to say loans stick around much longer. While some people in their 40’s still have over $25,000 in loans, 36 percent of them have been paying off debt for over seven years. However, it’s not all bad news – a majority of 40-year-olds no longer have any student debt.

College - It's (Still) Worth It

Times are changing and options for an education past high school have expanded, including training, apprenticeships, trade schools, and associate degrees. However, one factor hasn’t changed: those with a post-secondary education usually find themselves better-off financially. Loans have crippled Americans younger generations, but they continue to strive for a better future through their education.