People started saving less money.

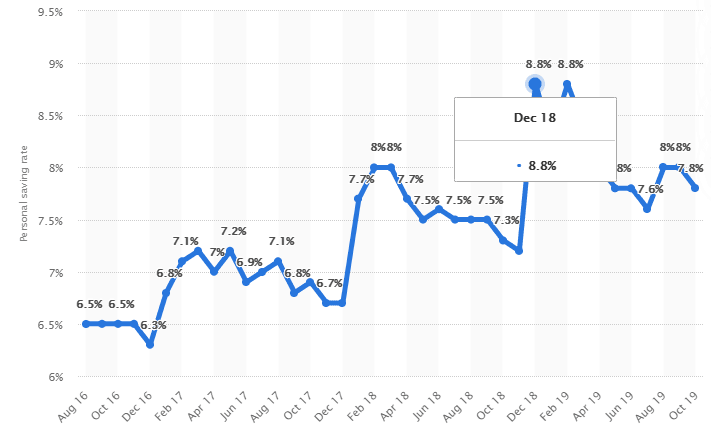

According to Statista, the personal saving rate in the United States was 8.8% in 2018. To compare, the same index was at 10.4% in 1960:

Image credit: Statista

Q4 2019 hedge fund letters, conferences and more

This percentage includes any strategy of accumulating capital for the future, from cutting down costs to investment and depositing one’s money to a bank.

One of the reasons for saving rate dropping almost 2% is price surge. According to Debt.com:

- the average household spends 56% of their income on food and groceries

- 40% of their income covers transportation costs

- survey respondents also claim that they spend about 33% of their income on housing, paying rent and making mortgage payments

Americans also started spending more during the holiday season. This year, their expenses grew 4%, reaching $1,047.83 per person, compared to last year - $1,007.24 per person. So, the general estimate of holiday expenses could potentially reach $800 billion.

With so many expenses and growing prices, Americans also started investing less.

So, what should be your plan to save up for the future in this unfavorable economic environment? What steps should you take to create an investment plan to increase your savings for the future?

Let’s take a look.

1. Assess Your Current Investment Options & Financial Situation

How much can you set aside every month to later make it your investment?

The first step in building your investment plan is determining your general financial capacity and find hidden sources of finances. To do this, financial analysts use the method called net worth analysis. This method usually includes:

- The analysis of assets – involves the comparison of your beginning and ending net worth, i.e. how much money you had at the beginning of a month and how much you ended up with after all the expenses.

- The analysis of expenditures – this method focuses more on your available income than on the assets that you’ve accumulated and compares available sources of funds to your total expenditures. This method helps you determine whether you spend more than you earn, and define the sources of income, which you can use for savings.

You employ one of these methods to count your net worth and assess your current financial situation. Or, you can take an easy route and follow this step-by-step guide to assess your current net worth:

Step #1: Make the list of assets

This list may consist of the following items:

- the money you have on your bank accounts (deposits or savings)

- your movable and immovable assets

- personal property (may include jewelry, pieces of art or expensive furniture you may own)

- insurance assets

After making a list of your available assets, determine their financial value and add up the total result to see your estimated net worth.

Step #2: Analyze what you owe

Create a list of liabilities, which may include:

- bank loans (car loans, mortgage)

- credit card payments

- education loans

Add up the outstanding balances to compare the result to your estimate net worth.

Step #3: Calculate your personal net worth

You can do it by subtracting the balance of your liabilities from the balance of your assets. The sum you get as the result is your personal net worth.

You can also use an online personal net worth calculator to speed things up.

This method not only helps you realistically assess your current financial situation but also find the sources of your main expenses. Thus, you get the insights, where you can cut your expenses to find financial sources for your future investments.

2. Compare Your Investment Goals to Current Market Situation

Why are you planning to start investing money? For retirement? Or to save up for future generations?

Determining your investment goals is a prerequisite step before you choose the investment option that suits your needs. To outline your investment goals, you can use the SMART model, considering the following elements when describing your investment goals:

- Specific – outline each goal as precisely as possible

- Measurable – based on your calculated personal net worth, define each goal with the consideration of the sources of your income and expenses.

- Achievable – for each goal, outline the actions that you will take to reach them.

- Relevant – your goals should be in line with your current life situation.

- Timely – have a timeframe for each of your goals, with clear deadlines.

If you’re working with websites that write for you your investment plan, make sure that you provide all the information on your current assets and liabilities to determine your investment goals as precisely as possible.

After you set your investment goals, it’s time to think about the risks you may encounter, like:

- Market risks. These include equity risks (investments in shares), currency risks (investments in foreign currencies), interest rate risks (debt investments, bonds).

- Liquidity risks – the case, when you cannot sell your investment at a normal price or withdraw your money at your convenience.

- Credit risks – the case, when a bank you invested money in cannot pay your interest (only applied to bonds).

- Inflation risks – the possibility of losing your investments because they do not keep up with inflation rates (happen often to cash or debt investments).

There is also a possibility of concentration risks, in case all your money is concentrated in 1 type of investment.

Your investments can also be under risk if you don’t take into account the possibility of cyber-attacks and breach of security. So, take into account the measures to protect your investments from online fraud and other hazards, when creating a list of possible investment options.

These risks either occur because of the fluctuations on the market or they may be forced by your personal life situations. Either way, study them very carefully when analyzing your investment options.

3. Pick Out Investment Options

When you assessed your personal financial situation well and feel comfortable with the current situation on the market, you can start exploring your investment options.

Here, we recommend you not to make rushed decisions. What you think may work for you may turn out to be a not very trustworthy investment option.

To start somewhere, you can review the list of the most popular investment options over the year. In 2019, according to Bankrate, the top 3 investment options were:

- Certificates of deposit – usually issued by banks, these assets usually have a higher interest rate than regular deposit and savings accounts. You cannot, however, withdraw for a specific time period without a financial penalty.

- Money market accounts – these are interest-bearing deposit accounts. They have higher interest rates, but inflation remains the main threat with this investment option.

- Treasury securities – issued by the government, these assets serve to raise money for projects. This is the safest investment option in terms of protecting your principal capital. These assets, however, can collapse, if the government goes through some kind of a hurdle.

If you’re looking for a more general list of investment options, browse trustworthy resources, like Financial Times, who provide and update the full list of the most secure investment options along with the time frame and any possible penalties.

Get Help From Advisors on your investment options

Building an investment plan yourself is a rather ambitious plan, which could take you several weeks of preparation. You can definitely to it yourself, but it will take time before you feel more or less comfortable with the constantly changing investment market.

Creating an effective investment plan is a labor-intensive task, and, as you can see, every step of preparing an investment plan involves at least two or three smaller steps, which also involve a lot of studying and analyzing both your financial situation, possible risks and the general situation on the market.

If you want to skip this labor-intensive part, you can always cooperate with investment advisors, who will help you take a fresh perspective on your personal financial situation, and will inform you about the best and the most comfortable options for you.