Gold price can go to $5,000 easily, but you need to have a correct gold investing strategy for 2020 and beyond. Enjoy the video where we discuss the gold price movements, recent and long-term, a value investing perspective on gold, gold as a hedge and some gold investing strategies.

Q4 2019 hedge fund letters, conferences and more

Gold Investing Strategy for 2020 - Gold Price to $5,000

Transcript

Good day fellow investors. So as I promised in the last video, today we're going to talk about gold. Because with all what's going on with the Fed, the ECB, everybody pumping more and more money into the system. It's very, very interesting to see how gold react and what kind of an investing strategy you can apply to gold. We're going to discuss gold prices, the current movement and the long term movement of gold prices can go can gold go to 5000?

I think it can in the future when I don't know. Therefore, we will discuss how gold behaves as a hedge and against what it is actually a hedge. Can go be an investment? Can you have gold with a dividend? Yes, you can. You'll see in a bit. Then what's the current situation from a value investing perspective on gold? What's the cost of gold? What's the risk reward? And what are alternatives to investing in gold? Also, from a hedging perspective.

Gold price look

Let's start. On the discussion on the price, last month, everybody expected gold prices to be up. Some were surprised in the comments. But gold prices actually fell due to the crisis that we now have. Now, why did gold prices fall? Well, usually gold prices, when there is a rush run to liquidity, gold prices are sold off as any other asset class. So when something goes down in the market when the market crashes, everything goes down.

And that's a given that's a normal so you must not take into account the short term moves to categorise something as an investment. Also, gold is not a hedge against stock price crashing because when stocks price crash margin calls and everything forced selling, rebalancing, panicking, going to the safe haven of treasuries, makes gold go down or not go up immediately. So that's something you have to keep in mind.

Does gold hedge?

What gold is a hedge against? It is a hedge against loose monetary policy, loose fiscal policy and lower interest rates. As you can see, since the Fed topped out with increasing interest rates at 2.5%, the beginning of 2019 Gold started going up up and up. And as especially up when it was clear that the Fed will be forced to lower interest rates, because it was clear that higher interest rates are completely detrimental to the economy. So loose monetary policies, gold up because gold is supposed to be fixed relatively fixed in supply, it is a real asset. Therefore not real assets, fiat currencies cannot compare to gold. So yes, gold is and should be a hedge.

Even if we look at the long term situation from 2000s, when it was clear that there is an issue with the system, with the debt, with the interest rate, gold slowly started going up. Then when the Fed started really printing the money increasing the balance sheet, gold prices anticipated what happened and went from 200, somewhere in 2001 to 1800 in 2011-12.

Gold investing strategy and peaks

Since then, gold, let's say peaked in 2012 and still hasn't reached those levels. So those that invested in 2012 are still waiting to break even and also something to note, another example of how gold prices when there is run to liquidity go down 2008 we know what happened in 2008, the crashes, the high volatility and the downward movement of stocks. Similarly, gold prices also went down for a while until it was clear that the Fed will intervene by printing more and more money which should increase the value, the price of gold in this case the value not the value of gold is always gold.

Now we are currently again in a similar situation, the crisis has arrived. Recession is upcoming, everything like many expected, the Fed offers more than 5 trillion of liquidity, Bank of China pushing money into the system, European Central Bank immediate injection of 135 billion, low interest rates, lower interest rates everywhere, many central banks have lowered interest rates. So here we are, and gold should be a long term hedge against that. And if you ask me the question will gold go to 5000? I think that somewhere in the future, gold will definitely be at 5000. When? I don't know. how long it will take? Will it take two years? Will it take 20 years?

I don't know. But it's likely that due to the policies, both fiscal and monetary all around the world, due to the conviction that zero interest rates are the best for the economy, at least short term they are. Due to that somewhere, sometimes it might explode, we might see inflation, we might see a scenario that we have seen in the 1970s again, and then yes, gold as a hedge against inflation might go to 5000. When? I don't know.

Gold investing strategy and Buffett

Now, let's see how gold fits the investment categorization as an asset class. How does gold fit your portfolio because if gold triples to 5000, it's not said it's the best hedge or investment out there. It's an easy, very beautiful story to tell, huge fiscal deficits, money printing and everything. So buy, buy buy gold, but especially on YouTube, most of those that sell that story also sell you gold, so they make money on commission.

When you buy on yourself, they don't really care where the price of gold goes. So be careful on that. As an investment, let's start with Warren Buffett, we all know his stance on gold. So they dig it out the ground in Africa or someplace, then we melt it down, dig another hole bury it again and pay people to stand around, guarding it. It has no utility, and therefore not an investment for Buffett because you don't get anything. And we read Buffett's letter to shareholders here on YouTube. So please check that video.

Gold doesn't have a dividend, doesn't grow ounces, doesn't reinvest the earnings, doesn't compound, which are the key things when it comes to long term investing and to what Buffett did over the last 60 years. So that's something you have to know when it comes to investing in gold. You're renouncing the dividend growth, compounding and reinvesting earnings. So gold is just a hard real asset that gives you protection against inflation. There are other and we'll see in a moment.

Dalio on precious metals

However, if you go to Ray Dalio, you can see that gold can have a yield, can give you a dividend, if you do what he says. And he usually says that each portfolio should have an all weather portfolio. 8% of gold exposure, and then you set the fixed percentage of your portfolio in gold. You rebalance after significant moves or 10%. When it goes up to 12%, you sell 2% of your portfolio, bring it down to 10%. So when it goes down to 8%, you bring it back to 10%. Rinse and repeat.

You get the yield, you get the dividend, you get returns, so you get somehow a return on the asset class which gold is. But you have to rebalance every few months or every year when it goes up or after 10%, 20%, 30% moves depending on which is your strategy. So that's also something to think about if you want to have gold in your portfolio.

My career investing

When I started this YouTube channel, I was really looking a lot of at the gold because I'm a value investor. And with gold prices, they were there about 1200, 1100, 1400. So much lower than now. And I was looking okay, I'm a value investor, I look for value, I look at the cost production cost of gold. And then I see okay, what is the risk and reward? when gold was at 1200, I saw a very low risk that it goes lower, yes, it can go to 1000 to 800, but for a short period of time.

And a very high possibility that it goes higher as it happened, because the stability of the system was there, which now isn't there anymore financial system, so money printing and everything and gold has jumped. This was my theory 2017-2018 when this channel was in the building because I saw gold as a value investment and this was the core of my theory.

Gold miners

The cost of mining gold is around 1000 per ounce. So if gold is close to 1000, when you add the debt, the limit resources that miners have, then you say, okay, it will not go that easy below 1000. So my theory was that gold was an investment, a value investment, and therefore I made a lot of videos about gold, and now you don't see them anymore because the risk reward has changed. I don't know where gold prices will go in the future. But I know that the margin of safety is closer to 1000 then it is to 1500. That's just my value investing perspective.

Also, if I look at Barrick's five year plan their cost of sales for gold are set at 1000 again, their long term plan 2021 they still expect gold prices to be at 1200. So there we are, this might last longer gold might go to 2000-3000. But then it's a rebalancing question, exposure to portfolio, more speculative exposure to portfolio, more than a value exposure to portfolio. So from a value investment perspective, I don't think gold has a place now in a value portfolio. In an all weather portfolio in, let's say, a speculative part as a hedge portfolio, then gold might have a position if that fits your investment style and preferences. So really see how it fits you and apply the best strategy for you.

Gold investing strategy and hedging

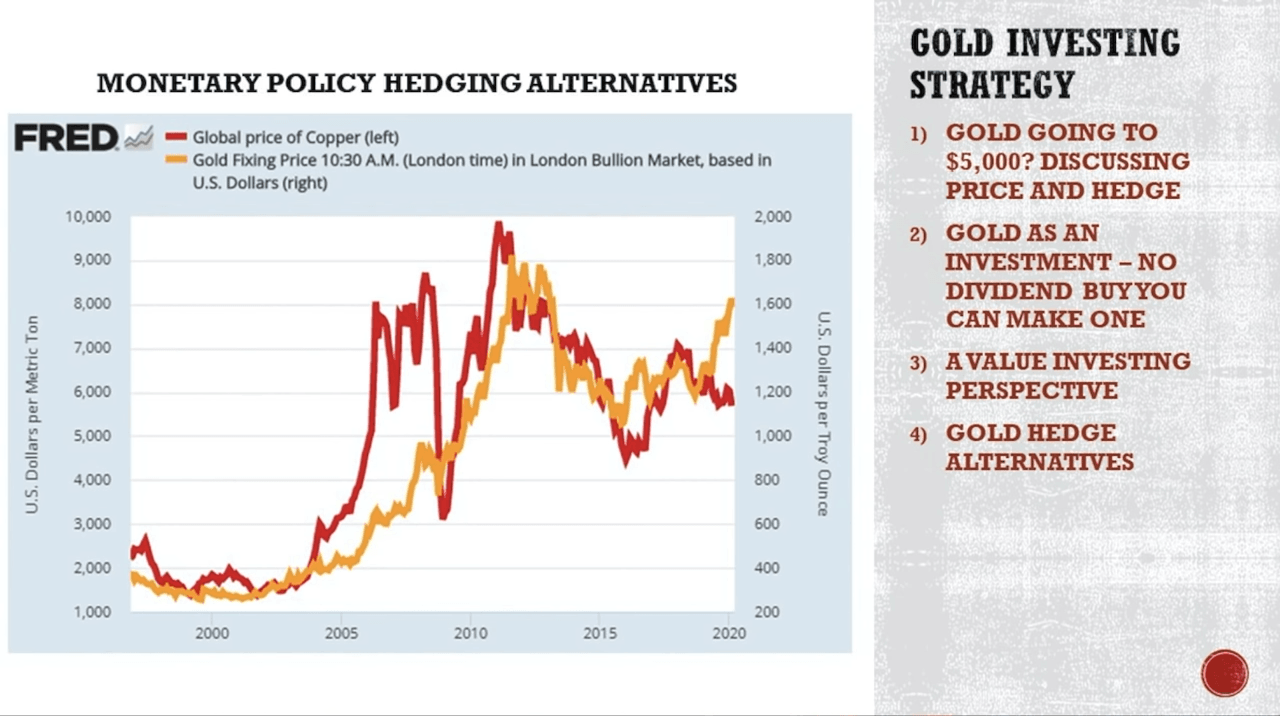

What are the gold hedge alternatives we see all this news pumping money, pumping money, pumping money, and then everybody says the first thing that comes to your mind okay gold is a hedge against inflation. I need to buy gold. Is gold a smart investment now? And all the questions that I get. However, if I compare gold prices and copper prices over the last 20 something years since we have had all the bank, all the expansions, balance sheets, low interest rates and everything, the returns as commodities, copper is also limited in supply, also gives you a hedge against possible inflation.

So, it's not that yes gold will go up sometimes somewhere but you don't know when so you might want to own also real assets that are also fixed in supply and that also give you protection plus maybe even the yield or return and we have seen what has happened to farmland. So this is Iowa farmland.

Stocks vs gold

Went from what? 1200 in 1990 to 8000 in 2010, so much more much higher than gold much better returns or even similar returns, low interest rates, push asset prices, real asset prices to the moon and in addition you get a yield growth, you can reinvest earnings, etc, etc. So, there are plenty of alternatives that you might want to consider when it comes to investing in gold. And then comparing what gold is as an asset class, as an investment to other options.

We recently discussed Visa as a stock. So if there is inflation, if things start if there is more money in the system, Visa will process process more money, more payments, more transactions, they will make more money, more margins, higher margins, improved earnings, more dividends, more buybacks so Visa will also be a business that has pricing power that will give you hedge against whatever we might see in the future also paperless payments, etc, etc.

A cautious approach

So there are plenty of things that gold has to be compared to before jumping into gold. My message is check gold, see how it fits your preferences, but don't be a gold bug, be smart about it. Diversification, yes, definitely.

However, this is a message from my stock market research platform on my gold and gold miner section, how a new member came and he says how he invested everything in gold in 2012. And over the last eight years, nothing happened he recently broke even and he asks whether he should buy businesses and sell gold but then if it goes up and that is all always the same issue with gold when you invest it you're speculating on the gold price. I have no idea where gold prices will go.

Portfolio allocation

So see how it fits your portfolio, your strategy, it's easy to get into the gold bug, let's say theory that gold prices will go to the moon, but years and years pass, and it doesn't happen very often. 25 years of nothing, while the index fund was up 15 times from 1980 to 2005, even longer if you consider long term returns, and we are still eight years of nothing and counting from 2011-2012.

Also from a very, very long perspective, this is something you have to keep in mind. So, to create the best gold investing strategy, gold returns $1 in 1802 would now be $4.52, so 0.7% is the annualised return per year compared to stocks 6.6% $1 is now 704,000-705,000. Probably even more because this ends in 2005-06.

Conclusion

So $1 is now probably a million and a half, something like that compared to gold that might be 20-25 bucks. So, really consider this when investing and how you're approaching it. You need to have a gold investing strategy. What will happen? How does that fit your portfolio? What are other opportunities out there? Nobody knows what will the price of gold being 12 to 14 months and yes, you can take advantage of volatility within all weather setting, a little bit of trading rebalancing for yield, but remember, gold doesn't produce anything.

Thank you for watching. Check whatever I do in the links in the description below. You have my blog, podcast book, stock market research platform, charity, whatever, subscribe to this channel, click that notification bell and I'm looking forward to your comments, and I'll see you in the next video.