Impala Asset Management nominated Leo Hindery and Brent Dewar to the board of Harley-Davidson, criticizing the motorcycle company’s strategic direction and executive pay levels. The move came after the company terminated its chief executive Matt Levatich on February 28, which Impala said was at the fund’s urging, but it declined a request by Impala to add its nominees to the board.

Q4 2019 hedge fund letters, conferences and more

The fund noted that Levatich’s reported compensation increased to more than $11 million in 2019, while adjusted motorcycle operating income declined by more than 20% and the stock underperformed. It also complained about the pay package awarded to Levatich's replacement.

"The board has still not shown that it is focused on positive change. To the contrary, one of the first decisions the incumbent directors made after firing Mr. Levatich was to reward their long standing colleague, Jochen Zeitz, the new acting president and CEO, with a pay package that could provide up to $8.5 million in salary, bonuses and restricted units for a short assignment," said Robert Bishop, Impala’s founder and chief investment officer in a statement. "This is yet another instance of this board being tone deaf to the plight of shareholders and further demonstrates the need for new perspectives on the board."

In January 2018, an Activist Insight Vulnerability report noted that Harley-Davidson’s declining share price could entice activists looking to break up its operations. The company’s share price has dropped 58.6% year-to-date and has continued to see sales decline, a figure the company has put down to changes in its demographic.

What We'll Be Watching For This Week

- How much backing will Cevian Capital partner Jonas Sunnergren receive as part of Nordea Bank’s board slate at the meeting tomorrow?

- Will Spar Group shareholders back founder and ex-chairman Rober Brown’s proposed bylaw amendments at the meeting on Thursday?

- How will Kirin shareholders vote on the Independent Franchise Partners’ two board nominees at the meeting on Friday?

- Will Toshiba Machine shareholders approve its shareholder rights plan as a defense mechanism against a hostile takeover offer from Yoshiaki Murakami at the meeting on Friday?

- Will the alliance led by Korea Corporate Governance Improvement Fund be successful in its attempt to replace Hanjin Kal’s top echelon at the meeting on Friday?

Activist Shorts Update: Citron's stake in Benefytt Technologies

Citron Research disclosed a stake in telemedicine firm Benefytt Technologies, formerly Health Insurance Innovations, on Wednesday and claimed the company’s share price could rise as much as 300% to $60 per share. In its published report, the short seller said that a U.S. Government briefing on Tuesday which amended the restrictions surrounding Medicare Advantage plans was a "moment that will make telemedicine mainstream," and has put Benefytt "at the forefront of this megatrend."

In November last year, short seller The Capitolist reported that HII would struggle to transition into a Medicare Advantage company. Fellow short seller Marcus Aurelius Value also disclosed a short position in HII last year when it claimed that predatory practices had "fuelled" HII's sales.

Despite the attention from short sellers, HII's operations have attracted long activist funds. Voss Capital disclosed a 9.2% stake in December last year, while Cannell Capital and P2 Capital Partners also have stakes in the firm.

Citron noted that there may be concerns regarding the allegations levied at Benefytt's former operations but suggested that it was akin to "being short Netflix because sending DVD [sic] in the mail is a bad idea."

Chart Of The Week

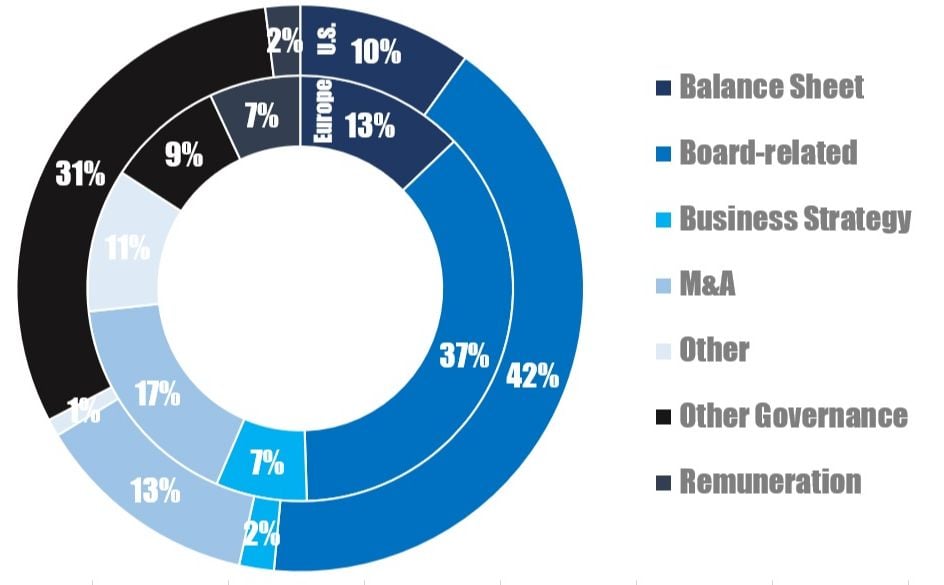

The proportion of all companies publicly subjected to activist demands based in the U.S. and in Europe between January 01 and March 20, 2020.

Note: rounding may lead to summation errors.