I see so much panic about stocks crashing, Trump always talking stocks, but the best thing for 95% of Americans and other investors would be for stocks to go down and stay down. Sounds crazy? Well, call me crazy and let the crazy professor explain the rationale of why a stock market crash is actually good for you. It will give you a different perspective on how to invest in the stock market and what investing in the stock market actually is.

Q4 2019 hedge fund letters, conferences and more

Why A Stock Market Crash Can Actually Be Great For You!!

Transcript

Good day fellow investors. I see so much panic in the comments in the media, hysteria about this virus situation. But as an investor as a long term investor, I start to smell opportunity and this is what I want to discuss today. Are you an investor? Or do you just wish your stocks to go up, up, up and up? Let me explain. I have a stock market research platform subscriber that often mentions how he bought Amazon at 30 and sold at 40. I think the rest is history. But that is the danger of focusing on the stock price. It feels good buy something sell later. It makes you think you're very smart.

And unfortunately, it's the most costly thing when it comes to investing. If you focus on businesses, you forget about the stock price and you are not then tempted to take the easy game, which is usually you trim the good flowers, you with the bad flowers. And this is how you get to great investment.

Tech stocks after the bubble

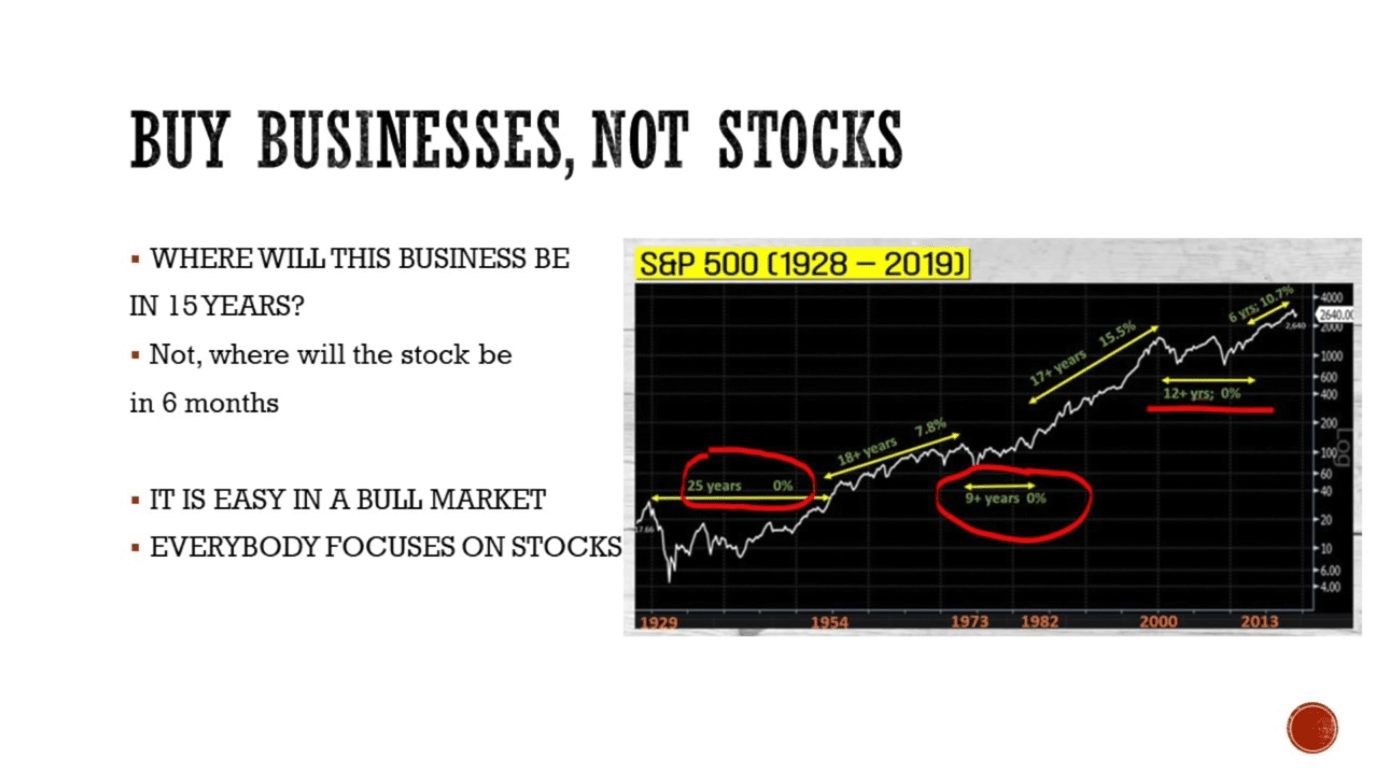

One Investment in Amazon makes a career in 2002. 25% don't mean much, but it's so easy to get engaged with, oh, look how much money I made 25% on that 25% here, but it might be costly. And the best mindset is to just be an investor. Please let me explain. The key is to buy businesses, not stocks, ask yourself something. Where will the business be in 15 years when it comes to investing? Don't ask yourself where will the stock price be in six months, one year, two years, because the latest bull market of 10 years will trick you there and you will lose great opportunities, you will lose the right mindset to have over your investment lifecycle that will probably last 50 if not more years. This is a great chart. And it's easy to buy stocks and sell them in a bull market.

As it has been the case over the last 10 years everything goes up. So you feel so smart. Everybody focuses on stocks. But what happens in the next situation where you have 25 years of zero returns nine years, 12 years and more of zero returns. If we get a stock market crash and the bear market, then it's not about stock prices, then it will be about buying businesses about being real investors. And here is where most will panic.

Similarly, the NASDAQ didn't go anywhere for 16 years. Nobody liked it in 2002, 2009. But it was the best place to look for businesses, not for just stocks that go up. So the key is to be happy when stocks are down. Let me give you an example. Investing 500 per month for six k per year. Over the last five years 2015 you will get free shares. The S&P 500, let's say the average was 2000 points in 2016 again free shares. But as the S&P 500 went up, up and up. Up to 3000 points, you would get two shares with $6,000, total 12.58 shares. If stocks would have gone down, you get too much more shares. And you can pause the video and see the mathematics here.

A stock market crash and buying the dip

So what's better 16 shares of the S&P 500 or 12 shares of the S&P 500 from an investing perspective, yes, those that bought in 2015 made more money. But it's not about making money in stocks because there will be periods where you will see 20 years of no returns. It's about owning more and more of great businesses. It's about buying more of great business having higher and higher dividends and reinvesting them.

Similarly we just discussed 3M, check that video. If you have missed it, it's a great business. And it's up to you whether you want it as an investment in your portfolio, or you're just speculating on higher stock prices. If you speculate on higher stock prices is something not sustainable for your life cycle. Therefore, everything becomes easier if you folks focus on simply accumulating more and more assets, and therefore, the stock market crash is the best thing that can happen to you.

Thank you for watching. Subscribe, click that notification bell. I'm looking forward to the comments how difficult it is to apply to apply a real investing mindset for you. Thank you and I'll see you in the next video.