Most of us are quite comfortable sharing bits and pieces of our lives with friends and coworkers. We discuss a wide range of subjects at work, from our love of a Netflix show to our disgust with the guy who always leaves the coffee pot with a dribble of java left at the bottom rather than simply brewing a new pot. Ugh — that guy. We even discuss politics, which is brave given the current political climate. Some folks wear red hats and others drink from “Nasty Woman” mugs. If that’s not a recipe for inter-office warfare, I don’t know what is. And still, we express ourselves.

Q4 2019 hedge fund letters, conferences and more

We tell each other when a loved one does us wrong, when we're looking for a new job, and when our child has found themselves in a predicament. In short, there's not much we won't talk about. Except credit card debt. We really don't want to admit when we're swimming in credit card debt.

Discussing personal finances - Our dirty little secret(s)

The Ascent, a personal finance brand by The Motley Fool, set out to learn more about which secrets we're willing to spill and those we keep close to the vest. After surveying over 1,000 people, here's what they found:

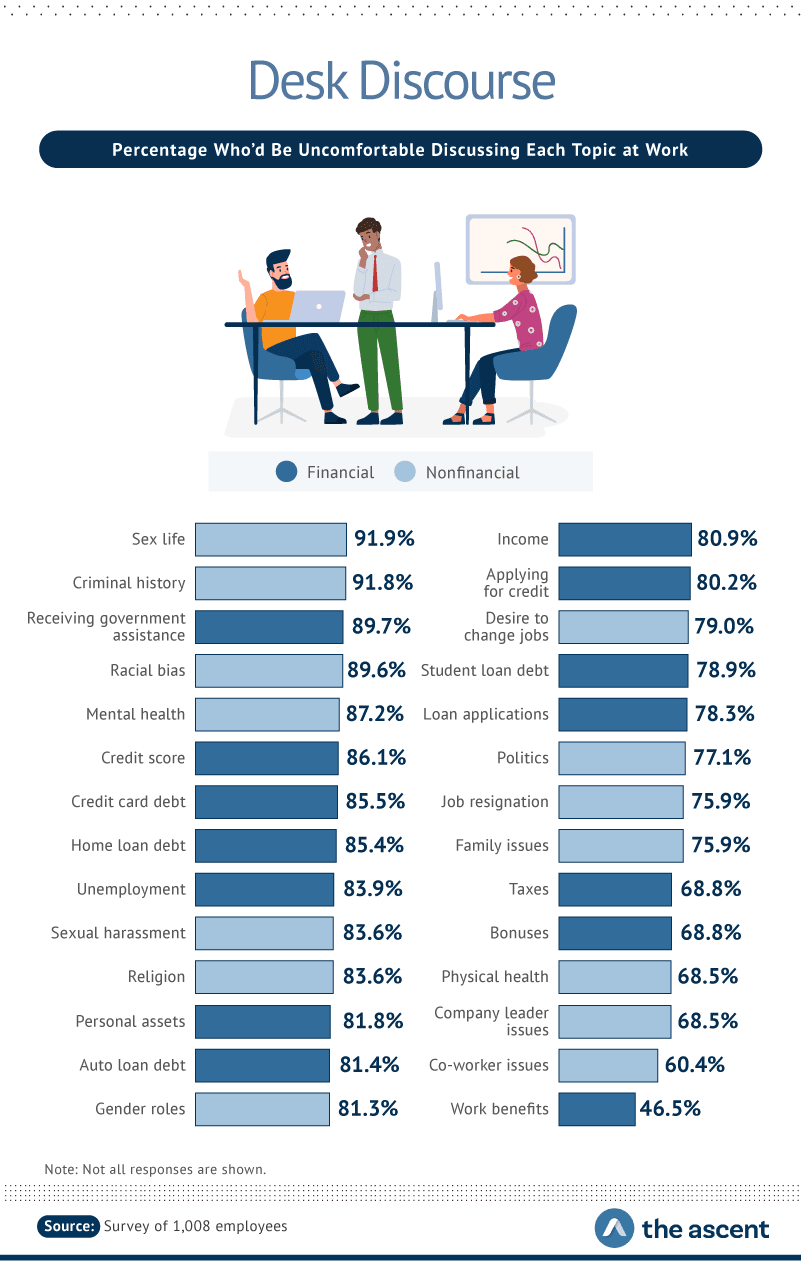

Approximately 65.7% of us are happy to discuss our desire for a new job at a dinner party, and nearly 50% of us will broach the subject of politics. Slightly more than 34% of us will tackle the topics of religion and taxes. We begin to get shy when it comes to unemployment, with only 25% saying we would be willing to discuss the subject. Less than 1 in 5 are willing to talk about credit card debt (roughly the same number of people who are cool talking about sex at the dinner table).

As far as workplace discussions are concerned, credit card debt ranks up there with other issues we're not willing to talk about with coworkers, including our criminal history, whether we're receiving government assistance, racial biases, our mental health, and our credit score. These topics, it appears, have become our darkest secrets.

While it may be true that none of these topics are appropriate for the workplace, it is still somewhat surprising where we draw the line, given that most of us spend more than 40 hours a week with our coworkers and come to view them as friends.

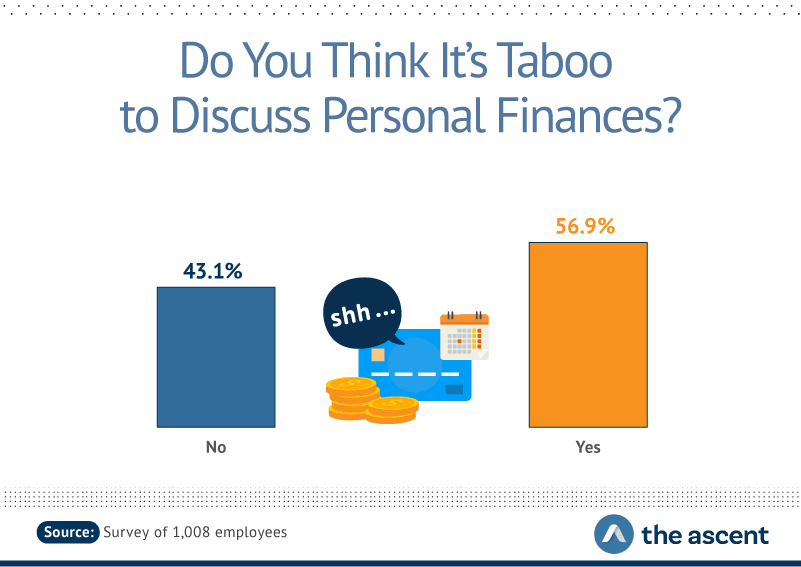

And we don't just avoid financial topics at dinner parties and work. The Ascent survey revealed that 56.9% of respondents feel as though personal finances are a taboo topic regardless of where they're discussed. Of women surveyed, 60.2% -- who are frequently the head of single parent households -- say that there is never a good time to discuss personal finances (compared to 53.6% of men).

How much money a person earns seems to play a small role in how willing they are to talk about finances. Of respondents, 59.4% who are dissatisfied with their financial situation think it's taboo to discuss the subject of money, while 55.0% of people who are satisfied with their income feel the same.

Interestingly, the level of employment had the opposite effect. The more senior a respondent's position, the less comfortable he or she was in discussing personal finances. By the time they neared retirement though, the taboo had lifted a bit. Of all survey respondents, those nearest the bliss of retirement were the least likely to consider discussions of personal finances taboo.

Why so reticent?

The truth is, many of us feel a little cagey talking about money, and there may be a good reason for that. We live in a society that puts great emphasis on "success," and according to the World Economic Forum (WEF), Americans describe success in very specific terms. For example, WEF found that we think we've "made it" if we earn more than $147,000, have 5.3 weeks of vacation time each year, never worry about medical bills, are able to loan money to family and friends, and donate a significant amount to charity.

One thing we don't associate with "success" is crushing debt. We don't want to tell anyone that we needed to pull out a credit card to pay for a prescription or our child's soccer camp. Everything -- from the car we drive to the clothes we buy -- is intended to give the impression that we have made it, that we're living the American Dream.

The problem with fantasy

In spite of the appearance we hope to present, the average American household earns $79,834 annually. Further, we owe an average of $6,194 in credit card debt and $1,155 in retail cards.

We can say that life is so much more than money (and know it's true), but we want other people to believe we have it all together. If we have a problem with debt, not talking about it may be the worst possible move. That's not to say that we should discuss our finances with random people we meet or acquaintances at work, but there is a time and place for sharing our credit card debt challenges.

Groups like Debtors Anonymous hold meetings nationwide and online, designed to connect us with other people who can help us work through debt issues. It's a place where we're surrounded by people with the same problem, folks who can offer insight and a roadmap for our trip back to financial solvency.

There is wisdom in carefully choosing with whom you share the personal details of your life -- financial and otherwise. Still, if there is someone you know well and trust implicitly, consider how freeing it may be to discuss credit card debt. Not only will it lift a bit of weight off your shoulders, but you may find an ally, a person who will support you as you work toward a healthier financial plan.