Over the last few months, Emolument surveyed 500 European alternative investments professionals about their latest salary, bonus and carried interest. Results show high salaries and bonuses across the board, but significant differences in carried interest allocation depending on roles, investment strategies and seniority levels.

The full results of the study and tailored pay benchmarks for alternative investments firms can be purchased here.

Q4 2019 hedge fund letters, conferences and more

Note: Unless specified otherwise, all numbers are medians.

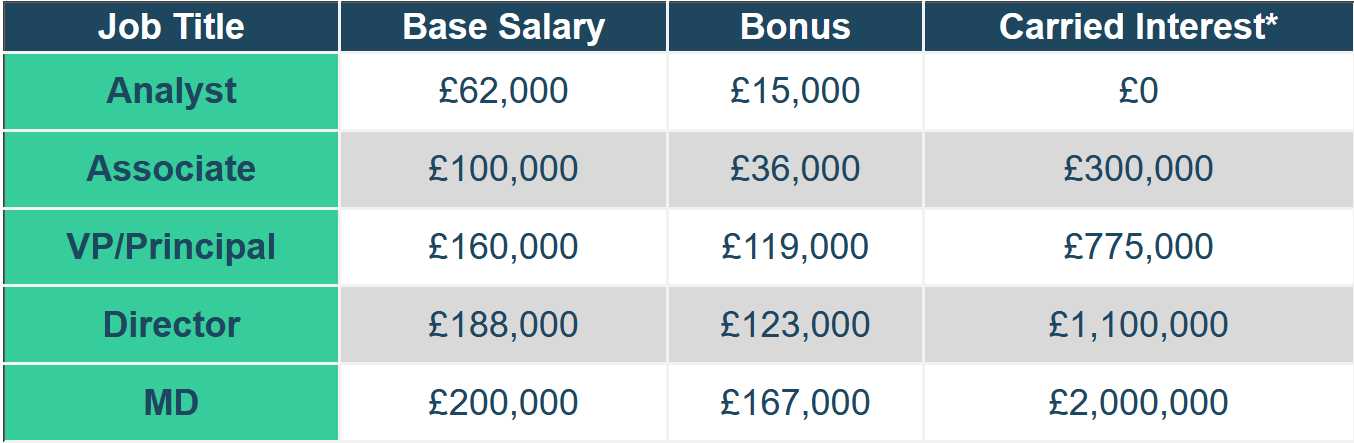

Alternative Investments Professionals' Pay by Seniority Level

Across all roles

*The total carried interest which will be allocated to the employee over the investment period based on the expected average performance for a fund in that investment strategy.

A booming start: From analyst to associate level, the compensation (salary and bonus) of an alternative investments employee jumps by 77% in just a few years (+£59,000). This steep progression continues at VP/Principal level, where the compensation increases by 105% from associate level (+£143,000).

...followed by a steady growth: After reaching VP level, salaries and bonuses' rise gradually slows down (only a 15% increase from Director to MD). But at those levels, these are of lesser importance as they become dwarfed by a different type of compensation: carried interest.

Carry is the name of the game: Carried interest is the share of the profit an employee will receive if the fund(s) he is investing performs as expected. As soon at it kicks in, at associate level, it becomes the most important part of pay for alternative investments professionals, amounting to three times the annual salary at associate level (£100,000 vs. £300,000) and up to 10 times the annual salary at MD level, reaching an eye-watering £2,000,000.

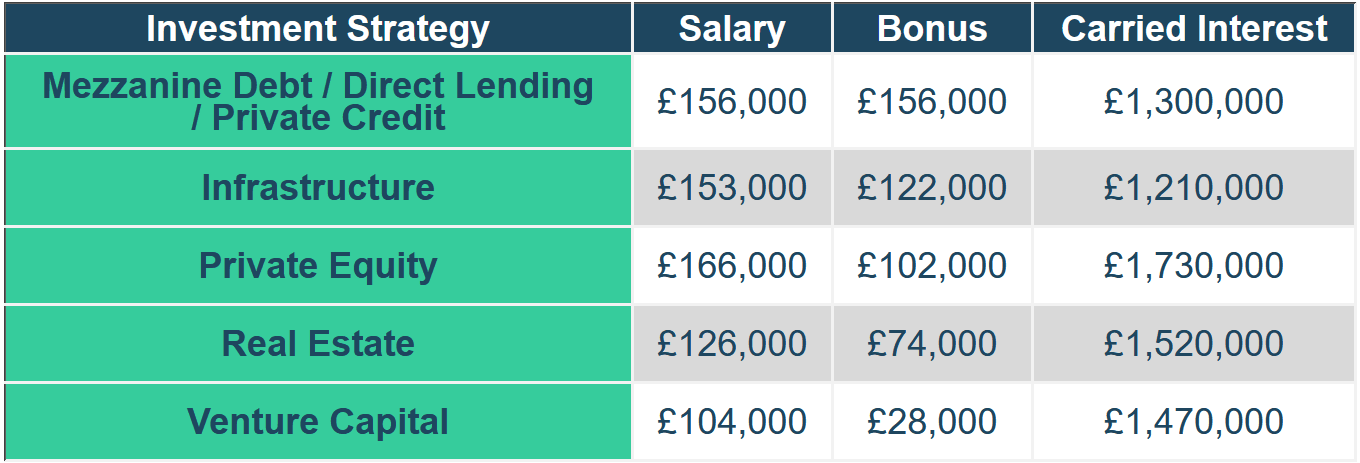

Pay by Investment Strategy

Investment roles only - Director Level

High salaries and bonuses do not imply a big carry: There is no significant link between an employee's annual pay and the value of the carry he is offered. Investment professionals working in Mezzanine Debt/Direct Lending/Private Credit receive the highest annual compensation (£312,000), but only rank 4 out of 5 when it comes to carried interest, at £1,300,000. Conversely, directors at venture capital firms earn the third largest carry (£1,470,000) while they rank last in terms of annual compensation (£132,000).

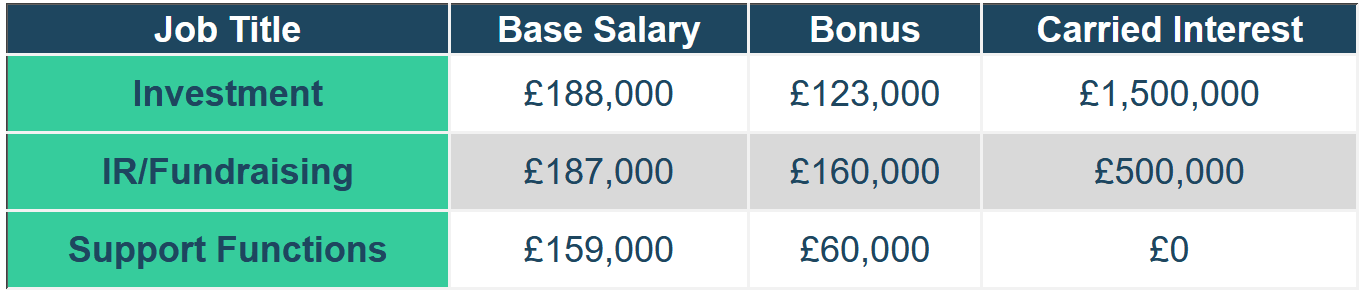

Pay by Job

Director Level

The closer to the money, the bigger the carry: While professionals working in IR/Fundraising functions receive the biggest annual compensation (£347,000), the highest paid employees are by far those working in investment roles, with a £1,500,000 carried interest.

Industry Compensation Trends

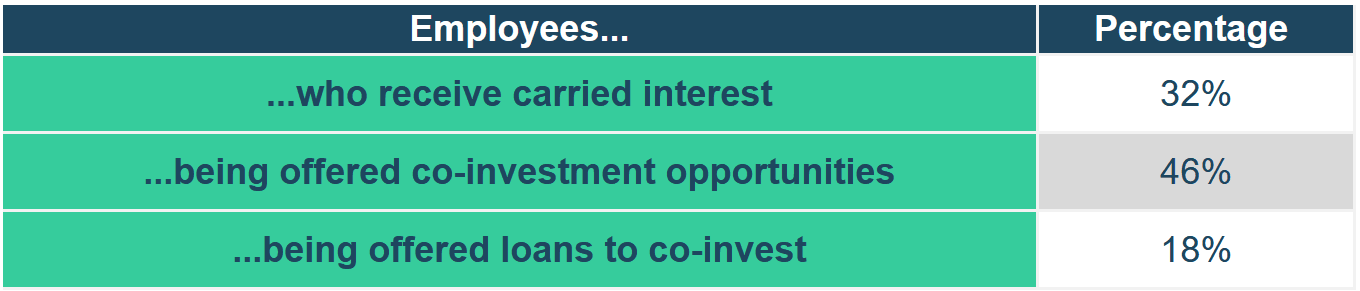

Not all employees receive carried interest: 68% of employees, mostly those working in non-investment and junior roles are not entitled to any carried interest, which makes their pay significantly lower than their colleagues'.

You can co-invest, but with your own money: While 46% of employees say their company offers them the opportunity to co-invest in their fund, only 18% say that their employer offers them a loan to do so.

Thomas Drewry, co-founder of Emolument said: "While pay is undeniably high across most roles at alternative investments firms, there are significant disparities from one company to another, mostly depending on investment strategies. These disparities also exist within firms, with senior employees working in investment roles reaping the vast majority of the benefits."