Black Bear Value Fund commentary for the month ended February 29, 2020, discussing benefit their credit shorts will get from an economic reckoning.

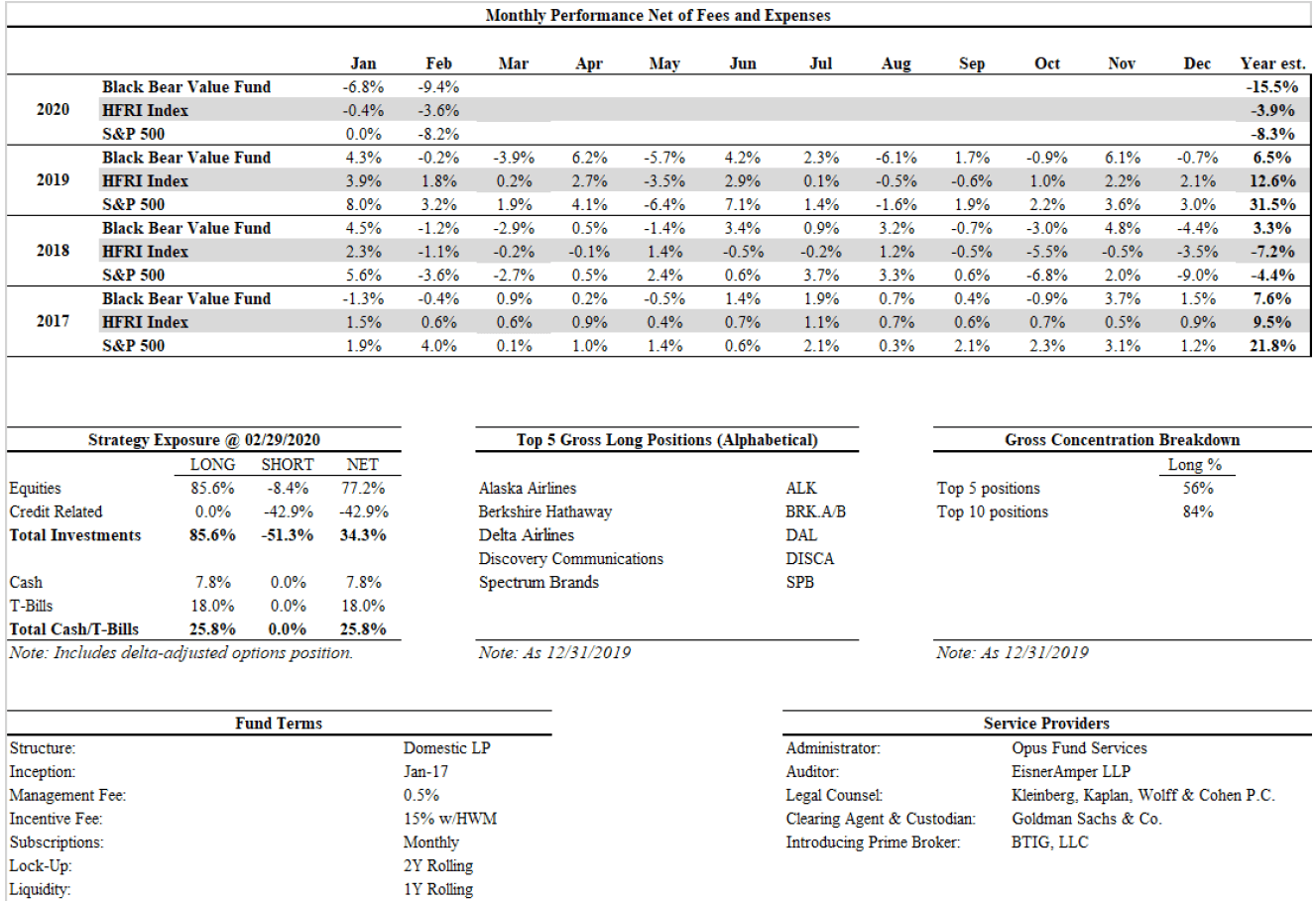

- The Fund returned -9.4%, net, in February and -15.5% YTD.

- The S&P 500 returned -8.2% in February and -8.3% YTD.

- The HFRI index returned -3.6% in February and -3.9% YTD.

Q4 2019 hedge fund letters, conferences and more

These results were a touch better than I had estimated when I sent the update earlier this month. Below is the update I shared last week. A number of new LP's are joining the partnership for April 1st and want to welcome them to Black Bear. I appreciate both the new and the old, particularly in this volatile environment. Our ability to act when others are scared is currently serving us well. You need the right partners in order to effectuate that...We do. I thank you for your trust.

Black Bear Value Fund Commentary

Dear Partners and Friends,

We have had our 2 biggest monthly draw-downs in back-to-back months with an estimated YTD return at ~ -16%. While I have the bulk of my net worth in the Partnership and am very comfortable with what we own, I am sympathetic that getting a monthly update like this can stir nervous energy. Markets can swing from euphoria to panic. Though the unknown can be scary, it is of critical importance not to let the market inform our decision making.

We own businesses that have been out of favor and are currently even more disliked. The fear and ensuing selling from coronavirus has significantly impacted the market’s current valuations of our businesses. Our companies are fundamentally sound with good balance sheets and can withstand pain. Many will prove to be a net beneficiary of current circumstances due to a conservatively managed business and balance sheet (think of Berkshire and their cash pile).

Credit Shorts To Benefit From Economic Reckoning

Cracks are beginning to show in the credit markets. If there is an economic reckoning the credit shorts we have on will benefit.

During times like these, business models get tested especially for funds that have short term lockups. Black Bear is designed to withstand the rocky times and play offense when others are on defense. We have a long-term lockup with long term investors. Many prefer to fail conventionally by selling with the crowd, versus profiting unconventionally and buying when others are scared. We do not have that problem, and I am looking to concentrate in our best ideas.

Some have asked “Why not wait until things are clearer?”. My answer is I don’t know if the deals we are being offered today will be available tomorrow. So far, each subsequent day has offered us better prices (lower) but waiting for the perfect time is futile. I see an opportunity to invest our money at very favorable rates and in good businesses, so I act. We do have a fair amount of cash and we have been investing incremental amounts as more value is offered.

We have had a number of partners add to their investments in the last few months with some new LP’s coming on board in Q1 and already for Q2. I appreciate all of our LP’s very much and the trust you have extended to me is valued.

Being able to act rationally during the uncomfortable times IS the opportunity.

All the best,

Adam