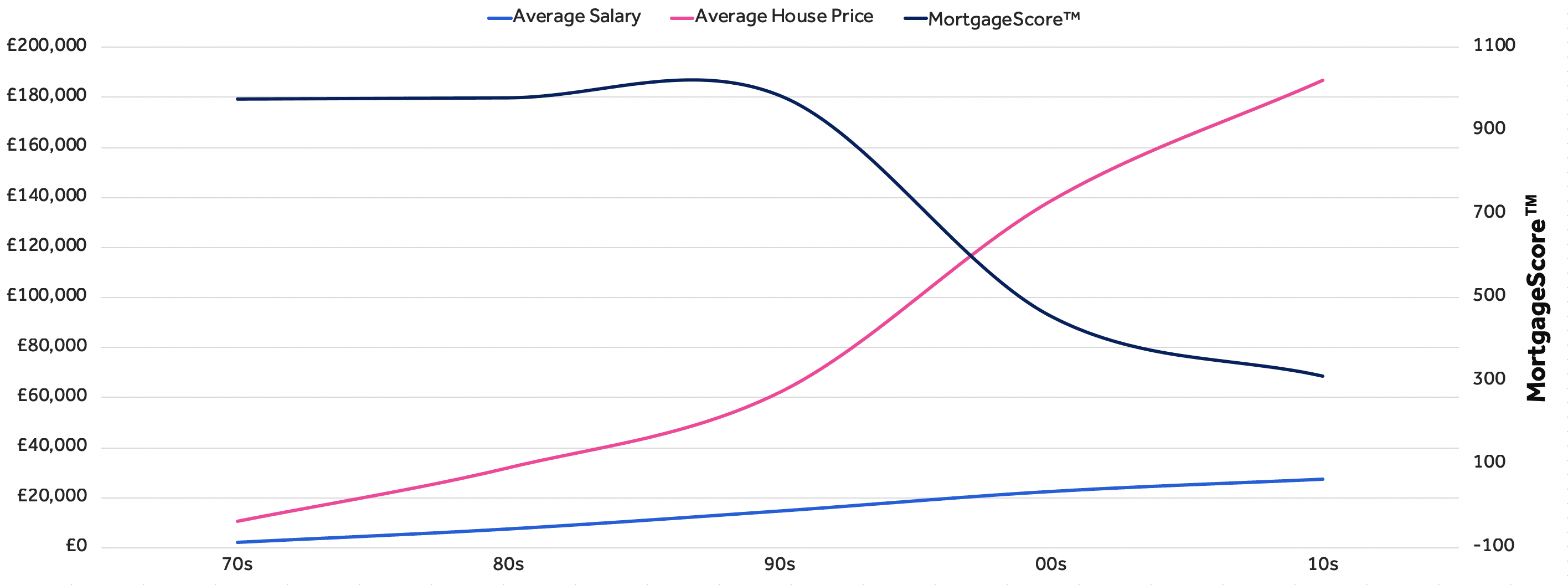

New research from digital broker, Mojo Mortgages, has revealed that first time buyers need to borrow 18 times more than an average first time buyer in the 1970s. Whilst average salaries have only increased 11 fold since the 1970s, the research as proven that it’s definitely harder to get on the property ladder now.

Q4 2019 hedge fund letters, conferences and more

Mojo Mortgages is aiming to revolutionise the mortgage industry, and in conjunction with releasing the research, it has also announced the launch of its unique service, MortgageScore™.

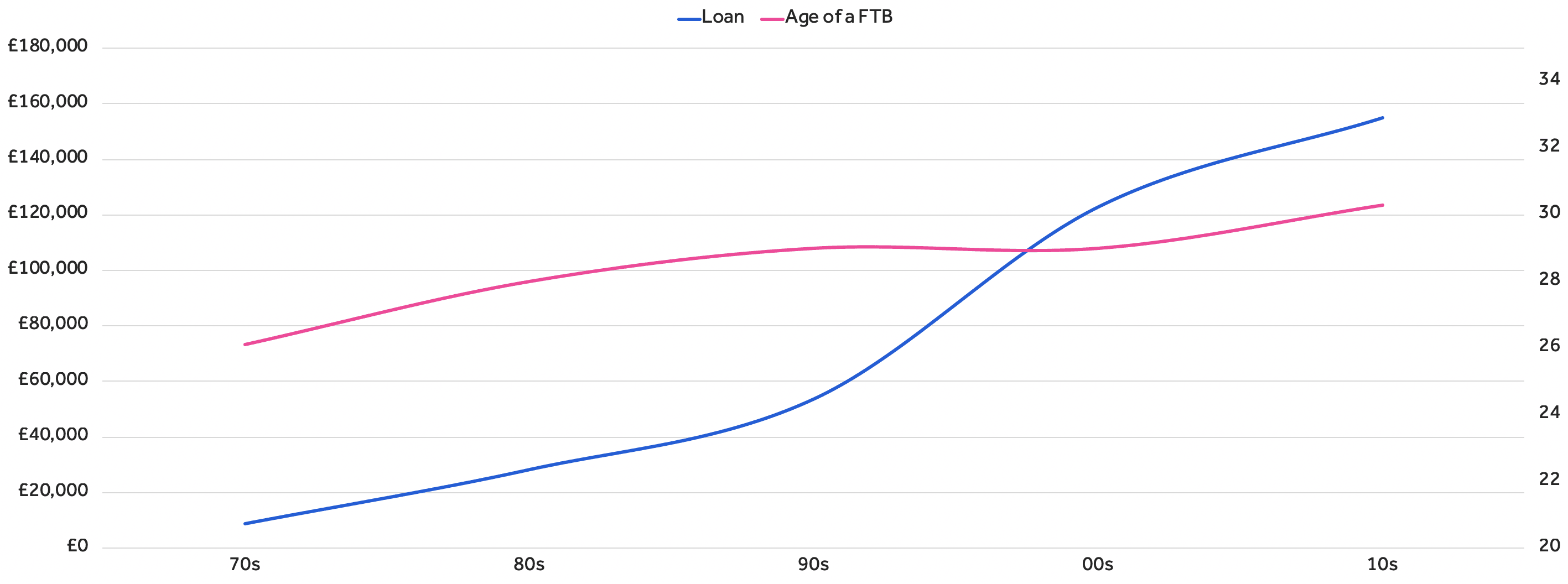

First time buyers are waiting longer and borrowing more

The free service will help potential first time homebuyers realistically assess how likely they are to get a mortgage, scoring them out of 1,000, as well as providing them with advice and coaching on what they need to do to help increase their scores.

The MortgageScore™ of a first time buyer in 1970 was a solid 1,000, whereas now, the score is exceptionally low at 200.

As part of the research, Mojo Mortgages analysed the average salary of a first time buyer from the 1970s to 2019, along with average household debt, disposable income, average age, cost of a house and the deposit needed, to figure out what their MortgageScore™ would be across the generations.

First time buyers by year

The analysis revealed that Boomers did have it the best, with first time buyers from 1970 through to 2003 having an average score of 975, making them 97.5% more likely to get accepted for a mortgage.

However, first time buyers from 2004 onwards had an average score of 284, meaning that their likelihood of getting accepted for a mortgage is just 25.5%.

The data also revealed that first time buyers are waiting longer to buy a house, with the average age having increased by eight years from 25 to 33, but, borrowing more – mainly because they have no other choice but to.

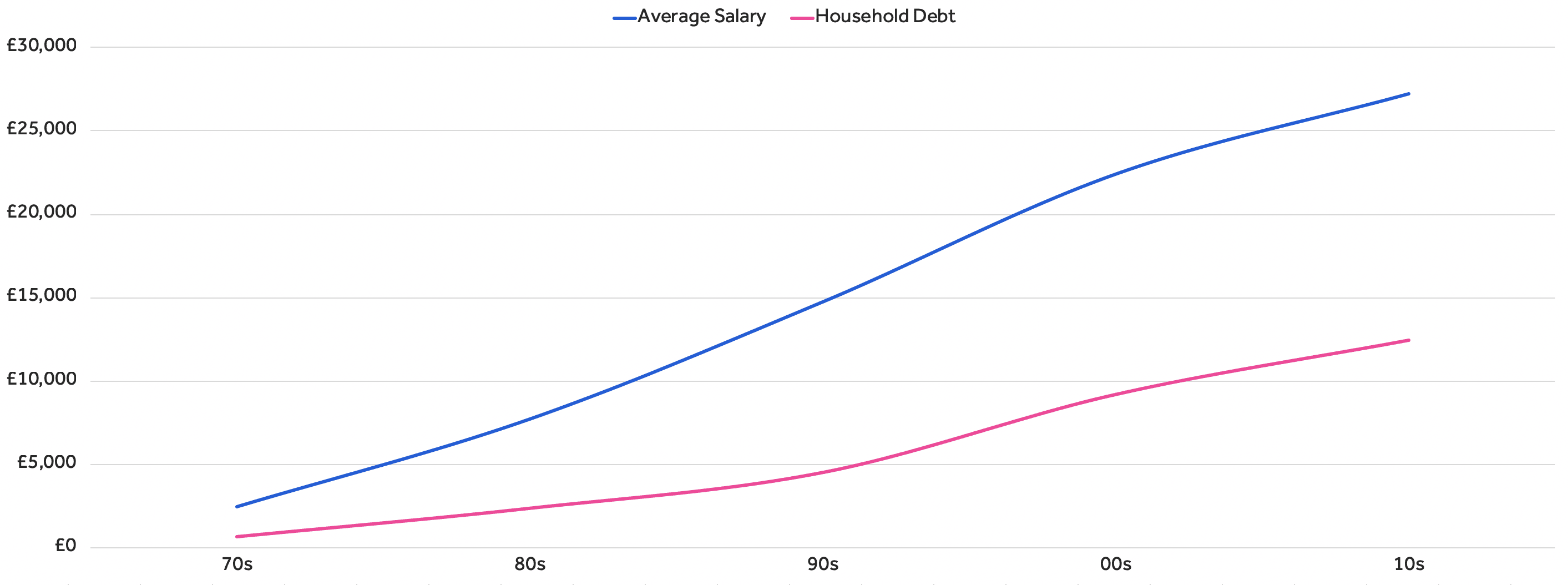

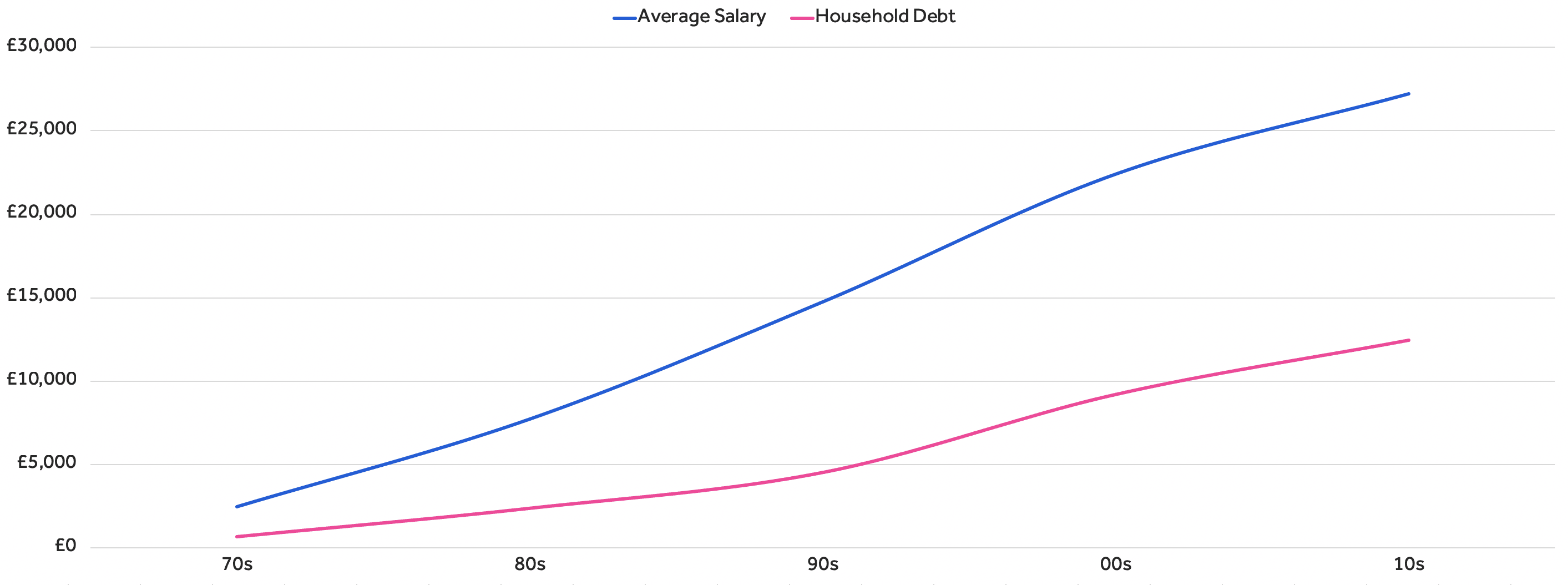

Salaries have increased but so has household debt

First time buyers these days need to borrow 18 times more than an average first time buyer in the 1970s, and property prices have increased by 1,661% (£186,924 vs £10,613) since the 1970s but salaries haven’t increased in line with this.

It now takes first time buyers an additional four years to get on the property ladder as they now have to produce higher deposits and borrow significantly more than first time buyers in the 1970s.

Property Prices

Property prices have increased by 1,661% (£186,924 vs £10,613) since the 1970s but salaries have not increased in line with this, so no wonder it’s so hard for first time buyers to get on the property ladder.

In 1970, you could buy a house for £4,690 – there aren’t many houses on the market for this now!

Further research Mojo Mortgages recently conducted revealed that 64% of 18-34 year olds will try to cut back on eating out and takeaways in order to save for a house deposit faster this year.

In addition to this, one in five respondents still believed that they wouldn’t ever be able to purchase a house, and a similar number said they would also cut down on the subscription services they have, such as Amazon Prime and Netflix in order to save for a deposit faster.

Since the 1970s, the rise of house prices, increasing household debt and a 1,517% increase in deposit requirements (£32,068 vs £1,983) means it’s more difficult than ever for first time buyers to own their own home.

So how does MortgageScore™ work?

MortgageScore™ completely free to use and looks at affordability and credit history amongst other aspects of income and expenditure to assess how mortgage ready someone is. More specifically for first time buyers, it aims to help them understand their eligibility for a mortgage and helps them get mortgage ready by providing personalised coaching. This is done by using open banking data as well as Experian data.

The score is calculated out of a thousand, and those who score over 500 will be able to access a wider range of lenders, while those who have a score of 499 or below will be offered tailored coaching via the service’s MortgageCoach to help them increase their scores. The ideal score for someone looking to buy their first home is 600 or above.

To look at the data in-depth, please visit: https://mojomortgages.com/mortgage-score-through-the-ages.

Data breakdown by year:

1970s

- Average salary in the 1970s: £2,345

- Average household debt: £693

- Avg disposable income: £6,653

- Average Cost of a house: £10,613

- Average deposit needed: £1,983

- Age of a first time buyer in the1970s: 26

- Average mortgage score: 977

1980s

- Average salary in the 1980s: £7,702

- Average household debt: £2,391

- Avg disposable income: £8,521

- Average Cost of a house: £32,054

- Average deposit needed: £3,938

- Age of a first time buyer in the1980s: 28

- Average mortgage score: 980

1990s

- Average salary in the 1990s: £14,741

- Average household debt: £4,528

- Avg disposable income: £11,174

- Average Cost of a house: £62,266

- Average deposit needed: £8,711

- Age of a first time buyer in the1990s: 29

- Average mortgage score: 985

2000s

- Average salary in the 1990s: £22,414

- Average household debt: £9,186

- Avg disposable income: £13,826

- Average Cost of a house: £138,834

- Average deposit needed: £16,111

- Age of a first time buyer in the 2000s: 29

- Average mortgage score: 456

2010s

- Average salary in the 2010s: £27,239

- Average household debt: £12,424

- Avg disposable income: £18,407

- Average Cost of a house: £186,924

- Average deposit needed: £32,068

- Age of a first time buyer in the 2010s: 30

- Average mortgage score: 313