I enjoyed reading the recent Warren Buffett letter to shareholders as it is always full of investing wisdom. Buffett’s letter have within them all a stock market investor and an index fund investor have to know. I focus on 3 core things when it comes to Buffett and investing in Berkshire stock and why BRK is better than an index fund. the 3 core advantages Berkshire has over others are the hidden earnings that allow for compounding, the cash hedge and the long-term mindset that isn’t going to go away no matter what happens to Munger and Buffett in the future!

Q4 2019 hedge fund letters, conferences and more

Warren Buffett Letter - 3 Advantages Berkshire Stock Has Over Index Funds

Transcript

Good day fellow investors. Value investors towards the end of February read Warren Buffett's annual letter. And in his letter, he shows that he's watching our channel. Well, he might not be watching. But the line of thought is very, very similar. We'll discuss that later. So if you like Buffett, subscribe to this channel and click that notification bell to get notified when there is a valuable video for you.

Let me dig into the content. There are five things that I want to discuss perhaps go a little bit deeper than Buffett and share with you that are extremely important. When it comes to investing. Everything you need to know about investing is summarised in Warren Buffett's letters to shareholders will discuss just a little bit that investing is about you, you have to pick what you want there. We're going to dig into the accounting and the hidden earnings that Berkshire has the free, let's say advantages that Berkshire gives to investors over others things. And what should we focus on when it comes to investing, earnings, retained earnings and then just comment a little bit on Warren's unfortunate, but really honest and open discussion about the future ahead.

Let's immediately start with the start of his letter discussing the earnings. Warren Buffett did 20% per year for the last 50 years, 52-53 years, and the S&P 500 The 10%. The difference is staggering when you compound those 10 percentage points of difference. The difference is staggering. But the S&P 500 is still has been still an amazing investment, of course, but Buffett did better. But here I really want to emphasise and this is also think Warren Buffett's message you have to find the investment that best suits you.

Holding Berkshire is you're owning just one business, you're putting all your money. If you did it 50 years ago, trusting Warren Buffett owning an index fund means that you trust the whole economy. You don't have to do anything. You don't have to think about anything. Of course now, Warren Buffett does that too for you? So Berkshire can also be considered an index fund. But this is just a mindset issue that we can look very, very back into and it was not an easy decision. However, Warren Buffett investing in businesses and will later discuss exactly what to look in those businesses made a great return. And I think that it's up to you which return you want to go for.

Index funds will probably return five to 6% over the long term. Investing into individual businesses with the right mindset will deliver more but you have to also put more effort into it. There is no other. Now let's go on to the accounting profit Berkshires profits in this year, according to the new accounting rules look staggering. He made more than $50 billion on stock market returns, which means that the stock market portfolio went up 50 billion. And according to new rules, accounting rules, he has to include that into the bottom line. So you will see Berkshire Hathaway with the price earnings ratio in the single digits now in all the financial data.

However, as he says it next year it can be down so earnings, Berkshire's bottom line earnings is not a measure to look at the measure to look at are Berkshire's operating earnings. However, there is something more important Berkshire reports only the earnings that it has to report accounting wise.

Earnings of Apple, they report only the dividend that they get from Apple. The difference between the payout and the dividend and real Apple's earnings is not reported into berkshares earnings because of accounting and therefore you have to understand the accounting and that brings you back to what are the real earnings from Berkshire.

And that's something Buffett emphasised. That's something we discussed in a video where I analysed Berkshire from August of last year. And that's why I say perhaps Buffett got the idea there. But just apart from the jokes, the mindset of this channel is similar to Buffett's.

Let's dig deeper into the accounting and the earnings. Buffett mentions the book from the 1920s called, 'Common stocks as long term investments' from Edgar Lawrence Smith, discussing how common stocks will do great because they are not paying out all the earnings that they have they retain those earnings part of that, they reinvest those earnings and that allows the power of compounding here where Keynes gave a review on the book, so retain a part of their profits and put them back into the business. Thus, there is an element of compound interest in investing in stocks, which other investments don't really have.

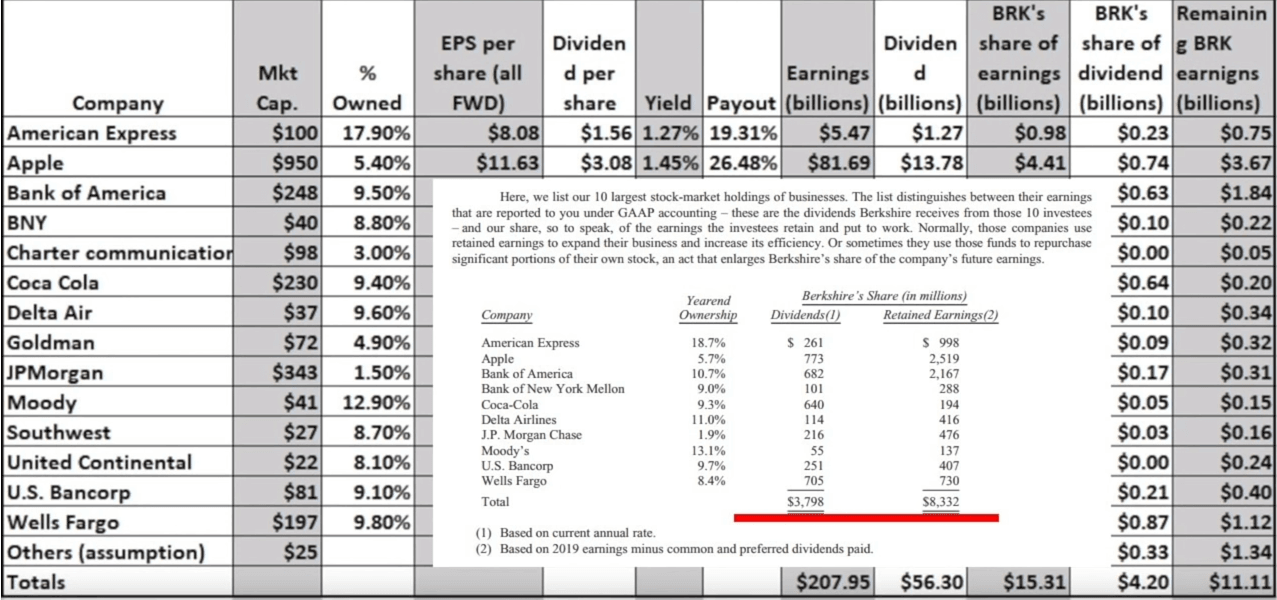

If we then look into the power of the risk of retained earnings a little bit more on accounting, if you own more than 50% of a company 100% of the earnings gets consolidated into your operational earnings. Berkshire owns 100% of Burlington Northern Santa Fe, complete earnings from Burlington go into Berkshire's operating earnings. However, they do not control Apple and only dividends are recorded. And this is part of the video I made on Berkshire in August. Watch that video, it's also in the links the in the link in the description below. And you see here all of Berkshire stock assets and the hidden earnings, only the dividends is reported but the dividend payout ratio is really really low.

So Berkshire's earnings are much much higher than here. I turned it into a billions discussion and here Warren Buffett did the same in his recent letter discussing how dividends are just 3.7 billion, but the real retained earnings are 8 billion. And then you further go into compounding on that, because the return on equity from those businesses is extremely high. So Mr. Smith from the book, gotta try it. It's all about returns on equity, its returns on invested earnings, retained earnings.

To dig deeper into Buffett's earnings, operational earnings, which you will want to focus on. We have Burlington Railroad, Berkshire Hathaway Energy making 8.3 billion in 2019. Clayton Homes and other four businesses 4.8 billion, other five businesses 1.9 billion, and then the remaining 2.7 billion, for a total of 17.7 billion. These are the operating earnings you have to focus on anything that has hidden earnings from the previous discussed non reported earnings because they don't own the company so they just report what they get into dividends. So these 5 billion indifference has to be added to the 17 billion we discussed here.

And then further on, insurance earnings aren't that high. But what's very important is the float that allows them to invest more money that allows them to have a protection margin of safety. And they have a lot of cash on their balance sheet, which is another advantage to the Berkshire has hidden earnings, and of course, cash. So to continue on the power of retained earnings.

What does it mean over the long term and that's what Buffett is buying. That's what Buffett is always has been focused on. If you look at the American experts company that they bought a long time ago. They paid 1.2 billion for their share, now it's worth 18.8 billion, not even counting all the dividends that came into.

Similarly, the Coca Cola company 1.3 billion invested 22 billion is the current value, again, not counting the dividends that came alongside that. Similarly, Visa compounding, and the message here is pretty simple. You just invest in a few good businesses, and the rest is done by itself. you're investing many more, some will do well, some will do not so well. But the key is that you hold on to on to those that do amazingly and that can compound earnings.

And you compound earnings, retained earnings, if you can focus on the return on net tangible equity, which is the return on the retained earnings, to run the business and if that is higher than 20% as it is for the companies listed here then you know you have great businesses and focus on what you can know, not on what you can't know. Challenge Warren and don't focus on the 240 billion of market valuation.

They focus on the businesses, they focus on what they own and they don't care whether the Fed will increase interest rates whether the rates wil be lowered or whatever so focus on what you can focus on the businesses forget about everything else.

This is the best message about the market economy news pundits and ever you ever been you can hear.

And it's almost certain that equities will do well over time and do better because of the power of compounding. So there will always be a warning This is pure Buffett always know okay, stocks can fall 50% you just have to stay disciplined, buy more and if you can control your emotions and do not use borrowed money. This is also a topic for this environment because there is a lot of borrowed money, you do extremely well.

So what are the three key components of Berkshire Hathaway that it offers to investors that are better than pretty much all the rest?

First, they have great businesses with extremely high return on tangible equity close to 20%. They have that compounding hidden earnings, 5 billion on hidden earnings that's not reported and that is constantly growing. Those hidden earnings are constantly growing thanks to buybacks, which is another thing that let's say the S&P 500 doesn't offer.

Through those hidden earnings they compound they increase and they have a lot of, as we said cash that is let's say a hedge against whatever might happen in the future from a crash from other opportunities from buying big businesses, big insurance businesses that might go bankrupt. And then you have, everything is summarised with Berkshire mindset of investing in long term businesses, of sticking to what we know and what we do best, low risk, no risk, finding businesses that will compound.

Which is something that is much different than the current corporate environment, think of Tesla, but it's something that works over the long term. And therefore, that's the advantage that Berkshire offers apart from a low price earnings ratio compared to the market.

So on the road, ahead, the company's hundred percent prepared for Warren and Munger's departure, unfortunately, and he has 99% of his network, put into Berkshire stock. He says S&P 500 is a great investment, but you have to see whether it is for you and what he does 99% of his wealth into Berkshire sends a clear message that Berkshire is still better than the s&p 500.

Because of the three key advantages, it offers a quick comment to finish on the corporate environment, how everybody is focused on fees, big mergers that the bank, the investment banks and the directors get fees, bigger fees for being in those boards.

And that's something Warren Buffett doesn't like that something is the advantage again of Berkshire Hathaway, where they can remain lean and focused on delivering returns to shareholder to shareholders. Don't ask Wall Street. Don't ask a barber whether you need a haircut. Thank you for watching. Looking forward to your comments.

Subscribe, click that notification bell. Don't forget to watch the other Warren Buffett video that I made in August that discusses the valuation of Berkshire and I'll see you in the next video.