Hindenburg Research: HF Foods Group Inc (NASDAQ:HFFG): 90%+ Downside on Massive Undisclosed Related-Party Transactions, Shareholder Cash Spent on Exotic Supercars & Outrageous Fundamental Valuation

Q4 2019 hedge fund letters, conferences and more

Learn more about Hindenburg Research

Summary: HF Foods Group

- HF Foods Group (“HF”) is the third SPAC merger orchestrated by Atlantic Acquisition, the sponsor of 2 other infamous public company debacles. First, Wins Finance, whose shares rocketed on allegedly manipulating its FTSE/Russell index qualification criteria, then plunged once ejected from the indices. Second, iFresh, which is down ~95% since its merger amidst a slew of related-party transactions that have sucked shareholder cash out of the business. We think HF Foods is a combination of the worst parts of both Wins and iFresh.

- HF’s massive $509 million merger with food distributor B&R appears to be a blatant undisclosed related-party transaction. The company claimed that the deal was negotiated at “arm’s length”, but we found multiple documents showing that both HF and B&R were part of the same Chinese investment group for years prior to the acquisition.

- HF has transacted with at least 43 separate related-party entities in 2019 alone. Several are based out of the company’s own headquarters and appear to have no operations. We visited others across the country and found red flags suggesting that these related parties are being used by insiders to extract cash from the business.

- We discovered that the company’s trucking subsidiary, ostensibly set up to transport food products, appears to have also used shareholder cash to purchase an undisclosed fleet of exotic supercars including Ferraris, Porsches, and a Bentley. We found photos of the Chairman’s teenage son bragging on Instagram about them being his vehicles.

- HF also directed over $2 million of shareholder cash to business entities owned by the Chairman’s teenage son, including one that bought another fleet of 7 Ferraris with vanity plates such as “FUCKAH0E”, “RUSINGLE”, “IPULL”, “DIKTAT0R”, and “IMHUMBLE”. (And yes, we have photos.)

- We think HF’s auditor has been asleep at the wheel. It was recently subpoenaed by the SEC for its work on iFresh (another Atlantic Acquisition SPAC mentioned above), and was lambasted in its recent Public Company Accounting Oversight Board (PCAOB) inspection report for a multitude of audit failures.

- The B&R merger more than doubled HF’s share count. However, FTSE/Russell mistakenly included almost all of these shares as part of the company’s free float, which sent HFFG’s price and volume soaring on Friday’s index rebalancing. We think this mistake may be reversed.

- We believe HF and its insiders are masking the true number of shares held by its affiliates. Once made clear to FTSE/Russell, we expect the recent forced index buying in HF will reverse and become forced selling.

- We see 90%+ downside for HF’s shares based on outrageously priced fundamentals, insider deals that appear to be hollowing out the company, and potential forced selling by FTSE/Russell.

Initial Disclosure: After extensive research, we have taken a short position in shares of HFFG. This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Learn more about Hindenburg Research

Basics on the Company

On Friday, a relatively unfollowed company called HF Foods Group Inc (NASDAQ:HFFG) (“HF” or “HF Foods”) surged almost 40% mid-day on no news. The stock traded over 1.8 million shares of volume on the day, more than 30 times its 60-day average volume. Investors who track the company might have wondered: “What on earth was that?”

We have been working on this report for months and had predicted that Friday would be the specific day when HFFG’s shares would surge. In fact, we specifically waited until after Friday’s surge before releasing our report. In our report, we provide a thorough explanation for this movement and why we believe it could help contribute to shares plunging well below recent levels.

HF Foods is one of the largest food distributors to Chinese restaurants in the United States. The company supplies over 10,000 Asian restaurants across 21 states, and has two segments: (1) sales to independent restaurants and (2) sales to wholesalers. [Pg. 3]

The company was founded in 1997 by a husband and wife team, Zhou Min Ni (who is currently Chairman/Co-CEO) and his wife, Chan Sin Wong (who formerly served as President and Director).

HF Foods went public via SPAC on August 23, 2018. The stock has since been volatile, particularly around Russell index rebalancing periods (more on this later).

In November 2019, HF Foods merged with B&R Global Holdings, a large West Coast-based Chinese food distributor, in a $509 million two-part deal. The acquisition provided HF Foods more scale, taking its annual revenue from over $300 million in 2019 [Pg. 30] to a combined $828 million. At present, the company discloses ownership of 14 distribution centers located across the East and West Coasts and a fleet of over 340 refrigerated vehicles. [Pg. 3]

Introduction: Dozens of Related-Party Transactions, Failure to Disclose Its $509 Million Mega-Merger was a Related-Party Deal, an Undisclosed Fleet of Supercars and Major Red Flags Around Its SPAC Sponsor and Auditor

Our research on HF, spanning several months, leads us to believe that the company’s insiders are looting the place. We found that the massive $509 million merger with B&R appears to be an undisclosed related-party transaction. Additionally, our report raises red flags relating to transactions with more than 40 additional related-party entities, the company’s apparent use of shareholder cash to purchase a fleet of exotic supercars, the track record of the company’s SPAC sponsor, and regulatory questions about the company’s auditor, who was recently subpoenaed by the SEC and lambasted by the Public Company Accounting Oversight Board (PCAOB).

Learn more about Hindenburg Research

Background: HFFG Has 60%-80% Fundamental Downside Before We Even Examine Its Most Alarming Issues

HF currently trades at a market cap of roughly $642 million[1] and a total enterprise value of $765 million.[2]

The company’s revenue growth appears to be stagnating while recent profitability has declined precipitously. Its 2019 pro-forma combined revenue was $828 million, representing year-over-year growth of only 1.2% relative to its 2018 pro-forma revenue of $818 million [Pg. 34]. This includes its recent acquisition of B&R. Over the same period, pro-forma net income plunged 64%, declining to $5.6 million in 2019 from $15.7 million in 2018. [Pg. 34]

We expect net income to further decline given (a) plunging margins, which we explain further below and (b) the slowdown caused by COVID-19, which has hurt all restaurants, but has disproportionately affected Chinese and Asian restaurants. [1,2,3]

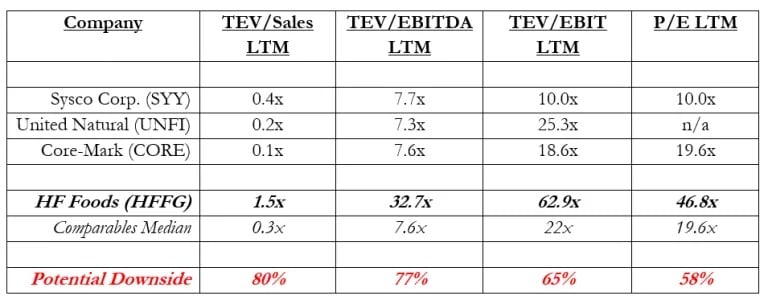

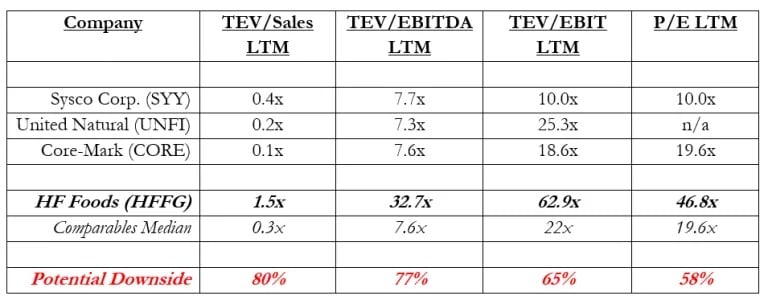

We compared the company to Sysco, United Natural Foods and Core-Mark, three of its closest peers, and found that HF is egregiously overvalued relative to its peer group across key metrics:

(Source: Capital IQ)

Read the full article here by Hindenberg Research