CNBC Exclusive: CNBC Excerpts: Omega Advisors’ Leon G. Cooperman Speaks with CNBC’s Scott Wapner Today

Q4 2019 hedge fund letters, conferences and more

WHEN: Today, Tuesday, February 18, 2020

WHERE: CNBC’s “Fast Money Halftime Report”

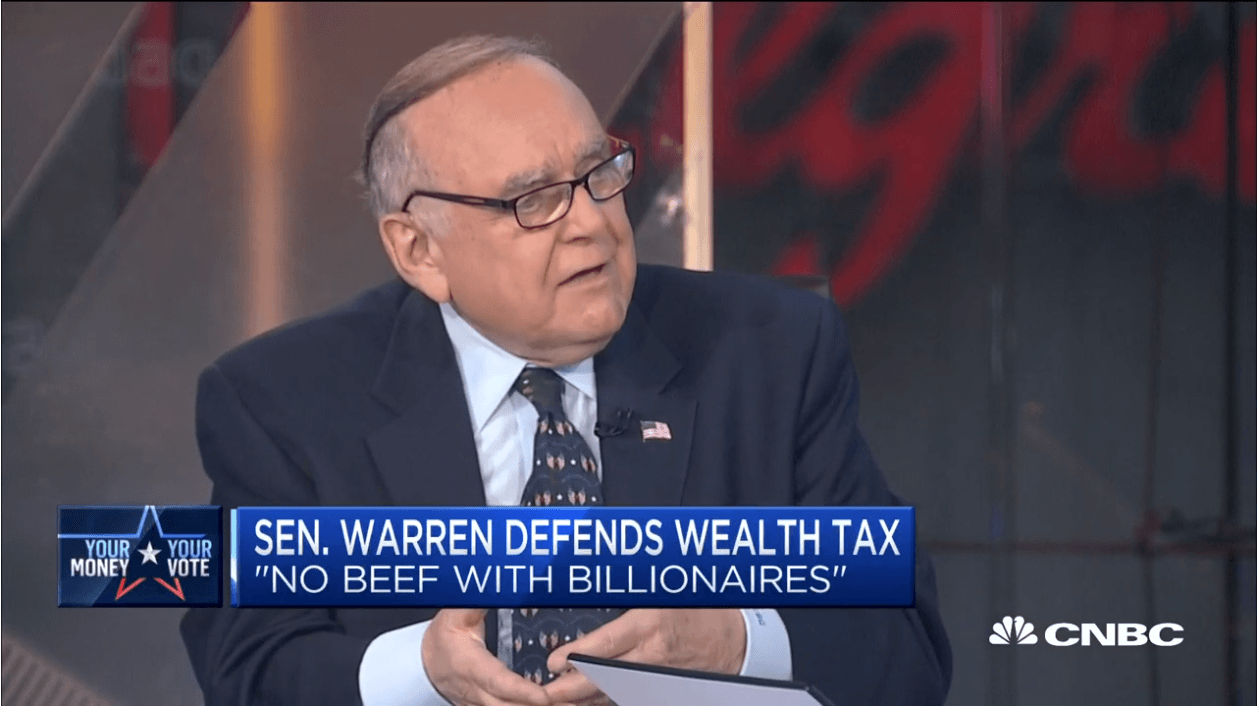

The following is the unofficial transcript of excerpts from a CNBC EXCLUSIVE interview with Omega Advisors founder, chairman and CEO Leon G. Cooperman on CNBC’s “Fast Money Halftime Report” (M-F 12PM – 1PM) today, Tuesday, February 18th. The following is a link to video of the interview on CNBC.com: https://www.cnbc.com/video/2020/02/18/full-interview-with-leon-cooperman.html.

All references must be sourced to CNBC.

Early Euphoria:

I would say we are this the early stages of knocking on the door of euphoria but we’re not quite in euphoria. Certain parts of the market are in euphoria, like Tesla. Other parts of the market, like energy. are in pessimism. And so, I am trying to find things that make sense. But the conditions for a big decline are not present.

I lock at Bernie Sanders as bigger threat than the Coronavirus.

When all the great minds in the scientific world focus on this problem that in three or four months, this will become resolved, much the way SARS and the Ebola virus was dealt with.

Next Crisis:

Well, I would say the next crisis is not going to be in the private sector, the next crisis is going to be in the public sector. The deficit is too damn large. And it continues to get larger and larger, and nobody, whether its Democrats or Republicans, is paying attention. We are mortgaging our future.

Leon G. Cooperman on Market Structure:

The market structure has changed. which bothers me greatly. And where as in the fourth quarter of 2018, there was nothing going on in the economy that justified I think the greatest decline since the Great Depression in the fourth quarter. It was the fact that there is no market structure left. You know, when I came to Wall Street 51 years ago, Goldman Sachs, Morgan Stanley, people like that, traded stocks for 50 cents a share and the Volcker Rule didn't exist. Now commissions are near zero. And plus, the Volcker Rule, so the brokers don't stabilize and provide bids to the market.

Leon G. Cooperman on Ripe for Setback:

Every measure of valuation in the market is extremely extended with one exception: the market is cheap relative to interest rates. The trouble is if interest rates belong at one and a half percent in the ten-year government, one and a half in Fed funds heading lower, you are not supposed to make 10,15, 20% in the stock market. You make 5 for 6 percent or 7 percent. And so, through February, Friday, you were up about 4.8%, multiply that by six. The market is ripe for setback. But we are not ripe for a bear market. That's my major message.