The COVID-19 pandemic and crash in oil prices has already had an influence on the current proxy season by prompting some activists to change their tactics. Carl Icahn has increased his stake in Occidental Petroleum to 10% from 2% and promised a proxy fight, after the company’s stock lost 71% of its value over the past month. Meanwhile, Icahn-backed Xerox temporarily shelved its pursuit of HP, saying it needs to prioritize its employees and customers. MG Capital launched a consent solicitation at HC2 Holdings just a few months before the annual meeting in an attempt to force change quicker and take the timing of the fight into its own hands.

Q4 2019 hedge fund letters, conferences and more

As the pandemic is still in its incipient phase, it would not be surprising to see more twists and turns over the next week. Colony Capital, which is facing a proxy contest from Blackwells Capital, has seen its stock plummet 60% over the past 30 days due to its exposure to the hotel industry. USA Technologies, the point-of-sale payments specialist where Hudson Executive Capital seeks to replace the entire board, dropped 33% as fewer point-of-sale transactions are expected given the stay-at-home trend. Big Lots, the U.S. retailer that faces a new challenge for board control from Macellum Advisors and Ancora Advisors, tumbled 54% over the past month. Aramark, a food service and uniforms vendor that is held by Mantle Ridge in a special purpose vehicle, is down by two-thirds.

The insurance sector has been fashionable with activists this year, but the industry was among the worst performers, potentially encouraging activists to be more assertive. Prudential, which just recently said it would float a minority stake in its U.S. arm following pressure from Third Point Partners, has shed 50% of its market capitalization over the past 30 days. Netherlands-based NN Group, which is under pressure from Elliott Management to sell assets, has crashed 45% during the past month.

What We'll Be Watching For This Week

- Will Texas Pacific Land Trust make a decision regarding its conversion into a corporation by its Friday deadline?

- Will market volatility continue this week?

Spruce Point's Take On Amcor

After posting a screenshot of its letter to packaging company Amcor to Twitter, Spruce Point said Tuesday that the firm could lose 40-60% of its value amid declining revenues and expensive liabilities that have been obscured by cost synergies since its merger with Bemis.

With listings in both the U.S. and Australia, Spruce Point said it believed the company's stock price was being supported by the latter's retail investors. It also pointed to the company's exposure to Italy, which is expected to endure a major economic shock from the COVID-19 virus, as a potential blow to its hopes of meeting financial targets.

"We believe Amcor will soon face a crossroads in its financial strategy between completing a $500m share repurchase program, increasing capex to remain competitive, and paying a generous $725m/year dividend," Spruce Point said. "Absent a suspension of repurchases, we believe Amcor will be unlikely to maintain its current dividend."

The activist short seller also said the company's chief accounting officer, Jerry Krempa, had his professional qualification removed in 2017 and may be misrepresenting his CPA status.

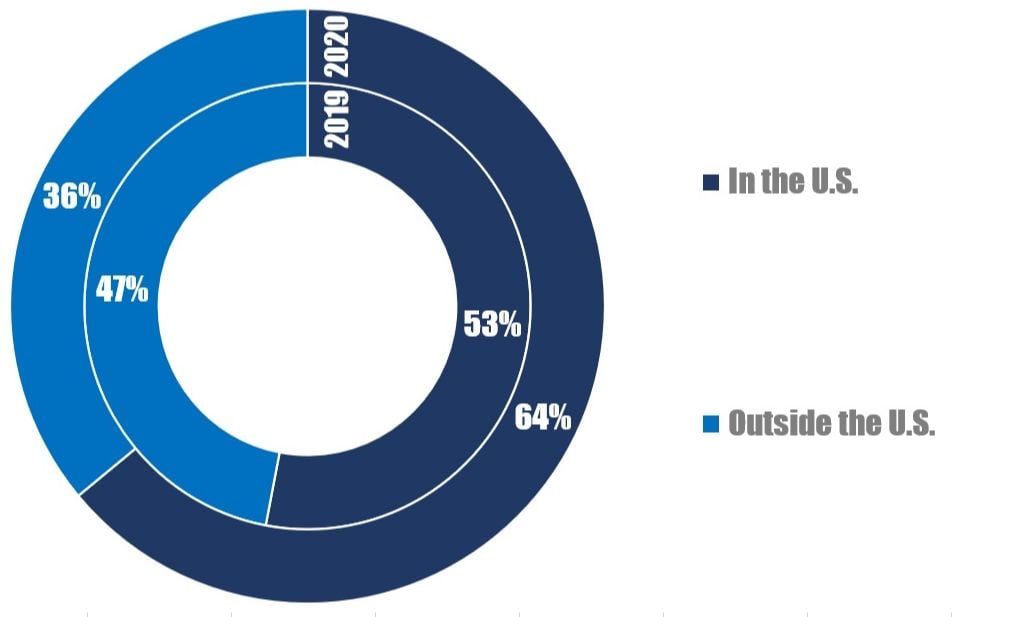

Chart Of The Week

The proportion of all companies publicly subjected to activist demands globally based inside and outside of the U.S. between January 01 and March 13 in 2019 and 2020, respectively.

Note: rounding may lead to summation errors.