The spread of information is fast, so whatever happens makes the stock market crash fast. People are selling in this doom and gloom situation as the market might go down more. The fact is nobody knows what will happen. The only thing that works always is being prepared for anything, invest for the long-term and keep rational.

Q4 2019 hedge fund letters, conferences and more

Doom And Gloom - Stock Market In Panic Mode - An Investor's Perspective

Transcript

Good day, fellow investors. It's gloom and doom, total panic out there. And I really wanted to do this video to give you a simple investors perspective, we're going to discuss what is investing versus speculation, the long term view that I have that I think is sustainable over a lifecycle. 50 years, and the current perspective that the media has been pounding this weekend, over everywhere to you. So you have to be really careful not to get under the influence of that. Then we're going to discuss the reason the real reason behind the panic, how it works in the financial system, and then it drills down to the individual out there, and we're going to compare it to what Buffett does. And we're going to conclude with just another perspective on a stock market crash that might surprise you.

Let's start so the news is all out there from Bloomberg, panic oil, there will be a recession, the email from the Bloomberg open that I received this morning is how the worst is still yet to come. So you better sell, sell, sell, sell in panic, The Wall Street Journal, okay, again terrible news global markets in turmoil really, really a disaster out there. And this is what the media has been bombarding you over the last month but before that it was all roses, it was all a bed of roses.

Italian stocks

Now in Europe, markets have really crashed the Italian index as the country's in lockdown is down another 10% we are down what 25% since the peak just not even a month ago. So since the peak the 20th of february two weeks ago, everything was great in Italy. And now it's all doom and gloom, pre market as I'm filming this before the US market opens all down four or 5%. So really, really doom and gloom situation. Now let me give you a fact. I have no idea what will happen next. So okay, the doom and gloom is there, stocks are crashing, headlines are tilting, but what will happen next? Nobody knows because that's normal in life and when investing, you are investing into uncertainty and uncertainty is completely normal.

You can get hit by a car, today, tomorrow, you anything can happen. You can win the lottery, there are a lot of uncertainties in life. So, it is with this will the corona virus disappear? Hopefully it will. Will it have severe consequences on the population on the economy? Short term, probably yes. Hopefully not longer term or a longer short term. But that's the environment we live in and we have always lived in.

Long term investing

The problem is that the school system and everything, train us to think in a linear way, but life is unlinear, is very, very volatile. And then the best perspective to start something to start thinking is okay, I don't know what will happen so let's see how can I be prepared for anything. And that was also the main message of Warren Buffett's last interview with CNBC that we summarised, and you can check it in the card here on YouTube.

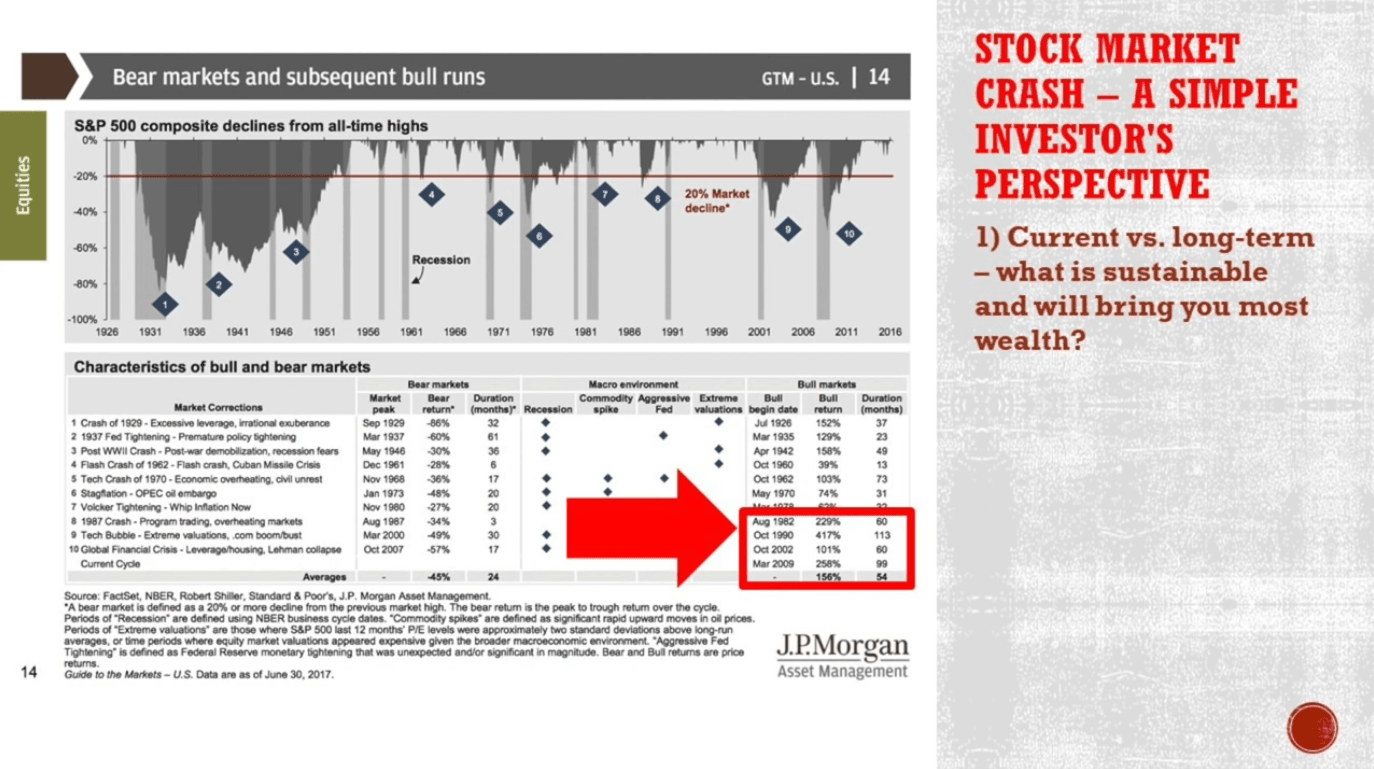

Let's dig deeper onto this situation look at the S&P 500 Composite declines for all time highs. This is a JPMorgan chart from their investor presentation. And you can see that the bear markets were 86%, 60%, 30%, 28%, 36%, 48%, 27%, 34% in 1987, 49% in March, 57% in October, from top tick to bottom tick and these things are completely normal. However, you never know when will the rebound come. If you look at the bull markets, again, huge runs somewhere longer somewhere are shorter, but on average, the bull market is stronger than the bear market.

So investing is a positive sum game. Stock market speculation not investing. Yes. And if you look at the last bull markets, or the mega bull market started at the worst possible time, in August 1982, then you can see, okay, really the S&P 500 exploded since then, despite the three crashes that we had since 1982. Investors must be very happy with the returns they achieved over the last 40 years and not that much concerned about the short term volatility.

Black swans vs doom and gloom

So you can't predict bull and bear markets. It all depends on so many things or black swans like we have seen in this case. And if we look at the Black Swan from Nassim Taleb, what he wrote 14 years ago, it's very interesting. So as we travel more and more on this planet, epidemics will be more acute We will have a general population dominated by a few numbers and the successful killer will spread vastly more efficiently. I see the risks of a very strange acute virus spreading through the planet. And that's the problems when it comes to investing is that those risks are not priced in while they should be. So the markets you will see those volatilities and the best answer is again to be ready for anything. So you cant predict bear markets, you cant predict bull markets.

Healthy vs unhealthy worry

It's not really healthy to worry about, the only thing you should focus on is being a long term investor. At least that's my message. That's what I do. I try to accumulate businesses, more and more, I'll get dividends, I'll get earnings, I'll get growth over the very long term. And despite the ups and downs, which I can't predict, I'll do well in time.

So focus on the business return not on the stock price, because it's very important that investing is something that you will do over a life cycle hopefully start with your teenage years and then finish when you are 80, 90 or who knows, probably never. If you do good investing over your life cycle, it's never it's a never ending story, you're probably donate all your money to a charity and it will simply continue in infinity and that's the key to investing. Ups and downs like this week, this day crashes everything that's bombarding you from the news, It's not the point of investing. And this is the answer long term, May 1973, the s&p 500 was at 104 points.

Stock gyrations vs business fundamentals

Now it is okay 3000, 2900. But still, you see what is the power of compounding what's the power of investing in businesses? And that's all you need to know when it comes to investing. And you see okay 1973 it was a great time to invest in stocks for the long term good dividends but then you look okay, what happened? 1974 the stock market crashed 50 something percent even Berkshire crashed 50 something percent. So it was a crazy environment.

But the answer as always is long term investing because long term allows you the compounding allows you to own businesses. And this turmoil that is described in the news next week, next month, next year will be something different. Hopefully the world will be a better place in five to 10 years. And that's what we are buying. That's what we are investing.

Now the reason for the panic This is very interesting. As always, it's always fear and greed and not being prepared to a situation. If you look at Italy, the debt is 134% of the gross domestic product. So that's double more than double what Germany has. So tell me which country will be more prepared for any kind of shocks? Well, Germany, Italy didn't prepare, didn't want to prepare, they preferred to spend on the current and not focus about what might happen in the future. And same with stocks, with investments, with individuals, those that are levered, those that are gambling, those will pay inevitably and unfortunately the price of what's going on. So this is the reason behind the panic, this is the real reason.

Doom and gloom and stocks

Also, similarly, what if the US gets hit? Well, look at the budget deficits accumulated over the last what 30-40 years before that the US was ready for anything and it could cope with World War One save the world World War Two, save the world again. But now it's a completely different story. So this is investing, this is the situation. And then let's go to the oracle of Omaha and discuss simply okay, what does a real investor do? And everybody is saying, oh, Buffett lost it.

Buffett is old, Buffett is getting old, Buffett is not investing in the new things, Buffett should be more levered. But then he, as always, he's just ready for anything 125 billion in cash, 20% cash position on his holdings, and that's it. Ready for anything. And if the governments, if people would be ready for anything, then there would be much, much less panic in the world.

Now discussing the stock market crash. What crash? If I look at the S&P 500 it's still above where it was. What's that? 5 months ago? 6 months ago? So okay, perhaps today it will break that low. But then again, look at the 5-year chart, a crash if somebody tells me a crash, thanks to the tax incentives, thanks for the free money, thanks to the low interest rates, I would call it okay stocks have crashed if we see the S&P 500 at 1500 points, but then it would still be up 100% since the 2000 bottom.

Conclusion

So forget about stock prices. Those are just for entertainment. Start focusing on businesses. Start focusing on being ready for anything in life, in portfolios, in investing, whatever. And then everything simply becomes easy, boring perhaps, you don't have to boost your ego with worrying and things like that. So your ego becomes small, small and goes away, but you are absolutely ready for anything.

And that's my message of today. I don't know what will happen. I'll simply stock, continue doing what I do accumulating good businesses over time.

And if you want to follow what I do, you can check my stock market research platform down in the links below. Thank you for watching, subscribe because also this video I did it because it will probably get a lot of views. Thanks to the title and everything and the proceeds go to charity. So we simply continue doing what we do and thank you for that. I'm looking forward to your comments and I'll see you in the next video.