Billionaire Eric Sprott Recently Shared His Secrets of Success + his 3 Mining Stock Investments Striking the Motherlode amid Coronavirus Pandemic Scare

Global Economic Slowdown plus Coronavirus Pandemic Creates Rare, Perfect Setting For Gold and Silver to Thrive

Q4 2019 hedge fund letters, conferences and more

- Mining Billionaire Eric Sprott Recently Shared His Secrets of Success in an Interview

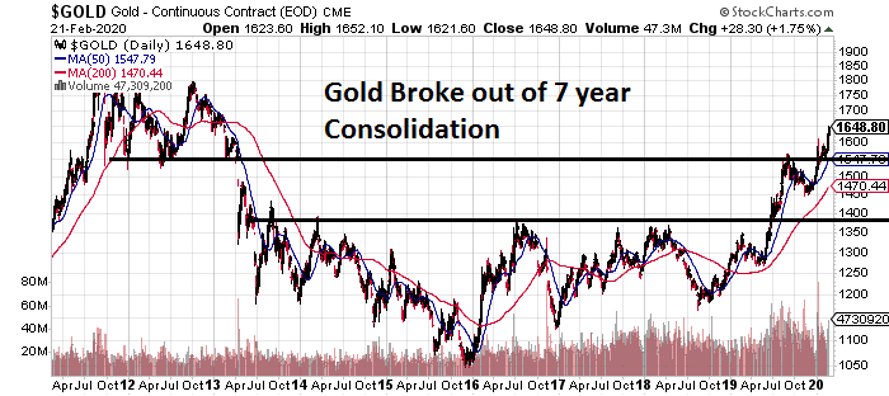

- Gold broke out of 7-year high of $1,600/oz on Tuesday as investors piled into bullion to mitigate risk of global coronavirus pandemic.

- Eric’s top 3 junior mining stocks could reap massive rewards with new discoveries on favorable backdrop of global monetary easing and deficit spending

Mining Billionaire Eric Sprott’s Gem Quotes from a recent interview with Financial Post

“‘I keep reading that people are never making (gold) discoveries, the rate of discoveries is going down,’ he said, occasionally rubbing his temples and closing his eyes. ‘The funny thing, well, I guess I’m the sucker then because I keep buying guys who say they’re making discoveries.’”

Many investors pride themselves on not selling when a stock hits a bump; but Sprott said it is equally important not to sell when the stock rises, at least not until it’s gone up five or even 10 times, a so-called tenbagger.

“I’ve had lots of tenbaggers and the important thing is to stay in it,” he said.

Sprott invests in a company that might strike gold and give him a 500 percent return, or even a coveted 1,000-per-cent return.

“You’ve got to have the dream, right?” he said. “You’ve got to have the dream you’re going to find something.”

Gold broke out of 7-year high of $1,600/oz on Tuesday as investors piled into bullion to mitigate risk of global coronavirus pandemic

There are now 30 nations which are infected with Coronavirus; Deaths from Coronavirus pandemic now have been in Taiwan, France, Italy, Japan, Iran, Korea, And The Philippines.

Director of the US Centers for Disease Control and Prevention (CDC), Dr. Robert Redfield was quoted on Feb 23, 2020 as saying,

“I think this virus is probably with us beyond this season, beyond this year, and I think eventually the virus will find a foothold and we’ll get community based transmission and you can start to think about it like seasonal flu. The only difference is we don’t understand this virus.”

Gold has responded positively to this global pandemic and just broke out of 7-year high of $1,600/oz.

“Virus Overshadows All as Traders Brace for 2020 Fed Rate Cuts….When the global economy goes south, the Fed steps in,” reports Bloomberg.

Eric’s 3 junior mining investments that could reap sizable rewards with new discoveries on favorable backdrop of global monetary easing and deficit spending

1. Kirkland Lake Gold LTD

586 million shares outstanding

Sprott bought over 20 million shares in 2017 at below $20 a share and saw his stake grew to over $1 billion over the next 3 years. Kirkland Lake recently completed the acquisition of Detour Gold and is well positioned to grow both in production and margin in the coming rising gold market.

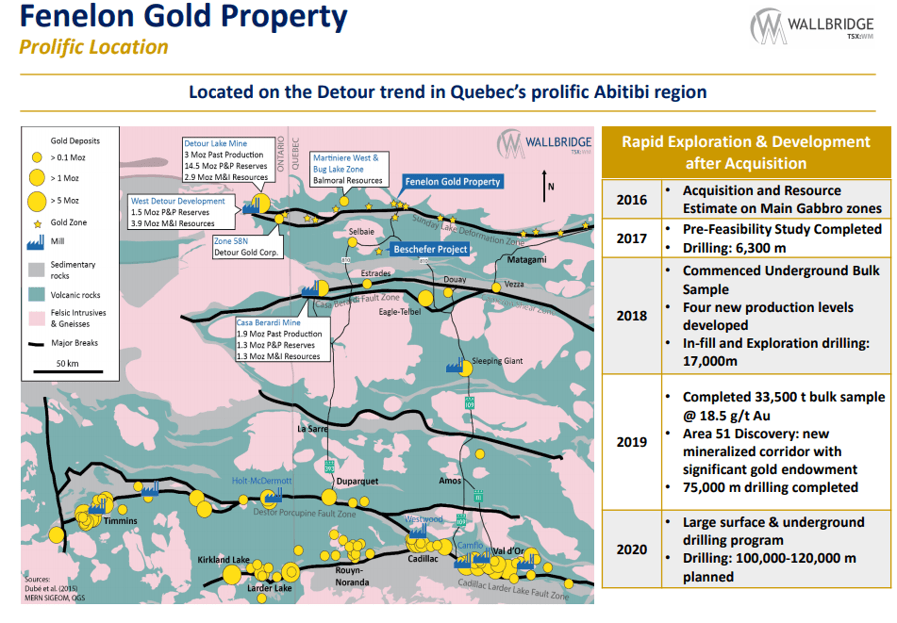

2. Wallbridge mining Company LTD

586 million shares outstanding

Flagship Fosterville Gold Mine in Australia and Detour Gold Mine in Canada

Flagship Project Fenelon Gold Property 50km from Canada’s 2nd largest Open Pit Detour Lake Gold Mine

Sprott has amassed over 120 million Wallbridge shares since 2018 when the stock was under 20 cents. Today it is over $100 million, a testament to his mantra to “not sell when the stock rises, at least not until it’s gone up five or even 10 times.”

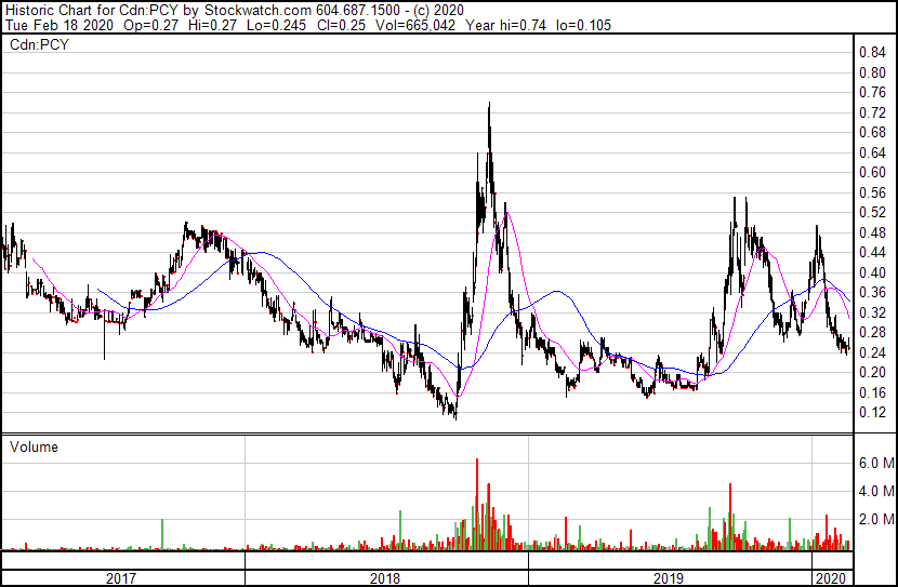

3. Prophecy Development Corp (TSX: PCY, OTC: PRPCF)

122 million shares outstanding

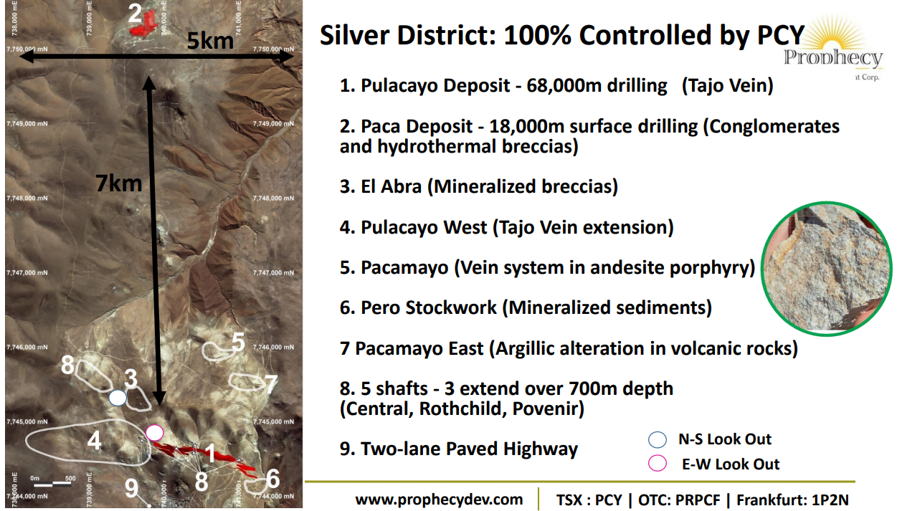

Sprott bought 10 million Prophecy shares in late 2019 as his starter position. He likes silver and was drawn to the high silver grades and the potential district size of Prophecy’s Pulacayo silver project in Bolivia.

Click to listen to Eric Sprott talking about Prophecy at 13:30 mark

“Invest on small level, interesting silver project in Potosi in Bolivia, has 43-101 50 million oz silver very high grade, company will focus on the asset, good deposit, will get a lot bigger with drills, looking forward to hanging on to that company and perhaps increasing my investment.”

Prophecy’s Pulacayo-Paca project has 30 million indicated silver ounces grading 455g/t Ag and 21 million inferred silver ounces grading 256g/t Ag, with only 30% of the known mineralization explored.

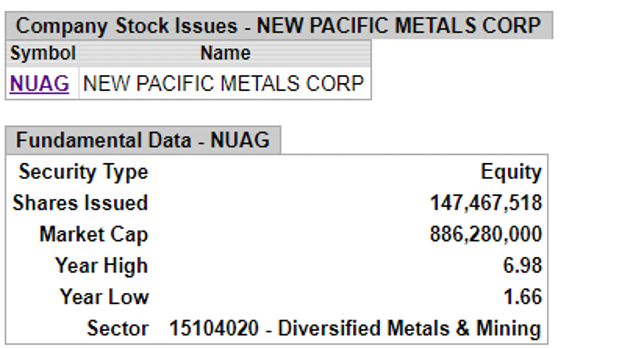

The Pulacayo project is within driving distance of New Pacific Metal’s giant silver discovery. Prophecy’s silver story was new to the market in August 2019 while New Pacific, which sports market capitalization of US$600 million, and has been marketing for the last several years.

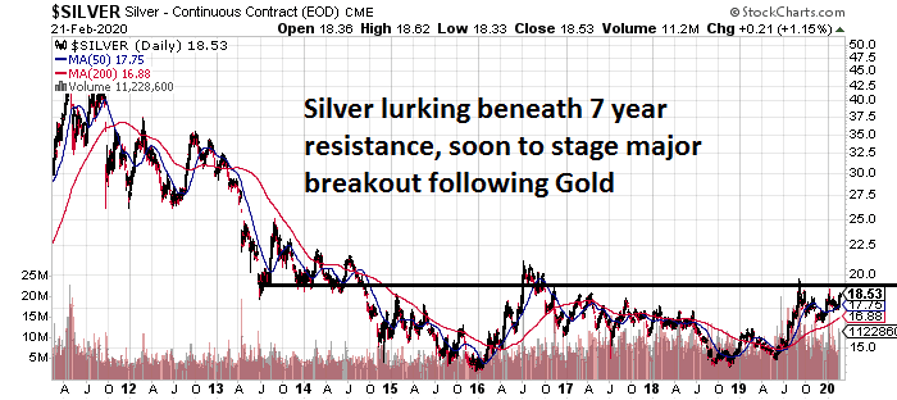

Silver has yet to enjoy breakout prices like those of gold; hence silver is a good entry point.

Prophecy is trading at 25 cents, with Pulacayo drill results pending.

Will the coronavirus pandemic boost prices? Let us know in the comments section.