Advantage: U.S. Equities

Here we are, another year-end letter. Hopefully, despite the continuous din of global turmoil and domestic politics, we are all feeling a bit better than last year at this time when our wounds were still fresh from a fourth quarter market decline that was among the worst in decades. This time around, we have just enjoyed one of the stronger markets in years during 2019, which makes us all feel much smarter and wiser than we were a year ago. Or it could simply be mean reversion.

Q4 2019 hedge fund letters, conferences and more

The biggest drivers to the year, in our view, were the continuing decline in interest rates and the continuing no-show of the imminent yet elusive next recession. With both trade war fears and recession fears receding, risk premiums declined, growth estimates rose, and markets went up. Equity duration arguably sits in the low teens (measured as (1+r) / r), and so a 90 basis point yield decline last year in the 10-year Treasury would suggest roughly a 12% gain in equities on the basis of a similar equity yield decline. With the U.S. equity risk premium also in decline, U.S. equities managed to mostly outperform long-term bonds.

U.S. equities also outperformed most world markets in 2019, with the exception of Italy, Russia and Greece. Outperformance by U.S. markets has been going on for a decade and is particularly surprising in the face of the growing gap between U.S. and Rest-Of-World (ROW) interest rates. With the highest long-term government bond rates in the developed world, recently surpassing Italy, and a yield gap that has been growing for a decade, ROW equities should be outperforming U.S. equities, but they’re not. While posting the highest government bond yield, the U.S. P/E ratio remains the highest in the world and therefore enjoys the lowest equity earnings yield at the same time. Hmmm, that’s odd. Longer term U.S. performance and valuation has gotten so lopsided that many big U.S. brokerage firms and media pundits are recommending increased allocations to ROW assets under primarily the thesis of P/E and performance mean reversion.

We know that mean reversion doesn’t always work, for example when the mean is changing. That may be a good mantra for the decade ahead. It’s certainly possible that the international markets have not made a giant error, but rather, the U.S. equity risk premium is now lower than the rest-of-world for good reason. As a relative mosaic to other countries, energy independence, near labor cost parity to Asia, and a military that can protect all of that seems like a noteworthy strategic advantage from a decade ago. As the world on average becomes older and wealthier, and U.S. based assets grow faster and are safer, demand for U.S. assets goes up and U.S. risk premia go down.

Also, as we’ve said in the past, Grandma does not understand negative interest rates, but there’s a chance that excess capital around the world will keep bidding asset values higher, and therefore push interest rates lower. For dollar denominated assets, not only is there still room to ease rates relative to other countries, but having a central bank that can print money people will accept in an emergency also seems like a plus.

In this new environment, we continue to ply a craft that recognizes we are always in a new environment. Companies that can serve evolving customer needs better than competitors will thrive. It is our job to find those good strategic businesses that have just managed to disappoint investors - to quote Covey - for urgent yet unimportant reasons, and avoid those that are unable to grow the value of their businesses.

Kevin E. Silverman, CFA

Chief Investment Officer

Sterling Partners Equity Advisors

Contact:

John A. Schattenfield

Head of Distribution

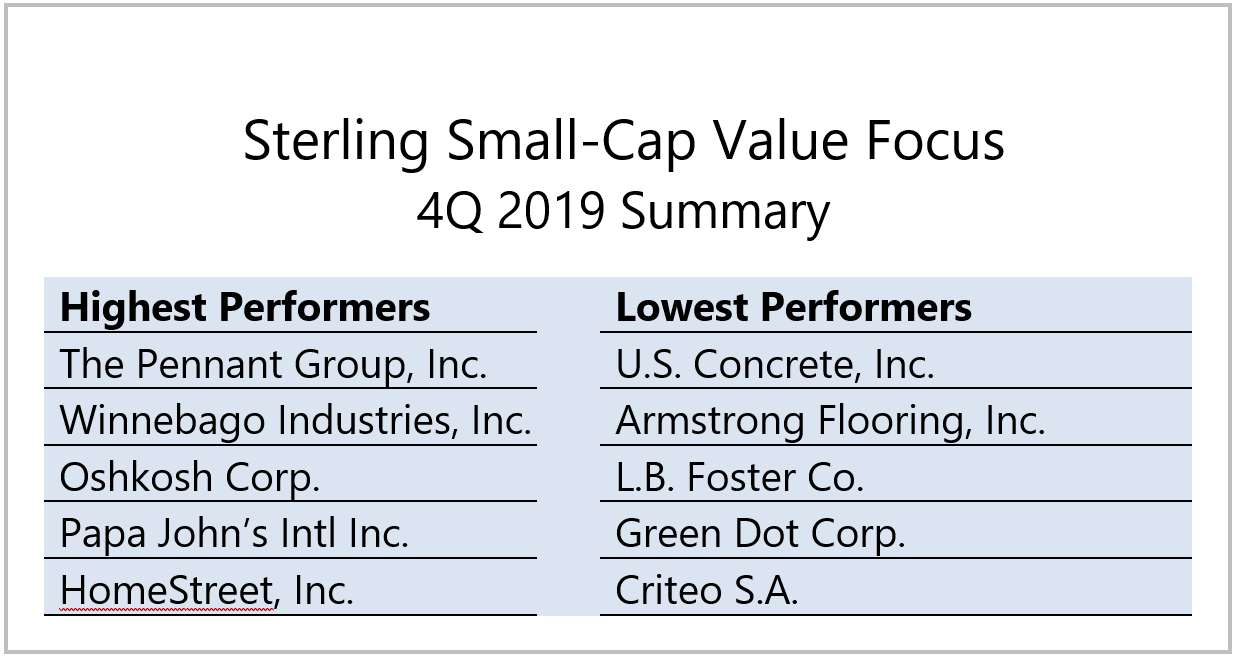

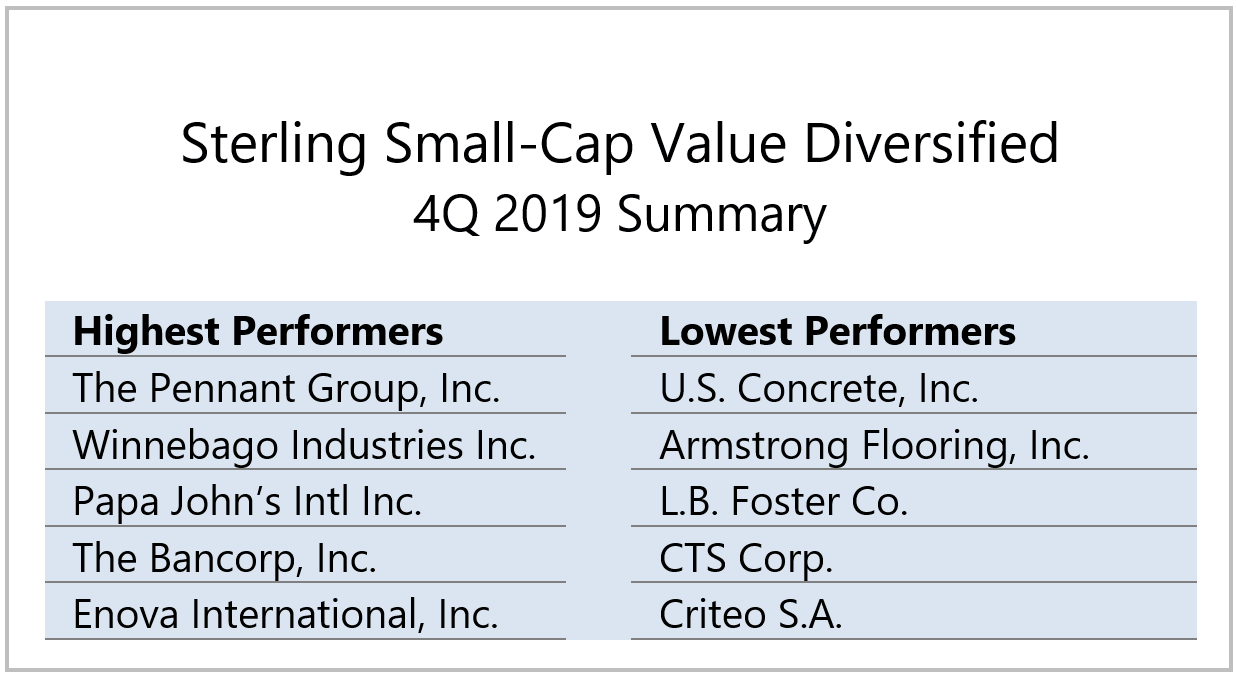

The Pennant Group, Inc. (PNTG) - Highest 5 Performing Security: Sterling Small-Cap Value Focus; Sterling Small-Cap Value Diversified

The Pennant Group, a recent spin-out of the Ensign Group (ENSG), provides healthcare services through 63 home health and hospice agencies and 52 senior living communities located throughout the United States. Pennant’s business model includes acquiring additional home health and hospice agencies and improving the cost structure. The spin-off was completed on October 1st and results have been better than expected, leading to good 4Q stock performance.

This business benefits from the aging demographics of the U.S. population, a thesis we have been investing in for a long time, by providing a broad spectrum of skilled nursing and assisted living services, physical, occupational and speech therapies, home health and hospice services and other rehabilitative and healthcare services.

Winnebago Industries, Inc. (WGO) - Highest 5 Performing Security: Sterling Small-Cap Value Focus; Sterling Small-Cap Value Diversified

Winnebago Industries is a manufacturer of recreation vehicles under the Winnebago, Newmar, Grand Design, and Chris-Craft brands primarily used in the leisure travel and outdoor recreation activities.

Winnebago reported their fiscal year ending and first quarter 2020 during the last quarter of 2019. Management discussed increased share in its towable segment and a successful full year in the marine industry. With the continued success of Grand Design and the addition of Newmar, Winnebago proves its commitment to building a diversified portfolio of brands.

We have owned WGO for many years around the thesis that leisure activities will continue to gain share of GDP. Winnebago has many strong brands, a low-cost manufacturing model, and a good understanding of the needs of its customers. We look forward to management executing on the building of its iconic brand portfolio over time.

Oshkosh Corp. (OSK) - Highest 5 Performing Security: Sterling Small-Cap Value Focus

Oshkosh is an integrated global industrial designing, manufacturing and servicing company across a broad range of access equipment, commercial, fire and emergency, military and specialty vehicles. In its most recent conference call, management provided strong earnings guidance for fiscal year 2020, with most of the operating income to be used for share repurchases. The significant repurchase should help management beat estimated earnings guidance, which drove the stock higher in 4Q.

We’ve owned this stock for a long time with the thesis that the company is a world class competitor in several large stable markets with entrenched competitive advantages. A long period of recovery has driven company profitability and capital strength back to historically superior levels, demonstrating the skill of OSK management, and the stock has performed nicely in the recent years.

Papa John’s Intl Inc. (PZZA) - Highest 5 Performing Security: Sterling Small-Cap Value Focus; Sterling Small-Cap Value Diversified

Papa John’s is one of the world’s largest pizza delivery & carry out companies with 5,343 system-wide company owned & franchise stores located in 49 countries. The company reported positive comparable North America sales, showing that its recently announced strategic plan is beginning to work, which led to good stock performance in the quarter.

We like the pizza delivery business and its share of the low cost, fast, convenient, hot food market. The value proposition only gets better with the use of technology. We bought PZZA on the belief that new management could move the comp and profitability metrics closer to levels of a few years ago, and ultimately closer to those of leading industry competitors. Management has taken important steps, including re-configuring the C-Suite and the Board, and appears energized to make strategic positive changes to improve the value of the company. We look forward to seeing this team execute on their plans.

HomeStreet (HMST) - Highest 5 Performing Security: Sterling Small-Cap Value Focus

HomeStreet is a financial services company in Seattle, Washington and holding company for HomeStreet Bank. During the quarter HomeStreet reported deposit growth of 3.8%. HMST approved a $25 million common stock share repurchase program that would commence during Q4 2019.

Because we believe generally that there is an over-capacity of lookalike banks, our approach is to own good banks that are also acquisition targets. We identify low cost providers or high service providers that are likely to get bought by an overpriced bank in an accretive acquisition as the industry consolidates. Our thesis is that while we wait for that, Glacier Bancorp is strategically growing value in the Pacific Northwest, an area growing faster than the U.S. average, and becoming one of the largest banks West of the Mississippi.

The Bancorp, Inc (TBBK) - Highest 5 Performing Security: Sterling Small-Cap Value Diversified

The Bancorp is a provider of financial services to non-bank financial service companies. We enjoy owning companies involved with non-banking services with card and other payment processing fees because of the generally oligopolistic pricing and above-average ROIs. The Bancorp is recognized in the payments industry as a top issuer of prepaid cards and top ACH originator.

The stock reacted well in the quarter as book value per share was up 22% versus the prior quarter year-over-year. Average loans and leases increased 31% to $2.6 billion for the quarter ended September 2019 versus the prior year.

Enova International, Inc. (ENVA) - Highest 5 Performing Security: Sterling Small-Cap Value Diversified

Enova is a provider of online financial services to non-prime consumers and small businesses, offering access to credit and its world-class online platform. Its underwriting algorithms are powered by advanced analytics and innovative technology.

Enova grew total loans and finance receivables 17% year-over-year, at the end of the 3rd quarter, leading to a good stock performance in 4Q. Our thesis on Enova is that digital transactions will continue to gain share of the financial industry, with a low-cost, high-service model.

U.S. Concrete (USCR) - Lowest 5 Performing Security: Sterling Small-Cap Value Focus; Sterling Small-Cap Value Diversified

U.S. Concrete is a leading supplier of concrete and aggregates for large-scale commercial, residential and infrastructure projects across the country. The company holds leading market positions in the metropolitan markets of New York, San Francisco, Dallas Fort Worth and Washington D.C.

USCR’s recent revenue growth was driven by higher ready-mixed concrete volumes and higher average sales prices in both its aggregate products and ready-mixed concrete segments.

We have a long history of owning cement and concrete companies on the evidence that owners enjoy a bit of local monopoly as a result of transportation costs limiting the physical area that can be served from a particular quarry. We believe USCR is a low-cost producer in its market area and enjoys an oligopolistic pricing environment. Our thesis includes the view that concrete remains a low-cost construction material of choice and that management is carefully choosing markets that are growing faster than the overall economy.

Armstrong Flooring, Inc. (AFI) - Lowest 5 Performing Security: Sterling Small-Cap Value Focus; Sterling Small-Cap Value Diversified

Armstrong Flooring is a leader in the design and manufacture of resilient flooring products across North America, spun out from Armstrong World Industries just a few years ago. We bought the stock on the belief that the company would look to its roots and emerge as a low-cost producer and distributor of commercial and residential flooring, but that hasn’t happened.

While continuing to look attractive on a cashflow basis, our thesis that AFI is a low cost producer appeared broken in the quarter as the company increased prices, lost market share, and lost money, a scenario that almost certainly wouldn’t occur with the low cost producer of a commodity. With our thesis broken, we sold our position in Armstrong Flooring.

L.B. Foster Co. (FSTR) - Lowest 5: Sterling Small-Cap Value Focus; Sterling Small-Cap Value Diversified

L.B. Foster is a manufacturer and distributor of transportation and energy infrastructure products and services with locations in North America and Europe. The stock was down in the quarter, but as often happens with stocks with little analyst coverage, there appears to us to be a misunderstanding of how good management performed in the quarter. The company reported a 7.7% decline in revenue but was able to generate significant cash flow used to reduce debt by $21.5 million, ending the quarter with a strong balance sheet. Management increased its outlook for the fourth quarter as current backlog and project timing supports sales that are greater than the third quarter.

We have owned FSTR for many years and despite some curveballs thrown in rail and energy a few years ago, we have been impressed with management’s ability to continually improve the business. We believe that the company’s competitive product line will continue to do well as infrastructure spending both in

transportation and energy grow. We expect management will use free cash flow to reduce debt, helping grow the EBITDA margin and ROI. At the current price, we believe FSTR offers an attractive long-tern return.

Green Dot Corp. (GDOT) - Lowest 5: Sterling Small-Cap Value Focus

Green Dot is a consumer financial services providing a range of reloadable prepaid debit cards and cash reload processing services with a mission to provide a full range of affordable and accessible financial services to customers.

During the quarter Green Dot announced an extended relationship with Walmart for their MoneyCard program through 2027 in addition to jointly creating an innovative Fintech JV Accelerator. Green Dot did indicate that their revenues would finish in the low end of its previous guidance even with positive progress in new Unlimited product, disappointing the market.

We own the stock on the thesis that the company will continue to gain market share with its low-cost model and that banking customers will increasingly gravitate to the convenience of online commerce.

Criteo S.A. (CRTO) - Lowest 5 Performing Security: Sterling Small-Cap Value Focus; Sterling Small-Cap Value Diversified

Criteo is an advertising platform designed to deliver advertising across all channels but most importantly, online. Our thesis is that advertising spending will continue to migrate to online and mobile from TV, and Criteo is positioned to benefit from that continuing migration. Once again, CRTO ended the quarter with a strong balance sheet with $409 million in cash. During the third quarter, CTRO added 238 new clients and continued a strong client retention at close to 90%.

There is currently much controversy around advertising and privacy that has led to market concerns about the viability of online targeted advertising and CRTO’s role in that. This has given investors an opportunity for a good return in our view. Customers continue to hire CRTO to optimize their online ad spend, and CRTO remains one of the few independents of choice in an eco-system of giants. We continue to believe CRTO management and data scientists will manage to grow the value of this business over time.

CTS Corp. (CTS) - Lowest 5: Sterling Small-Cap Value Focus Diversified

CTS is a designer and manufacturer of industrial products including sensors, actuators, and electronic components in North America, Europe, and Asia across many industries. The company posted a slight decline in revenue for the third quarter which upset the stock. Their total booked business was $1.86 billion, up 2% versus the prior quarter 2018. It’s not a surprise to us that trade issues led to caution among customers during the quarter.

CTS is a traditionally high margin business with a large contracted backlog across many industries. We enjoy owing this company as it flies under the radar with little Wall Street coverage but continues to grow differentiated profitable businesses across several strong industries. We look forward to CTS continuing to add value to our portfolio.