Ray Dalio says, “Buy Gold.” Sven Carlin’s thoughts on Dalio’s letter that he recommend reading. Gold is a non productive asset, and thus a speculative assets. Value investors can do better than to bet on gold.

Buy Gold, Says Ray Dalio – Sven Carlin’s Thoughts

Q4 2019 hedge fund letters, conferences and more

Transcript

Good day fellow investors. This week's big news is a new letter from Ray Dalio and please read it on LinkedIn. He has written an article talking about paradigm shifts, how what we have lived through over the last 10 years, might be completely different over the next 10 years and how people don't expect that and how people invest in equities, stocks, index funds, because that has been the best investment over the last 45 years. And they think it will be the best investment over the next 35 years.

But that's not usually so and things will change and his messages to be diversified with gold because to sum up his letter, central banks will print more money to keep interest rates low. Equities did great in the past, but not anymore, as valuations don't justify pushing prices higher. So there is a new paradigm that burdens are higher and income is smaller from assets as prices are higher, because as interest rates go down, the prices of assets go up and the yield on those assets goes down.

Devaluation Of Currencies

It increases that burdens. So the solution is that currencies have done he doesn't know when currencies will be sacrificed. So we will see devaluations debasement of currencies, and he says that each portfolio should be better diversified, holding gold.

I really think that someone that has index funds and has been following the trend over the last 10 years, that he should look into diversification of his assets of his portfolio, because what did well in the past might not be so good in the future.

The worst thing you can do is to own bonds, currencies and hope be safer because usually savers are those that get screwed when central bank's print more and more money, and we have seen a lot of pain with pension funds, which don't have the option to invest 100% into equities and they missed out on a lot of gains over the last 10 years, because they invested in bonds with very, very low or even negative interest rates.

13 trillion of assets is invested with sub zero or zero interest rates on it. So that's the amount of money that is happy sitting aside not earning anything with real negative returns.

Interest Rates And Non Productive Assets

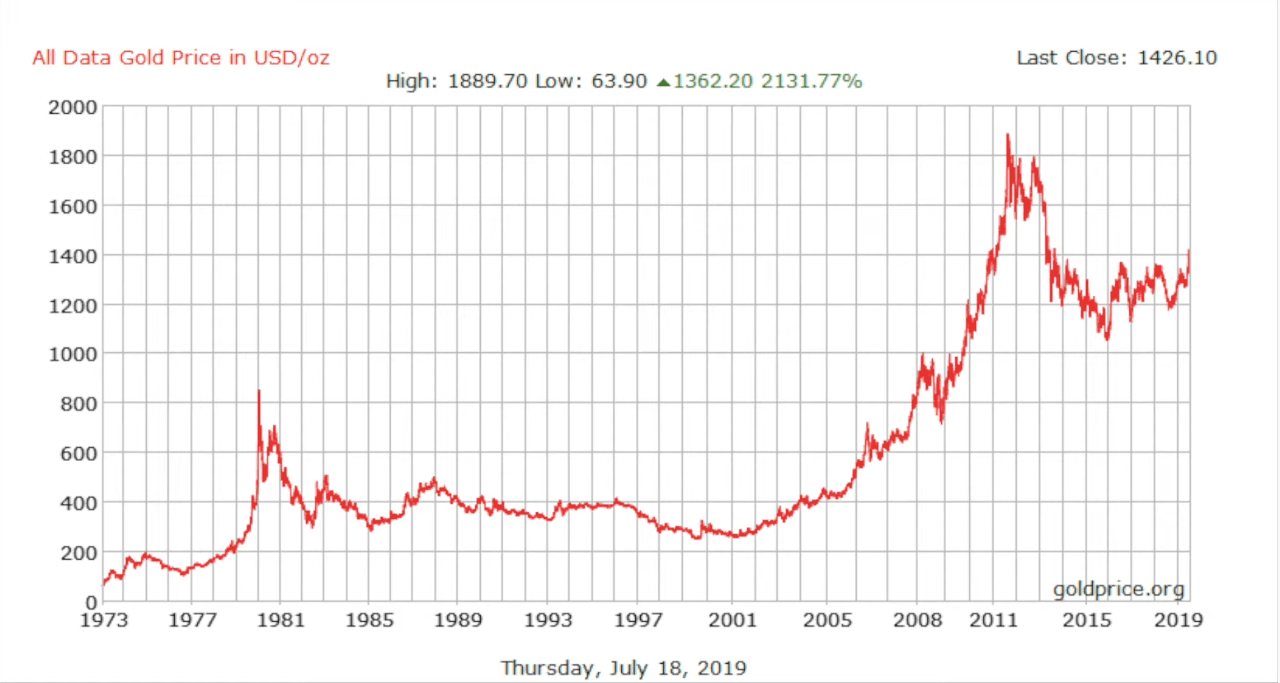

In any case, just to comment on gold, you have to see how that fits you. Gold is a non productive asset. It is just the hedge so you won't make any money while you are holding gold because it will just protect you from gold doesn't go up in price is the currency that loses its value, so it will be your protection on currency depreciation.

So, it is up to you whether you just want to be diversified with gold and keep up the non thinking investment environment like investing in index funds etc or you will start to look for assets that have yields, assets that will give you yields over the long term no matter the currency environment that will have the pricing power to adjust their prices in an inflationary environment because when central bank's print money, and that will not being enough like we have seen now with the Fed not increasing interest rates because higher interest rates are too much to stimulate the economy.

They will print money and give it directly to the government to invest in infrastructure projects, to build new roads, new train rails, etc. And that will lead to a lot of commodities. So perhaps commodities are a way to have a producing assets that will give you also protection in case of currency devaluation.

So I'm thinking of gold and I'm here going with Buffett, just because okay, it's not productive, you have to be a trader, you have to be a speculator. And if you own gold, yes, you have to own it. But then you have to sell as it goes up and buy as it goes down something very few are doing.

Why Gold Is A Non Productive Asset

if you look at my gold video that I published two years ago, now the gold prices are higher. Now the video gets views now the interest is there for gold, but when gold prices were lower and lingering, nobody cared. But that was the time to buy now it is the time to sell a part of what you bought in the past. So you have to keep that in mind and constantly rebalance, which is Ray Dalio's message and he will make an article on it in the future. So this is the news for today. Please read read alias article.

See how it fits your Investment style, and then see how to go about it. It's not just investing in gold is just like investing in index funds. So the simplest option, and that's what he is selling in his article. But I think there are many, many other options a little bit more sophisticated that offer you both offer you're both protection, and both yields on real assets that will, in the long term prevail over any other asset strategy.

Please subscribe if you want to hear more about this business like investing assets where we look for both protection value investing with a margin of safety and a high return on the assets that we own. Thank you and I'll see you in the next video.